UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

BLUE RIDGE BANKSHARES, INC.

(Exact name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1) |

Title of each class of securities to which transaction applies: |

2) |

Aggregate number of securities to which transaction applies: |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

4) |

Proposed maximum aggregate value of transaction: |

5) |

Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1) |

Amount Previously Paid: |

|

|

2) |

Form, Schedule or Registration Statement No.: |

©2024 Blue Ridge Bank, N.A. All Rights Reserved. Blue Ridge Bankshares, Inc.�(NYSE American: BRBS)��Pre-Shareholder Meeting Town Hall��February 2024 MYBRB.BANK

DISCLOSURE Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. For information on the risks and uncertainties that could affect the Company’s actual results, please see the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections and elsewhere in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, as amended, the Company’s Quarterly Report on Form 10-Q for the most recently ended fiscal quarter and in filings the Company makes from time to time with the Securities and Exchange Commission. The Company cautions not to place undue reliance on its forward-looking information and statements, which speak only as of the date of this presentation. The Company does not undertake to, and will not, update or revise these forward-looking statements after the date hereof, whether as a result of new information, future events, or otherwise.

BLUE RIDGE BANKSHARES, AT A GLANCE Deposit market share data as of June 30, 2023; Excludes Capital One Financial Corporation Reflects data as of December 31, 2023 Reflects data as of February 6, 2023 Source: S&P Capital IQ Pro (27 branches) (16 offices from Maryland to South Carolina) Winchester Washington D.C. Luray Harrisonburg Charlottesville Fairfax Richmond Northern Neck Virginia Beach Raleigh Durham Greensboro Charlotte Wilmington Fredericksburg Martinsville Bank Branch Mortgage Office LPO Norfolk Virginia North Carolina EMPLOYEES DEPOSIT MARKET SHARE 1 #7 Virginia-based bank ASSETS $3.1 billion² DEPOSITS $2.6 billion² GROSS LOANS $2.4 billion² MARKET CAPITALIZATION ~$52.0 million³ Blue Ridge Bankshares Acquisitions EMPLOYEES 523 Full-time equivalents (FTEs)

Blue Ridge Bank, N.A. (the “Bank”) entered into a formal consent order (the “Order”) with the Office of the Comptroller of the Currency (“OCC”) on January 24, 2024¹. The Order replaces the formal written agreement entered into on August 29, 2022 (the “Written Agreement”)². Generally, the Order follows the directives of the Written Agreement, adding requirements for: Strategic plan Capital plan Dates by which certain directives are required Individual Minimum Capital Ratios (“IMCR”) by requiring capital ratios for the Bank that are higher than those required for capital adequacy purposes generally. Specifically, the Bank is required to maintain a leverage ratio of 10.00% and a total capital ratio of 13.00%. MITIGATING STEPS TAKEN The Bank is actively working to bring policies, procedures, and operations into conformity with OCC directives. Added significant leadership talent to remediate OCC directives. Commenced a private placement capital raise (the “Private Placement”)³ pursuant to which the Company has agreed to issue and sell the Company’s common stock with gross proceeds of $150,000,000. The Private Placement requires regulatory and shareholder approval. The shareholder meeting is set for March 6, 2024. A complete copy of the Order was included in a Form 8-K filed with the Securities and Exchange Commission (“SEC”) on January 25, 2024. A complete copy of the Written Agreement was included in a Form 8-K filed with the SEC on September 1, 2022. See the Form 8-K filed with the SEC on December 21, 2023 and the Company’s proxy statement filed with the SEC on January 24, 2024 for information on the Private Placement. SUMMARY OF THE CONSENT ORDER AND MITIGATING

Bank Level Capital Ratios (12/31/2023) Assumes $100.0 million received by the Company from the Private Placement is contributed as tier 1 capital to the Bank as of the date presented Well-capitalized minimum ratios as defined by the PCA: 5.0% Tier 1 Leverage ratio, 6.5% CET1 ratio, 8.0% Tier 1 ratio and 10.0% Total Capital ratio. The Order requires the Bank to maintain individual minimum capital ratios that are higher than those required for capital adequacy purposes generally. Specifically, the Bank is required to maintain a leverage ratio of 10.00% and a total capital ratio of 13.00%. See the Company’s Form 8-K filed January 25, 2024 for more information regarding the consent order Source: Company data CURRENT AND PRO FORMA CAPITAL RATIOS Current Capital Well-Capitalized Minimum² Individual Minimum Capital Ratios² Pro Forma Capital¹

REVIEW OF BLUE RIDGE’S HISTORICAL BALANCE SHEET GROWTH Total Assets ($M) Gross Loans Held-for-Investment ($M) Total Deposits ($M) Tangible Book Value Per Share ($)¹ Reflects the impact of Accumulated Other Comprehensive Income (AOCI) on Tangible Book Value per Share. See the Appendix for certain calculations related to GAAP to Non-GAAP reconciliations.

LOANS HELD FOR INVESTMENT PORTFOLIO Loan Composition (12/31/2023 - $ in thousands) Key Highlights Loans held for investment have declined since the end of Q2 2023. Loan yields have improved steadily in each quarter of 2023, from 5.72% in Q4 2022 to 6.33% in Q4 2023. The held for investment loan-to-deposit ratio measured 94.7% as of December 31, 2023, compared to 88.1% at the prior quarter-end. The Company intends for non-core loans to amortize, providing liquidity and the ability to serve in the core customer base, without significant asset growth in the near term. Q4 2023 Yield on Loans³: 6.33% $2.4B Includes PPP loans Includes farmland mortgages of $5.5 million Excludes PPP loans Source: Bank level call report as of December 31, 2023 and Company data

CRE LOAN PORTFOLIO OVERVIEW CRE Loan Portfolio (Investor & Multifamily) by Type (12/31/2023) $662M Source: Company data

DEPOSIT PORTFOLIO Key Highlights Deposits related to fintech relationships were $465.9 million (18.2% of total deposits) at December 31, 2023, compared to $720.8 million (26.0% of total deposits) at the prior quarter-end. The Company is actively reducing its banking-as-a-service fintech activities. Uninsured deposits were $573.9 million (22.3% of total deposits) at December 31, 2023. Cost of deposits increased during 2023 from 0.85% in Q4 2022 to 2.73% in Q4 2023. Higher deposit costs reflect the impact of higher market interest rates and a shift in the mix of funding. Deposit Composition (12/31/2023 - $ in thousands) Q4 2023 Cost of Deposits: 2.73% $2.6B Excludes $27.4 million of fintech-related noninterest bearing deposits Excludes $438.5 million of fintech-related interest bearing deposits Source: Company data

QUESTIONS & ANSWERS

APPENDIX

RECONCILIATION OF NON-GAAP DISCLOSURES Excludes mortgage servicing rights Source: Company data

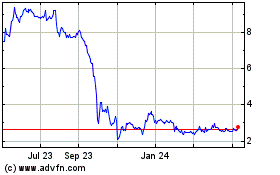

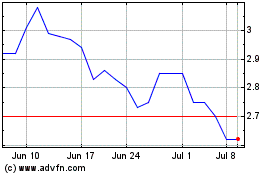

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Apr 2023 to Apr 2024