UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed

by the Registrant x |

| |

| Filed

by a Party other than the Registrant ¨ |

| |

| Check

the appropriate box: |

| ¨ |

Preliminary

Proxy Statement |

| ¨ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive

Proxy Statement |

| x |

Definitive

Additional Materials |

| ¨ |

Soliciting

Material under §240.14a-12 |

| |

CREDIT

SUISSE COMMODITY STRATEGY FUNDS

CREDIT SUISSE OPPORTUNITY FUNDS

CREDIT SUISSE TRUST

CREDIT SUISSE

ASSET MANAGEMENT INCOME FUND, INC.

CREDIT SUISSE

HIGH YIELD BOND FUND |

| (Name

of Registrant as Specified In Its Charter) |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment

of Filing Fee (Check the appropriate box): |

| x |

No

fee required. |

| ¨ |

Fee

paid previously with preliminary materials. |

| ¨ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| Mutual

Fund

Proxy Fact

Sheet For:

|

| CREDIT

SUISSE FUNDS |

| Joint

Special Meeting Important Dates |

|

Joint

Special Meeting Location |

| Record

Date |

JUNE

23, 2023 |

|

OFFICES

OF THE FUNDS

ELEVEN MADISON AVENUE

FLOOR 2B

NEW YORK, NEW YORK

10010 |

| Mail

Date |

JULY

20, 2023 |

|

| Meeting

Date |

AUGUST

24, 2023

@ 4:00 PM (ET) |

|

| Additional

Information |

|

Contact

Information |

| Tickers

|

SEE

PAGE 5 |

|

Inbound

Line |

1-877-674-6273 |

| CUSIPs

|

SEE

PAGE 5 |

|

Website |

https://am.credit-suisse.com/ |

What are

Shareholders being asked to vote on?

ALL

FUNDS

| 1. | To

approve a new investment advisory agreement between your Fund and Credit Suisse Asset Management,

LLC; |

CREDIT

SUISSE STRATEGIC INCOME FUND ONLY

| 2. | To

approve a new sub-advisory agreement between Credit Suisse Asset Management, LLC and Credit

Suisse Asset Management Limited; |

| CREDIT

SUISSE FUNDS |

| |

| · Credit

Suisse Commodity Return Strategy Fund, a series of Credit Suisse Commodity Strategy Funds |

· Credit

Suisse Multialternative Strategy Fund, a series of Credit Suisse Opportunity Funds |

| |

|

| · Credit

Suisse Floating Rate High Income Fund, a series of Credit Suisse Opportunity Funds |

· Commodity

Return Strategy Portfolio, a series of Credit Suisse Trust |

| |

|

| · Credit

Suisse Strategic Income Fund, a series of Credit Suisse Opportunity Funds |

· Credit

Suisse Asset Management Income Fund, Inc. |

| |

|

| · Credit

Suisse Managed Futures Strategy Fund, a series of Credit Suisse Opportunity Funds |

· Credit

Suisse High Yield Bond Fund |

| |

|

| each,

a “fund” and collectively, the “funds” |

ALL FUNDS

PROPOSAL 1:

To approve a new investment advisory agreement between your Fund and Credit Suisse Asset Management, LLC;

What are

shareholders being asked to approve?

Shareholders are

being asked to approve a new investment advisory agreement between their Fund and Credit Suisse Asset Management, LLC (“Credit

Suisse”) (each such agreement, a “New Investment Advisory Agreement”).

What is happening?

On

the Closing Date of June 12, 2023, Credit Suisse Group AG (“CS Group”) merged with

and into UBS Group AG, a global financial services company (“UBS Group”), with UBS Group remaining as the surviving company

(the “Merger”).

Immediately prior

to the Closing Date, CS Group was the ultimate parent company of Credit Suisse.

Why are shareholders

being asked to vote to approve the New Advisory Agreements?

Each Fund was party

to an investment advisory agreement with Credit Suisse prior to the Closing Date (collectively, the “Prior Advisory Agreements”).

As required by

the Investment Company Act of 1940, as amended (the “1940 Act”), each Prior Advisory Agreement provided that the agreement

would automatically terminate upon its assignment. The closing of the Merger was deemed to result in an assignment of each Prior Advisory

Agreement, resulting in its automatic termination as of the Closing Date.

Each Fund requires

shareholder approval of its New Investment Advisory Agreement for the Funds to continue to receive investment advisory services from

Credit Suisse.

Will the

Merger result in any changes in the investment objective(s), principal investment strategies or policies of the Funds?

No changes to the

investment objective(s), principal investment strategies and policies, principal risks, fundamental and non-fundamental investment policies,

of the Funds are currently contemplated as a result of the Merger.

see

also information about the ubs transition on pages 4-5

of fact sheet

How does

each Fund’s New Advisory Agreement differ from each Fund’s Prior Advisory Agreement?

Each New Advisory

Agreement will be identical to the corresponding Prior Advisory Agreement, except for the dates of execution, effectiveness and termination

and certain non-material changes.

Will the

Funds’ contractual advisory fee rates increase?

The Funds’

contractual advisory fee rates will not change as a result of its New Advisory Agreement(s).

Will the

portfolio personnel change in connection with the Merger?

No changes to the

portfolio managers (other than potential personnel changes outside of Credit Suisse’s control) are currently contemplated as a

result of the Merger.

see

also information about the ubs transition on pages 4-5

of fact sheet

Given that

the Prior Advisory Agreements terminated on the Closing Date, is there any investment advisory agreement currently in place for my Fund?

Prior to the Closing

Date, the Board of each Fund approved an interim investment advisory agreement with Credit Suisse (collectively, the “Interim Advisory

Agreements”).

The Interim Advisory

Agreements did not require shareholder approval. The Interim Advisory Agreements took effect upon the Closing Date when the Prior Advisory

Agreements were deemed to have terminated, so that Credit Suisse could continue to manage the Funds following the Closing Date.

Each Interim Advisory

Agreement will terminate upon the earlier of shareholder approval of the corresponding New Advisory Agreement or 150 days following the

Closing Date (i.e., November 9, 2023).

Each Interim Advisory

Agreement contains the same terms and conditions as the corresponding Prior Advisory Agreement except for the effective and termination

dates, the termination and escrow provisions required by Rule 15a-4 under the 1940 Act and certain nonmaterial changes. During the

period that each Interim Advisory Agreement is in effect, Credit Suisse’s advisory fees will be held in an interest-bearing escrow

account, pursuant to Rule 15a-4.

What happens

if the New Advisory Agreements are not approved by shareholders?

Shareholder approval

of a Fund’s New Investment Advisory Agreement is not contingent upon shareholder approval of any other Fund’s New Investment

Advisory Agreement.

If shareholders

of a Fund do not approve the New Advisory Agreement(s), Credit Suisse will not be able to provide investment advisory services to that

Fund after the expiration of the 150-day period following the Closing Date (which will occur on November 9, 2023), and that Fund

may be forced to liquidate.

CREDIT SUISSE STRATEGIC INCOME FUND

ONLY (“STRATEGIC INCOME FUND”)

PROPOSAL 2:

To approve a new sub-advisory agreement between Credit Suisse Asset Management, LLC and Credit Suisse Asset Management Limited;

What are

shareholders being asked to approve?

Solely with respect

to the Strategic Income Fund, shareholders are being asked to approve a new sub-advisory agreement between Credit Suisse and Credit Suisse

Asset Management Limited (“Credit Suisse UK”) with respect to the Fund (the “New Sub-Advisory Agreement”).

Why are shareholders

being asked to vote to approve the New Sub-Advisory Agreement?

Each Fund was party

to an investment advisory agreement with Credit Suisse and Credit Suisse was party to a sub-advisory agreement with Credit Suisse UK

with respect to the Strategic Income Fund prior to the Closing Date (collectively, the “Prior Advisory Agreements”).

As required by

the 1940 Act, each Prior Advisory Agreement provided that the agreement would automatically terminate upon its assignment. The closing

of the Merger was deemed to result in an assignment of each Prior Advisory Agreement, resulting in its automatic termination as of the

Closing Date.

The Strategic Income

Fund requires shareholder approval of the New Sub-Advisory Agreement for the Funds to continue to receive investment advisory services

from Credit Suisse and Credit Suisse UK.

Given that

the Prior Advisory Agreements terminated on the Closing Date, is there any investment sub-advisory agreement currently in place for the

Strategic Income Fund?

Prior to the Closing

Date, the Board approved an interim investment advisory agreement with Credit Suisse and, in the case of the Strategic Income Fund, an

interim sub-advisory agreement between Credit Suisse and Credit Suisse UK (collectively, the “Interim Advisory Agreements”).

The Interim Advisory

Agreements did not require shareholder approval. The Interim Advisory Agreements took effect upon the Closing Date when the Prior Advisory

Agreements were deemed to have terminated, so that Credit Suisse and Credit Suisse UK could continue to manage the Funds following the

Closing Date.

Each Interim Advisory

Agreement will terminate upon the earlier of shareholder approval of the corresponding New Advisory Agreement or 150 days following the

Closing Date (i.e., November 9, 2023).

Each Interim Advisory

Agreement contains the same terms and conditions as the corresponding Prior Advisory Agreement except for the effective and termination

dates, the termination and escrow provisions required by Rule 15a-4 under the 1940 Act and certain nonmaterial changes. During the

period that each Interim Advisory Agreement is in effect, Credit Suisse’s advisory fees and Credit Suisse UK’s sub-advisory

fees will be held in an interest-bearing escrow account, pursuant to Rule 15a-4.

What happens

if the New Sub-Advisory Agreement for the Strategic Income Fund is not approved by shareholders?

Shareholder approval

of the New Sub-Advisory Agreement between Credit Suisse and Credit Suisse UK with respect to the Strategic Income Fund is contingent

upon shareholder approval of the New Investment Advisory Agreement between the Strategic Income Fund and Credit Suisse.

Therefore, if the

shareholders of the Strategic Income Fund do not approve such Fund’s New Investment Advisory Agreement, then approval of the New

Sub-Advisory Agreement for the Strategic Income Fund will be deemed null and the Board of the Strategic Income Fund will then consider

whether other actions, if any, are warranted.

Who is paying

for the costs related to the Joint Special Meeting?

All costs of the

proxy and the shareholder meetings, including proxy solicitation costs, legal fees and the costs of printing and mailing the proxy statement,

will be borne by Credit Suisse.

INFORMATION

ABOUT THE UBS TRANSITION

What is the

UBS Transition about?

It is anticipated

that Credit Suisse will transition the investment advisory services that they currently provide to the Funds to one or more registered

investment advisers affiliated with UBS Group on or prior to June 12, 2024 (the “UBS Transition”).

In connection with,

or following the completion of, the UBS Transition, it is possible that there could be Fund-specific changes. However, the exact structure

and timing of the UBS Transition and Fund-specific changes (if any) related to the UBS Transition have not yet been finalized.

Any Fund-specific

changes would be implemented without shareholder approval to the extent permitted under the federal securities laws (except for any changes

to a Fund’s fundamental investment policies, which would require shareholder approval). Shareholders of a Fund will be promptly

notified of any material Fund-specific changes.

| PHONE: |

To

cast your vote by telephone with a proxy specialist, call the toll-free number found on your proxy card. Representatives are

available to take your voting instructions Monday through Friday 9:00 a.m. to 10:00 p.m. Eastern Time. |

| MAIL: |

To

vote your proxy by mail, check the appropriate voting box on the proxy card, sign and date the card and return it in the enclosed

postage-paid envelope. |

| TOUCH-TONE: |

To

cast your vote via a touch-tone voting line, call the toll-free number and enter the control number found on your proxy

card. |

| INTERNET: |

To

vote via the Internet, go to the website on your proxy card and enter the control number found on the proxy card. |

The Proxy Statement

is available online at: vote.proxyonline/CSAM/Proxy2023.pdf

AST Fund Solutions,

LLC is identified in the Proxy Statement as the proxy solicitor for the Funds.

| FUND

NAME |

CLASS |

TICKER |

CUSIP |

| Credit

Suisse Commodity Return Strategy Fund |

A |

CRSAX |

22544R107 |

| Credit

Suisse Commodity Return Strategy Fund |

C |

CRSCX |

22544R206 |

| Credit

Suisse Commodity Return Strategy Fund |

I |

CRSOX |

22544R305 |

| Credit

Suisse Floating Rate High Income Fund |

A |

CHIAX |

22540S877 |

| Credit

Suisse Floating Rate High Income Fund |

C |

CHICX |

22540S851 |

| Credit

Suisse Floating Rate High Income Fund |

I |

CSHIX |

22540S836 |

| Credit

Suisse Strategic Income Fund |

A |

CSOAX |

22540S760 |

| Credit

Suisse Strategic Income Fund |

C |

CSOCX |

22540S752 |

| Credit

Suisse Strategic Income Fund |

I |

CSOIX |

22540S745 |

| Credit

Suisse Managed Futures Strategy Fund |

A |

CSAAX |

22540S737 |

| Credit

Suisse Managed Futures Strategy Fund |

C |

CSACX |

22540S729 |

| Credit

Suisse Managed Futures Strategy Fund |

I |

CSAIX |

22540S711 |

| Credit

Suisse Multialternative Strategy Fund |

A |

CSQAX |

22540S794 |

| Credit

Suisse Multialternative Strategy Fund |

I |

CSQIX |

22540S778 |

| Commodity

Return Strategy Portfolio |

1 |

CCRSX |

22544K888 |

| Commodity

Return Strategy Portfolio |

2 |

CCRRX |

22542L847 |

| Credit

Suisse Asset Management Income Fund, Inc. |

NOT

APPLICABLE |

CIK |

224916106 |

| Credit

Suisse High Yield Bond Fund |

NOT

APPLICABLE |

DHY |

22544F103 |

| Credit

Suisse Funds

Level I Call Guide

(CONFIRM

RECEIPT OF PROXY MATERIAL)

|

Good (morning,

afternoon, evening), my name is (AGENT’S FULL NAME).

May I please

speak with (SHAREHOLDER’S FULL NAME)?

(Re-Greet

If Necessary)

I am calling on

a recorded line regarding your current investment with Credit Suisse Funds. I wanted to confirm that you have received the proxy material

for the Joint Special Meeting of Shareholders scheduled to take place on August 24, 2023.

Have you received

the information?

(Pause for

response)

If “Yes” or positive response:

If you’re not able to attend the meeting, I can record your voting instructions by phone. |

If “No” or negative response:

I would be happy to review the meeting agenda and record your vote by phone. |

You are being asked to vote in favor of a proposal to approve the New Investment Advisory Agreement for your Fund. In addition, if you

are a shareholder of the Strategic Income Fund, you are being asked to approve the New Sub-Advisory Agreement. Each Fund's Board approved

the Fund's New Investment Advisory Agreement. Would you like vote “In Favor” at this time?

(Pause For

Response)

(Review Voting

Options with Shareholder If Necessary)

If we identify

any additional accounts you own with Credit Suisse Funds before the meeting takes place, would you like to vote those accounts in the

same manner as well?

(Pause For

Response)

*Confirmation

– I am recording your (Recap Voting Instructions). Today (Today’s Date & Time).

For confirmation

purposes:

| · | Please

state your full name. (Pause) |

| · | According

to our records, you reside in (city, state, zip code). (Pause) |

| · | To

ensure that we have the correct address for the written confirmation, please state your street

address. (Pause) |

Thank you. You

will receive written confirmation of this vote within 3 to 5 business days. Upon receipt, please review and retain for your records.

If you should have any questions, please call the toll-free number listed on the confirmation. Mr. /Ms. ___________, your vote

is important and your time is greatly appreciated. Thank you and have a good (morning, afternoon, evening.)

Updated 07-21-2023

Credit Suisse

Funds

Answering

Machine Script

Hello.

I am calling

regarding your investment with Credit Suisse Funds.

The Joint Special

Meeting of Shareholders is scheduled to take place on August 24, 2023. All shareholders are being asked to consider and vote on

an important matter. As of today, your vote has not been registered.

Please contact

us as soon as possible at 1-877-674-6273 toll-free Monday through Friday between the hours of 9:00am and 10:00pm Eastern Time.

Your vote is

very important. Thank you and have a good day.

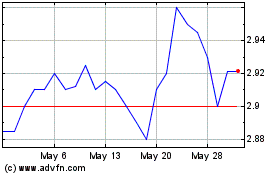

Credit Suisse Asset Mana... (AMEX:CIK)

Historical Stock Chart

From Apr 2024 to May 2024

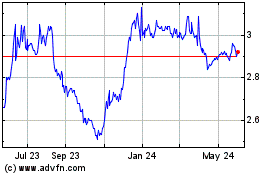

Credit Suisse Asset Mana... (AMEX:CIK)

Historical Stock Chart

From May 2023 to May 2024