UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

AMERISERV FINANCIAL, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to nominate, and to file a preliminary

proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of,

director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation (the “Company”).

On September 8, 2023, Driver

delivered a letter (the “September 8th Letter”) to Mr. J. Michael Adams, Chairman of the board of directors of

the Company, and Mr. Jeffery A. Stopko, President and Chief Executive Officer of the Company, a copy of which is attached hereto as Exhibit

1 and incorporated herein by reference. The September 8th Letter included as exhibits two letters previously delivered by Driver

to the board of directors of the Company (the “Board Letter”) and shareholders of the Company (the “Shareholder Letter”),

respectively, subsequent to the conclusion of the Company’s 2023 annual meeting of shareholders. A copy of the Board Letter is attached

hereto as Exhibit 2 and a copy of the Shareholder Letter is attached hereto as Exhibit 3, each of which is incorporated herein by reference.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver Management”),

together with the other participants named herein (collectively, “Driver”), intends to nominate, and to file a preliminary

proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of,

director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation (the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY

TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE

AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS

IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation are currently

anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”) and J. Abbott R. Cooper.

As of the date hereof, the participants in the proxy

solicitation beneficially own in the aggregate 350,503 shares of Common Stock, par value $0.01 per share, of the Company (the “Common

Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 350,503 shares of Common Stock, including 1,000 shares

held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the 350,503 shares

of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management, may be deemed

to beneficially own the 350,503 shares of Common Stock directly beneficially owned by Driver Opportunity.

Exhibit 1

September 8, 2023

BY EMAIL

J. Michael Adams

Chairman

Board of Directors

Jeffery A. Stopko

President and CEO

AmeriServ Financial, Inc.

216 Franklin Street

Johnstown, PA 15901

Gentlemen,

Reference is made to your letter to shareholders of AmeriServ Financial,

Inc. (“AmeriServ”) dated August 31, 2023 that references a letter that Driver Opportunity Partners I LP sent to AmeriServ

shareholders on August 2, 2023 and a demand letter Driver Opportunity Partners I LP sent to AmeriServ’s board of directors on the

same day. Those letters are attached hereto for reference.

I had considered rebutting all of the spurious claims made in your

letter, but I think this “X” post says all there needs to be said:

1266 East Main Street

Suite 700R

Stamford, CT 06902

Exhibit 2

August 2, 2023

Board of Directors

AmeriServ Financial, Inc.

216 Franklin Street

Johnstown, PA 15901

Via email to jstopko@ameriserv.com

Ladies and Gentlemen,

Driver Opportunity Partners I LP (together with its managing member,

Driver Management Company, “Driver”) is the record owner of 1,000 shares (the “Record Shares”) of

the common stock (the “Common Stock”) of AmeriServ Financial Inc. (“AmeriServ” or the “Company”).

Driver has been the holder of record of the Record Shares since August 30, 2022. In addition to the Record Shares, Driver is the beneficial

owner of approximately 270,000 shares of Common Stock.

Driver is hereby demands that the board of directors (the “Board”)

immediately bring an action on behalf of the Company against J. Michael Adams, Kim Kunkle, Richard Bloomington, Amy Bradley, David Hickton,

Margaret O’Malley, Daniel Onorato, Mark Pasquerilla, Jeffery Stopko, Sara Sargent and Allan Dennison (Mr. Dennison, Ms. Sargent,

Mr. Adams, Mr. Kunkle, Ms. Bradley, Ms. O’Malley, Mr. Onorato, Mr. Pasquerilla and Mr. Stopko are referred to as the “Incumbent

Board” and Mr. Bloomington, Mr. Hickton, Mr. Kunkle, Ms. Bradley, Ms. O’Malley, Mr. Onorato, Mr. Pasquerilla and Mr. Stopko

are referred to as the “Current Board”; together with the Incumbent Board, they are referred to as the “Current

and Former Directors” or the “Culpable Parties”) for breach of their fiduciary duty in violation of 15 Pa.

C.S. § 1712.

Overview

As measured by return on assets (“ROA”), a standard

metric of a bank’s profitability, AmeriServ has underperformed peers for decades, routinely generating a fraction of the ROA generated

by peer institutions, as illustrated by the below chart comparing AmeriServ to the S&P U.S. Small Cap Banks Index (the “Small

Cap Banks Index”):1

1 All data per S&P Capital IQ.

Soundview Plaza

1266 East Main Street, Suite 700R

Stamford, CT 06902

Despite AmeriServ’s failure to generate anywhere close to

peer levels of profitability, the Current and Former Directors spent $1.7 million during the first half of 2023 in an attempt to deprive

AmeriServ’s shareholders of the right to vote for candidates for election to director nominated by Driver.2The Current and Former Directors reckless and faithless actions in seeking to entrench themselves resulted in AmeriServ

reporting a loss of $0.01 per diluted share of Common Stock for the quarter ended June 30, 2023.

While, as a general matter, the business and affairs of a Pennsylvania

corporation are managed by or under the authority of its board of directors, a corporation has no particular interest in who specifically

serves as director. Under Pennsylvania law, the election of directors is a right reserved exclusively to shareholders. However, when confronted

with a dissident shareholder (Driver), unsatisfied with a status quo that had produced little to nothing in terms of shareholder value,

the Incumbent Board began to expend corporate resources in an attempt to prevent AmeriServ shareholders from being able to vote for candidates

for election to director nominated by Driver.

The Incumbent Board’s actions to stymie Driver’s proxy

contest were not in the best interests of AmeriServ. Indeed, the only interests served by the Incumbent Board’s actions were their

own—specifically, their interests in entrenching themselves and ensuring that, at AmeriServ’s 2023 annual meeting of shareholders

(the “2023 Annual Meeting”), the only candidates for election to director who AmeriServ shareholders could vote for

would be those selected by the Incumbent Board. The pretext for rejecting Driver’s candidates was that Driver’s notice of

nomination failed to comply with AmeriServ’s “advance notice” bylaw. However, despite causing AmeriServ to spend $1.7

million during the first half of 2023, the Incumbent Board has not demonstrated—and cannot demonstrate—any of the following:

| · | How preventing AmeriServ’s shareholders from voting for Drivers’ nominees at the 2023 Annual Meeting was in AmeriServ’s

best interests; |

| · | How AmeriServ would have been injured if the Incumbent Board had accepted Driver’s notice of nomination despite any alleged

deficiencies, or worked with Driver to remedy any alleged deficiencies prior to the 2023 Annual Meeting; |

| · | How AmeriServ would have been injured if the Incumbent Board “approved” J. Abbott R. Cooper for service on the Board of

Directors as contemplated by AmeriServ’s “interlocks” bylaw;3 |

| · | How denying that the adoption of the interlocks bylaw required, under the terms of AmeriServ’s bylaws, approval by AmeriServ

shareholders is in AmeriServ’s best interests; and |

| · | How AmeriServ would have been injured by allowing Mr. Brandon Simmons to sit for election to the Board of Directors, as AmeriServ

has never raised a specific disclosure issue with respect to Mr. Simmons or his candidacy; |

| · | How engaging in costly and protracted litigation, whose sole purpose was to prevent AmeriServ’s shareholders from voting for

Driver’s nominees at the 2023 Annual Meeting (thus ensuring that the Incumbent Board’s nominees were elected), is in AmeriServ’s

best interests. |

It is a matter of settled corporate law that, with respect to the

management of a corporation, directors are the agents of the corporation’s owners, its shareholders. The right to choose its agents

is the right of the principal, not the agent. Any attempts by any agent to usurp that right do not constitute the exercise of “business

judgement,” since the basis for the business judgement rule is that, once shareholders have selected directors, those directors

are permitted to exercise their good faith business judgement in how the corporation is to be managed. The business judgement rule gives

directors considerable leeway in its management of the corporation but it does not allow directors to substitute their judgement for that

of shareholders when it comes to electing board members.

Currently, Driver and AmeriServ are litigants in three separate

actions, and AmeriServ is continuing to incur additional legal expense to contest those actions. In a press release dated July 18, 2023

(included as an exhibit to a Current Report on Form 8-K filed by AmeriServ on July 18, 2023), AmeriServ states:

2 AmeriServ has not disclosed the amount it spent during 2022 in its efforts to suppress and neutralize Driver’s dissenting voice.

3 Driver does not concede that the interlocks bylaw is valid or of any legal effect.

Total non-interest expense in the second quarter of 2023 increased

by $1.1 million, or 8.8%, when compared to the second quarter of 2022 and increased by $1.6 million, or 6.6%, during the first half of

2023 when compared to the first half of 2022. The rise in total non-interest expense for both time periods is primarily due to increased

legal and professional fees related to the Company’s recent annual meeting proxy contest and defense against an activist investor.

These costs amounted to $1.1 million in the second quarter of 2023 and $1.7 million for the six-month period. Given that the Company’s

shareholders voted to elect the Board’s slate of director candidates, the Company expects costs related to the activist issue to

decline significantly in the second half of 2023.

There is no basis for the statement “given that the Company’s

shareholders voted to elect the Board’s slate of director candidates, the Company expects costs related to the activist issue to

decline significantly in the second half of 2023”—the results of the 2023 Annual Meeting are immaterial to the outcome of

any of the pending actions involving Driver and AmeriServ, a fact that is (or should be) known to the Board of Directors. Driver believes

that the above statement—a false and misleading statement of material fact—was intentionally made at the direction of the

Current Board in order to mislead AmeriServ’s shareholders, who might be justifiably concerned at the Current Board’s continued

waste of corporate resources, into believing that there is an end in sight to the costs to AmeriServ of the Current and Former Directors

disloyal attempts to insulate themselves from accountability to AmeriServ’s shareholders. In addition to continuing wantonly to

waste corporate resources on litigation entirely unrelated to any cognizable interest of AmeriServ (as opposed to the personal interests

of the Current and Former Directors), the Current Board has potentially exposed AmeriServ to liability for securities fraud for knowingly

making false and misleading statements of material fact.

Factual Background Giving Rise to Claims Against

the Culpable Parties

A Legacy of Underperformance

By almost any measure, AmeriServ has underperformed peers for years.

One measure that is particularly relevant to investors in a publicly traded bank holding company is the valuation implied by the trading

price of its common stock and, in particular, its stock price as a percentage of tangible book value per share. Since tangible book value

per share (“TBVPS”)—the difference between the bank holding companies tangible assets and tangible liabilities

divided by the number of shares—represents the theoretical value to be received for each share in the event of a liquidation, if

a bank holding company’s stock trades at price to tangible book value (“P/TBV”) of less than 100% for an extended

period of time, the public market, in effect, is putting negative value on the business as a going concern.

As illustrated by the below chart comparing P/TBV for the Common

Stock with the Small Cap Banks Index, the Common Stock has consistently traded at a significant discount to TBVPS for an extended period

of time:

A Dissident Shareholder Calls for Change and Is Rebuffed

Beginning in November 2022, Driver attempted to express its concern

regarding AmeriServ’s long-term underperformance to Allan Dennison, then the chairman of the Board of Directors. After a series

of fruitless attempts at explaining to Mr. Dennison how AmeriServ’s executive compensation programs actually were creating an incentive

for AmeriServ’s management to underperform peers and how the Board of Directors’ failure to hold AmeriServ’s management

accountable for AmeriServ’s underperformance was ensuring that such underperformance would continue, Driver indicated its intention

to nominate candidates for election to the Board of Directors at the 2023 Annual Meeting.

Faced with the prospect of being held accountable by shareholders

for AmeriServ’s long-term underperformance, and considering the prospect of a proxy fight to be a “threat,” the Incumbent

Board immediately engaged legal counsel to “fight” Driver. Rather than summoning what few arguments they might be able to

muster to convince AmeriServ’s shareholders to vote in favor of the Incumbent Board’s nominees at the 2023 Annual Meeting—which

would have acknowledged that electing directors is a right reserved exclusively to AmeriServ’s shareholders—the Incumbent

Board, instead, immediately sought to play an illegitimate gatekeeper role in an attempt to establish itself as the arbiter of who was

“suitable” to be a director.

Specifically, once Driver had notified the Incumbent Board of its

intent to nominate Mr. Cooper, Julius “Izzy” Rudolph and Brandon Simmons for election at the 2023 Annual Meeting, the Incumbent

Board demanded that Driver’s nominees allow themselves to be interviewed by the Incumbent Board and complete questionnaires prepared

by the Incumbent Board, neither of which are required by AmeriServ’s bylaws. When Driver refused to comply with the Incumbent Board’s

demands—for the obvious reason that the Incumbent Board was unlikely to recommend that AmeriServ’s shareholders vote for Driver’s

nominees rather than those selected by the Incumbent Board and any information gleaned in an “interview” was far more likely

to be used against Driver’s nominees in a contested director election—the Incumbent Board determined, as evidenced by the

sworn testimony of Mr. Dennison, that Driver’s nominees were “not appropriate” for the Board of Directors due to their

failure to participate in the Incumbent Board’s preferred, but unauthorized, method for selecting nominees.

The Alleged Deficiencies

On January 17, 2023, Driver delivered its notice of nomination to

the Incumbent Board. Shortly thereafter, by letter dated January 31, 2023 (the “January 31 Letter”), the Incumbent

Board notified Driver of purported deficiencies in Driver’s notice of nomination, the majority of which related to the requirement

that the notice of nomination include all the information that would be required to be included in a proxy statement filed with the Securities

and Exchange Commission (the “SEC”), which requirement is referred to as the “Proxy Information Requirement.”

The January 31 Letter did not include any explanation as to how the Proxy Information Requirement was in the best interests of AmeriServ

or why accepting Driver’s notice of nomination despite the purported deficiencies listed in the January 31 Letter would be contrary

to the best interests of AmeriServ.

Following receipt of the January 31 Letter, Driver attempted in

good faith to address the purported deficiencies listed in that letter. In addition, on February 8, Driver filed its preliminary proxy

statement with respect to the 2023 Annual Meeting with the SEC. In response to comments from the staff of the SEC, Driver filed amendments

to its preliminary proxy statement on March 17, 2023, March 21, 2023 and April 24, 2023. After being advised by the staff of the SEC that

it had no further comments on the preliminary proxy statement, Driver filed its definitive proxy statement (“Driver’s Definitive

Proxy Statement”) with the SEC on April 26, 2023, and, immediately thereafter, copies of Driver’s Definitive Proxy Statement

were mailed or otherwise distributed to AmeriServ’s shareholders.

The March 14 Board of Directors Meeting

On March 14, 2023, the Incumbent Board formed a plan to prevent

AmeriServ’s shareholders from having the opportunity to vote for Driver’s nominees at the 2023 Annual Meeting by declaring

that Driver’s notice of nomination was invalid for failing to comply with the Proxy Information Requirement. On information and

belief:

| · | There was no assessment of how any purported failure by Driver to comply with the Proxy Information Requirement—particularly

in light of the Incumbent Board’s actual knowledge that Driver’s Definitive Proxy Statement would not be mailed or otherwise

distributed to AmeriServ’s shareholders until after the SEC had completed its review thereof—might harm or adversely impact

AmeriServ or its shareholders; |

| · | Despite the clear and very real possibility that Driver would commence litigation to enforce its right to nominate candidates for

election to director, there was no assessment of how defending against any such litigation—taking into account the cost of lawyers’

fees and other expenses as well as the time and attention of AmeriServ’s management that would need to be diverted from the day

to day management of AmeriServ—was in the best interests of AmeriServ, particularly in comparison to any injury or adverse effect

that AmeriServ might suffer in the event the Incumbent Board accepted Driver’s notice of nomination despite the purported deficiencies;

and |

| · | There was no discussion of what interests of AmeriServ were being served by determining that Driver’s notice of nomination was

invalid or weighing of those interests against the obvious and completely foreseeable ramifications (i.e., protracted litigation) of taking

such action. |

The Incumbent Board Rejects Driver’s Notice of Nomination

and Litigation Ensues

By letter dated March 15, 2023, the Incumbent Board notified Driver

that it was rejecting Driver’s notice of nomination. On March 17, 2023, the Incumbent Board caused AmeriServ to file a complaint

against Driver in the Court of Common Pleas for Cambria County seeking, among other things, a declaratory judgment that Driver’s

notice of nomination was invalid, which action (referred to as the “AmeriServ Litigation”) was subsequently removed

to the United States District Court for the Western District of Pennsylvania (the “Western District Court”). On March

29, 2023, Driver filed a complaint against the Incumbent Board in the Western District Court seeking, among other things, a declaration

that Driver’s notice of nomination was validly made (referred to as the “Driver Litigation”).

Following commencement of the AmeriServ Litigation and the Driver

Litigation, the Incumbent Board scheduled the 2023 Annual Meeting for May 26, 2023, with full knowledge that neither the AmeriServ Litigation

nor the Driver Litigation would be resolved by that time. During May 2023, a two-day-long hearing was held in the Western District Court

with respect to Driver’s motion to enjoin the 2023 Annual Meeting until the Driver Litigation could be resolved. The 2023 Annual

Meeting was held on May 26, 2023 and both the AmeriServ Litigation and the Driver Litigation remain pending—the fact that the 2023

Annual Meeting has occurred had no dispositive effect on either the AmeriServ Litigation or the Driver Litigation, and any contention

that, as a result of the 2023 Annual Meeting having occurred, the costs to AmeriServ of either the AmeriServ Litigation or the Driver

Litigation (as well as other litigation previously initiated by Driver to enforce its rights as a shareholder to inspect certain of AmeriServ’s

books and records) might subside is not only without any basis in fact but contrary to the actual knowledge of the Current Board.

The Interlocks Bylaw

The Current and Former Directors contend that AmeriServ’s

bylaws contain the interlocks bylaw, despite the fact that such bylaw was never validly adopted by AmeriServ’s shareholders. While

the interlocks bylaw purports to prohibit any person from serving on the Board of Directors if that person is serving, or has during the

preceding five-year period has served, as a director of any other depository institution, unless that person is “approved”

by a majority of the Board of Directors. According to the Incumbent Board, the interlocks bylaw is not related to or grounded in any applicable

banking law or regulation and exists merely to deter potential conflicts of interest. The Current and Former Directors have claimed, including

in soliciting material filed with the SEC, that the interlocks bylaw prohibits Mr. Cooper from serving on the Board of Directors due to

the fact that he is currently a member of the board of directors of The First of Long Island Corporation, a publicly traded bank holding

company.

The interlocks bylaw does not contain any standards or criteria

for “approving” persons who are serving, or in the past five years have served, on the board of a depositary institution—the

determination to “approve” such a person appears to be entirely discretionary. The Incumbent Board has admitted that its

concerns regarding potential conflicts of interests that might arise if a person who is serving, or in the past five years has served,

on the board of a depositary institution are entirely speculative and that it is unaware of any actual conflicts of interest that might

arise if Mr. Cooper were to be elected to the Board of Directors. A key aspect of both the AmeriServ Litigation and the Driver Litigation

is whether the interlocks bylaw is valid or of any legal effect, despite the fact that the Current and Former Directors have failed to

demonstrate how prohibiting Mr. Cooper from serving on the Board of Directors is in the best interests of the corporation.

Claims Against the Culpable Parties

In furtherance of their own interests—specifically to safeguard

their own board seats and ensure that AmeriServ’s shareholders will only be able to vote for candidates for election to directors

selected by them—the Culpable Parties have injured AmeriServ by causing it to expend (and continue to expend) significant sums of

money on litigation that advances no cognizable interest of AmeriServ. Furthering the injury to AmeriServ, the Culpable Parties faithless

and negligent actions have caused AmeriServ to record a loss for the second quarter of 2023, a loss that the Culpable Parties acknowledge

is “primarily attributable” to its actions to prevent shareholders from voting for Driver’s candidates for election

to director at the 2023 Annual Meeting. The Culpable Parties have not—and cannot—articulate any valid interest of AmeriServ

in denying AmeriServ’s shareholders the opportunity to vote for Driver’s candidate for election to director at the 2023 Annual

Meeting. More specifically, the Culpable Parties have not—and cannot—offer any valid rationale as to (i) how the corporation

would be injured or adversely affected if Driver’s nomination, despite any purported deficiencies, had been accepted, (ii) how any

purported deficiencies harmed the corporation or its shareholders or deprived AmeriServ’s shareholders of access to any material

information (particularly in light of the fact that Driver’s Definitive Proxy Statement was subject to thorough review by the SEC),

or (iii) how any potential benefits to denying shareholders the opportunity to vote for Driver’s candidates for election to director

might outweigh the significant costs that the corporation has and will continue to incur as a result of the Culpable Parties blind determination

to avoid being held accountable for decades of underperformance.

By causing AmeriServ to expend significant sums—leading to

an operating loss—on litigation that is unrelated to any cognizable interest of the corporation, the Culpable Parties have violated

their fiduciary duties. In addition, by making false statements of material fact relating to the interlocks bylaw, as well as claims that

the occurrence of the 2023 Annual Meeting will limit further legal and other expenses, the Culpable Parties have exposed AmeriServ to

potential liability under federal securities laws, also in violation of their fiduciary duty. As a result of the Culpable Parties violations

of fiduciary duty outlined in this letter, AmeriServ has sustained and will continue to sustain significant damages.

Accordingly, pursuant to Pennsylvania law, Driver hereby demands

that the Board of Directors: (i) appoint a special litigation committee (a “SLC”) to undertake an independent investigation

into the Culpable Parties’ breaches of fiduciary duties and any other violations of Pennsylvania and/or federal law; and (ii) commence

a civil action against all of the Culpable Parties to recover for the benefit of AmeriServ the damages sustained by the Company as a result

of the misconduct described herein.

Pursuant to Pennsylvania law, if within a reasonable time after

receipt of this letter, the Board of Directors has not appointed an SLC and commenced an action as demanded herein, Driver will be entitled

to commence a shareholder’s derivative action on behalf of the Company seeking appropriate relief.

| |

Driver Opportunity Partners I LP |

| |

|

| |

By: |

Driver Management Company LLC, its general partner |

| |

|

|

|

| |

/s/ J. Abbott R. Cooper, Managing Member |

Exhibit 3

August 2, 2023

Fellow AmeriServ Shareholders,

First, to the holders of the approximately 16.5% of the issued and

outstanding shares of AmeriServ common stock who voted for our nominees at AmeriServ’s 2023 annual meeting, I want to thank you

for your support, particularly in light of AmeriServ’s incumbent Board’s ongoing efforts—which include refusing to publicly

disclose the number of shares voted for our nominees on our proxy card at AmeriServ’s 2023 annual meeting—to silence dissenting

voices and disregard widespread shareholder discontent. Given that only about 38% of the issued and outstanding shares of AmeriServ common

stock were voted in favor of the incumbent board of directors’ nominees, it seems abundantly clear that AmeriServ’s rejection

of our notice of nomination was informed by a very real fear that AmeriServ shareholders would finally hold AmeriServ’s board and

management team accountable for decades of underperformance.

Regardless of whether you voted for our nominees, AmeriServ’s

shareholders deserve the opportunity to decide who should serve on the AmeriServ board. Unfortunately, AmeriServ’s entrenched board

believes that it is better suited than you—the owners of AmeriServ—to determine who is suitable to serve as a director. Given

AmeriServ’s track record of decades of underperformance, it is not surprising that the AmeriServ board decided to invalidate our

nominees rather than risk giving shareholders a choice in the election of directors.

During the first six months of 2023, AmeriServ’s board spent

an incredible $1.7 million to deprive you of the opportunity to vote for our nominees at the 2023 annual meeting, which resulted in a

net loss of $187,000 during the second quarter. Much of that expense was on litigation whose sole purpose was to allow the board’s

nominees to run unopposed, guaranteeing their, in our view, illegitimate victory. While the 2023 annual meeting has come and gone, that

litigation continues and, despite AmeriServ’s claims to the contrary, the board has no reasonable basis to conclude that the costs

of that litigation will subside in the near term. We are committed to protecting our rights as shareholders and are more than willing

to spend our money to defend those rights. How committed are you to allowing AmeriServ’s board to continue limiting your choice

in the election of directors and how willing are you to allow AmeriServ’s board to continue to waste AmeriServ’s resources

in a desperate attempt to further entrench themselves?

We think that the facts are obvious: the AmeriServ board was

desperately afraid that one or more of our nominees would be elected to the board and, rather than face that risk, took steps—at

an enormous and still mounting cost to AmeriServ—to try to ensure that their nominees would run unopposed. We believe that

is a clear violation of the board’s fiduciary duties and have demanded that the board investigate that wrongdoing and take legal

action to recover the losses sustained by all shareholders. Included is a demand letter that we delivered to the AmeriServ board. If you,

like us, are tired of the board wasting AmeriServ’s resources in a futile attempt to preserve a status quo that has produced little

to nothing in terms of shareholder value, then we urge you to contact the chairman of AmeriServ’s board (by email to jmadams@ameriserv.com)

and demand that the board start working for shareholders instead of fighting with them. If you do, you might ask what the cost

would have been to AmeriServ if the board had simply accepted our notice of nomination and allowed for a contested election of directors

at the 2023 annual meeting—we’re confident it would have been a small fraction of the $1.7 million they spent protecting their

own seats —and then ask yourself if guaranteeing that the board’s nominees were elected was really worth the difference.

| |

Driver Opportunity Partners I LP |

| |

|

| |

By: |

Driver Management Company LLC, its general partner |

| |

|

|

|

| |

/s/ J. Abbott R. Cooper, Managing Member |

Soundview Plaza

1266 East Main Street, Suite 700R

Stamford, CT 06902

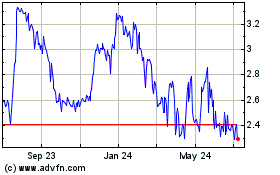

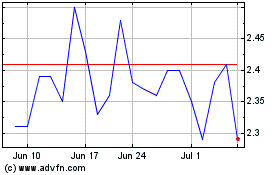

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024