Uniswap Surges Toward $8.74 – Can UNI Push Through To New Heights?

November 06 2024 - 12:30PM

NEWSBTC

Uniswap (UNI) is riding a wave of renewed bullish momentum, with

its price inching closer to the critical $8.74 resistance level.

This surge has captured the attention of investors eager to see if

UNI can overcome this hurdle and unlock fresh upside potential. As

the market sentiment shifts more positively, the $8.74 level is a

pivotal strength test for Uniswap’s rally. This article

uncovers the dynamics behind Uniswap’s climb toward $8.74,

evaluating if this resistance level could be the gateway to further

gains. We’ll examine the key technical indicators, market

sentiment, and potential challenges to determine if UNI’s bullish

momentum can sustain a breakout, positioning it for a move to

higher levels. What’s Driving The Recent Uniswap Surge? After

rebounding from the $6.742 support level, UNI has displayed robust

bullish momentum, pushing decisively above the 100-day Simple

Moving Average (SMA) on the 4-hour chart. The move indicates a

strong shift in sentiment as buyers regain control, propelling

Uniswap toward the critical $8.748 resistance mark. Now approaching

this resistance, UNI is testing the resilience of its upward

strength, with a breakthrough possibly paving the way for

additional gains and establishing a new higher trading range. Also,

the 4-hour Relative Strength Index (RSI) analysis highlights

renewed upside potential, with the RSI climbing from the oversold

zone to above the 50% threshold. Now sitting at 85%, this upward

movement suggests a strong increase in buying pressure, signaling a

shift from the previous bearish phase toward a more neutral and

potentially optimistic outlook. Related Reading: Uniswap Rallies In

Bearish Conditions, Can UNI Break New Grounds? Additionally, the

daily chart shows Uniswap is on a solid upward trajectory,

underscored by a strong bullish candlestick that reflects sustained

buying pressure. UNI’s position above the 100-day SMA further

supports this positive price action, reinforcing the likelihood of

continued gains. Trading consistently above this key SMA signals

strengthening positive sentiment, as buyers maintain control and

push the price toward higher levels, possibly setting the stage for

a test of upcoming resistance zones. Lastly, the RSI on the daily

chart has risen to 67%, recovering from a previous dip to 37%. If

the RSI continues to climb, it could indicate growing strength in

UNI’s price action. Additionally, staying above the 60% level would

significantly boost the chances of sustained bullish momentum and

potential breakouts, further reinforcing the asset’s positive

sentiment. Resistance Or Launchpad? What $8.74 Means For UNI’s

Future The $8.74 level for Uniswap represents a critical point of

resistance determining the next phase of its price movement. If UNI

can break through this barrier, it could act as a launchpad for

further gains, with the $10 mark and beyond becoming attainable

targets as the upbeat pressure accelerates. Related Reading: UNI

Price Bounces Back 13% Above $5.6, Can Bulls Maintain Control?

However, if the resistance holds, it may trigger a pullback, which

could cause UNI to test key support levels and possibly lead to a

consolidation phase. Featured image from LinkedIn, chart from

Tradingview.com

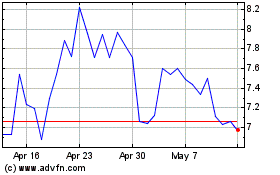

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024