Filed Pursuant to Rule 424(b)(3)

Registration Statement No.:

333-281910

FINAL

PROSPECTUS

7,812,500

Shares of Common Stock

This

prospectus relates to the resale, from time to time, of up to an aggregate of 7,812,500 shares of common stock, par value $0.000001 per

share, of Xtant Medical Holdings, Inc. by the selling stockholders named in this prospectus, including their respective donees, pledgees,

transferees, assignees or other successors-in-interest. The selling stockholders acquired these shares from us pursuant to a Securities

Purchase Agreement, dated as of August 7, 2024, pursuant to which we issued an aggregate of 7,812,500 shares of common stock in a private

placement at a per share purchase price of $0.64.

We

are not selling any shares of our common stock under this prospectus and will not receive any proceeds from sales of the shares offered

by the selling stockholders, although we will incur expenses in connection with the offering. The registration of the resale of the shares

of common stock covered by this prospectus does not necessarily mean that any of the shares will be offered or sold by the selling stockholders.

The timing and amount of any sales are within the sole discretion of the selling stockholders.

The

shares of common stock offered under this prospectus may be sold by the selling stockholders through public or private transactions,

on or off the NYSE American, at prevailing market prices or at privately negotiated prices. For more information on the times and manner

in which the selling stockholders may sell the shares of common stock under this prospectus, please see the section entitled “Plan

of Distribution,” beginning on page 16 of this prospectus.

Our

common stock is listed on the NYSE American under the symbol “XTNT.” On August 28, 2024, the last reported sale price of

our common stock on the NYSE American was $0.71 per share.

Investing

in our shares of common stock involves a high degree of risk. See “Risk Factors” beginning on page 2 of this prospectus,

as well as those risk factors described in any applicable prospectus supplement and in the documents we incorporate by reference.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 11, 2024.

TABLE

OF CONTENTS

We

are responsible for the information contained and incorporated by reference in this prospectus and any accompanying prospectus supplement

we prepare or authorize. Neither we nor the selling stockholders, as defined below, have authorized anyone to provide any information

or to make any representations other than those contained in or incorporated by reference into this prospectus and any accompanying prospectus

supplement we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. This prospectus and any accompanying prospectus supplement are an offer to sell only the shares offered hereby,

but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus and any accompanying

prospectus supplement is current only as of the date of the applicable document. Our business, financial condition, results of operations

and prospects may have changed since those dates. It is important for you to read and consider all the information contained in this

prospectus and in any accompanying prospectus supplement, including the documents incorporated by reference herein or therein, before

making your investment decision.

For

investors outside the United States: we have not, and the selling stockholders have not, taken any action to permit this offering or

possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offer and sale of the common stock and the distribution of this prospectus outside the United States.

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”),

under the Securities Act of 1933, as amended (“Securities Act”). Under this registration process, the selling stockholders

named in this prospectus may offer or sell shares of our common stock in one or more offerings from time to time. Each time the selling

stockholders named in this prospectus (or in any supplement to this prospectus) sell shares of our common stock under the registration

statement of which this prospectus is a part, such selling stockholders must provide a copy of this prospectus and any applicable prospectus

supplement to a potential purchaser as required by law.

In

certain circumstances we may provide a prospectus supplement that may add, update or change information contained in this

prospectus. Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in

a prospectus supplement. You should read both this prospectus and any prospectus supplement, including all documents incorporated

herein or therein by reference, together with additional information described under “Where You Can Find More

Information” beginning on page 18 of this prospectus and “Incorporation of Certain Information by

Reference” beginning on page 17 of this prospectus.

Neither

we, nor the selling stockholders, have authorized any other person to provide you with different information. If anyone provides you

with different or inconsistent information, you should not rely on it. Neither we nor any of the selling stockholders will make an offer

to sell our common stock in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing

in this prospectus and any prospectus supplement is accurate as of the date on its respective cover, and that any information incorporated

by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial

condition, results of operations and prospects may have changed since those dates.

Unless

otherwise indicated, information contained in or incorporated by reference into this prospectus concerning our industry and the markets

in which we operate, including our general expectations and market position, market opportunity and market share, is based on information

from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted

by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions

based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s

future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, see “Risk Factors”

beginning on page 2 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions

and estimates. See “Cautionary Note Regarding Forward-Looking Statements” beginning on page 7 of this prospectus.

Solely

for convenience, trademarks and trade names referred to in this prospectus may appear without the ® and ™ symbols,

but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our

rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Unless

the context otherwise indicates, the terms “Xtant,” “XTNT,” “Company,” “we,” “us,”

and “our” as used in this prospectus refer to Xtant Medical Holdings, Inc. and our subsidiaries, and the term “common

stock” refers to our common stock, par value $0.000001 per share. The phrase “this prospectus” refers to this prospectus

and any applicable prospectus supplement, unless the context otherwise requires.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and selected information contained in this prospectus. This summary

is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common

stock. For a more complete understanding of the Company and this offering, we encourage you to read and consider the more detailed

information included or incorporated by reference in this prospectus, including risk factors, see “Risk Factors”

beginning on page 2 of this prospectus, and our most recent consolidated financial statements and related notes.

About

Xtant Medical Holdings, Inc.

We

are a global medical technology company focused on the design, development, and commercialization of a comprehensive portfolio of orthobiologics

and spinal implant systems to facilitate spinal fusion in complex spine, deformity, and degenerative procedures. Our products serve the

specialized needs of orthopedic and neurological surgeons, including orthobiologics for the promotion of bone healing, implants and instrumentation

for the treatment of spinal disease. We promote our products in the United States through independent distributors and stocking agents,

supported by direct employees.

We

have an extensive sales channel of independent commissioned agents and stocking distributors in the United States representing some or

all of our products. We also maintain a national accounts program to enable our agents to gain access to integrated delivery network

hospitals (“IDNs”) and through group purchasing organizations (“GPOs”). We have biologics contracts with major

GPOs, as well as extensive access to IDNs across the United States for both biologics and spine hardware systems. While our focus is

the United States market, we promote and sell our products internationally through direct sales representatives and stocking distribution

partners in Canada, Mexico, South America, Australia, and certain Pacific region countries.

The

address of our principal executive office is 664 Cruiser Lane Belgrade, Montana 59714 and our telephone number is (406) 388-0480.

Our

Recent Private Placement

Securities

Purchase Agreement

On

August 7, 2024, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with accredited investors

(the “Investors”), pursuant to which we agreed to issue 7,812,500 shares of common stock in a private placement (the “Private

Placement”) at a per share purchase price of $0.64. The closing of the Private Placement occurred on August 9, 2024. We received

gross proceeds of approximately $5.0 million before deducting estimated offering fees and expenses payable by the Company. We expect

to use the net proceeds from the Private Placement for working capital and other general corporate purposes.

Under

the terms of the Securities Purchase Agreement, each of our directors and executive officers entered into lock-up agreements with the

Company pursuant to which they agreed, subject to certain customary exceptions, not to offer, sell, contract to sell, hypothecate, pledge

or otherwise dispose of (or enter into any transaction which is designed to, or might reasonably be expected to, result in the disposition

(whether by actual disposition or effective economic disposition due to cash settlement or otherwise), directly or indirectly, or establish

or increase a put equivalent position or liquidate or decrease a call equivalent position, with respect to, any shares of our common

stock or securities convertible, exchangeable or exercisable into, shares of our common stock beneficially owned, held or hereafter acquired

by such director or executive officer.

Registration

Rights Agreement

Under

the terms of the Securities Purchase Agreement, we entered into a registration rights agreement (the “Registration Rights Agreement”)

with the Investors at the closing of the Private Placement pursuant to which we agreed to prepare and file a shelf resale registration

statement (the “Resale Registration Statement”) with the SEC within 30 days of the date of the closing for purposes of registering

the resale of the shares of common stock (the “Registrable Securities”). The registration statement of which this prospectus

is a part has been filed to satisfy this obligation. Under the terms of the Registration Rights Agreement, we agreed to use commercially

reasonable best efforts to cause the Resale Registration Statement to be declared effective by the SEC within 60 days of the date of

the closing (90 days in the event the Resale Registration Statement is reviewed by the SEC). If we fail to meet the specified filing

deadlines or keep the Resale Registration Statement effective, subject to certain permitted exceptions, we will be required to pay liquidated

damages to the Investors. We also agreed, among other things, to indemnify the selling stockholders from certain liabilities and to pay

all fees and expenses incident to our performance of or compliance with the Registration Rights Agreement.

The

Offering

| Common

stock to be offered by the selling stockholders: |

|

Up

to 7,812,500 shares |

| |

|

|

| Common

stock to be outstanding after the offering: |

|

138,710,402 shares |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any proceeds from the sale of shares in this offering. See “Use of Proceeds” beginning on page

9 of this prospectus. |

| |

|

|

| Risk

factors: |

|

You

should read the “Risk Factors” beginning on page 2 of this prospectus and the “Risk Factors”

sections of the documents incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding

to invest in shares of our common stock. |

| |

|

|

| Stock

exchange listing: |

|

Our

common stock is listed on the NYSE American under the symbol “XTNT.” |

RISK

FACTORS

Before

making an investment decision, you should carefully consider the following risks and the risks described in the “Risk Factors”

section of our most recent Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024, and

our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed with the SEC on August 8, 2024, and in any other

documents incorporated by reference into this prospectus, as updated by our future filings. The occurrence of any of the events described

below could have a material adverse effect on our business, financial condition, results of operations, cash flows, prospects or the

value of our common stock. These risks are not the only ones that we face. Additional risks not currently known to us or that we currently

deem immaterial also may impair our business.

Risks

Related to this Offering and Our Common Stock

Sales

of shares in connection with this offering may cause the market price of our common stock to decline.

In

connection with the Private Placement, we entered into the Securities Purchase Agreement and Registration Rights Agreement, pursuant

to which we agreed to register for resale with the SEC the shares of our common stock issued to the selling stockholders in the Private

Placement. The registration statement of which this prospectus is a part has been filed to satisfy this obligation. Upon the effectiveness

of the registration statement, the shares we issued in the Private Placement may be freely sold in the open market. The sale of a significant

amount of these shares of our common stock in the open market, or the perception that these sales may occur, could cause the market price

of our common stock to decline or become highly volatile.

Shares

of our common stock are equity securities and are subordinate to our outstanding indebtedness.

Shares

of our common stock are common equity interests. This means that our common stock will rank junior to any outstanding shares of our preferred

stock that we may issue in the future or to the indebtedness under our Amended and Restated Credit, Security and Guaranty Agreement (Term

Loan), as amended, and Amended and Restated Credit, Security and Guaranty Agreement (Revolving Loan), as amended (together, the “Credit

Agreements”) with MidCap Financial Trust and MidCap Funding IV Trust, respectively, and any future indebtedness we may incur and

to all creditor claims and other non-equity claims against us and our assets available to satisfy claims on us, including claims in a

bankruptcy or similar proceeding. Additionally, unlike indebtedness, where principal and interest customarily are payable on specified

due dates, in the case of our common stock, (i) dividends are payable only when and if declared by our Board of Directors, and (ii) as

a corporation, we are restricted to making dividend payments and redemption payments out of legally available assets. We have never paid

a dividend on our common stock and have no current intention to pay dividends in the future. In addition, our Credit Agreements preclude

us from paying dividends. Furthermore, our common stock places no restrictions on our business or operations or on our ability to incur

indebtedness or engage in any transactions, subject only to the voting rights available to stockholders generally.

Our

inability to comply with the continued listing requirements of the NYSE American could result in our common stock being delisted, which

could affect its market price and liquidity and reduce our ability to raise capital.

We

are required to meet certain qualitative and financial tests to maintain the listing of our common stock on the NYSE American. If we

do not maintain compliance with the continued listing requirements for the NYSE American within specified periods and subject to permitted

extensions, our common stock may be recommended for delisting (subject to any appeal we would file). No assurance can be provided that

we will continue to comply with these continued listing requirements. If our common stock were delisted, it could be more difficult to

buy or sell our common stock and to obtain accurate quotations, and the price of our stock could suffer a material decline. Delisting

would also impair our ability to raise capital.

The

market price of our common stock is extremely volatile, which may affect our ability to raise capital in the future and may subject the

value of the investment of our stockholders to sudden decreases.

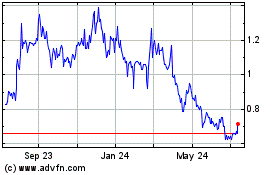

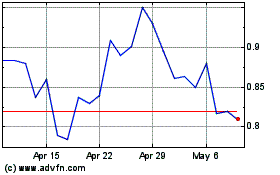

The

market price for securities of medical device and biotechnology companies, including ours, historically has been highly volatile, and

the market from time to time has experienced significant price and volume fluctuations that are unrelated to the operating performance

of such companies. The trading volume and prices of our common stock have been and may continue to be volatile and could fluctuate widely

due to factors both within and beyond our control. During 2023, the sale price of our common stock ranged from $0.58 to $1.39 per share,

and our daily trading volume ranged from 1,000 to 790,000 shares. During the first six months of 2024, the sale price of our common stock

ranged from $1.31 to $0.60 per share, and our daily trading volume ranged from 7,300 to 949,700 shares. Such volatility may be the result

of broad market and industry factors. Future fluctuations in the trading price or liquidity of our common stock may harm the value of

the investment of our stockholders in our common stock. Factors that may have a significant impact on the market price and marketability

of our common stock include, among others:

| ● | the

terms of any potential future transaction(s) related to debt financing, debt restructuring

or capital raising; |

| ● | our

ability to make interest payments under our Credit Agreements; |

| ● | our

observance of covenants under our Credit Agreements; |

| ● | announcements

of technological innovations or new commercial products by us or our present or potential

competitors; |

| ● | developments

or disputes concerning patent or other proprietary rights; |

| ● | developments

in our relationships with employees, suppliers, distributors, sales representatives and customers; |

| ● | acquisitions

or divestitures; |

| ● | litigation

and government proceedings; |

| ● | adverse

legislation, including changes in governmental regulation; |

| ● | third-party

reimbursement policies; |

| ● | additions

or departures of key personnel; |

| ● | sales

of our equity securities by our significant stockholders or management or sales of additional

equity securities by our Company; |

| ● | changes

in securities analysts’ recommendations; |

| ● | changes

in health care policies and practices; |

| ● | the

delisting of our common stock or halting or suspension of trading in our common stock by

the NYSE American; |

| ● | economic,

social and other external factors, such as epidemics or pandemics, supply chain disruptions,

labor shortages and persistent inflation; and |

| ● | general

market conditions. |

In

the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has

often been instituted. These lawsuits often seek unspecified damages, and as with any litigation proceeding, one cannot predict with

certainty the eventual outcome of pending litigation. Furthermore, we may have to incur substantial expenses in connection with any such

lawsuits and our management’s attention and resources could be diverted from operating our business as we respond to any such litigation.

We maintain insurance to cover these risks for us and our directors and officers, but our insurance is subject to high deductibles to

reduce premium expense, and there is no guarantee that the insurance will cover any specific claim that we currently face or may face

in the future, or that it will be adequate to cover all potential liabilities and damages.

Our

actual operating results may differ significantly from our guidance, which could cause the market price of our common stock to decline.

We

issue guidance regarding our future performance, such as our anticipated annual revenue, that represents our management’s estimates

as of the date of release. This guidance, which consists of forward-looking statements, is prepared by our management and is qualified

by, and subject to, the assumptions and the other information contained or referred to in the release. Our guidance is not prepared with

a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and neither any independent

registered public accounting firm nor any other independent expert or outside party compiles, examines or reviews the guidance and, accordingly,

no such person expresses any opinion or any other form of assurance with respect thereto.

Guidance

is based upon a number of assumptions and estimates that, while presented with numerical specificity, is inherently subject to significant

business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific

assumptions with respect to future business decisions, some of which will change. We generally state possible outcomes as high and low

ranges which are intended to provide a sensitivity analysis as variables are changed but are not intended to represent that actual results

could not fall outside of these ranges. The principal reason that we release this data is to provide a basis for our management to discuss

our business outlook with analysts and investors. We do not accept any responsibility for any projections or reports published by any

such persons.

Guidance

is necessarily speculative in nature, and it can be expected that some or all of the assumptions of the guidance furnished by us will

not materialize or will vary significantly from actual results. Accordingly, our guidance is only an estimate of what management believes

is realizable as of the date of release. Actual results will vary from the guidance and the variations may be material. Investors should

also recognize that the reliability of any forecasted financial data will diminish the farther in the future that the data are forecast.

In light of the foregoing, investors are urged to put the guidance in context and not to place undue reliance on it.

Any

failure to successfully implement our operating strategy or the occurrence of any of the events or circumstances set forth in our most

recent Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024, and our Quarterly Report

on Form 10-Q for the quarterly period ended June 30, 2024, filed with the SEC on August 8, 2024 could result in the actual operating

results being different than our guidance, and such differences may be adverse and material. The failure to achieve such guidance could

disappoint investors and analysts and cause the market price of our common stock to decline.

We

may issue additional common stock resulting in stock ownership dilution.

From

time to time, we issue equity securities to raise additional financing and in connection with debt restructurings. In our recent Private

Placement, we issued $5.0 million of shares of common stock at a per share purchase price of $0.64 per share. Future dilution may occur

due to additional future equity issuances and/or equity financing events by us, including any potential future restructuring of our outstanding

indebtedness. In addition, we may raise additional capital through the sale of equity or convertible debt securities, which would further

dilute the ownership interests of our stockholders. As of June 30, 2024, we had outstanding warrants to purchase approximately 12,237,470

shares of our common stock, stock options to purchase 4,719,585 shares of our common stock, restricted stock unit awards covering 3,948,058

shares of our common stock, performance stock unit awards covering 1,772,217 shares of our common stock (assuming target performance)

and deferred stock unit awards covering 1,920,171 shares of our common stock under the Xtant Medical Holdings, Inc. 2023 Equity Incentive

Plan, Xtant Medical Holdings, Inc. Second Amended and Restated 2018 Equity Incentive Plan, and our prior equity compensation plan, and

5,554,340 shares available for issuance under the Xtant Medical Holdings, Inc. 2023 Equity Incentive Plan. If these or any future warrants,

options or restricted stock units are exercised or otherwise converted into shares of our common stock, our stockholders will experience

additional dilution.

The

sale or availability for sale of substantial amounts of our common stock or other equity securities could adversely affect the market

price of our common stock.

Sales

of substantial amounts of our common stock or a preferred stock in the public market, or the perception that these sales could occur,

could adversely affect the market price of our common stock and could materially impair our ability to raise capital through equity offerings

in the future. We cannot predict what effect, if any, market sales of securities beneficially owned by OrbiMed Advisors LLC or any other

stockholder or the availability of these securities for future sale will have on the market price of our common stock.

If

securities analysts stop publishing research or reports about us or our business, or if they downgrade our common stock, the trading

volume and market price of our common stock could decline.

The

market for our common stock relies in part on the research and reports that industry or financial analysts publish about us or our business.

We do not control these analysts. If any analyst who covers us downgrades our stock or lowers its future stock price targets or estimates

of our operating results, our stock price could decline rapidly. Furthermore, if any analyst ceases to cover our Company, we could lose

visibility in the market. Each of these events could, in turn, cause our trading volume and the market price of our common stock to decline.

Anti-takeover

provisions in our organizational documents and agreements may discourage or prevent a change in control, even if a sale of the Company

could be beneficial to our stockholders, which could cause our stock price to decline and prevent attempts by our stockholders to replace

or remove our current management.

Several

provisions of our Restated Certificate of Incorporation (“Charter”) and Third Amended and Restated Bylaws (“Bylaws”)

and our Investor Rights Agreement (as amended, the “Investor Rights Agreement”) with OrbiMed Royalty Opportunities II, LP

(“Royalty Opportunities”) and ROS Acquisition Offshore (“ROS”) could make it difficult for our stockholders to

change the composition of our Board of Directors, preventing them from changing the composition of management. In addition, several provisions

of our Charter and Bylaws may discourage, delay or prevent a merger or acquisition that our stockholders may consider favorable. These

provisions include:

| ● | We

have shares of common stock and preferred stock available for issuance without stockholder

approval. The existence of unissued and unreserved common stock and preferred stock may enable

the Board of Directors to issue shares to persons friendly to current management or to issue

preferred stock with terms that could render more difficult or discourage a third-party attempt

to obtain control of us by means of a merger, tender offer, proxy contest or otherwise, thereby

protecting the continuity of our management. |

| ● | Shares

of our common stock do not have cumulative voting rights in the election of directors, so

our stockholders holding a majority of the shares of common stock outstanding will be able

to elect all of our directors. |

| ● | Special

meetings of the stockholders may be called only by the Board of Directors, the chair of the

Board of Directors or the chief executive officer. |

| ● | The

Board of Directors may adopt, alter, amend or repeal our Bylaws without stockholder approval. |

| ● | Unless

otherwise provided by law, any newly created directorship or any vacancy occurring on the

Board of Directors for any cause may be filled by the affirmative vote of a majority of the

remaining members of the Board of Directors even if such majority is less than a quorum,

and any director so elected shall hold office until the expiration of the term of office

of the director whom he or she has replaced or until his or her successor is elected and

qualified. |

| ● | Prior

to July 26, 2030, fixing the number of directors at more than seven directors requires the

approval of at least 75% of our directors then holding office. |

| ● | The

affirmative vote of the holders of at least two-thirds of the voting power of the then outstanding

shares of our capital stock entitled to vote generally in the election of directors, voting

together as a single class, is required to amend or repeal the provisions of our Charter

related to the amendment of our Bylaws, the Board of Directors and our stockholders as well

as the general provisions of our Charter. |

| ● | Stockholders

must follow advance notice procedures to submit nominations of candidates for election to

the Board of Directors at an annual or special meeting of our stockholders, including director

election contests subject to the SEC’s universal proxy rules, and must follow advance

notice procedures to submit other proposals for business to be brought before an annual meeting

of our stockholders. |

| ● | Unless

we consent in writing to an alternative forum, the Court of Chancery of the State of Delaware,

(or, if the Court of Chancery of the State of Delaware does not have subject matter jurisdiction,

a state court located within the State of Delaware or, if no state court located within the

State of Delaware has subject matter jurisdiction, the federal district court for the District

of Delaware), will be the exclusive forum for (i) any derivative action or proceeding brought

on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any

director, officer or other employee to us or our stockholders, (iii) any action asserting

a claim arising under any provision of the General Corporation Law of the State of Delaware

(“DGCL”), our Charter or our Bylaws, or (iv) any action asserting a claim governed

by the internal-affairs doctrine; provided, however, that unless we consent in writing to

an alternative forum, the federal district courts of the United States of America shall be,

to the fullest extent permitted by applicable law, the exclusive forum for the resolution

of any complaint asserting a cause of action arising under the Securities Act. |

| ● | The

Investor Rights Agreement includes director nomination rights, which provide that so long

as the Ownership Threshold (as defined in the Investor Rights Agreement) is met, Royalty

Opportunities and ROS are entitled to nominate such individuals to the Board of Directors

constituting a majority of the directors. In addition, under the Investor Rights Agreement,

so long as the Ownership Threshold is met, certain matters require the approval of Royalty

Opportunities and ROS to proceed with such a transaction, including without limitation, the

sale, transfer or other disposition of our assets or businesses or our subsidiaries with

a value in excess of $250,000 in the aggregate during any fiscal year (other than sales of

inventory or supplies in the ordinary course of business, sales of obsolete assets (excluding

real estate), sale-leaseback transactions and accounts receivable factoring transactions). |

| ● | The

Letter Agreement between us and Mr. Stavros Vizirgianakis includes director nomination rights,

which terminate on the earlier of (i) the date on which Mr. Vizirgianakis ceases to hold

at least 75% of the shares of common stock purchased by him in our 2022 private placement,

(ii) October 7, 2024, or (iii) upon written notice of Mr. Vizirgianakis to us. |

These

anti-takeover provisions could substantially impede the ability of our stockholders to benefit from a change in control and, as a result,

could materially adversely affect the market price of our common stock and the ability of our stockholders to realize any potential change-in-control

premium.

Our

Board of Directors is authorized to issue and designate shares of our preferred stock without stockholder approval.

Our

Charter authorizes our Board of Directors, without the approval of our stockholders, to issue up to 10 million shares of our preferred

stock, subject to limitations prescribed by applicable law, rules and regulations and the provisions of our Charter, as shares of preferred

stock in series, to establish from time to time the number of shares to be included in each such series and to fix the designation, powers,

preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof. The powers, preferences

and rights of these series of preferred stock may be senior to or on parity with our common stock, which may reduce its value.

Our

Charter designates the Court of Chancery of the State of Delaware as the exclusive forum for certain litigation that may be initiated

by our stockholders, which could limit the ability of our stockholders to obtain a favorable judicial forum for disputes with us.

Our

Charter provides that, unless we consent in writing to an alternative forum, the Court of Chancery of the State of Delaware, (or, if

the Court of Chancery of the State of Delaware does not have subject matter jurisdiction, a state court located within the State of Delaware

or, if no state court located within the State of Delaware has subject matter jurisdiction, the federal district court for the District

of Delaware), will be the exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting

a claim of breach of a fiduciary duty owed by any director, officer or other employee to us or our stockholders, (iii) any action asserting

a claim arising under any provision of the DGCL, our Charter or our Bylaws, or (iv) any action asserting a claim governed by the internal-affairs

doctrine. Furthermore, unless we consent in writing to an alternative forum, the federal district courts of the United States of America

shall be, to the fullest extent permitted by applicable law, the exclusive forum for the resolution of any complaint asserting a cause

of action arising under the Securities Act. Any person or entity purchasing or otherwise acquiring any interest in any security of Xtant

will be deemed to have notice of and consented to these provisions. This provision may limit the ability of our stockholders to obtain

a favorable judicial forum for disputes with us.

We

have never paid dividends and do not expect to do so in the foreseeable future.

We

have not declared or paid any cash dividends on our common stock. The payment of dividends in the future will be dependent on our earnings

and financial condition and on such other factors as our Board of Directors considers appropriate. Unless and until we pay dividends,

stockholders may not receive a return on their shares of our common stock. There is no present intention by our Board of Directors to

pay dividends on our common stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development

of our business. In addition, the terms of our Credit Agreements preclude us from paying dividends. As a result, appreciation, if any,

in the market price of our common stock will be the sole source of gain for our stockholders for the foreseeable future.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements contained in or incorporated by reference into this prospectus, or filings with the SEC and our public releases, that are

not purely historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Our

forward-looking statements include, but are not limited to, statements regarding our “expectations,” “hopes,”

“beliefs,” “intentions” or “strategies” regarding the future. In addition, any statements that refer

to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking

statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should” and “would,” as well as similar expressions, may identify

forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. Forward-looking statements

contained in or incorporated by reference into this prospectus may include, for example, statements about the following topics and are

subject to certain risks and uncertainties, including the following:

| ● | our

use of proceeds from the Private Placement, which use is within the discretion of management; |

| ● | our

ability to increase revenue and our ability to improve our gross margins, our operating expenses

as a percentage of revenue, and obtain and sustain profitability; |

| ● | our

ability to become operationally self-sustaining by controlling our supply chain and becoming

less reliant on production and manufacturing of our products outside of our control, which

we believe will allow us to be a larger and more diverse producer of biologics; |

| ● | our

ability to integrate the products acquired as part of the acquisition of Surgalign SPV, Inc.,

the acquisition of certain assets and liabilities of Surgalign Holdings, Inc., and the acquisition

of certain assets of RTI Surgical, Inc. and achieve future sales of those products as anticipated,

especially given their respective declines in sales before we acquired them, and other risks

associated with those acquisitions and any future business combinations or acquisitions we

may pursue; |

| ● | the

effect of our private label and original equipment manufacturer business on our business

and operating results and risks associated therewith, including fluctuations in our operating

results and decreased profit margins; |

| ● | our

ability and success in implementing key growth and process improvement initiatives designed

to increase our production capacity, revenue and scale and risks associated with such growth

and process improvement initiatives; |

| ● | our

ability to implement successfully our four key growth pillars, which are focused on introducing

new products; expanding our distribution network and achieving greater contract access; leveraging

and penetrating adjacent markets and completing targeted strategic acquisitions; |

| ● | risks

associated with our international operations, including but not limited to the effect of

foreign currency exchange rate fluctuations and compliance with foreign legal and regulatory

requirements, current and future wars, related sanctions and geopolitical tensions, political

risks associated with the potential instability of governments and legal systems in countries

in which we or our customers or suppliers conduct business, and other potential conflicts; |

| ● | our

ability to operate in international markets and effectively manage our international subsidiaries,

which require management attention and financial resources; |

| ● | our

ability to navigate manufacturing challenges related to the production of biologics products

and recover from our prior stem cell shortage and our ability to win back stem cell customers

and achieve future stem cell revenue as anticipated; |

| ● | our

ability to retain and expand our agreements with GPOs and IDNs and sell products to members

of such GPOs and IDNs; |

| ● | the

effect of inflation and supply chain disruptions, which could result in delayed product launches,

lost revenue, higher costs, decreased profit margins, and other adverse effects on our business

and operating results; |

| ● | the

effect of labor and staffing shortages at hospitals and other medical facilities on the number

of elective procedures in which our products are used and as a result our revenues, as well

as global and local labor shortages and loss of personnel, which have adversely affected

and may continue to adversely affect our ability to produce product to meet demand; |

| ● | our

ability to remain competitive; |

| ● | our

ability to rebrand and integrate acquired products with our existing product line and successfully

transition our customers from some of our older legacy hardware products to these new products

and the anticipated adverse effect of these transitions on our organic revenue growth rate; |

| ● | our

ability to innovate, develop, introduce and market new products and technologies and the

success of such new products and technologies, including our recently launched amniotic membrane

allografts, SimpliGraft™ and SimpliMax™; |

| ● | our

dependence on and ability to retain and recruit independent sales agents and distributors

and motivate and incentivize them to sell our products, including in particular our dependence

on key independent agents for a significant portion of our revenue; |

| ● | the

ability of our sales personnel, including our independent sales agents and distributors,

to achieve expected results; |

| ● | our

reliance on third party suppliers and manufacturers; |

| ● | the

effect of product liability claims and other litigation to which we may be subjected and

product recalls and defects; |

| ● | the

effect of infectious diseases on our business, operating results and financial condition; |

| ● | the

effect of fluctuations in foreign currency exchange rates on our earnings and our foreign

currency translation adjustments; |

| ● | risks

associated with and the effect of a shift in procedures using our products from hospitals

to ambulatory surgical centers, which would put pressure on the price of our products and

margins; |

| ● | our

ability to obtain and maintain regulatory approvals in the United States and abroad and the

effect of government regulations and our compliance with government regulations; |

| ● | the

ability of our clinical trials to demonstrate competent and reliable evidence of the safety

and effectiveness of our products; |

| ● | our

ability to remain accredited with the American Association of Tissue Banks and continue to

obtain a sufficient number of donor cadavers for our products; |

| ● | our

ability to obtain and maintain government and third-party coverage and reimbursement for

our products; |

| ● | our

ability to attract, retain and engage qualified technical, sales and processing personnel

and members of our management team, especially in light of a tight labor market and increasing

cost of living in and around the Belgrade, Montana area; |

| ● | our

ability to maintain sufficient liquidity to fund our operations and obtain financing on reasonable

terms when needed and the effect of such additional financing on our business, results of

operations, financial condition and stockholders; |

| ● | our

ability to service our debt and comply with the covenants in our credit agreements and the

effect of our significant indebtedness on our business, results of operations, financial

condition and prospects; |

| ● | our

expectations regarding operating trends, future financial performance and expense management

and our estimates of our future revenue, expenses, ongoing losses, gross margins, operating

leverage, capital requirements and our need for, or ability to obtain, additional financing

and the availability of our credit facilities; |

| ● | our

ability to effectively remediate our outstanding material weaknesses and maintain effective

internal control over financial reporting; |

| ● | our

ability to obtain and protect our intellectual property and proprietary rights and operate

without infringing the intellectual property rights of others; |

| ● | our

ability to maintain our stock listing on the NYSE American Exchange; |

| ● | risks

inherent in being a controlled company; and |

| ● | the

effect of a global economic slowdown, rising interest rates and the prospects for recession,

a possible U.S. government shutdown, as well as past and potential future disruptions in

access to bank deposits or lending commitments due to bank failures, which could materially

and adversely affect our revenue, liquidity, financial condition and results of operations. |

The

forward-looking statements contained in this prospectus or in any documents incorporated by reference are based on our current expectations

and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting

us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties, or assumptions,

many of which are beyond our control, which may cause actual results or performance to be materially different from those expressed or

implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in

this prospectus, see “Risk Factors” beginning on page 2 of this prospectus, our Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the SEC on April 1, 2024, and our Quarterly Report on Form 10-Q for the quarterly period ended

June 30, 2024, filed with the SEC on August 8, 2024.

Should

one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in

material respects from those projected in these forward-looking statements. We caution you that the forward-looking statements contained

in this prospectus are not guarantees of future performance, and we cannot assure you that those statements will be realized or that

the forward-looking events and circumstances will occur. All forward-looking statements speak only as of the date of this prospectus.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required under applicable securities laws. The cautionary statements qualify all forward-looking

statements attributable to us or persons acting on our behalf.

You

should also read carefully the factors described in the “Risk Factors” in our Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the SEC on April 1, 2024, our Quarterly Report on Form 10-Q for the quarterly period ended June 30,

2024, filed with the SEC on August 8, 2024, and in any other documents incorporated by reference into this prospectus, as updated by

our future filings, to better understand significant risks and uncertainties inherent in our business and underlying any forward-looking

statements. As a result of these factors, actual results could differ materially and adversely from those anticipated or implied in the

forward-looking statements in this report, and you should not place undue reliance on any forward-looking statements.

USE

OF PROCEEDS

We

are filing the registration statement of which this prospectus is a part to permit holders of our common stock described in the section

entitled “Selling Stockholders,” beginning on page 14 of this prospectus, to resell such shares. We are not selling

any securities under this prospectus and will not receive any proceeds from the sale of shares by the selling stockholders.

We

will bear all expenses incurred in connection with the performance of our obligations under the Registration Rights Agreement.

DESCRIPTION

OF SECURITIES

The

following description, together with the additional information we include in any applicable prospectus supplement, summarizes the material

terms and provisions of our common stock and preferred stock and does not purport to be complete. It is subject to and qualified in its

entirety by reference to the provisions of our Charter, Bylaws and the Investor Rights Agreement, which are filed as exhibits to the

registration statement that includes this prospectus and are incorporated by reference herein, and the agreement between the Company

and Stavros G. Vizirgianakis (the “Lead Investor Agreement”). We encourage you to read our Charter, our Bylaws, the Investor

Rights Agreement, the Lead Investor Agreement and the applicable provisions of the DGCL for additional information.

Authorized

and Outstanding Capital Stock

Our

Charter provides that we have authority to issue 300,000,000 shares of common stock, 138,710,402 of which are issued and

outstanding as of August 28, 2024 and 10,000,000 shares of preferred stock, none of which are issued and outstanding as of the date

of this prospectus. As of August 28, 2024, in the aggregate, we had outstanding warrants to purchase 12,237,470 shares of our common

stock, stock options to purchase 4,459,062 shares of our common stock, restricted stock unit awards covering 3,249,340

shares of our common stock, performance stock unit awards covering 1,710,776 shares of our common stock (assuming target

performance) and deferred stock unit awards covering 2,611,096 shares of our common stock under the Xtant Medical Holdings,

Inc. 2023 Equity Incentive Plan, Xtant Medical Holdings, Inc. Second Amended and Restated 2018 Equity Incentive Plan, and our prior

equity compensation plan, and 4,553,228 shares available for issuance under the Xtant Medical Holdings, Inc. 2023 Equity

Incentive Plan.

Our

preferred stock may be issued from time to time in one or more series. The Board of Directors is authorized, by resolution or resolutions,

to fix the number of shares of any series of preferred stock and to determine the designation, powers, rights, preferences, qualifications,

limitations, privileges and restrictions, if any, of any wholly unissued series of preferred stock, including without limitation, authority

to fix by resolution or resolutions the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption

(including sinking fund provisions), redemption price or prices and liquidation preferences of any such series, and the number of shares

constituting any such series and the designation thereof, or any of the foregoing.

We

may amend from time to time our Charter to increase the number of authorized shares of common stock or preferred stock. Any such amendment

would require the approval of the holders of a majority of the voting power of the shares entitled to vote thereon. In addition, pursuant

to our Charter, the Board of Directors is authorized to increase (but not above the total number of authorized shares of the class) or

decrease (but not below the number of shares of any such series then outstanding) the number of shares of any series (including a series

of preferred stock), the number of which was fixed by it, subsequent to the issuance of shares of such series then outstanding, subject

to certain limitations, without the vote of our stockholders.

Common

Stock

Voting

Rights

Each

holder of our common stock is entitled to one vote per share on each matter submitted to a vote at a meeting of stockholders, including

in all elections for directors. Stockholders are not entitled to cumulative voting in the election of directors. Subject to applicable

law and the rights, if any, of the holders of outstanding shares of any series of preferred stock we may designate and issue in the future,

holders of our common stock are entitled to vote on all matters on which stockholders are generally entitled to vote.

Our

stockholders may vote either in person or by proxy. At all meetings of stockholders for the election of directors at which a quorum is

present, a plurality of the votes cast shall be sufficient to elect. All other elections and questions presented to the stockholders

at a meeting at which a quorum is present shall, unless otherwise provided by our Charter, our Bylaws, the rules or regulations of any

stock exchange applicable to us or applicable law or pursuant to any regulation applicable to us or our securities, be decided by the

affirmative vote of the holders of a majority in voting power of the shares of our stock that are present in person or by proxy and entitled

to vote thereon.

Dividends

Our

Board of Directors may authorize, and we may make, distributions to our stockholders, subject to any restriction in our Charter and to

those limitations prescribed by law and contractual restrictions. Subject to preferences that may apply to any shares of preferred stock

outstanding at the time, the holders of our common stock will be entitled to share equally, identically and ratably in any dividends

that the Board of Directors may determine to issue from time to time.

Liquidation

Rights

Upon

liquidation, dissolution or winding up, all holders of our common stock are entitled to participate pro rata in our assets available

for distribution, subject to applicable law and the rights, if any, of the holders of any class of preferred stock then outstanding.

Other

Rights and Preferences

Under

the terms of our Charter and Bylaws, holders of our common stock have no preemptive rights, conversion rights or subscription rights,

and there are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the

holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred

stock that the Board of Directors may designate and issue in the future. Our Charter and Bylaws do not restrict the ability of a holder

of our common stock to transfer his, her or its shares of common stock. All shares of our common stock currently outstanding are fully

paid and non-assessable.

Transfer

Agent

The

transfer agent for our common stock is Broadridge Corporate Issuer Solutions, Inc.

Exchange

Listing

Our

common stock is listed on NYSE American under the symbol “XTNT.”

Anti-Takeover

Effects of Certain Provisions of our Charter, Bylaws, the Investor Rights Agreement and the Lead Investor Agreement, Our Status as a

Controlled Company and under the DGCL

Anti-takeover

provisions in our Charter, Bylaws, the Investor Rights Agreement and the Lead Investor Agreement, our status as a controlled company

and under the DGCL may discourage or prevent a change in control, even if such a sale could be beneficial to our stockholders.

Charter

and Bylaws

Our

Charter and Bylaws contain the following anti-takeover provisions that may have an anti-takeover effect of delaying, deferring or preventing

a change in control of the Company:

| ● | We

have shares of common stock and preferred stock available for issuance without stockholder

approval. The existence of unissued and unreserved common stock and preferred stock may enable

the Board of Directors to issue shares to persons friendly to current management or to issue

preferred stock with terms that could render more difficult or discourage a third-party attempt

to obtain control of us by means of a merger, tender offer, proxy contest or otherwise, thereby

protecting the continuity of our management. |

| ● | Shares

of our common stock do not have cumulative voting rights in the election of directors, so

our stockholders holding a majority of the shares of common stock outstanding will be able

to elect all of our directors. |

| ● | Special

meetings of the stockholders may be called only by the Board of Directors, the Chair of the

Board of Directors or the Chief Executive Officer. |

| ● | The

Board of Directors may adopt, alter, amend or repeal our Bylaws without stockholder approval. |

| ● | Unless

otherwise provided by law, any newly created directorship or any vacancy occurring on the

Board of Directors for any cause may be filled by the affirmative vote of a majority of the

remaining members of the Board of Directors, even if such majority is less than a quorum,

and any director so elected shall hold office until the expiration of the term of office

of the director whom he or she has replaced or until his or her successor is elected and

qualified. |

| ● | Prior

to July 26, 2030, fixing the number of directors at more than seven directors requires the

approval of at least 75% of our directors then holding office. |

| ● | The

affirmative vote of the holders of at least two-thirds of the voting power of the then outstanding

shares of our capital stock entitled to vote generally in the election of directors, voting

together as a single class, is required to amend or repeal the provisions of our Charter

related to the amendment of our Bylaws, the Board of Directors and our stockholders as well

as the general provisions of our Charter. |

| ● | Stockholders

must follow advance notice procedures to submit nominations of candidates for election to

the Board of Directors at an annual or special meeting of our stockholders, including director

election contests subject to the SEC’s universal proxy rules, and must follow advance

notice procedures to submit other proposals for business to be brought before an annual meeting

of our stockholders. |

| ● | Unless

we consent in writing to an alternative forum, the Court of Chancery of the State of Delaware

(or, if the Court of Chancery of the State of Delaware does not have subject matter jurisdiction,

a state court located within the State of Delaware or, if no state court located within the

State of Delaware has subject matter jurisdiction, the federal district court for the District

of Delaware) will be the exclusive forum for (i) any derivative action or proceeding brought

on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any

director, officer or other employee to us or our stockholders, (iii) any action asserting

a claim arising under any provision of the DGCL, our Charter or our Bylaws, or (iv) any action

asserting a claim governed by the internal-affairs doctrine; provided, however, that unless

we consent in writing to an alternative forum, the federal district courts of the United

States of America shall be, to the fullest extent permitted by applicable law, the exclusive

forum for the resolution of any complaint asserting a cause of action arising under the Securities

Act. |

Investor

Rights Agreement

We

are party to an Investor Rights Agreement, which includes certain provisions that may have an anti-takeover effect of delaying, deferring

or preventing a change in control of the Company. The Investor Rights Agreement includes director nomination rights, which provide that

so long as the Ownership Threshold (as defined in the Investor Rights Agreement) is met, Royalty Opportunities and ROS are entitled to

nominate such individuals to the Board of Directors constituting a majority of the directors. In addition, under the Investor Rights

Agreement, so long as the Ownership Threshold is met, certain matters require the approval of Royalty Opportunities and ROS to proceed

with such a transaction, including without limitation, the sale, transfer or other disposition of assets or businesses of the Company

or its subsidiaries with a value in excess of $250,000 in the aggregate during any fiscal year (other than sales of inventory or supplies

in the ordinary course of business, sales of obsolete assets (excluding real estate), sale-leaseback transactions and accounts receivable

factoring transactions).

Lead

Investor Agreement

In

connection with our 2022 private placement, we entered into the Lead Investor Agreement with Stavros G. Vizirgianakis, as the lead investor

of the 2022 private placement, pursuant to we agreed to provide certain director nomination rights to Mr. Vizirgianakis. Pursuant to

the terms of the Lead Investor Agreement, we expanded the size of our Board of Directors by one position and elected Mr. Vizirgianakis

as a director to fill the vacancy created as a result of the increase, effective upon completion of the first closing of the 2022 private

placement. In addition, we elected Mr. Vizirgianakis as Chair of the Board of Directors, effective upon completion of the first closing.

The director nomination rights set forth in the Lead Investor Agreement will terminate on the earlier of (i) the date on which Mr. Vizirgianakis

ceases to hold at least 75% of the shares of our common stock to be purchased by him in the 2022 private placement; (ii) October 7, 2024;

or (iii) upon written notice of Mr. Vizirgianakis to the Company.

Controlled

Company Status

We

are a “controlled company” as defined in section 801(a) of the NYSE American Company Guide because more than 50% of the combined

voting power of all of our outstanding common stock is beneficially owned by OrbiMed Advisors LLC. Our status as a controlled company

may have an anti-takeover effect of delaying, deferring or preventing a change in control of the Company.

Section

203 of the DGCL

We

have elected to be subject to Section 203 of the DGCL (“Section 203”), and we are prohibited from engaging in any business

combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder,

with the following exceptions:

| |

● |

before

such date, the Board of Directors approved either the business combination or the transaction that resulted in the stockholder becoming

an interested stockholder; |

| |

● |

upon

completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned

at least 85% of the voting shares outstanding at the time the transaction began, excluding for purposes of determining the voting

shares outstanding (but not the outstanding voting shares owned by the interested stockholder) those shares owned (i) by persons

who are directors and also officers and (ii) employee stock plans in which employee participants do not have the right to determine

confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

● |

on

or after such date, the business combination is approved by the Board of Directors and authorized at an annual or special meeting

of the stockholders, and not by written consent, by the affirmative vote of at least 66-2/3% of the outstanding voting shares that

are not owned by the interested stockholder. |

In

general, Section 203 defines business combination to include the following:

| |

● |

any

merger or consolidation involving the company and the interested stockholder; |

| |

● |

any

sale, transfer, pledge or other disposition of 10% or more of the assets of the company involving the interested stockholder; |

| |

● |

subject

to certain exceptions, any transaction that results in the issuance or transfer by the company of any shares of the company to the

interested stockholder; |

| |

● |

any

transaction involving the company that has the effect of increasing the proportionate share of the shares or any class or series

of shares of the company beneficially owned by the interested stockholder; or |

| |

● |

the

receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or

through the company. |

In

general, by reference to Section 203, an “interested stockholder” is an entity or person who, together with the person’s

affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status

owned, 15% or more of the outstanding voting shares of the company.

Limitations

of Liability and Indemnification Matters

We

have adopted provisions in our Charter that limit or eliminate the liability of our directors and officers for monetary damages for breach

of their fiduciary duties, except for a breach of the duty of loyalty to our Company or its stockholders, for acts or omissions not in

good faith or involving intentional misconduct or a knowing violation of law, or for any transaction from which a director or officer,

as the case may be, derived an improper personal benefit. Accordingly, our directors and officers will not be personally liable for monetary

damages for breach of their fiduciary duties as directors or officers, respectively, except with respect to the following:

| |

● |

any

breach of their duty of loyalty to us or our stockholders; |

| |

● |

acts

or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; |

| |

● |

in

the case of directors, unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of

the DGCL; |

| |

● |

any

transaction from which the director or officer derived an improper personal benefit; or |

| |

● |

in

the case of officers, any action by or in the right of the Company. |

This

limitation of liability does not apply to liabilities arising under the federal securities laws and does not affect the availability

of equitable remedies such as injunctive relief or rescission. If Delaware law is amended to authorize the further elimination or limiting

of director or officer liability, then the liability of our directors and/or officers will be eliminated or limited to the fullest extent

permitted by Delaware law as so amended.

Our

Bylaws provide for mandatory indemnification of directors and officers to the maximum extent allowed by applicable law. We believe that

indemnification under our Bylaws covers at least negligence and gross negligence on the part of indemnified parties. In addition, we

have also entered into indemnification agreements with our directors and officers, pursuant to which we must:

| |

● |

indemnify

officers and directors against certain liabilities that may arise because of their status as officers and directors; |

| |

● |

advance

expenses, as incurred, to officers and directors in connection with a legal proceeding subject to limited exceptions; and |

| |

● |

cover

officers and directors under any general or directors’ and officers’ liability insurance policy maintained by us. |

We

also maintain directors’ and officers’ liability insurance.

We

believe that these provisions and agreements are necessary to attract and retain qualified persons as directors and executive officers.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling

us pursuant to the foregoing provisions, the opinion of the SEC is that such indemnification is against public policy as expressed in

the Securities Act and is therefore unenforceable.

SELLING

STOCKHOLDERS

The

shares of our common stock offered under this prospectus may be offered from time to time by the selling stockholders named below or

by any of their respective pledgees, donees, transferees or other successors-in-interest. As used in this prospectus, the term “selling

stockholders” includes the selling stockholders identified below and any donees, pledgees, transferees or other successors-in-interest

selling shares received after the date of this prospectus from a selling stockholder as a gift, pledge or other non-sale related transfer.

The selling stockholders named below acquired the shares of our common stock being offered under this prospectus directly from us following

the Private Placement. We issued the shares to the selling stockholders in reliance on an exemption from the registration requirements

of the Securities Act pursuant to Section 4(a)(2) of the Securities Act and Rule 506 promulgated thereunder.

The

following table sets forth as of August 28, 2024: (1) the name of each selling stockholder for whom we are registering shares of our

common stock under the registration statement of which this prospectus is a part, (2) the number of shares of our common stock beneficially

owned by each of the selling stockholders prior to the offering, determined in accordance with Rule 13d-3 under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), (3) the number of shares of our common stock that may be offered by each selling

stockholder under this prospectus and (4) the number of shares of our common stock to be owned by each selling stockholder after completion

of this offering. We will not receive any of the proceeds from the sale of the shares of our common stock offered under this prospectus.

The amounts and information set forth below are based upon information provided to us by the selling stockholders or their representatives,

or on our records, as of August 28, 2024. The percentage of beneficial ownership for the following table is based on 138,710,402

shares of our common stock outstanding as of August 28, 2024.

To

our knowledge, except as indicated in the footnotes to this table, each stockholder named in the table has sole voting and investment

power with respect to all shares of our common stock shown in the table to be beneficially owned by such stockholder. Except as described

below, none of the selling stockholders has had any position, office or other material relationship with us or any of our predecessors

or affiliates within the past three years. In addition, based on information provided to us, none of the selling stockholders that are

affiliates of broker-dealers, if any, purchased the shares of our common stock outside the ordinary course of business or, at the time

of their acquisition of such shares, had any agreements, understandings or arrangements with any other persons, directly or indirectly,

to dispose of the shares. Information concerning the selling stockholders may change from time to time, and any changed information will

be set forth in supplements to this prospectus to the extent required.

| | |

Shares

Beneficially Owned Prior to the Offering | | |

Number

of Shares Being | | |

Shares

Beneficially Owned After Completion of the Offering | |

| Name of Selling

Stockholder | |

Number | | |

Percentage | | |

Offered | | |

Number | | |

Percentage | |

| Blackwell Partners

LLC - Series A(1) | |

| 5,286,317 | | |

| 3.8 | % | |

| 3,031,530 | | |

| 2,254,787 | | |

| 1.6 | % |

| Corbin Sustainability &

Engagement Fund, L.P.(1) | |

| 234,375 | | |

| * | | |

| 234,375 | | |

| — | | |

| — | |

| Nantahala Capital Partners

Limited Partnership(1) | |

| 1,863,585 | | |

| 1.3 | % | |

| 1,180,136 | | |

| 683,449 | | |

| * | |

| NCP RFM LP(1) | |

| 1,508,223 | | |

| 1.1 | % | |

| 866,459 | | |

| 641,764 | | |

| * | |

| Pinehurst

Partners, L.P.(1) | |

| 2,500,000 | | |

| 1.8 | % | |

| 2,500,000 | | |

| — | | |

| — | |

| Total | |

| 11,392,500 | | |

| | | |

| 7,812,500 | | |

| | | |

| | |

*

Less than 1%

| (1) |

Nantahala

Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition

of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered

the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder

that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Exchange Act or any other purpose.

Wilmot Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive

power over the shares held by the selling stockholder. |

Material

Relationships Between Selling Stockholders and Xtant

2024

Private Placement

On

August 7, 2024, we entered into the Securities Purchase Agreement with the Investors, pursuant to which we agreed to issue 7,812,500