WINCHESTER, Va., Nov. 24 /PRNewswire-FirstCall/ -- American

Woodmark Corporation (NASDAQ:AMWD) today announced results for the

second quarter of its fiscal year 2010, that ended on October 31,

2009. Net sales declined 23% compared with the second quarter of

the prior fiscal year to $104,068,000. Net sales declined 25%

during the six-month period ended October 31, 2009, compared with

the comparable period of the prior fiscal year. The Company's sales

declines in each of its sales channels approximated the overall

rate of decline during the second quarter of fiscal year 2010. The

Company generated a net loss of ($5,279,000) or ($0.37) per diluted

share during the second quarter of fiscal year 2010, compared with

a net loss of ($481,000) or ($0.03) per diluted share in the second

quarter of its prior fiscal year. The Company generated a net loss

of ($11,685,000) or ($0.83) per diluted share in the six-month

period ended October 31, 2009, compared with a net loss of

($324,000) or ($0.02) per diluted share in the comparable period of

the prior fiscal year. The Company previously announced several

initiatives to reduce costs during the fourth quarter of its prior

fiscal year, including the permanent closure of two manufacturing

plants, the suspension of operations at a third plant, and a

reduction-in-force of salaried personnel. The Company successfully

completed these initiatives during the first quarter of fiscal year

2010. In connection with these initiatives, the Company recorded

net-of-tax restructuring charges of ($146,000), or ($0.01) per

diluted share during its second quarter, and ($1,742,000), or

($0.12) per diluted share, during the six-month period ending

October 31, 2009. Exclusive of these charges, net loss for the

second quarter of fiscal year 2010 was ($5,133,000), or ($0.36) per

diluted share, and ($9,943,000) or ($0.70) per diluted share for

the sixmonth period ended October 31, 2009. Gross profit for the

second quarter of fiscal year 2010 was 12.2% of net sales, compared

with 14.4% in the second quarter of the prior fiscal year. Gross

profit was 12.0% of net sales during the first six months of fiscal

year 2010, compared with 15.2% of net sales during the comparable

period of the prior fiscal year. The decline in gross profit margin

during the three and six-month periods primarily reflected the

unfavorable impact of inefficiencies in direct labor and

manufacturing overhead costs stemming from the impact of lower

sales volumes. Partly offsetting these adverse factors were

favorable impacts from lower fuel and material costs, as well as

reduced manufacturing overhead costs related to the plant closures.

Selling, general and administrative costs were 20.1% of net sales

in the second quarter of fiscal year 2010, up from 15.2% of net

sales in the second quarter of the prior fiscal year. Selling,

general and administrative costs were 19.7% of net sales in the

first six months of fiscal year 2010, up from 15.6% in the

comparable period of the prior fiscal year. The Company's operating

expense ratio increased during fiscal year 2010 due primarily to

the reduction in sales and to the absence of a credit that occurred

in the prior year relating to a terminated retiree health care

plan. The Company experienced negative free cash flow of ($2.0)

million (defined as cash provided by operating activities net of

cash used for investing activities) in the second quarter of fiscal

year 2010, compared with positive free cash flow generated in the

second quarter of the prior fiscal year of $2.1 million. The

Company's decline in free cash flow was driven by a combination of

the increased net loss and payments made to satisfy severance

obligations. The Company announced a quarterly cash dividend of

$0.09 per share to be paid on December 21, 2009, to shareholders of

record on December 7, 2009. American Woodmark Corporation

manufactures and distributes kitchen cabinets and vanities for the

remodeling and new home construction markets. Its products are sold

on a national basis directly to home centers, major builders and

through a network of independent distributors. The Company

presently operates eleven manufacturing facilities and nine service

centers across the country. Safe harbor statement under the Private

Securities Litigation Reform Act of 1995: All forwardlooking

statements made by the Company involve material risks and

uncertainties and are subject to change based on factors that may

be beyond the Company's control. Accordingly, the Company's future

performance and financial results may differ materially from those

expressed or implied in any such forward-looking statements. Such

factors include, but are not limited to, those described in the

Company's filings with the Securities and Exchange Commission and

the Annual Report to Shareholders. The Company does not undertake

to publicly update or revise its forward looking statements even if

experience or future changes make it clear that any projected

results expressed or implied therein will not be realized. AMWD-F

AMWD-E AMERICAN WOODMARK CORPORATION Unaudited Financial Highlights

(in thousands, except share data)

------------------------------------------------------------------------

Operating Results ----------------- Three Months Ended Six Months

Ended October 31 October 31 --------------------

--------------------- 2009 2008 2009 2008 --------- ----------

---------- ---------- Net Sales $104,068 $134,939 $204,903 $274,092

Cost of Sales & Distribution 91,399 115,471 180,400 232,564

--------- ---------- ---------- ---------- Gross Profit 12,669

19,468 24,503 41,528 Sales & Marketing Expense 14,510 15,122

27,859 30,691 G&A Expense 6,380 5,435 12,607 11,976

Restructuring charges 233 -- 2,787 -- --------- ----------

---------- ---------- Operating Loss (8,454) (1,089) (18,750)

(1,139) Interest & Other (Income) Expense (7) (328) (53) (589)

Income Tax Benefit (3,168) (280) (7,012) (226) --------- ----------

---------- ---------- Net Loss $(5,279) $ (481) $(11,685) $(324)

========= ========== ========== ========== Earnings Per Share:

Weighted Average Shares Outstanding - Diluted 14,138,091 14,031,376

14,125,859 14,050,490 Loss Per Diluted Share $(0.37) $(0.03)

$(0.83) $(0.02) Condensed Consolidated Balance Sheet

------------------------------------ October 31, April 30, 2009

2009 ---------- -------- Cash & Cash Equivalents $69,391

$82,821 Customer Receivables 31,003 26,944 Inventories 26,525

32,684 Other Current Assets 13,461 11,089 -------- -------- Total

Current Assets 140,380 153,538 Property, Plant & Equipment

122,695 132,928 Other Assets 23,769 17,271 -------- -------- Total

Assets $286,844 $303,737 ======== ======== Current Portion -

Long-Term Debt $866 $859 Accounts Payable & Accrued Expenses

48,851 57,308 -------- -------- Total Current Liabilities 49,717

58,167 Long-Term Debt 26,175 26,475 Other Liabilities 18,232 15,413

-------- -------- Total Liabilities 94,124 100,055 Shareholders'

Equity 192,720 203,682 -------- -------- Total Liabilities &

Shareholders' Equity $286,844 $303,737 ======== ======== Condensed

Consolidated Statements of Cash Flows

----------------------------------------------- Six Months Ended

October 31 -------------------- 2009 2008 ------- ------- Net Cash

Provided (Used) by Operating Activities $(6,438) $16,506 Net Cash

Used by Investing Activities (4,595) (6,990) ------- ------- Free

Cash Flow $(11,033) $9,516 Net Cash Used by Financing Activities

(2,397) (5,393) ------- ------- Net Increase/(Decrease) in Cash and

Cash Equivalents (13,430) 4,123 Cash and Cash Equivalents,

Beginning of Period 82,821 56,932 ------- ------- Cash and Cash

Equivalents, End of Period $69,391 $61,055 ======= =======

DATASOURCE: American Woodmark Corporation CONTACT: Glenn Eanes,

Vice President and Treasurer, +1-540-665-9100 Web Site:

http://www.americanwoodmark.com/

Copyright

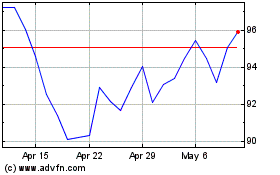

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From May 2024 to Jun 2024

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jun 2023 to Jun 2024