UPDATE: Newcrest Mining Wants Access To Lihir Gold Data Room

April 19 2010 - 9:19PM

Dow Jones News

Newcrest Mining Ltd. (NCM.AU) on Tuesday said it wants access to

target Lihir Gold Ltd.'s (LGL.AU) data room to do further due

diligence on the Papua New Guinea-based gold miner and is willing

to alter the structure of its A$9 billion-plus offer.

In a letter sent to Lihir Gold's Chairman Ross Garnaut and to

the Australian Stock Exchange, Newcrest Mining Chairman Don Mercer

said that his group has spent the past two weeks talking to

shareholders, many of whom are also Lihir investors, about its bid

and the response has been "very positive and supportive".

"Our consultations also confirm our view that the terms of our

revised proposal are full and fair," he said, although added

Newcrest is prepared to improve its offer structure by ensuring

shareholders who want more shares and less cash, or vice-versa,

have that option through a "mix and match" structure and was

prepared to discuss its proposal further with Lihir.

Lihir earlier this month rejected Newcrest's offer, pitched at

one Newcrest share for every nine Lihir shares plus 22.5 Australian

cents cash per Lihir share. Lihir rejected that as not reflecting

the value of the company's assets or offering a sufficient control

premium.

Mercer said that Newcrest had already improved its offer before

the bid was made public.

"Following our approach in February, Newcrest made its offer

unambiguously financially compelling by increasing our offer value

by over A$1 billion in our revised March 29 proposal after

considering the limited information covered during a two day due

diligence," Mercer said.

A soaring gold price has seen both Newcrest and Lihir tipped as

potential takeover targets for offshore gold majors who are looking

to replace reserves, and analysts have said that said Barrick Gold

Corp. (ABX), Newmont Mining Corp. (NEM) and Anglo American Plc

(AAL.LN) were among those who could potentially intervene in the

takeover tussle.

Lihir Gold last week said it had appointed Macquarie Capital

Advisers and Greenhill Caliburn to help it assess a range of

strategic options and Mercer noted that Lihir had indicated a data

room has been prepared to assist potential acquirers.

"We would reasonably expect to be given access to that data room

to assist our ongoing review," Mercer said in his letter.

"We assume that other parties require a formal proposal in order

to be given access to due diligence and request your confirmation

that no other parities have been or will be given due diligence on

terms more advantageous than afforded to Newcrest," Mercer

wrote.

But he said any deal was not vital to Newcrest, and warned that

recent gains in Lihir's share price may be at risk if Newcrest's

proposal does not go ahead.

"We have said consistently that the Lihir opportunity is

compelling but not vital to Newcrest," Mercer said.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From May 2024 to Jun 2024

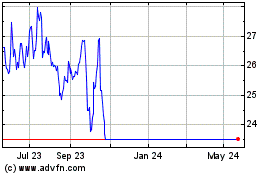

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Jun 2023 to Jun 2024