Uniswap Consolidates At $17: A Calm Before The Bullish Storm?

December 07 2024 - 10:30PM

NEWSBTC

Uniswap (UNI) is holding steady above the $17 mark, following a

successful break above this level. With the bulls maintaining their

grip on this critical support level, speculation is rising about

whether this could be the calm before a bullish storm. As

market sentiment remains optimistic, this analysis examines UNI’s

current price action by evaluating technical indicators to

determine if it can gather enough momentum for a breakout rally.

Could this period of stabilization set the stage for further

upside? Let’s explore the technical setup and market dynamics that

are shaping this crucial moment for Uniswap. Analyzing Uniswap

Consolidation Phase And Market Signals UNI’s price on the 4-hour

chart shows signs of upside momentum as it eyes a potential

breakout toward the critical $20 resistance level. Holding above

the 100-day Simple Moving Average (SMA) strengthens the bullish

case, indicating growing confidence among buyers. This positioning

highlights UNI’s capacity to push higher and sustain its upward

trajectory, provided key resistance levels are cleared.

Additionally, an examination of the 4-hour Relative Strength Index

(RSI) reveals a notable climb, with the indicator reaching the 72%

threshold after rebounding from a recent low of 69%. This sharp

increase reflects a robust surge in bullish momentum, as

intensified buying pressure has propelled the RSI into overbought

territory. Such a shift indicates a significant change in market

sentiment, signaling heightened confidence among traders and

investors. Related Reading: Uniswap Processes Over $2 Trillion On

Ethereum: UNI Bull Run Inevitable? The move into overbought levels

suggests that demand for Uniswap has surged, often indicative of

potential near-term price growth. However, the elevated RSI also

calls for caution, as it may hint at a correction period or a minor

pullback before the uptrend resumes. UNI’s Path Forward: Momentum

Builds Above $17 Uniswap’s price has firmly stabilized above the

$17 level, demonstrating a shift in market dynamics as upbeat

momentum starts to gain traction. This crucial support zone

provides a solid base for further upward movement, with technical

indicators pointing to growing buying pressure. If the bulls can

sustain this uptrend, a breakout toward higher resistance levels,

such as $20, may be imminent. Related Reading: Uniswap: Market

Swing Yields 12% Gains – Can UNI Sustain The Momentum? However,

traders should closely monitor market conditions, as a failure to

sustain the current bullish momentum could lead to a correction or

pullback, causing the price to drop toward the $17 support level.

If Uniswap fails to hold above this key level, a break below $17

could signal a deeper decline, with the next possible support zones

being the 100-day SMA and the $11.8 level. Such a scenario would

indicate weakening market sentiment and an extended drop could set

the stage for additional bearish pressure. Featured image from

Adobe Stock, chart from Tradingview.com

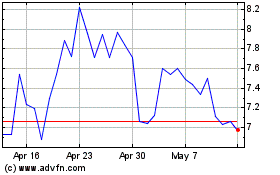

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024