UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Constellation Energy Partners LLC

-----------------------------------------------------------------------------

(Name of Issuer)

-----------------------------------------------------------------------------

Common Units representing Class B Limited Liability Company Interests

-----------------------------------------------------------------------------

(Title of Class of Securities)

21038E101

-----------------------------------------------------------------------------

(CUSIP Number)

Gregg T. Abella

Investment Partners Asset Management, Inc.

One Highland Avenue

Metuchen, New Jersey 08840

732-205-0391

-----------------------------------------------------------------------------

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

October 18, 2012

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ ].

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The Information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 21038E101

---------------------------------------------------------------------------

1 NAME OF REPORTING PERSON

Investment Partners Asset Management, Inc.

---------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [ ]

---------------------------------------------------------------------------

3 SEC USE ONLY

---------------------------------------------------------------------------

4 SOURCE OF FUNDS OO

---------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

---------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Investment Partners Asset Management, Inc. is organized under the

laws of Delaware.

---------------------------------------------------------------------------

7 SOLE VOTING POWER

252,923

-----------------------------------------------------

NUMBER OF 8 SHARED VOTING POWER

SHARES

BENEFICIALLY 958,742

OWNED BY -----------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING

PERSON 252,923

----------------------------------------------------

10 SHARED DISPOSITIVE POWER

958,742

---------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,211,665

---------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES [ ]

---------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.12%

---------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

IA

---------------------------------------------------------------------------

Item 1. Security and Issuer

This statement relates to the Common Units representing Class B Limited Liability Company Interests (“Common Units”) of Constellation Energy Partners LLC, which is located at 1801 Main Street, Suite 1300, Houston, Texas 77002.

Item 2. Identity and Background

The reporting person is Investment Partners Asset Management, Inc., a corporation organized in the State of Delaware that does business as an investment adviser. Its principal office is located at One Highland Avenue, Metuchen, NJ 08840. During the last five years, the reporting person (i) has not been convicted in a criminal proceeding and (ii) has not been a party to a civil proceeding described in Item 2(e) of Schedule 13D.

Item 3. Source and Amount of Funds or Other Consideration

The source of all funds used in making purchases was client assets.

Item 4. Purpose of Transaction

The purpose of the acquisition is investment. However, from time to time the reporting person intends to make recommendations to the issuer's management and/or board of managers with the goal of enhancing unitholder value and the income-paying capacity of the Common Units generally, through operational efficiencies, corporate finance strategies, cost containment, and corporate governance initiatives. The reporting person may also recommend strategic initiatives, such as capital structure and balance sheet restructurings or a sale, merger, acquisition, or other transaction. To this end, the reporting person's attorney has sent a letter to the board of managers (attached hereto as an exhibit), laying out its concerns and making the following demands:

(1) a meeting or conference call in the immediate future with the full board of managers to discuss points 2 - 6 below;

(2) the right to place on the board of managers an energy-industry expert who is committed to representing the minority investors, maintaining the issuer’s tax structure, and following the issuer’s primary business objective;

(3) the written commitment from the board that it will cut management compensation and expenses immediately, reducing them to levels similar to those that existed prior to 2009;

(4) the removal of any and all anti-takeover mechanisms, which are now deterring, or are highly likely in the future to deter, potential acquirers and are now depressing and will continue to depress the market value of the Common Units;

(5) the rescission of executives’ “golden parachutes,” which similarly entrench management at minority investors’ expense; and

(6) the cooperation of the issuer and its board of managers and executives in providing all information requested by any bankers, investment bankers, advisors or consultants that the reporting person may contact and

refer to the issuer to explore a near-term financing, merger, or sale of the issuer or similar transaction.

Item 5. Interest in Securities of the Issuer

a) The reporting person believes that the number of Common Units that are outstanding is 23,681,878 as of August 9, 2012, based on information provided in the issuer’s most recent quarterly report on Form 10-Q. As of October 23, 2012, the reporting person may have been deemed the beneficial owner of 1,211,665 Common Units, or approximately 5.12% of the total number of Common Units outstanding.

b) The reporting person has sole power to vote and sole dispositive power for 252,923 Common Units, or approximately 1.07% of the total number of Common Units outstanding.

The reporting person has shared voting power and shared dispositive power for 958,742 Common Units, approximately 4.05% of the total number of Common Units outstanding.

c) Clients of the reporting person have made the following purchases and sales of shares of the issuer within the past 60 days. Each such transaction was effected by Investment Partners Asset Management, Inc., on behalf of its clients.

|

Type of Transaction

|

Date of Transaction

|

Number of Common Units

|

Price Per Common Unit

|

Where and How Effected

|

|

Purchase

|

09/05/2012

|

1,000

|

$1.2999

|

Open market

|

|

Purchase

|

09/06/2012

|

100

|

$1.2300

|

|

|

Purchase

|

10/17/2012

|

20,100

|

$1.2919

|

|

|

Purchase

|

10/18/2012

|

24,100

|

$1.3492

|

|

|

Purchase

|

10/19/2012

|

18,372

|

$1.4570

|

Open market

|

d) Clients of the reporting person are entitled to receive all dividends, distributions and proceeds of sale.

e) Not applicable.

Item 6. Contracts, Arrangements, Understandings, or Relationships with

Respect to Securities of the Issuer

None

Item 7. Material to be Filed as Exhibits

Letter to the Board of Managers of Constellation Energy Partners LLC, dated October 23, 2012.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

Date: October 23, 2012

Investment Partners Asset Management, Inc.

By:

/s/ Gregg T. Abella

Name: Gregg T. Abella

Title: Officer

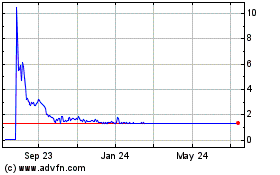

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jul 2023 to Jul 2024