Atlanta Braves Holdings, Inc. (“Atlanta Braves Holdings”)

(Nasdaq: BATRA, BATRK) today reported third quarter 2023

results.

Headlines include(1):

- Total revenue grew 11% to $272 million in third quarter

- Baseball revenue up 11% to $256 million

- Mixed-use development revenue up 10% to $16 million

- Mixed-use development generated $11 million of Adjusted

OIBDA(2) in third quarter

- Atlanta Braves secured sixth consecutive NL East Title

- 54 game sellouts and 3.2 million tickets sold for 2023

season

Corporate Updates

On July 18, 2023, Liberty Media Corporation (“Liberty Media”)

completed the split-off of the Braves and its associated mixed-use

development (the “Split-Off”) into the separate public company

Atlanta Braves Holdings. The businesses and assets at Atlanta

Braves Holdings consist of Braves Holdings, LLC, the owner and

operator of the Atlanta Braves Major League Baseball Club, and

certain assets and liabilities associated with the Braves’ ballpark

and mixed-use development, called The Battery Atlanta, which were

previously attributed to the Braves Group tracking stock of Liberty

Media. For purposes of this presentation, Atlanta Braves Holdings

standalone results, assets and liabilities represent the

combination of the historical financial information of the Braves

Group until the date of the Split-Off. Although Atlanta Braves

Holdings was reported as a combined company until the date of the

Split-Off, it is now a consolidated company and all periods

reported in this presentation are referred to as consolidated.

Discussion of

Results

Three months ended

Nine months ended

September 30,

September 30,

2022

2023

% Change

2022

2023

% Change

amounts in thousands

amounts in thousands

Baseball revenue

$

231,279

$

256,266

11

%

$

478,037

$

528,762

11

%

Mixed-use development revenue

14,168

15,558

10

%

39,265

44,157

12

%

Total revenue

245,447

271,824

11

%

517,302

572,919

11

%

Operating costs and expenses:

Baseball operating costs

(194,216

)

(198,195

)

(2

)

%

(390,027

)

(430,424

)

(10

)

%

Mixed-use development costs

(2,089

)

(2,247

)

(8

)

%

(6,399

)

(6,451

)

(1

)

%

Selling, general and administrative,

excluding stock-based compensation

(24,626

)

(31,037

)

(26

)

%

(73,519

)

(84,686

)

(15

)

%

Adjusted OIBDA

$

24,516

$

40,345

65

%

$

47,357

$

51,358

8

%

Operating income (loss)

$

(4,692

)

$

15,716

NM

$

(23,371

)

$

(14,074

)

40

%

Regular season home games in period

38

37

79

80

Unless otherwise noted, the following discussion compares

financial information for the three months ended September 30, 2023

to the same period in 2022.

Baseball revenue is derived from two primary sources on an

annual basis: (i) baseball event revenue (ticket sales,

concessions, advertising sponsorships, suites and premium seat

fees) and (ii) broadcasting revenue (national and local broadcast

rights). Mixed-use development revenue is derived from the Battery

Atlanta mixed-use facilities and primarily includes rental

income.

The following table disaggregates revenue by segment and by

source:

Three months ended

Nine months ended

September 30,

September 30,

2022

2023

% Change

2022

2023

% Change

amounts in thousands

amounts in thousands

Baseball:

Baseball event

$

134,941

$

160,794

19

%

$

281,144

$

324,280

15

%

Broadcasting

66,901

69,337

4

%

130,646

138,786

6

%

Retail and licensing

17,590

20,904

19

%

39,200

45,026

15

%

Other

11,847

5,231

(56

)

%

27,047

20,670

(24

)

%

Baseball revenue

231,279

256,266

11

%

478,037

528,762

11

%

Mixed-use development

14,168

15,558

10

%

39,265

44,157

12

%

Total revenue

$

245,447

$

271,824

11

%

$

517,302

$

572,919

11

%

There were 37 regular season home games played in the third

quarter of 2023 compared to 38 regular season home games in the

prior year period.

Baseball revenue increased 11% in the third quarter. Baseball

event and retail and licensing revenue grew primarily due to

increased ticket demand and attendance at regular season home

games. Broadcasting revenue increased due to contractual rate

increases. Other revenue declined due to fewer concerts at the

ballpark compared to the prior year period. Mixed-use development

revenue increased 10% during the third quarter due to increases in

rental income related to tenant recoveries and various new lease

agreements, as well as higher sponsorship revenue.

Operating income and Adjusted OIBDA increased in the third

quarter. Revenue growth more than offset increased baseball

operating costs due to higher player salaries and minor league team

and player expenses. Selling, general and administrative expense

increased during the third quarter primarily driven by costs

related to the Split-Off.

FOOTNOTES

1)

Atlanta Braves Holdings will be available

to answer questions related to these headlines and other matters on

Liberty Media Corporation’s earnings conference call that will

begin at 10:00 a.m. (E.T.) on November 3, 2023. For information

regarding how to access the call, please see “Important Notice”

later in this document.

2)

For a definition of Adjusted OIBDA (as

defined by Atlanta Braves Holdings) and the applicable

reconciliation, see the accompanying schedule.

Important Notice: Atlanta Braves Holdings (Nasdaq: BATRA,

BATRK) will be available to answer questions on Liberty Media

Corporation’s third quarter earnings conference call which will

begin at 10:00 a.m. (E. T.) on November 3, 2023. The call can be

accessed by dialing (877) 704-2829 or (215) 268-9864, passcode

13736986 at least 10 minutes prior to the start time. The call will

also be broadcast live across the Internet and archived on our

website. To access the webcast go to

https://www.bravesholdings.com/investors/news-events/ir-calendar.

Links to this press release will also be available on the Atlanta

Braves Holdings website.

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements about business strategies, product

and marketing strategies, future financial performance and

prospects, and other matters that are not historical facts. These

forward-looking statements involve many risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements, including, without

limitation, Atlanta Braves Holdings’ ability to recognize

anticipated benefits from the split-off, possible changes in the

regulatory and competitive environment in which Atlanta Braves

Holdings operates (including an expansion of MLB), the unfavorable

outcome of pending or future litigation, operational risks of

Atlanta Braves Holdings and its business affiliates, including

operations outside of the U.S., Atlanta Braves Holdings’

indebtedness and its ability to obtain additional financing on

acceptable terms and cash in amounts sufficient to service debt and

other financial obligations, tax matters, compliance with

government regulations and potential adverse outcomes of regulatory

proceedings, changes in the nature of key strategic relationships

with broadcasters, partners, vendors and joint venturers, the

impact of organized labor, the performance and management of the

mixed-use development and the impact of inflation and weak economic

conditions on consumer demand. These forward-looking statements

speak only as of the date of this press release, and Atlanta Braves

Holdings expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statement contained herein to reflect any change in Atlanta Braves

Holdings’ expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based.

Please refer to the publicly filed documents of Atlanta Braves

Holdings, including Amendment No. 5 to the Registration Statement

on Form S-4 filed by Atlanta Braves Holdings with the Securities

and Exchange Commission on June 8, 2023, the Registration Statement

on Form S-1 filed by Atlanta Braves Holdings with the Securities

and Exchange Commission on September 8, 2023, and the most recent

Form 10-Q, for additional information about Atlanta Braves Holdings

and about the risks and uncertainties related to Atlanta Braves

Holdings’ business which may affect the statements made in this

press release.

NON-GAAP FINANCIAL MEASURES AND SUPPLEMENTAL

DISCLOSURES

SCHEDULE 1: Reconciliation of Adjusted OIBDA to Operating Income

(Loss)

To provide investors with additional information regarding our

financial results, this press release includes a presentation of

Adjusted OIBDA, which is a non-GAAP financial measure, for Atlanta

Braves Holdings together with reconciliations to operating income,

as determined under GAAP. Atlanta Braves Holdings defines Adjusted

OIBDA as operating income (loss) plus depreciation and

amortization, stock-based compensation, separately reported

litigation settlements, restructuring, acquisition and impairment

charges.

Atlanta Braves Holdings believes Adjusted OIBDA is an important

indicator of the operational strength and performance of its

businesses by identifying those items that are not directly a

reflection of each business’ performance or indicative of ongoing

business trends. In addition, this measure allows management to

view operating results and perform analytical comparisons and

benchmarking between businesses and identify strategies to improve

performance. Because Adjusted OIBDA is used as a measure of

operating performance, Atlanta Braves Holdings views operating

income as the most directly comparable GAAP measure. Adjusted OIBDA

is not meant to replace or supersede operating income or any other

GAAP measure, but rather to supplement such GAAP measures in order

to present investors with the same information that Atlanta Braves

Holdings’ management considers in assessing the results of

operations and performance of its assets.

The following table provides a reconciliation of Adjusted OIBDA

for Atlanta Braves Holdings to operating income (loss) calculated

in accordance with GAAP for the three and nine months ended

September 30, 2022 and September 30, 2023.

Three months ended

Nine months ended

September 30,

September 30,

(amounts in thousands)

2022

2023

2022

2023

Operating income (loss)

$

(4,692

)

$

15,716

$

(23,371

)

$

(14,074

)

Impairment of long-lived assets and other

related costs

4,811

34

4,811

564

Stock-based compensation

3,062

3,309

9,188

9,653

Depreciation and amortization

21,335

21,286

56,729

55,215

Adjusted OIBDA

$

24,516

$

40,345

$

47,357

$

51,358

Baseball

$

18,072

$

36,918

$

28,653

$

38,796

Mixed-use development

9,696

10,661

26,093

29,980

Corporate and other

(3,252

)

(7,234

)

(7,389

)

(17,418

)

SCHEDULE 2: Cash and Debt

The following presentation is provided to separately identify

cash and debt information. Atlanta Braves Holdings cash decreased

$24 million during the third quarter due to cash used in operations

primarily due to seasonal working capital changes, as well as

capital expenditures, partially offset by the release of restricted

cash pursuant to the terms of various financial debt arrangements

and net borrowing. Atlanta Braves Holdings debt increased $16

million in the third quarter primarily due to borrowings under the

TeamCo revolver and mixed-use development credit facilities.

(amounts in thousands)

June 30, 2023

September 30, 2023

Atlanta Braves Holdings Cash

(GAAP)(a)

$

130,537

$

106,715

Debt:

Baseball

League wide credit facility

$

—

$

—

MLB facility fund - term

30,000

30,000

MLB facility fund - revolver

43,125

41,400

TeamCo revolver

—

10,000

Term debt

168,561

165,370

Mixed-use development

301,127

312,399

Total Atlanta Braves Holdings

Debt

$

542,813

$

559,169

Deferred financing costs

(4,118

)

(3,898

)

Total Atlanta Braves Holdings Debt

(GAAP)

$

538,695

$

555,271

___________________

a)

Excludes restricted cash held in reserves

pursuant to the terms of various financial obligations of $52

million and $20 million as of June 30, 2023 and September 30, 2023,

respectively.

ATLANTA BRAVES

HOLDINGS

CONDENSED CONSOLIDATED BALANCE

SHEET INFORMATION

September 30, 2023

(unaudited)

September 30,

December 31,

2023

2022

amounts in thousands

except share amounts

Assets

Current assets:

Cash and cash equivalents

$

106,715

150,664

Restricted cash

19,814

22,149

Accounts receivable and contract assets,

net of allowance for credit losses

99,095

70,234

Other current assets

18,224

24,331

Total current assets

243,848

267,378

Property and equipment, at cost

1,061,776

1,007,776

Accumulated depreciation

(312,286

)

(277,979

)

749,490

729,797

Investments in affiliates, accounted for

using the equity method

105,614

94,564

Intangible assets not subject to

amortization:

Goodwill

175,764

175,764

Franchise rights

123,703

123,703

299,467

299,467

Other assets, net

120,420

99,455

Total assets

$

1,518,839

1,490,661

Liabilities and Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

68,339

54,748

Deferred revenue and refundable

tickets

106,120

104,996

Current portion of debt

7,786

74,806

Other current liabilities

7,056

6,361

Total current liabilities

189,301

240,911

Long-term debt

547,485

467,160

Redeemable intergroup interests

—

278,103

Finance lease liabilities

106,751

107,220

Deferred income tax liabilities

56,682

54,099

Pension liability

10,712

15,405

Other noncurrent liabilities

32,257

28,253

Total liabilities

943,188

1,191,151

Equity:

Preferred stock, $.01 par value.

Authorized 50,000,000 shares; zero shares issued at September 30,

2023 and December 31, 2022

—

—

Series A common stock, $.01 par value.

Authorized 200,000,000 shares; issued and outstanding 10,318,202

and zero at September 30, 2023 and December 31, 2022,

respectively

103

—

Series B common stock, $.01 par value.

Authorized 7,500,000 shares; issued and outstanding 977,795 and

zero at September 30, 2023 and December 31, 2022, respectively

10

—

Series C common stock, $.01 par value.

Authorized 200,000,000 shares; issued and outstanding 50,427,249

and zero at September 30, 2023 and December 31, 2022,

respectively

504

—

Additional paid-in capital

1,088,517

—

Former parent’s investment

—

732,350

Accumulated other comprehensive earnings

(loss), net of taxes

(3,510

)

(3,758

)

Retained earnings (deficit)

(522,018

)

(429,082

)

Total stockholders' equity/former parent's

investment

563,606

299,510

Noncontrolling interests in equity of

subsidiaries

12,045

—

Total equity

575,651

299,510

Commitments and contingencies

Total liabilities and equity

$

1,518,839

1,490,661

ATLANTA BRAVES

HOLDINGS

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS INFORMATION

September 30, 2023

(unaudited)

Three months ended

Nine months ended

September 30,

September 30,

2023

2022

2023

2022

amounts in thousands, except

per share amounts

Revenue:

Baseball revenue

$

256,266

231,279

$

528,762

478,037

Mixed-use development revenue

15,558

14,168

44,157

39,265

Total revenue

271,824

245,447

572,919

517,302

Operating costs and expenses:

Baseball operating costs

198,195

194,216

430,424

390,027

Mixed-use development costs

2,247

2,089

6,451

6,399

Selling, general and administrative,

including stock-based compensation

34,346

27,688

94,339

82,707

Impairment of long-lived assets and other

related costs

34

4,811

564

4,811

Depreciation and amortization

21,286

21,335

55,215

56,729

256,108

250,139

586,993

540,673

Operating income (loss)

15,716

(4,692)

(14,074)

(23,371)

Other income (expense):

Interest expense

(9,657)

(7,999)

(28,017)

(20,528)

Share of earnings (losses) of affiliates,

net

12,725

9,975

23,384

22,118

Realized and unrealized gains (losses) on

intergroup interests, net

(20,392)

(30,940)

(83,178)

5,163

Realized and unrealized gains (losses) on

financial instruments, net

2,593

5,778

5,672

12,238

Gains (losses) on dispositions, net

15

68

2,518

20,283

Other, net

1,209

161

2,863

329

Earnings (loss) before income taxes

2,209

(27,649)

(90,832)

16,232

Income tax benefit (expense)

(8,256)

(2,248)

(2,104)

(5,465)

Net earnings (loss)

$

(6,047)

(29,897)

$

(92,936)

10,767

Basic net earnings (loss) attributable to

Series A, Series B and Series C Atlanta Braves Holdings, Inc.

shareholders per common share

$

(0.10)

(0.48)

$

(1.51)

0.17

Diluted net earnings (loss) attributable

to Series A, Series B and Series C Atlanta Braves Holdings, Inc.

shareholders per common share

$

(0.10)

(0.48)

$

(1.51)

0.17

ATLANTA BRAVES

HOLDINGS

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS INFORMATION

September 30, 2023

(unaudited)

Nine months ended

September 30,

2023

2022

amounts in thousands

Cash flows from operating activities:

Net earnings (loss)

$

(92,936)

10,767

Adjustments to reconcile net earnings

(loss) to net cash provided by (used in) operating activities:

Depreciation and amortization

55,215

56,729

Stock-based compensation

9,653

9,188

Impairment of long-lived assets

—

4,811

Share of (earnings) losses of affiliates,

net

(23,384)

(22,118)

Realized and unrealized (gains) losses on

intergroup interests, net

83,178

(5,163)

Realized and unrealized (gains) losses on

financial instruments, net

(5,672)

(12,238)

(Gains) losses on dispositions, net

(2,518)

(20,283)

Deferred income tax expense (benefit)

(6,086)

(2,111)

Cash receipts from returns on equity

method investments

12,350

14,850

Other charges (credits), net

4,856

2,041

Net change in operating assets and

liabilities:

Current and other assets

(67,475)

(22,628)

Payables and other liabilities

11,513

5,543

Net cash provided by (used in) operating

activities

(21,306)

19,388

Cash flows from investing activities:

Capital expended for property and

equipment

(45,313)

(13,174)

Cash proceeds from dispositions

—

47,840

Investments in equity method affiliates

and equity securities

(125)

(5,273)

Other investing activities, net

110

—

Net cash provided by (used in) investing

activities

(45,328)

29,393

Cash flows from financing activities:

Borrowings of debt

52,248

134,753

Repayments of debt

(38,997)

(235,368)

Payments to settle intergroup

interests

—

(13,828)

Contribution from noncontrolling

interest

12,045

—

Other financing activities, net

(4,946)

(5,135)

Net cash provided by (used in) financing

activities

20,350

(119,578)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(46,284)

(70,797)

Cash, cash equivalents and restricted cash

at beginning of period

172,813

244,113

Cash, cash equivalents and restricted cash

at end of period

$

126,529

173,316

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102958609/en/

Shane Kleinstein (720) 875-5432

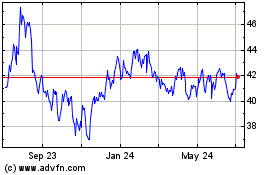

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Oct 2024 to Nov 2024

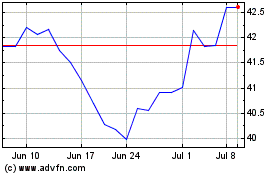

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Nov 2023 to Nov 2024