American Lithium Corp. (“American Lithium” or the “Company”)

(TSX-V:LI | NASDAQ:AMLI | Frankfurt:5LA1) is pleased to provide

details of assay results from three diamond drill holes recently

drilled at the Falchani Lithium project in Puno, southeastern Peru

(“Falchani”). These 3 holes were drilled under the ten-hole

Environmental Impact Assessment (“EIA”) hydrology drilling program

launched at Falchani last fall as part of the EIA hydrology study

designed by EDASI SAC and SRK Peru with field work overseen by

EDASI. This program has successfully demonstrated that there are no

water table issues within proposed development areas across

Falchani and the program has also enabled the drilling and analysis

of core down to a depth of 120 metres (“m”). Once full results from

this program are complete all data and assays will be incorporated

into an updated resource report on Falchani to be prepared by

Stantec Consulting, Inc (“Stantec”).

Core logging and assay results from these three

diamond holes intersected intervals of typical Falchani volcanic

tuff as well as large sections of breccias with highlights

including Lithium up to 5,645 ppm and Cesium up to 1.22%, the

highest grades of both metals encountered to date from 1 m drill

core interval samples at Falchani. These holes were drilled in key

areas both within and outside the current Falchani resource

footprint and will add additional information to the planned

mineral resource estimate update with a focus on expanding the

overall resource and reclassifying the existing resource. Full

details of the results from these three holes are set out

below:

EIA Drill Program and Initial

ResultsLink to: Figure 1 – Falchani EIA Hydrology and

Previous Drill Hole Location Map (also see below)

- EIA diamond

drill hole Pz04-TV (vertical) intersected lithium

mineralization over the entire vertical drill hole; 0-120 m

averaged 2,186 ppm Lithium (Li); 841 ppm Cesium (Cs); 1,215 ppm

Rubidium (Rb); and 2.62% Potassium (K) - (see Table 1 – Drill Hole

Pz04-TV results, below):

- Several

substantial sub-intervals of +3,000 ppm Li intersected;

- Maximum Li of

5,645 ppm Li over 1 m at 54 m downhole; and

- This drill hole

is the westernmost drill hole reported at Falchani and extends the

drilled mineralization approximately 250 m further west.

Mineralization remains open at depth (>120 m).

- EIA diamond

drill hole Pz03-TV (vertical) intersected the

strongest Cesium mineralization to date with associated moderate

lithium mineralization over the upper 63 m downhole averaging 1,428

ppm Li; 4,770 ppm Cs; 1,188 ppm Rb; and 2.67% K (see Table 2 –

Drill Hole Pz03-TV results, below):

- The upper

interval (0-23 m) is richer in Li with the lower interval (23-63 m)

much richer in Cs, including the highest 1 m Cs interval sample

encountered at Falchani of 12,160 ppm Cs (1.2% Cs);

- Cs

mineralization is associated with more intense brecciation and

hydrothermal overprint observed in this hole, drilled from within

the natural valley separating the east and western parts of the

Falchani resource. This hole establishes the deposit

thickness/bottom within the valley.

- EIA diamond

drill hole Pz06-TV (vertical) intersected typical

Falchani tuff over the entire 86 m drilled and analyzed to date

averaging 2,739 ppm Li; 338 ppm Cs; 1,292 ppm Rb; and 2.87% K (see

Table 3 – Drill Hole Pz06-TV results, below); drilling at this

location continues in Li mineralization.

- Ground water has

yet to be encountered in any holes within the 120 m reporting drill

depth, so EDASI and the Company is requesting permission from ANA,

the National Water Authority, to drill deeper:

- 10 diamond drill

holes were approved for EIA drilling, including installation of

downhole piezometers to monitor water table and local groundwater

parameters where water is encountered;

- Every 5m EDASI

collects drill hole wall-rock measurements of moisture content,

water, etc. resulting in very slow drill advancement, but essential

data and information for feasibility study;

- Drill core

chemical analysis is required under the EIA, and reporting

mineralization is allowed; and

- EIA Program is

close to completion and additional results will be reported when

available.

Simon Clarke, CEO of American Lithium

states, “We are excited to have intersected thick, high

grade lithium mineralization west of the current Falchani resource

footprint, which should allow for resource expansion. The strong

cesium and lithium mineralization encountered in the central valley

bisecting Falchani is also very interesting from a strategic

perspective with higher than previously recorded cesium grades. The

entire EIA program will provide valuable additional data to the

existing drill results from Falchani.

We are also very pleased to be back working

constructively and successfully in Peru. We received the first new

permits for the new Quelcaya targets several weeks ago and have

also launched a new drill program on some of our best targets

across the Macusani Plateau. We anticipate receiving our next drill

permits for additional infill and expansion drilling at both the

Falchani Deposit and the Macusani Uranium Project shortly.

Expanding and reclassifying the resource is a key piece of the

updated PEA we are targeting for the end of Q3.”

Figure 1 – Falchani EIA Hydrology and Previous

Drill Hole Location Map

Hole Pz04-TV was drilled approximately 250 m

west of Platform 36 (Falchani West – 2020 drilling), the

westernmost holes from the 2020 resource drill program. Thick Li,

Cs and Rb mineralization was intersected in rhyolite tuff,

structural-hydrothermal breccia and subvolcanic rhyolitic intrusive

rocks directly at surface to 120 m downhole depth. This expands the

Falchani mineralization to the west, where the deposit remains

open. The drill hole ended in mineralization and remains open at

depth at this location.

Hole Pz03-TV was drilled in the northern portion

of the intervening erosional valley that essentially bisects the

Falchani deposit into eastern and western sides. It was collared

300 m southwest of Platform 25 (Falchani East – 2020 drilling) and

450 m northeast of Platform 14 (Falchani West – 2020 drilling).

This drill hole intersected 63 m of Li, Cs and Rb mineralization in

intensely brecciated rhyolite tuff lithologies, including the

strongest Cs mineralization to date on the project (1 m interval

>1.2% Cs at 34 m downhole). This establishes the base of

mineralization definitively at this location where previously,

resource modelers interpreted it as much thinner, due to lack of

previous drilling. The remainder of the drill hole from 63 m to 115

m intersected older porphyritic rhyolite flow units with much lower

Li, Cs and Rb contents.

Hole Pz06-TV was drilled approximately 100 m

east of Platform 13 (Falchani West – 2020 drilling) towards the

intervening valley and has intersected typical Falchani tuff

mineralization over the entire drilled and reported thickness of 86

m. This drill hole encountered adverse ground conditions and had to

be abandoned while still in mineralization. The hole was

subsequently restarted from surface and drilling continues in

mineralized tuff units.

Table 1 – Drill Hole Pz04-TV

results

|

Pz04-TV – 120.0 m total depth - Vertical |

From (m) |

To (m) |

Thickness (m) |

Li (ppm) |

Cs (ppm) |

Rb (ppm) |

K (%) |

|

|

0.0 |

120.0 |

120.0 |

2,186 |

841 |

1,215 |

2.62 |

|

including |

1.5 |

11.0 |

9.5 |

3,090 |

503 |

1,506 |

3.03 |

|

including |

50.0 |

90.0 |

40.0 |

3,001 |

746 |

1,156 |

2.50 |

|

including |

50.0 |

68.0 |

18.0 |

4,108 |

610 |

1,461 |

2.23 |

|

Maximum Li interval |

54.0 |

55.0 |

1.0 |

5,645 |

|

|

|

|

Maximum Cs interval |

19.0 |

20.0 |

1.0 |

1,400 |

|

|

|

|

Maximum Rb interval |

6.5 |

8.0 |

1.5 |

1,564 |

|

|

|

Table 2 – Drill Hole Pz03-TV

results

|

Pz03-TV – 115.0 m total depth - Vertical |

From (m) |

To (m) |

Thickness (m) |

Li (ppm) |

Cs (ppm) |

Rb (ppm) |

K (%) |

|

|

0.0 |

63.0 |

63.0 |

1,428 |

4,770 |

1,082 |

2.55 |

|

including |

0.0 |

23.0 |

23.0 |

2,222 |

594 |

1,401 |

3.94 |

|

including |

23.0 |

63.0 |

40.0 |

972 |

7,171 |

899 |

1.93 |

|

Maximum Li interval |

20.0 |

21.0 |

1.0 |

3,543 |

|

|

|

|

Maximum Cs interval |

34.0 |

35.0 |

1.0 |

12,160 |

|

|

|

|

Maximum Rb interval |

21.0 |

22.0 |

1.0 |

1,830 |

|

|

|

Table 3 – Drill Hole Pz06-TV

results

|

Pz06-TV – 86.0 m total depth – Vertical; drilling

continues |

From (m) |

To (m) |

Thickness (m) |

Li (ppm) |

Cs (ppm) |

Rb (ppm) |

K (%) |

|

|

0.0 |

86.0 |

86.0 |

2,739 |

338 |

1,292 |

2.87 |

|

Maximum Li interval |

85.0 |

86.0 |

1.0 |

3,381 |

|

|

|

|

Maximum Cs interval |

80.0 |

81.0 |

1.0 |

699 |

|

|

|

|

Maximum Rb interval |

83.0 |

84.0 |

1.0 |

1,458 |

|

|

|

Quality Assurance, Quality Control and

Data VerificationDiamond drilling is being conducted using

Company-owned drill rigs with local contract personnel. Drill core

samples are cut longitudinally with a diamond saw with one-half of

the core placed in sealed bags and shipped to Certimin’s sample

analytical laboratory in Lima for sample preparation, processing

and ICP-MS/OES multi-element analysis. Certimin is an ISO 9000

certified assay laboratory. The Company’s Qualified Person for the

drill program, Mr. Ted O’Connor, has verified the data disclosed,

including drill core, sampling and analytical data in the field and

laboratory. The program is designed to include a comprehensive

analytical quality assurance and control routine comprising the

systematic use of Company inserted standards, blanks and field

duplicate samples, internal laboratory standards and has also

included check analyses at other accredited laboratories. Downhole

thicknesses for vertical drill holes are considered accurate true

thickness intersections.

Qualified PersonMr. Ted

O’Connor, P.Geo., Executive Vice President of American Lithium, and

a Qualified Person as defined by National Instrument 43-101

Standards of Disclosure for Mineral Projects, has reviewed and

approved the scientific and technical information contained in this

news release.

About American

LithiumAmerican Lithium is actively engaged in the

development of large-scale lithium projects within mining-friendly

jurisdictions throughout the Americas. The Company is currently

focused on the continued development of its strategically located

TLC Lithium Claystone Project in the richly mineralized Esmeralda

lithium district in Nevada, as well as continuing to advance its

Falchani Hard-rock Lithium Project and Macusani Uranium Project in

southeastern Peru. All three projects, TLC, Falchani and Macusani

have been through robust preliminary economic assessments, exhibit

strong significant expansion potential and enjoy strong community

support. Pre-feasibility work is well advanced at Falchani and has

commenced at TLC.

For more information, please contact the Company

at info@americanlithiumcorp.com or visit our website

at www.americanlithiumcorp.com for project update videos and

related background information.

Follow us

on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of

American Lithium Corp.

“Simon Clarke”CEO & DirectorTel: 604 428 6128

For Media Inquiries:

Nancy ThompsonVorticom, Inc.212-532-2208

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward

Looking InformationThis news release contains certain

forward-looking information and forward-looking statements

(collectively “forward-looking statements”) within the meaning of

applicable securities legislation. All statements, other than

statements of historical fact, are forward-looking statements.

Forward-looking statements in this news release include, but are

not limited to, statements regarding the ability to appeal the

judicial ruling, the anticipated completion of pre-feasibility

work, and any other statements regarding the business plans,

expectations and objectives of American Lithium. Forward-looking

statements are frequently identified by such words as "may",

"will", "plan", "expect", "anticipate", "estimate", "intend",

“indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”,

“efforts”, “option” and similar words, or the negative connotations

thereof, referring to future events and results. Forward-looking

statements are based on the current opinions and expectations of

management and are not, and cannot be, a guarantee of future

results or events. Although American Lithium believes that the

current opinions and expectations reflected in such forward-looking

statements are reasonable based on information available at the

time, undue reliance should not be placed on forward-looking

statements since American Lithium can provide no assurance that

such opinions and expectations will prove to be correct. All

forward-looking statements are inherently uncertain and subject to

a variety of assumptions, risks and uncertainties, including risks,

uncertainties and assumptions related to: American Lithium’s

ability to achieve its stated goals; which could have a material

adverse impact on many aspects of American Lithium’s businesses

including but not limited to: the ability to access mineral

properties for indeterminate amounts of time, the health of the

employees or consultants resulting in delays or diminished

capacity, social or political instability in Peru which in turn

could impact American Lithium’s ability to maintain the continuity

of its business operating requirements, may result in the reduced

availability or failures of various local administration and

critical infrastructure, reduced demand for the American Lithium’s

potential products, availability of materials, global travel

restrictions, and the availability of insurance and the associated

costs; the judicial appeal process in Peru, and any and all future

remedies pursued by American Lithium and its subsidiary Macusani to

resolve the title for 32 of its concessions; the ongoing ability to

work cooperatively with stakeholders, including but not limited to

local communities and all levels of government; the potential for

delays in exploration or development activities; the interpretation

of drill results, the geology, grade and continuity of mineral

deposits; the possibility that any future exploration, development

or mining results will not be consistent with our expectations;

risks that permits will not be obtained as planned or delays in

obtaining permits; mining and development risks, including risks

related to accidents, equipment breakdowns, labour disputes

(including work stoppages, strikes and loss of personnel) or other

unanticipated difficulties with or interruptions in exploration and

development; risks related to commodity price and foreign exchange

rate fluctuations; risks related to foreign operations; the

cyclical nature of the industry in which American Lithium operates;

risks related to failure to obtain adequate financing on a timely

basis and on acceptable terms or delays in obtaining governmental

approvals; risks related to environmental regulation and liability;

political and regulatory risks associated with mining and

exploration; risks related to the uncertain global economic

environment and the effects upon the global market generally, any

of which could continue to negatively affect global financial

markets, including the trading price of American Lithium’s shares

and could negatively affect American Lithium’s ability to raise

capital and may also result in additional and unknown risks or

liabilities to American Lithium. Other risks and uncertainties

related to prospects, properties and business strategy of American

Lithium are identified in the “Risk Factors” section of American

Lithium’s Management’s Discussion and Analysis filed on May 29,

2023, and in recent securities filings available at www.sedar.com.

Actual events or results may differ materially from those projected

in the forward-looking statements. American Lithium undertakes no

obligation to update forward-looking statements except as required

by applicable securities laws. Investors should not place undue

reliance on forward-looking statements.

Cautionary Note Regarding Macusani

ConcessionsThirty-two of the 169 concessions held by

American Lithium’s subsidiary Macusani, are currently subject to

Administrative and Judicial processes (together, the “Processes”)

in Peru to overturn resolutions issued by INGEMMET and the Mining

Council of MINEM in February 2019 and July 2019, respectively,

which declared Macusani’s title to 32 of the concessions invalid

due to late receipt of the annual validity payments. In November

2019, Macusani applied for injunctive relief on 32 concessions in a

Court in Lima, Peru and was successful in obtaining such an

injunction on 17 of the concessions including three of the four

concessions included in the Macusani Uranium Project PEA. The grant

of the Precautionary Measure (Medida Cautelar) has restored the

title, rights and validity of those 17 concessions to Macusani

until a final decision is obtained at the last stage of the

judicial process. A Precautionary Measure application was made at

the same time for the remaining 15 concessions and was ultimately

granted by a Court in Lima, Peru on March 2, 2021 which has also

restored the title, rights and validity of those 15 remaining

concessions to Macusani, with the result being that all 32

concessions are now protected by Precautionary Measure (Medida

Cautelar) until a final decision on this matter is obtained at the

last stage of the judicial process. The favourable judge’s ruling

confirming title to all 32 concessions from November 3, 2021

represents the final stage of the current judicial process.

However, this ruling has recently been appealed by MINEM and

INGEMMET. American Lithium has no assurance that the outcome of

these appeals will be in the Company’s favour.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ce3482e-f076-4761-afeb-bbab9ca1f2ea

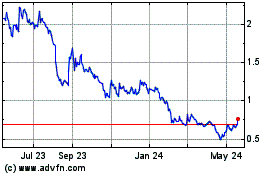

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

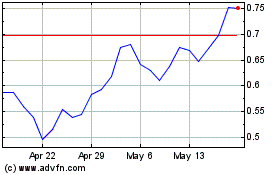

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

From Apr 2023 to Apr 2024