High Yielding REITs Gain Popularity During Market Unrest

August 23 2011 - 8:16AM

Marketwired

In the aftermath of S&P's downgrade to the US' credit rating

investors are looking for safe havens. Traditionally, high yielding

REITs garner attention due to their reliable income. As REITs,

these companies are typically not taxed on their income but are

required to pay out 90 percent of their taxable income in

dividends. The Bedford Report examines the outlook for diversified

REITs and provides equity research on American Capital Agency

Corporation (NASDAQ: AGNC) and ARMOUR Residential REIT, Inc. (NYSE:

ARR). Access to the full company reports can be found at:

www.bedfordreport.com/AGNC www.bedfordreport.com/ARR

Most Mortgage REITs have portfolios made up principally of

mortgages insured by the federal agencies Fannie Mae, Freddie Mac

and Ginnie Mae. They typically borrow at low rates and lend in the

mortgage markets at higher rates, usually by buying mortgage-backed

securities. By purchasing bonds guaranteed by the government,

analysts argue these companies take on no risk of default, with the

principle concern being an interest rate risk. The good news for

REIT investors is that The Fed last week announced that it would

hold its benchmark interest rate near zero for at least through

mid-2013, replacing an earlier promise to keep it there for "an

extended period."

Meanwhile continued housing market weakness has buoyed apartment

occupancy rates and stabilized rental fees to the benefit of the

residential real estate investment trust industry. High

unemployment has also led many homeowners to rent helping to reduce

vacancies.

The Bedford Report releases stock research on REITs so investors

can stay ahead of the crowd and make the best investment decisions

to maximize their returns. Take a few minutes to register with us

free at www.bedfordreport.com and get exclusive access to our

numerous analyst reports and industry newsletters.

Currently American Capital Agency pays an annual dividend of

$5.60 a share for a hefty yield of around 19.6 percent. The company

reported total revenues of $264.7 million in the second quarter as

compared to just $50.6 million in the same quarter a year

earlier

ARMOUR Residential REIT pays an annual dividend of $1.44 per

share for a huge yield of around 19.4 percent. The Company's

portfolio consisted of Fannie Mae, Freddie Mac and Ginnie Mae

mortgage securities and was valued at $5.3 billion as of June 30,

2011.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

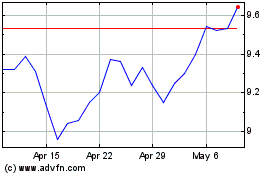

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

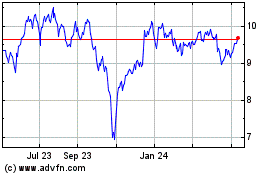

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jul 2023 to Jul 2024