Current Report Filing (8-k)

November 25 2014 - 9:48AM

Edgar (US Regulatory)

|

| | | | | | |

| | | | |

| | | | |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

|

FORM 8-K |

|

CURRENT REPORT |

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

|

Date of Report (Date of earliest event reported): | November 25, 2014 |

|

|

American Woodmark Corporation |

(Exact name of registrant as specified in its charter) |

|

|

Virginia | | 000-14798 | | 54-1138147 |

(State or other jurisdiction | | (Commission | | (IRS Employer |

of incorporation) | | File Number) | | Identification No.) |

|

3102 Shawnee Drive, Winchester, Virginia | | 22601 |

(Address of principal executive offices) | | (Zip Code) |

|

Registrant’s telephone number, including area code: | (540) 665-9100 |

|

Not applicable |

(Former name or former address, if changed since last report) |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

|

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

American Woodmark Corporation

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On November 25, 2014, the Registrant issued a press release announcing results for its second quarter of fiscal year 2015 ended October 31, 2014. The press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

ITEM 8.01 OTHER EVENTS

On November 20, 2014, the Board of Directors of the Company authorized an additional repurchase of up to $25 million of the Company's common shares. Repurchases may be made from time to time in the open market, or through privately negotiated transactions or otherwise, in compliance with applicable laws, rules and regulations, at prices and on terms the Company deems appropriate and subject to the Company's cash requirements for other purposes, compliance with the covenants under the Company's revolving credit facility, and other factors management deems relevant. The authorization does not obligate the Company to acquire a specific number of shares during any period, and the authorization may be modified at any time at the discretion of the Board. Management expects to fund share repurchases using available cash and cash generated from operations. Repurchased shares will become authorized but unissued common shares.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit 99.1 Registrant’s Press Release dated November 25, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

AMERICAN WOODMARK CORPORATION

(Registrant)

|

| | |

| | |

/s/ M. SCOTT CULBRETH | | /s/ KENT B. GUICHARD |

| | |

M. Scott Culbreth | | Kent B. Guichard |

Senior Vice President and Chief Financial Officer | | Chairman & Chief Executive Officer |

| | |

Date: November 25, 2014 | | Date: November 25, 2014 |

Signing on behalf of the registrant and as principal financial officer | | Signing on behalf of the registrant and as principal executive officer |

| | |

Exhibit 99.1

|

| |

| |

| P. O. Box 1980 |

| Winchester, VA 22604-8090 |

|

| |

|

|

Contact: | Glenn Eanes Vice President and Treasurer 540-665-9100 |

|

|

|

AMERICAN WOODMARK CORPORATION ANNOUNCES SECOND QUARTER RESULTS |

AUTHORIZES STOCK REPURCHASE |

WINCHESTER, Virginia (November 25, 2014) -- American Woodmark Corporation (NASDAQ: AMWD) today announced results for its second fiscal quarter ended October 31, 2014.

Net sales for the second fiscal quarter increased 14% to $217.7 million compared with the same quarter of the prior fiscal year. Net sales for the first six months of the current fiscal year increased 17% to $429.6 million from the comparable period of the prior fiscal year. The Company experienced growth in both the remodeling and new construction channels during the second quarter of fiscal year 2015, with new construction growth exceeding 20%.

Net income was $7.7 million ($0.48 per diluted share) for the second quarter of the current fiscal year compared with $5.3 million ($0.34 per diluted share) for the second quarter of the prior fiscal year.

Net income for the first six months of fiscal year 2015 was $16.9 million ($1.07 per diluted share) compared with $11.9 million ($0.77 per diluted share) for the same period of the prior fiscal year. Exclusive of one-time tax credits, the Company generated $15.8 million ($1.00 per diluted share) of net income for the first six months of the current fiscal year compared with $11.9 million ($0.77 per diluted share) for the same period of the prior fiscal year

Gross profit for the second quarter of the current fiscal year was 17.0% of net sales compared with 16.9% in the same quarter of the prior year. Gross profit for the first six months of the current fiscal year was 17.2% of net sales compared with 17.9% for the same period in the prior year. Gross profit in the current quarter was favorably impacted by higher sales volume and improved operating efficiency that was partially offset by material inflation, costs associated with crewing and infrastructure to support higher levels of sales and installation activity, costs associated with new product launches and higher employee benefit costs. Gross profit for the first six months of the current fiscal year was favorably impacted by higher sales volume and improved operating efficiency that was more than offset by material inflation and costs associated with crewing and infrastructure to support higher levels of sales and installation activity.

Selling, general and administrative costs for the second quarter of fiscal year 2015 were 11.3% of net sales compared with 12.3% in the same quarter of the prior year. Selling, general and administrative costs for the first six months of the current fiscal year were 11.2% of net sales compared with 12.5% for the same period in the prior year. The improvement in the Company’s operating expense ratio was driven by favorable leverage from increased sales and on-going expense control.

The Company generated net cash from operating activities of $18.6 million during the first half of fiscal year 2015 compared with $15.8 million during the same period in the prior year. The improvement in the Company’s cash from operating activities was driven primarily by higher operating profitability and partially offset by changes in working capital, which included increases in inventory levels to support higher sales. Net cash used by investing activities was $26.0 million during the first half of the current fiscal year compared with $5.8 million during the same period of the prior year due primarily to an $18.0 million investment in short-term certificates of deposit and increased investment in property, plant and equipment. Net cash provided by financing activities decreased $9.0 million during the first half of the current fiscal year compared to the same period in the prior

AMWD Announces Second Quarter Results

Page 2

November 25, 2014

year as the company repurchased 163,326 shares of common stock at a cost of $5.1 million and proceeds from the exercise of stock options decreased $3.6 million.

On November 20, 2014, the Board of Directors authorized an additional stock repurchase program of up to $25 million of the Company's outstanding common shares. Management expects to fund share repurchases using available cash and cash generated from operations.

American Woodmark Corporation manufactures and distributes kitchen cabinets and vanities for the remodeling and new home construction markets. Its products are sold on a national basis directly to home centers, major builders and through a network of independent distributors. The Company presently operates nine manufacturing facilities and nine service centers across the country.

Safe harbor statement under the Private Securities Litigation Reform Act of 1995: All forward‑looking statements made by the Company involve material risks and uncertainties and are subject to change based on factors that may be beyond the Company's control. Accordingly, the Company's future performance and financial results may differ materially from those expressed or implied in any such forward-looking statements. Such factors include, but are not limited to, those described in the Company's filings with the Securities and Exchange Commission and the Annual Report to Shareholders. The Company does not undertake to publicly update or revise its forward looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

AMWD Announces Second Quarter Results

Page 3

November 25, 2014

|

| | | | | | | | | | | | | | | | | |

AMERICAN WOODMARK CORPORATION |

|

|

|

|

|

|

|

|

|

|

Unaudited Financial Highlights |

|

|

|

|

|

|

|

|

|

|

(in thousands, except share data) |

|

|

|

|

|

|

|

|

|

|

Operating Results |

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended |

| Six Months Ended |

|

|

| October 31 |

| October 31 |

|

|

| 2014 |

| 2013 |

| 2014 |

| 2013 |

|

|

|

|

|

|

|

|

|

|

Net Sales |

| $ | 217,693 |

|

| $ | 190,532 |

|

| $ | 429,610 |

|

| $ | 368,627 |

|

Cost of Sales & Distribution |

| 180,712 |

|

| 158,258 |

|

| 355,515 |

|

| 302,638 |

|

| Gross Profit |

| 36,981 |

|

| 32,274 |

|

| 74,095 |

|

| 65,989 |

|

Sales & Marketing Expense |

| 16,296 |

|

| 15,867 |

|

| 31,811 |

|

| 30,351 |

|

G&A Expense |

| 8,245 |

|

| 7,590 |

|

| 16,656 |

|

| 15,991 |

|

Restructuring Charges, net |

| — |

|

| 31 |

|

| 3 |

|

| 113 |

|

Insurance Proceeds |

| — |

|

| — |

|

| — |

|

| (94 | ) |

| Operating Income |

| 12,440 |

|

| 8,786 |

|

| 25,625 |

|

| 19,628 |

|

Interest & Other (Income) Expense |

| 118 |

|

| 155 |

|

| 249 |

|

| 315 |

|

Income Tax Expense |

| 4,651 |

|

| 3,360 |

|

| 8,467 |

|

| 7,387 |

|

| Net Income |

| $ | 7,671 |

|

| $ | 5,271 |

|

| $ | 16,909 |

|

| $ | 11,926 |

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share: |

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding - Diluted |

| 15,960,236 |

|

| 15,581,605 |

|

| 15,864,560 |

|

| 15,479,180 |

|

|

|

|

|

|

|

|

|

|

|

Income Per Diluted Share |

| $ | 0.48 |

|

| $ | 0.34 |

|

| $ | 1.07 |

|

| $ | 0.77 |

|

AMWD Announces Second Quarter Results

Page 4

November 25, 2014

|

| | | | | | | | | |

Condensed Consolidated Balance Sheet |

|

|

|

|

|

|

|

|

| October 31 |

| April 30 |

|

|

| 2014 |

| 2014 |

|

|

|

|

|

|

Cash & Cash Equivalents |

| $ | 130,863 |

|

| $ | 135,700 |

|

Investments - certificates of deposit |

| 18,000 |

|

| — |

|

Customer Receivables |

| 54,784 |

|

| 46,475 |

|

Inventories |

| 35,335 |

|

| 31,523 |

|

Other Current Assets |

| 12,231 |

|

| 11,718 |

|

| Total Current Assets |

| 251,213 |

|

| 225,416 |

|

Property, Plant & Equipment |

| 76,202 |

|

| 74,049 |

|

Other Assets |

| 28,170 |

|

| 30,599 |

|

| Total Assets |

| $ | 355,585 |

|

| $ | 330,064 |

|

|

|

|

|

|

|

Current Portion - Long-Term Debt |

| $ | 1,316 |

|

| $ | 1,146 |

|

Accounts Payable & Accrued Expenses |

| 78,292 |

|

| 75,273 |

|

| Total Current Liabilities |

| 79,608 |

|

| 76,419 |

|

Long-Term Debt |

| 20,315 |

|

| 20,453 |

|

Other Liabilities |

| 40,924 |

|

| 42,647 |

|

| Total Liabilities |

| 140,847 |

|

| 139,519 |

|

Stockholders' Equity |

| 214,738 |

|

| 190,545 |

|

| Total Liabilities & Stockholders' Equity |

| $ | 355,585 |

|

| $ | 330,064 |

|

|

| | | | | | | | | |

Condensed Consolidated Statements of Cash Flows |

|

|

|

|

|

|

|

|

| Six Months Ended |

|

|

| October 31 |

|

|

| 2014 |

| 2013 |

|

|

|

|

|

|

Net Cash Provided by Operating Activities |

| $ | 18,637 |

|

| $ | 15,812 |

|

Net Cash Used by Investing Activities |

| (25,984 | ) |

| (5,796 | ) |

Free Cash Flow |

| (7,347 | ) |

| 10,016 |

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities |

| 2,510 |

|

| 11,517 |

|

Net Increase (Decrease) in Cash and Cash Equivalents |

| (4,837 | ) |

| 21,533 |

|

Cash and Cash Equivalents, Beginning of Period |

| 135,700 |

|

| 96,971 |

|

|

|

|

|

|

|

Cash and Cash Equivalents, End of Period |

| $ | 130,863 |

|

| $ | 118,504 |

|

- END -

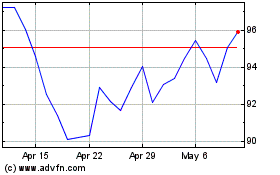

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From May 2024 to Jun 2024

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jun 2023 to Jun 2024