Current Report Filing (8-k)

October 15 2020 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 9, 2020

COHEN & COMPANY INC.

(Exact name of registrant as specified in

its charter)

|

Maryland

|

|

1-32026

|

|

16-1685692

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

Cira

Centre

2929

Arch Street, Suite 1703

Philadelphia,

Pennsylvania

|

|

19104

|

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s telephone number, including

area code: (215) 701-9555

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

COHN

|

|

The NYSE American Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On October 9, 2020 and effective October 15, 2020

(the “Effective Date”), Cohen & Company, LLC (the “Operating LLC”), a Delaware limited

liability company and a subsidiary of Cohen & Company Inc., a Maryland corporation (the “Company”),

entered into Amendment No. 4 to Investment Agreement (the “Investment Agreement Amendment”), which amended

the Investment Agreement, dated September 29, 2017, as amended (the “Investment Agreement”), between the

Operating LLC and Cohen Bros. Financial LLC (“Cohen Bros.”), a Delaware limited liability company of which Daniel

G. Cohen is the sole member. Daniel G. Cohen is the President and Chief Executive of the Company’s European operations

and Chairman of the Company’s Board of Directors and the Operating LLC’s Board of Managers.

Pursuant to the Investment Agreement Amendment, the Investment

Agreement was amended as of the Effective Date to, among other things, (A) decrease the “Investment Amount” under

the Investment Agreement from $6,500,000 to $4,000,000 in exchange for a one-time payment of $2,500,000 from the Operating Company

to Cohen Bros.; and (B) provide that the term “Investment Return” (as defined in the Investment Agreement) will

mean an annual return equal to, (i) for any twelve-month period following September 29, 2020 (each, an “Annual

Period”) in which the revenue of the business of J.V.B. Financial Group, LLC, the Company’s wholly owned subsidiary

(“Revenue of the Business”), is greater than zero, the greater of 20% of the Investment Amount or 9.4% of the Revenue

of the Business, or (ii) for any Annual Period in which the Revenue of the Business is zero or less than zero, 3.75% of the

Investment Amount. Prior to the Investment Agreement Amendment, the term “Investment Return” under the Investment Agreement

was defined as (A) with respect to any Annual in which the Revenue of the Business was greater than zero, the greater of 20%

of the Investment Amount or 15.2% of the Revenue of the Business, or (ii) for any Annual Period in which the Revenue of the

Business was zero or less than zero, 3.75% of the Investment Amount

The foregoing description of the Investment Agreement Amendment

does not purport to be complete and is qualified in its entirety by reference to the full text of the Investment Agreement Amendment,

a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

* Filed electronically herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

COHEN & COMPANY INC.

|

|

|

|

|

|

Date: October 15, 2020

|

By:

|

|

/s/ Joseph

W. Pooler, Jr.

|

|

|

|

Name:

|

Joseph W. Pooler, Jr.

|

|

|

|

Title:

|

Executive Vice President, Chief

Financial Officer and Treasurer

|

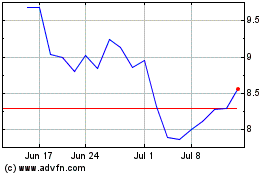

Cohen & (AMEX:COHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cohen & (AMEX:COHN)

Historical Stock Chart

From Apr 2023 to Apr 2024