Chairman and CEO T.J. Falgout, III to Step Down as Chief Executive

Officer BENTONVILLE, Ark., Sept. 6 /PRNewswire-FirstCall/ --

America's Car-Mart, Inc. (NASDAQ:CRMT) today announced its

operating results for the first fiscal quarter ended July 31, 2007.

Highlights of first quarter operating results: -- Net income of

$2.1 million ($.18 per diluted share) -- Provision for credit

losses of 21.8% of sales vs. 22.5% for the first fiscal quarter of

2007 (26.6% for fourth fiscal quarter of 2007 and 29.1% for full

year 2007) -- Accounts over 30 days past due down to 4.1% at July

31, 2007 from 5.6% at July 31, 2006 -- $7.2 million decrease in

debt for the quarter, down to $33.7 million. Debt to equity is 27%,

and debt to Finance Receivables is 19% at July 31, 2007 -- Revenue

decline of 5.6% -- Retail unit sales decrease of 14.9% For the

three months ended July 31, 2007, revenues decreased 5.6% to $58.7

million compared with $62.2 million in the same period of the prior

year. Income for the quarter was $2.1 million or $.18 per diluted

share, versus $4.2 million, or $0.35 per diluted share in the same

period last year. Retail unit sales were down 14.9%, with 5,847

vehicles in the current quarter, compared to 6,867 in the same

period last year. Same store revenue decreased 8.3% during the

quarter. Finance Receivables grew by $2.3 million during the

quarter or 1.3%, aided by sales of our new Payment Protection Plan

product. The allowance for credit losses is 22% of Finance

Receivables principal balance at July 31, 2007 compared to 19.2% at

July 31, 2006. This increased percentage equates to approximately

$5 million in additional reserve to cover future credit losses on a

net Receivable base $10 million less than at the end of the first

quarter of fiscal 2007. "Vehicle sales were moderate as we

continued to focus significant efforts on underwriting initiatives

to enhance the quality of our Finance Receivable portfolio," said

T.J. ("Skip") Falgout, III, Chairman and Chief Executive Officer of

America's Car-Mart. "We are very pleased with our credit losses and

collections efforts for the first quarter and believe that positive

results from our hard work provide proof that we are on the right

track. Also, our recent initiatives related to purchasing and sales

are beginning to have positive effects, and we expect sales volumes

to improve into the future." "Once again, credit losses,

collections and current receivables all improved as compared to the

first quarter of 2007 and as compared to recent quarters. Our

average percentage of Finance Receivables current was 81.7% for the

quarter compared to 79% for the first quarter of 2007," stated Mr.

Falgout. "We are very pleased with our strong cash flows from

operations which have allowed us to pay down our debt by $7.2

million during the quarter and $15.3 million from its high point at

the end of October 2006. We continue to be disciplined in requiring

higher down-payments at certain dealerships and shorter terms with

our loans to ensure we set the customer up for success. These

efforts have had a positive effect on our operating cash flows,

evidenced by the increase in our collections as a percentage of

average Finance Receivables. We will continue to focus on ensuring

that we earn an appropriate return on our invested capital on a

lot-by-lot basis and that we employ capital appropriately into the

future. In addition, we have made significant investments in our

infrastructure over the last two years and we believe we are now

positioned to leverage these costs to support higher sales and loan

volumes." "Our new Payment Protection Plan product has been very

well received by our customers and we expect to expand sales of

this product beyond the states of Arkansas and Alabama, the two

states where we sold this product in the first quarter." said

William H. ("Hank") Henderson, President of America's Car-Mart.

"Sales of this product to our new customers is in excess of 85%,

and we have also experienced great sales of this product to our

existing customers. This product will help our customers in

situations where their vehicle is stolen or totaled. This is

another example of Car-Mart being the leader in cultivating repeat

customers, the life-blood of our industry." "We are very proud of

our associates and their efforts during the past several months. We

are seeing positive results on the collections side of the business

and we anticipate the sales volumes to increase into the future as

we focus on better inventory, sales training and the continuation

of our pursuit of repeat customers. Additionally, we believe our

Payment Protection Plan will draw new customers to Car-Mart," said

Mr. Henderson. "We will continue to work hard at improving our lot

level operations and fully expect our financial results to follow

accordingly." In line with its succession plan, Mr. Falgout will

retire as Chief Executive Officer effective at the Company's annual

shareholders' meeting on October 16, 2007. Mr. Falgout, a major

shareholder, will remain as Chairman of the Board of Directors.

Effective October 16, 2007, upon Mr. Falgout's retirement as Chief

Executive Officer, Mr. Henderson has been elected and named Chief

Executive Officer. Mr. Henderson will also retain the title of

President, the position he has held with the Company since 2002.

"On behalf of the Board of Directors, I want to thank Skip for his

efforts and contributions to the growth and success of Car-Mart,

helping to guide the Company to become America's largest publicly

traded 'buy-here/pay-here' company," stated Mr. Henderson. "I look

forward to his future contributions, support and counsel as we

continue to move forward." "We are all excited about Hank assuming

the CEO title," stated Mr. Falgout. "Hank combines over 21 years of

experience at Car-Mart with strong vision and leadership skills, as

he has demonstrated these skills in transforming the Company into a

multi-state force in the 'buy-here/pay-here' segment of the

automotive industry." Conference Call Management will be holding a

conference call on Thursday, September 6, 2007 at 11:00 a.m.

Eastern time to discuss first quarter results. A live audio of the

conference call will be accessible to the public by calling (800)

309-9490. International callers dial (706) 634-0104. Callers should

dial in approximately 10 minutes before the call begins. A

conference call replay will be available one hour following the

call for seven days and can be accessed by calling (800) 642-1687

(domestic) or (706) 645-9291 (international), conference call ID

#14914428 About America's Car-Mart America's Car-Mart operates 93

automotive dealerships in nine states and is the largest publicly

held automotive retailer in the United States focused exclusively

on the "Buy Here/Pay Here" segment of the used car market. The

Company operates its dealerships primarily in small cities

throughout the South-Central United States selling quality used

vehicles and providing financing for substantially all of its

customers. For more information on America's Car-Mart, please visit

our website at http://www.car-mart.com/. Included herein are

forward-looking statements, including statements with respect to

projected revenues and earnings per share amounts. Such

forward-looking statements are based upon management's current

knowledge and assumptions. There are many factors that affect

management's view about future revenues and earnings. These factors

involve risks and uncertainties that could cause actual results to

differ materially from management's present view. These factors

include, without limitation, assumptions relating to unit sales,

average selling prices, credit losses, gross margins, operating

expenses, collection results, operational initiatives underway and

economic conditions, and other risk factors described under

"Forward-Looking Statements" of Item 1A of Part I of the Company's

Annual Report on Form 10-K for the fiscal year ended April 30, 2007

and its current and quarterly reports filed with or furnished to

the Securities and Exchange Commission. All forward-looking

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. The Company does

not undertake any obligation to update forward-looking statements.

America's Car-Mart, Inc. Consolidated Results of Operations

(Operating Statement Dollars in Thousands) %Change As a % of Sales

Three Months Ended 2007 Three Months Ended July 31, vs. July 31,

2007 2006 2006 2007 2006 Operating Data: Retail units sold 5,847

6,867 (14.9)% Average number of stores in operation 92.0 86.7 6.1

Average retail units sold per store per month 21.2 26.3 (19.4)

Average retail sales price $8,407 $7,913 6.2 Same store revenue

growth -8.3 % 1.9 % Net charge-offs as a percent of average Finance

Receivables 6.4 % 6.1 % Collections as a percent of average Finance

Receivables 17.1 % 16.0 % Average percentage of Finance

Receivables-Current 81.7 % 79.0 % Average down-payment percentage

7.6 % 5.3 % Period End Data: Stores open 92 88 4.5 % Accounts over

30 days past due 4.1 % 5.6 % Finance Receivables, gross $180,801

$191,487 (5.6)% Operating Statement: Revenues: Sales $52,863

$56,338 (6.2)% 100.0 % 100.0 % Interest income 5,844 5,853 (0.2)

11.1 10.4 Total 58,707 62,191 (5.6) 111.1 110.4 Costs and expenses:

Cost of sales 31,538 31,336 0.6 59.7 55.6 Selling, general and

administrative 11,195 10,470 6.9 21.2 18.6 Provision for credit

losses 11,519 12,655 (9.0) 21.8 22.5 Interest expense 810 902

(10.2) 1.5 1.6 Depreciation and amortization 274 232 18.1 0.5 0.4

Total 55,336 55,595 (0.5) 104.7 98.7 Income before taxes 3,371

6,596 6.4 11.7 Provision for income taxes 1,230 2,441 2.3 4.3 Net

income $2,141 $4,155 4.0 7.4 Earnings per share: Basic $0.18 $0.35

Diluted $0.18 $0.35 Weighted average number of shares outstanding:

Basic 11,875,782 11,850,796 Diluted 11,967,690 11,983,528 America's

Car-Mart, Inc. Consolidated Balance Sheet and Other Data (Dollars

in Thousands) July 31, April 30, 2007 2007 Cash and cash

equivalents $238 $257 Finance receivables, net $141,488 $139,194

Total assets $174,272 $173,598 Total debt $33,676 $40,829

Stockholders' equity $126,140 $123,728 Shares outstanding

11,878,115 11,874,708 Finance receivables: Principal balance

$180,801 $178,519 Deferred Revenue - Payment Protection Plan

$(2,302) $ - Allowance for credit losses (39,313)(a) (39,325)(a)

Finance receivables, net of allowance & deferred revenue

$139,186 $139,194 Allowance as % of net principal balance 22.02 %

22.03 % (a) Represents the weighted average for Finance Receivables

generated by the Company (at 22.0%) and purchased Finance

Receivables. Changes in allowance for credit losses: Three Months

Ended July 31, 2007 2006 Balance at beginning of year $39,325

$35,864 Provision for credit losses 11,519 12,655 Net charge-offs

(11,493) (11,566) Change in allowance related to purchased accounts

(38) 236 Balance at end of period $39,313 $37,189 DATASOURCE:

America's Car-Mart, Inc. CONTACT: T.J. ("Skip") Falgout, III, CEO,

+1-972-717-3423, or Jeffrey A. Williams, CFO, +1-479-464-9944, both

of America's Car-Mart, Inc. Web site: http://www.car-mart.com/

Copyright

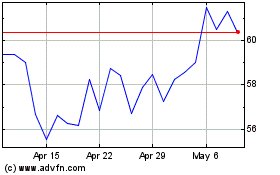

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jun 2024 to Jul 2024

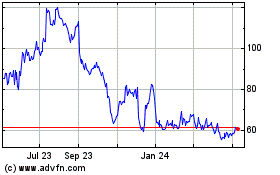

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jul 2023 to Jul 2024