Zacks Market Strategy Update - Analyst Blog

October 25 2012 - 11:10AM

Zacks

Here is a brief summary of highlights in October’s Zacks

Market Strategy.

Top-Down S&P 500 End-of-Year 2012 Target

Holding or raising new S&P 500 (SPY) highs

above 1470 is possible, but the more likely scenario we are in is a

range-bound market until a firm resolution of Fiscal Cliff issues.

1390-1400 is our low end. One stop lower, the 200-day moving

average rests at 1375.

In late October, some Zacks experts think equity markets have

reached a phase where you have a battle of the long-term bullish

view vs. a short-term range-bound and even bearish view.

Long-term, one has to believe the primary bullish trend is intact

until proven otherwise. That is especially true with GDP expected

to ratchet up to +1.9% growth in the 3rd quarter versus only +1.3%

in the 2nd quarter.

However, in the short term, this stock market has some gains to

digest, a Presidential election dead-heat, and a Fiscal Cliff

problem looming right behind.

On the Fiscal Cliff, the San Francisco Fed had this to

say:

We assume Congress will let the payroll tax reduction and

extended unemployment benefits expire at year-end, but will agree

to extend the Bush tax cuts and adjust the alternative minimum

tax.

We also expect Congress to limit the spending cuts mandated in the

Budget Control Act of 2011.

In October, six macro trends had notable effects on S&P

500 Sectors and Industries

(1) For Zacks-Ranked goods and services industries, we see the

Housing Recovery in strong earnings surprises tied to Housing.

Housing (ITB) and Construction (MLI), (MTB) -related goods and

services industries that have very strong Zacks Industry

Ranks include Home Furnishing-Appliance, Building

Products, and Construction & Engineering.

Building momentum in U.S. housing also helps the Financials

sector. We see a strong Zacks Industry Ranking for

Banks-Major and Banks &Thrifts.

(2) A stronger U.S. stock market is a new macro theme.

Investment Banking & Brokering saw an upgrade in

October. Strong U.S. stock markets keep the Investment

Fund industry one of the most highly rated.

(3) With modest GDP growth, Consumer Staples is presently

a key strength.

(4) Fiscal Cliff tax sunsets that will raise U.S. personal income

tax rates or sequestration that cuts spending appear to hurt the

Industrials sector. We have seen weakness in capital

goods spending and hiring.

Industrials weakness is apparent in October downgrades to

Industrial Conglomerates, Metal Fabricating and

Commercial Services for Industrials.

(5) IT weakness is a notable feature of the weak global GDP growth

environment. Growing revenues is difficult for the big global

IT businesses. The shift to smaller screen tablets and mobile

is not helping, either.

There is no highly rated IT industry. In an important signal,

October saw a downgrade to the Semiconductor industry.

(6) China slowdown issues play out with a Market Weight rating to

Energy.

In addition, there are other notable effects to Materials and

Industrial sectors. The Steel and Metals-Non-Ferrous

Industries are still struggling due to these China slowdown

effects, along with the Coal industry. Another element to

the China slowdown is fresh weakness in Transportation

industries, which saw a notable downgrade in October, as weak coal

shipping and prices play out.

MUELLER INDS (MLI): Free Stock Analysis Report

M&T BANK CORP (MTB): Free Stock Analysis Report

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

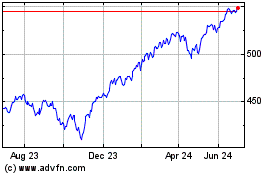

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Sep 2024 to Oct 2024

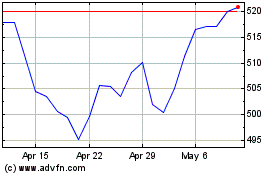

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Oct 2023 to Oct 2024