Current Report Filing (8-k)

December 07 2020 - 4:22PM

Edgar (US Regulatory)

0001327068

false

0001327068

2020-12-03

2020-12-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report

(Date of earliest event reported): December 3, 2020

UNITED

STATES OIL FUND, LP

(Exact name of

registrant as specified in its charter)

|

Delaware

|

|

001-32834

|

|

20-2830691

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1850 Mt. Diablo

Boulevard, Suite 640

Walnut Creek,

California 94596

(Address

of principal executive offices) (Zip Code)

(510)

522-9600

Registrant’s

telephone number, including

area code

Not Applicable

(Former name

or former address, if changed since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

o Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company o

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to

Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered:

|

|

Shares

of United States Oil Fund, LP

|

|

USO

|

|

NYSE Arca, Inc.

|

Item 1.01 Entry into a Material

Definitive Agreement.

Effective

December 3, 2020, the United States Oil Fund, LP (the “Registrant”) has

engaged Macquarie Futures USA LLC (“MFUSA”) to serve as an additional futures commission merchant (“FCM’)

for the Registrant.

The

Customer Agreement between the Registrant and MFUSA (“the Agreement”) requires MFUSA to provide services to the Registrant,

in connection with the purchase and sale of futures contracts that may be purchased or sold

by or through MFUSA for the Registrant’s account. Under the Agreement, the Registrant pays MFUSA commissions for executing

and clearing trades on behalf of the Registrant. As a result, MFUSA will serve as an FCM for the Registrant along with (1) RBC

Capital Markets, LLC, (2) RCG Division of Marex Spectron, and (3) E D & F Man Capital Markets Inc.

The

foregoing description of the Agreement is not complete and is qualified in its entirety by reference to the full text of the Agreement,

a form of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item

8.01 Other Events.

Update of Indicative Fund Value Disclosure

The

Registrant has updated its disclosure of the methodology for calculating the Registrant’s indicative fund value, which is

set forth under the heading “Calculating Per Share NAV” in the Registrant’s prospectus. The amended disclosure

is intended to provide greater detail on the valuation of the Registrant’s investments for purposes of calculating the Registrant’s

indicative fund value.

Update to Legal Proceedings

On

June 19, 2020, USCF, USO, John P. Love, and Stuart P. Crumbaugh were named as defendants in the Lucas Class Action (the “Initial

Lucas Class Complaint”). The Initial Lucas Class Complaint alleges that, beginning in March 2020, in connection with USO’s

registration and issuance of additional USO shares, USCF, USO, and the other defendants in the Initial Lucas Class Action failed

to disclose to investors in USO certain extraordinary market conditions and the attendant risks that caused the demand for oil

to fall precipitously, including the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. Plaintiff alleges that

USCF, USO, and the other defendants in the Initial Lucas Class Action possessed inside knowledge about the consequences of these

converging adverse events on USO and did not sufficiently acknowledge them until late April and May 2020, after USO suffered losses

and was allegedly forced to abandon its investment strategy. The Court thereafter consolidated the Initial Lucas Class Action

with two related putative class action complaints and appointed a lead plaintiff. The consolidated class action is pending in

the U.S. District Court for the Southern District of New York under the caption In re:

United States Oil Fund, LP Securities Litigation, Civil Action No. 1:20-cv-04740. The consolidated class action seeks

to certify a class and award the class compensatory damages at an amount to be determined at trial.

On

November 30, 2020, the lead plaintiff filed an amended complaint in In re: United States

Oil Fund, LP Securities Litigation (the “Amended Lucas Class Complaint”). In addition to amending the Initial

Lucas Class Complaint with respect to the underlying facts, including revising the start of the class period to February 2020,

and adding claims under the Securities Act of 1933, the Amended Lucas Class Complaint added as defendants directors of USCF (Nicholas

D. Gerber, Andrew F Ngim, Robert L. Nguyen, Peter M. Robinson, Gordon L. Ellis, and Malcolm R. Fobes III); marketing agent (ALPS

Distributors, Inc.); and Authorized Participants (ABN Amro, BNP Paribas Securities Corporation, Citadel Securities LLC, Citigroup

Global Markets, Inc., Credit Suisse Securities USA LLC, Deutsche Bank Securities Inc., Goldman Sachs & Company, J.P. Morgan

Securities Inc., Merrill Lynch Professional Clearing Corporation, Morgan Stanley & Company Inc., Nomura Securities International

Inc., RBC Capital Markets LLC, SG Americas Securities LLC, UBS Securities LLC, and Virtu Financial BD LLC).

USCF, USO, and

the other defendants in In re: United States Oil Fund, LP Securities Litigation

intend to vigorously contest such claims and move for their dismissal.

Item 9.01

Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

UNITED STATES OIL FUND,

LP

|

|

|

|

By:

|

United States Commodity Funds LLC, its

general partner

|

|

|

|

|

|

|

Date: December 7, 2020

|

|

By:

|

/s/

John P. Love

|

|

|

|

Name:

|

John P. Love

|

|

|

|

Title:

|

President

and Chief Executive Officer, and

Management

Director

|

|

|

|

|

|

|

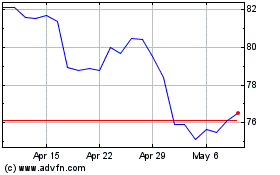

United States Oil (AMEX:USO)

Historical Stock Chart

From Aug 2024 to Sep 2024

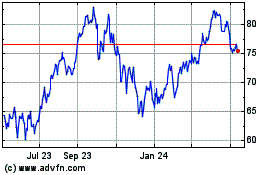

United States Oil (AMEX:USO)

Historical Stock Chart

From Sep 2023 to Sep 2024