Current Report Filing (8-k)

August 25 2020 - 9:02AM

Edgar (US Regulatory)

ACADIA PHARMACEUTICALS INC false 0001070494 0001070494 2020-08-24 2020-08-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 24, 2020

ACADIA Pharmaceuticals Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-50768

|

|

06-1376651

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

3611 Valley Centre Drive, Suite 300

San Diego, California

|

|

92130

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (858) 558-2871

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. of Form 8-K):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.0001 per share

|

|

ACAD

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

On August 24, 2020, ACADIA Pharmaceuticals Inc. (the “Company”) issued 1,174,208 shares of the Company’s common stock in connection with the closing of the transactions contemplated by the Merger Agreement (as defined below) pursuant to the exemption from the registration requirements provided in Section 4(a)(2) of the Securities Act of 1933, as amended, for transactions by an issuer not involving any public offering.

The information set forth in Item 8.01 of this report is incorporated by reference into this Item 3.02.

On August 24, 2020, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among the Company, Queen Merger Sub, Inc. (“Merger Sub”), CerSci Therapeutics Incorporated (“CerSci”), and Shareholder Representative Services LLC, and on the same day, the transactions contemplated by the Merger Agreement closed and Merger Sub merged with and into CerSci, with CerSci as the surviving corporation and the Company’s wholly-owned subsidiary.

CerSci is a clinical-stage biotechnology company with worldwide rights to a portfolio of novel compounds for neurological conditions, including non-opioid therapies for acute and chronic pain. CerSci’s lead development program is a unique Reactive Species Decomposition Accelerant, a first-in-class mechanism focused on interrupting pathways that sensitize neurons to pain. The portfolio contains additional preclinical stage molecules, including brain penetrant molecules, with potential for symptomatic and disease modifying treatment utility in neurodegenerative diseases.

Pursuant to the terms of the Merger Agreement, in connection with the closing of the transactions contemplated by the Merger Agreement, the former holders of CerSci’s capital stock, warrants or options (or collectively, the “CerSci Equityholders”), were entitled to $52.5 million as upfront consideration, subject to certain adjustments, $47.2 million of which was paid through the issuance of 1,174,208 shares of the Company’s common stock at closing. In addition, CerSci Equityholders may be eligible to receive up to $887.0 million in development, commercialization and sales milestones, in addition to tiered royalties in the mid-single digits based on annual net sales, which milestones and royalties would be payable in cash. Under the terms of the Merger Agreement, the Company agreed to file with the Securities and Exchange Commission a registration statement on Form S-3 to register for resale of the shares of the Company’s common stock that the Company issued as part of the consideration for the merger at closing.

A copy of the Company’s press release issued August 25, 2020 is furnished herewith as Exhibit 99.1.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ACADIA Pharmaceuticals Inc.

|

|

|

|

|

|

|

Dated: August 25, 2020

|

|

|

|

By:

|

|

/s/ Austin D. Kim

|

|

|

|

|

|

|

|

Austin D. Kim

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel & Secretary

|

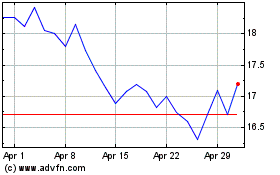

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Aug 2024 to Sep 2024

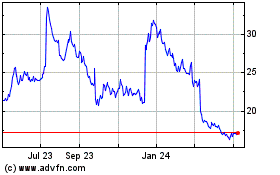

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Sep 2023 to Sep 2024