NEAR Protocol’s Expansion: Q4 2023 Shows 1,250% Rise In Daily Active Addresses

January 29 2024 - 9:30PM

NEWSBTC

NEAR Protocol, the Blockchain Operating System (BOS), experienced

significant growth in key metrics during the fourth quarter (Q4) of

2023. The protocol’s native token, NEAR, recorded a remarkable 16%

year-to-date growth and witnessed a surge in adoption.

Circulating Market Cap Soars 245% According to a Messari report,

the entire crypto market cap increased in Q4 2023, largely driven

by the anticipation surrounding the introduction of spot Bitcoin

exchange-traded funds (ETFs). NEAR actively participated in

the overall market rally and achieved additional gains due to its

heightened network activity and significant announcements. As a

result, NEAR’s circulating market cap for the end of 2023 reached

$3.7 billion, marking a 245% increase quarter-on-quarter (QoQ) and

a 246% increase year-on-year (YoY). Furthermore, NEAR’s fully

diluted market cap reached $4.3 billion. The protocol’s market cap

ranking also soared, climbing 10 places to reach approximately 30th

by the end of 2023. Related Reading: Selling Pressure Subsides As

Grayscale Sends 8.6K Bitcoin To Coinbase, Falling Below Average In

Q4 2023, NEAR’s revenue grew substantially, primarily generated

from network transaction fees, reaching $750,000. The increase in

revenue was attributed to the heightened activity generated by

projects such as KAIKAINOW and NEAR Inscriptions. During the

Inscriptions craze, revenue surged due to a transaction spike,

driving up transaction fees. Notably, NEAR employs a fee-burning

mechanism, where 70% of all fees are burned, while the remaining

30% is directed to the contract from which the transaction

originated. NEAR User Base Skyrockets Another key metric

demonstrating the protocol’s growth in Q4 2023 is that NEAR

experienced significant growth in its user base. Average

daily active addresses increased by 1,250% YoY, reaching 870,000 in

Q4 2023. In addition, the number of daily new addresses grew by a

remarkable 550% YoY to 170,000 in Q4 2023. According to

Messari, this expansion comes after the successful launch and

adoption of projects such as KAIKAINOW and contributions from the

Sweat Economy, Aurora, and Playember, which further supported this

positive trend. NEAR’s daily active addresses were notably higher

than those of other leading blockchain networks. For example,

Optimism averaged 72,000 daily active addresses, Arbitrum 150,000,

Polygon PoS 375,000, and Aptos 60,000 in Q4 2023. NEAR Inscriptions

significantly drove network activity, reaching a yearly high of 14

million transactions in December. Despite this substantial

increase, transaction fees remained stable, staying below $0.01 for

the quarter. Top 25 Blockchain By TVL In Q4 2023 NEAR’s Total

Value Locked (TVL) reached $128 million by the end of Q4 2023,

marking a remarkable 147% increase from the previous quarter. Among

blockchains, NEAR positioned itself at approximately 25th place

regarding TVL. Within the NEAR Network’s TVL, NEAR

contributed $59 million, accounting for nearly 46% of the total TVL

on the network. The remaining TVL was distributed across various

decentralized finance (DeFi) applications, including Aurora, Ref,

Berry Club, and Flux. Additionally, NEAR announced partnerships

with projects such as Chainlink and decentralized exchange (DEX)

SushiSwap. According to Messari, the integration with

Chainlink’s decentralized oracle network provided NEAR developers

with access to real-world data and external Application Programming

Interfaces (APIs), enhancing the functionality and usability of

NEAR-based applications. On the other hand, the collaboration

with SushiSwap allowed NEAR users to access a wide range of token

swaps, liquidity pools, and yield farming opportunities, enabling

developer adoption and increased usage within the ecosystem.

Related Reading: Crypto Exchange Predicts 1000x Returns On XRP

Price With Ambitious Rise To $594 Ultimately, looking ahead to

2024, Messari said the protocol’s vision is to iterate the

technology roadmap, attract more developers, and attract more

leading protocols. Featured image from Shutterstock, chart

from TradingView.com

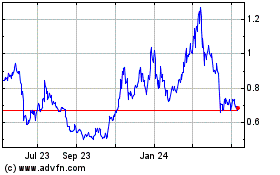

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

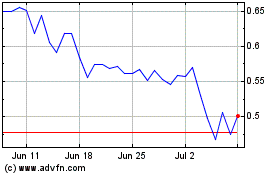

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024