Euro Drops In Lackluster Trade

February 05 2024 - 12:56AM

RTTF2

The euro fell against its most major counterparts in the

European session on Monday, as hopes of early U.S. rate cuts faded

and the Eurozone's services PMI came in at 48.4 in January, down

slightly from December's 48.8.

Robust U.S. jobs data coupled with relatively hawkish comments

from Federal Reserve Chair Jerome Powell in an interview broadcast

Sunday night led investors to scale back bets on interest rate cuts

this year.

The dollar and bond yields rose, weighing on investors' risk

appetite.

Meanwhile, the Eurozone Sentix Investor Confidence Index

improved further from -15.8 in January to -12.9 in February.

The euro eased to 0.8529 against the pound and 159.70 against

the yen, from an early 4-day high of 0.8554 and a 6-day high of

160.27, respectively. The euro is seen finding support around 0.82

against the pound and 155.00 against the yen.

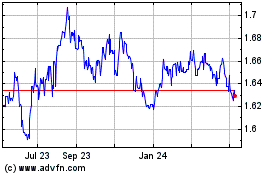

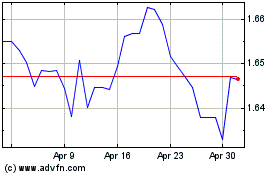

The euro retreated to 1.6538 against the aussie and 1.7722

against the kiwi, down from an early 4-day high of 1.6601 and a

1-week high of 1.7809, respectively. The euro is likely to face

support around 1.61 against the aussie and 1.74 against the

kiwi.

The euro touched 1.0761 against the greenback, its lowest level

since December 12. If the euro falls further, it is likely to test

support around the 1.05 region.

The euro reached as low as 1.4506 against the loonie. Next key

support for the euro is likely seen around the 1.42 level.

In contrast, the euro climbed to a 6-day high of 0.9363 against

the franc. If the currency rises further, it may find resistance

around the 0.98 level.

Looking ahead, ISM services PMI for January will be released in

the New York session.

Euro vs AUD (FX:EURAUD)

Forex Chart

From Oct 2024 to Nov 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Nov 2023 to Nov 2024