Newcrest Board Rejects Newmont Takeover Proposal, But Willing to Share Information

February 15 2023 - 5:14PM

Dow Jones News

By Rhiannon Hoyle

Newcrest Mining Ltd. on Thursday said its board has rejected a

roughly $17 billion takeover proposal from Newmont Corp., but has

told the U.S. gold-mining giant it would be willing to share some

information to see if it can improve upon its offer.

Newmont, based in Colorado and one of the world's largest

producers of gold, recently submitted a conditional and nonbinding

indicative proposal to acquire Newcrest, Australia's largest listed

gold producer. Newmont said it would offer 0.380 of its own shares

for each Newcrest share held.

"The board has considered the indicative proposal and has

unanimously determined to reject the offer as it does not represent

sufficient value for Newcrest shareholders," the company said on

Thursday.

"In order to determine if Newmont can provide an improved

proposal for consideration by the board that appropriately reflects

the value of Newcrest, the board has indicated to Newmont that it

is prepared to provide access to limited, non-public information on

a non-exclusive basis," Newcrest said.

Access to the information would be subject to some conditions,

including the signing of an appropriate non-disclosure agreement,

it added.

The proposal followed an earlier approach by the U.S. company

that valued each Newcrest share at 0.363 Newmont shares, which

Newcrest directors also rejected.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

February 15, 2023 16:59 ET (21:59 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

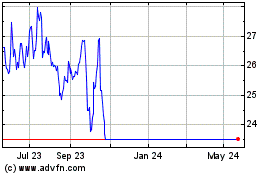

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Sep 2024 to Oct 2024

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Oct 2023 to Oct 2024