NovaBay Pharmaceuticals, Inc. (NYSE American: NBY) (the

“Company” or “NovaBay”), today announced the pricing of its

underwritten public offering of 3,200,380 shares of common stock

(or pre-funded warrants in lieu thereof), 3,200,380 Series F-1

warrants to purchase up to 3,200,380 shares of common stock,

3,200,380 Series F-2 warrants to purchase up to 3,200,380 shares of

common stock and 3,200,380 Series F-3 warrants to purchase up to

3,200,380 shares of common stock. The combined public offering

price for each share of common stock (or pre-funded warrant in lieu

thereof) and accompanying Series F-1 warrant, Series F-2 warrant

and Series F-3 warrant is $1.10.

In addition, the Company has granted the underwriter for the

offering a 45-day option to purchase up to 477,272 additional

shares of common stock and/or up to 477,272 Series F-1 warrants to

purchase up to 477,272 shares of common stock, up to 477,272 Series

F-2 warrants to purchase up to 477,272 shares of common stock and

up to 477,272 Series F-3 warrants to purchase up to 477,272 shares

of common stock or any combination thereof, as determined by the

underwriter, at the public offering price, less underwriting

discounts and commissions, in each case solely to cover

over-allotments, if any.

Ladenburg Thalmann & Co. Inc. is acting as sole bookrunning

manager for the offering.

Each share of common stock (and each pre-funded warrant in lieu

thereof) is being sold together with one Series F-1 warrant to

purchase one share of common stock, one Series F-2 warrant to

purchase one share of common stock, and one Series F-3 warrant to

purchase one share of common stock. The Series F-1 warrants have an

exercise price of $1.10 per share, are exercisable immediately upon

issuance, and will expire five years following the date of

issuance. The Series F-2 warrants have an exercise price of $1.10

per share, are exercisable immediately upon issuance, and will

expire six months following the date of issuance. The Series F-3

warrants have an exercise price of $1.10 per share, are exercisable

immediately upon issuance, and will expire one year following the

date of issuance. The pre-funded warrants will be immediately

exercisable at a nominal exercise price of $0.01 per share and may

be exercised at any time until all of the pre-funded warrants are

exercised in full. The Series F-1 warrants, the Series F-2 warrants

and the Series F-3 warrants will each include a one-time reset of

the exercise price to a price equal to the lesser of (i) the then

exercise price and (ii) 90% of the five-day volume weighted average

prices for the five (5) trading days immediately preceding the date

that is sixty calendar days after issuance of the Series F-1

warrants, the Series F-2 warrants and the Series F-3 warrants, as

applicable.

The aggregate gross proceeds from the offering will be

approximately $3.5 million, or $4.0 million if the underwriter

exercises its over-allotment option in full, before deducting

underwriting discounts and commissions and other offering expenses

and excluding any proceeds that may be received upon the exercise

of the Series F-1 warrants, Series F-2 warrants, and Series F-3

warrants. No assurance can be given that any of the warrants will

be exercised. NovaBay currently intends to use the net proceeds of

the offering to redeem the outstanding principal amount of its

Original Discount Senior Secured Convertible Debentures due

November 1, 2024 and for working capital and general corporate

purposes.

The offering is expected to close on or about July 29, 2024,

subject to the satisfaction of customary closing conditions.

The offering is being conducted pursuant to NovaBay’s

registration statement on Form S-1 (File No. 333-280423) previously

filed with and declared effective by the Securities and Exchange

Commission (the “SEC”) on July 25, 2024 (the “registration

statement”). The offering is being made only by means of a

prospectus forming part of the effective registration statement

relating to the offering. A preliminary prospectus describing the

terms of the offering has been filed with the SEC and is available

on the SEC’s website located at http://www.sec.gov and a final

prospectus relating to the offering will be filed with the SEC.

Electronic copies of the final prospectus, when available, may be

obtained on the SEC’s website at http://www.sec.gov and may also be

obtained, when available, by contacting Ladenburg Thalmann &

Co. Inc., Prospectus Department, 640 5th Avenue, 4th Floor, New

York, NY 10019 (telephone number 1-800-573-2541) or by emailing

prospectus@ladenburg.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of such state or jurisdiction.

About NovaBay Pharmaceuticals, Inc.

NovaBay’s leading product Avenova® Antimicrobial Lid & Lash

Solution is often recommended by eyecare professionals for

blepharitis and dry eye disease. Manufactured in the U.S., Avenova

spray is formulated with NovaBay's patented, proprietary, stable

and pure form of hypochlorous acid. All Avenova products are

available directly to consumers through online distribution

channels such as Amazon.com and Avenova.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, including, but not limited to, statements that are based

upon management's current expectations, assumptions, estimates,

projections and beliefs. The use of words such as, but not limited

to, “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “preliminary,” “should,” “target,” “will,” or “would”

and similar words or expressions are intended to identify

forward-looking statements. These statements include, but are not

limited to, statements regarding the timing and completion of the

offering, and the intended use of net proceeds therefrom. These

statements are based on information available to the Company as of

the date of this press release and are subject to numerous

important factors that involve known and unknown risks,

uncertainties and other factors that may cause actual results or

achievements to be materially different and adverse from those

expressed in or implied by the forward-looking statements. New

risks and uncertainties may emerge from time to time, and it is not

possible to predict all risks and uncertainties. Other risks

relating to the Company’s business, including risks that could

cause results to differ materially from those projected in the

forward-looking statements in this press release, are detailed in

the Company’s latest Form 10-Q/K filings and registration

statement, as may be amended from time to time, filing with the

SEC, especially under the heading “Risk Factors.” The

forward-looking statements in this release speak only as of this

date, and the Company disclaims any intent or obligation to revise

or update publicly any forward-looking statement except as required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725797972/en/

NovaBay Justin Hall Chief

Executive Officer and General Counsel 510-899-8800

jhall@novabay.com

Investor Relations LHA

Investor Relations Jody Cain 310-691-7100 jcain@lhai.com

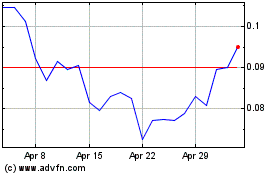

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Nov 2023 to Nov 2024