Cardano (ADA) Faces Risk Of 30% Drop – On-Chain Metrics Confirm A Slow Demand

October 01 2024 - 7:00PM

NEWSBTC

Cardano has seen a strong 26% surge following the Federal Reserve’s

interest rate cuts announcement two weeks ago, boosting optimism

across the crypto market. Analysts and investors are

questioning the sustainability of the recent surge. Despite the

initial rally, Cardano’s price failed to close above a key

resistance level, signaling potential weakness in the uptrend.

Related Reading: Solana (SOL) ‘Could Go Parabolic’ Once It Breaks

$200 Resistance – Analyst On-chain data from Santiment reveals a

decline in demand for ADA, adding to investor caution. Decreased

network activity and buying pressure raise doubts about the

sustainability of the current rally. As the market awaits

further developments, investors are closely watching for signs of a

reversal or continuation of the uptrend, understanding that ADA’s

next move could set the tone for its performance in the weeks

ahead. Cardano Indicator Shows Concerning Data Cardano faces a

significant risk of a 30% drop to its yearly low of around $0.27,

as on-chain data from Santiment reveals rising selling pressure and

diminishing demand. The warning signs for ADA’s price have

become clearer, with its daily active-address (DAA) divergence

showing a negative reading of -43.3% at the time of writing. This

metric, which tracks the correlation between an asset’s price

movements and changes in its daily active addresses, has remained

negative since September 7, indicating a troubling trend for

Cardano. The negative DAA divergence suggests that much of ADA’s

rally this month, following the Federal Reserve’s interest rate

cuts, has been fueled more by broader market sentiment than by any

specific demand for ADA itself. This lack of organic demand

increases the likelihood of a steep correction shortly. Without

sustained buying pressure, Cardano’s price could drop sharply as

traders begin to lock in profits, further driving prices downward.

Related Reading: SUI Ready To Test $2 Resistance – Bullish Pattern

Suggests New ATH Soon If ADA fails to break above its current

resistance level of around $0.41, analysts expect a deeper

correction, potentially pushing the price back to the yearly low of

$0.27. With weakening demand and increasing selling pressure,

Cardano’s near-term outlook looks uncertain, and traders are

bracing for further downside risk. ADA Price Action: Testing A

Crucial Supply Level ADA trades at $0.38, following a 10% dip from

its daily 200 exponential moving average (EMA) at $0.41. This level

has become a crucial resistance area, as the price formed a new

local high around this zone. ADA must reclaim the $0.41 level and

push above the next key resistance at $0.45 to confirm a bullish

trend for the coming weeks. Successfully breaking past these levels

would signal renewed strength, giving the bulls control and

potentially leading to higher prices. However, if ADA fails to push

above these critical levels, the altcoin could face further

downside pressure. A failure to reclaim $0.41 and surpass $0.45

would likely result in increased selling, triggering a potential

30% drop. In such a scenario, ADA would be at risk of revisiting

its yearly low of around $0.27. Related Reading: Dogecoin

Could Target $0.20 Soon, Analyst Predicts – Is DOGE Primed For A

Rally? Given the current market uncertainty and declining demand,

traders are carefully watching ADA’s price movements, as the next

few days could be pivotal for determining whether a bullish

breakout or a deeper correction is on the horizon. Featured image

from Dall-E, chart from TradingView

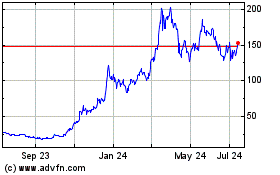

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024