Prospectus Filed Pursuant to Rule 424(b)(7) (424b7)

February 06 2019 - 5:03PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-216512

PROSPECTUS SUPPLEMENT NO. 1

(To Prospectus dated March 22, 2017)

PARAMOUNT GOLD NEVADA CORP.

3,135,000 Shares of Common Stock

This prospectus supplement No. 1 supplements, updates and amends certain information contained in the prospectus dated March 22, 2017, covering the registering for resale by the selling stockholders named in the prospectus of 2,090,000 shares of our common stock and 1,045,000 shares of our common stock issuable upon the exercise of the warrants described in the prospectus by the selling stockholders named in the prospectus.

You should read this prospectus supplement No. 1 in conjunction with the prospectus. This prospectus supplement No. 1 is not complete without, and may not be delivered or used except in conjunction with, the prospectus, including any amendments or supplements thereto. This prospectus supplement No. 1 is qualified by reference to the prospectus, except to the extent that the information provided by this prospectus supplement No. 1 supersedes information contained in the prospectus.

The purpose of this prospectus supplement No. 1 is solely to amend and restate the “Selling Stockholders” table on page 7 of the prospectus to reflect certain transfers from certain selling stockholders previously identified in the prospectus to other parties who as a result of such transfers are being added or substituted as selling stockholders.

Our common stock is listed on the NYSE American LLC under the symbol

“

PZG

”

. On February 5, 2019, the last reported sales price of our common stock on the NYSE American LLC was $0.99 per share.

INVESTING IN OUR COMMON STOCK INVOLVES RISKS. YOU SHOULD CAREFULLY CONSIDER THE RISK FACTORS SET FORTH OR INCORPORATED BY REFERENCE INTO THIS PROSPECTUS, ANY APPLICABLE PROSPECTUS SUPPLEMENT AND OUR PERIODIC REPORTS FILED FROM TIME TO TIME WITH THE SECURITIES AND EXCHANGE COMMISSION, AS DESCRIBED UNDER THE SECTION ENTITLED “RISK FACTORS” ON PAGE 4 OF THE PROSPECTUS, BEFORE MAKING ANY DECISION WHETHER TO INVEST IN OUR COMMON STOCK.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 6, 2019.

SELLING STOCKHOLDERS

The table and related footnotes set forth under the caption “Selling Stockholders” on page 7 of the prospectus is hereby amended and replaced in its entirety as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned Prior to Offering

|

|

|

|

|

|

Shares Beneficially Owned After the Offering

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage

(1)

|

|

|

Shares Offered

|

|

|

Number

|

|

|

Percentage

(1)

|

|

|

FCMI Parent Co.

|

|

|

5,166,310

|

|

|

|

19.5%

|

|

|

|

745,200

|

|

|

|

4,669,510

|

|

|

|

17.6%

|

|

|

Seavista, LLC

|

|

|

558,383

|

|

|

|

2.1%

|

|

|

|

429,000

|

|

|

|

129,383

|

|

|

|

*

|

|

|

Lincoln Park Capital, LLC

(3)

|

|

|

62,500

|

|

|

|

*

|

|

|

|

62,500

|

|

|

|

-

|

|

|

|

*

|

|

|

Richard O’Brien

(

4

)

|

|

|

62,500

|

|

|

|

*

|

|

|

|

62,500

|

|

|

|

-

|

|

|

|

*

|

|

|

Nordgestion S.A.

|

|

|

105,000

|

|

|

|

*

|

|

|

|

90,000

|

|

|

|

15,000

|

|

|

|

*

|

|

|

Seabridge Gold Inc.

(

2

) (

5

)

|

|

|

2,413,563

|

|

|

|

9.1%

|

|

|

|

183,400

|

|

|

|

2,230,163

|

|

|

|

8.4%

|

|

|

Ian Mackellar

|

|

|

340,050

|

|

|

|

1.3%

|

|

|

|

61,150

|

|

|

|

279,000

|

|

|

|

1.1%

|

|

|

Marshall Berol

|

|

|

33,500

|

|

|

|

*

|

|

|

|

10,500

|

|

|

|

23,000

|

|

|

|

*

|

|

|

1567509 Ontario Inc.

|

|

|

163,100

|

|

|

|

*

|

|

|

|

85,800

|

|

|

|

77,300

|

|

|

|

*

|

|

|

Tom E.S. Wright

|

|

|

16,015

|

|

|

|

*

|

|

|

|

14,300

|

|

|

|

1,715

|

|

|

|

*

|

|

|

James Anthony

(

6

)

|

|

|

314,300

|

|

|

|

1.2%

|

|

|

|

114,300

|

|

|

|

200,000

|

|

|

|

*

|

|

|

Wayne E. Wew

(7

)

|

|

|

357,500

|

|

|

|

1.3%

|

|

|

|

357,500

|

|

|

|

-

|

|

|

|

*

|

|

|

Talkot Fund, L.P.

|

|

|

260,967

|

|

|

|

*

|

|

|

|

240,450

|

|

|

|

20,517

|

|

|

|

*

|

|

|

Gary Grauberger

|

|

|

115,000

|

|

|

|

*

|

|

|

|

115,000

|

|

|

|

-

|

|

|

|

*

|

|

|

John Pelow

|

|

|

228,600

|

|

|

|

*

|

|

|

|

228,600

|

|

|

|

-

|

|

|

|

*

|

|

|

Porter Partners

|

|

|

561,149

|

|

|

|

2.1%

|

|

|

|

200,000

|

|

|

|

361,149

|

|

|

|

1.4%

|

|

|

Childress Family LP

|

|

|

57,200

|

|

|

|

*

|

|

|

|

57,200

|

|

|

|

-

|

|

|

|

*

|

|

|

EDJ Limited

|

|

|

106,771

|

|

|

|

*

|

|

|

|

50,000

|

|

|

|

56,771

|

|

|

|

*

|

|

|

Total

|

|

|

10,922,408

|

|

|

|

41.2%

|

|

|

|

3,107,400

|

|

|

|

8,063,508

|

|

|

|

30.4%

|

|

* Less than one percent

|

|

(1)

|

The percentage is based upon 26,519,954 shares of our common stock outstanding after the offering as of February 5, 2019.

|

|

|

(2)

|

Mr. Rudi Fronk, the chairman and chief executive officer of Seabridge Gold Inc. (“Seabridge”), Mr. Christopher Reynolds, the chief financial officer of Seabridge, and Eliseo Gonzalez-Urien, a director of Seabridge, are all members of our Board of Directors.

|

|

|

(3)

|

62,500 warrants were acquired in a private transaction and subsequently exercised.

|

|

|

(4)

|

62,500 warrants were acquired in a private transaction and subsequently exercised.

|

|

|

(5)

|

The 183,400 shares offered include 28,600 warrants were acquired in a private transaction and subsequently exercised.

|

|

|

(6)

|

114,300 warrants were acquired in a private transaction and subsequently exercised.

|

|

|

(7)

|

157,500 warrants were acquired in a private transaction and subsequently exercised.

|

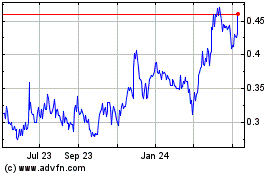

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Apr 2023 to Apr 2024