0000842717false00008427172023-10-302023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2023

BLUE RIDGE BANKSHARES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Virginia |

001-39165 |

54-1838100 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

1807 Seminole Trail Charlottesville, Virginia |

|

22901 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (540) 743-6521

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, no par value |

|

BRBS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.02. Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On October 30, 2023, management of Blue Ridge Bankshares, Inc. (the “Company”) and the Audit Committee of its Board of Directors, after consultation with the Company’s independent registered public accounting firm and its primary regulator, determined that certain specialty finance loans that, as previously disclosed, were placed on nonaccrual, reserved for, or charged off in the interim periods ended March 31, 2023 and June 30, 2023 should have been reported as nonaccrual, reserved for, or charged off in earlier periods.

As a result, the Company’s audited financial statements included in the Company’s annual report on Form 10-K for the year ended December 31, 2022, and unaudited interim financial statements included in quarterly reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023 should no longer be relied upon and will be restated. The restated financial statements will be reflected in an amendment to the Company’s annual report on Form 10-K for the year ended December 31, 2022, and amendments to the Company’s quarterly reports on Form 10-Q for the interim periods ended March 31, 2023 and June 30, 2023. The Company expects to file these amendments to Form 10-K and Form 10-Q in the next several weeks.

Net Impact of Financial Restatements

The Company does not believe that the restatement reflects any significant financial impact on the Company’s financial condition as of June 30, 2023 and September 30, 2023, or any trends in the Company’s business or its prospects.

The effect of the adjustments will result in lower net income and earnings per share in the year ended December 31, 2022, and greater net income and earnings per share in the quarter period ended March 31, 2023, and lower net loss and losses per share for the quarter and six-month periods ended June 30, 2023. The cumulative impact on net income over these periods is expected to be an increase of $2.6 million.

Balance sheets amounts, including loans held for investment, allowance for credit losses (previously, allowance for loan losses), accrued interest receivable, deferred tax asset, other assets, and stockholders’ equity, are affected as of December 31, 2022 and March 31, 2023. The restatements are not expected to have any impact on total balance sheet amounts, including stockholders’ equity, as of June 30, 2023. It is expected loans held for investment and allowance for credit losses will each be reduced in the amount of $4.5 million as of June 30, 2023. The adjustment to the allowance for credit losses to implement the Current Expected Credit Losses (CECL) accounting standard as of January 1, 2023, will also be restated, thus affecting the cumulative effect adjustment to stockholders’ equity as of January 1, 2023, and resulted in the positive adjustment to earnings in the six months ended June 30, 2023.

The following tables summarize the expected effects of the restatement on select statement of operations and balance sheet amounts as reported as of and for the periods stated and are unaudited, except for the as reported December 31, 2022 statement of operations and balance sheet:

|

|

|

|

|

|

|

|

|

|

|

For the year ended December 31, 2022 |

|

|

|

|

Unaudited |

|

Unaudited |

|

Dollars in thousands, except per share data |

As Reported |

|

Adjustments |

|

As Restated |

|

Net interest income |

$ |

110,391 |

|

$ |

(5,824 |

) |

$ |

104,567 |

|

Provision for loan losses |

|

17,886 |

|

|

7,801 |

|

|

25,687 |

|

Income (loss) from continuing operations before income tax expense |

|

35,821 |

|

|

(13,625 |

) |

|

22,196 |

|

Income tax expense (benefit) |

|

8,244 |

|

|

(3,045 |

) |

|

5,199 |

|

Net income from continuing operations |

$ |

27,577 |

|

$ |

(10,580 |

) |

$ |

16,997 |

|

Basic and diluted earnings (loss) per common share from continuing operations |

$ |

1.46 |

|

$ |

(0.56 |

) |

$ |

0.90 |

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2022 |

|

|

|

|

Unaudited |

|

Unaudited |

|

Dollars in thousands |

As Reported |

|

Adjustments |

|

As Restated |

|

Loans held for investment, net of deferred fees and costs |

$ |

2,399,092 |

|

$ |

— |

|

$ |

2,399,092 |

|

Allowance for loan losses |

|

(22,939 |

) |

|

(7,801 |

) |

|

(30,740 |

) |

Accrued interest receivable |

|

12,393 |

|

|

(824 |

) |

|

11,569 |

|

Deferred tax asset, net |

|

9,182 |

|

|

3,045 |

|

|

12,227 |

|

Other assets |

|

19,175 |

|

|

(5,000 |

) |

|

14,175 |

|

Total assets |

$ |

3,141,045 |

|

$ |

(10,580 |

) |

$ |

3,130,465 |

|

Total stockholders' equity |

$ |

259,373 |

|

$ |

(10,580 |

) |

$ |

248,793 |

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended March 31, 2023 |

|

Dollars in thousands, except per share data (unaudited) |

As Reported |

|

Adjustments |

|

As Restated |

|

Net interest income |

$ |

27,359 |

|

$ |

(2,163 |

) |

$ |

25,196 |

|

Provision (benefit) for credit losses - loans |

|

4,100 |

|

|

(5,210 |

) |

|

(1,110 |

) |

Income from continuing operations before income tax expense |

|

2,095 |

|

|

3,047 |

|

|

5,142 |

|

Income tax expense |

|

491 |

|

|

681 |

|

|

1,172 |

|

Net income from continuing operations |

$ |

1,604 |

|

$ |

2,366 |

|

$ |

3,970 |

|

Basic and diluted earnings per common share from continuing operations |

$ |

0.09 |

|

$ |

0.13 |

|

$ |

0.22 |

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2023 |

|

Dollars in thousands (unaudited) |

As Reported |

|

Adjustments |

|

As Restated |

|

Loans held for investment, net of deferred fees and costs |

$ |

2,448,992 |

|

$ |

(4,197 |

) |

$ |

2,444,795 |

|

Allowance for credit losses |

|

(29,974 |

) |

|

(5,987 |

) |

|

(35,961 |

) |

Accrued interest receivable |

|

14,915 |

|

|

(790 |

) |

|

14,125 |

|

Deferred tax asset, net |

|

9,605 |

|

|

3,123 |

|

|

12,728 |

|

Other assets |

|

21,264 |

|

|

(3,000 |

) |

|

18,264 |

|

Total assets |

$ |

3,334,911 |

|

$ |

(10,851 |

) |

$ |

3,324,060 |

|

Total stockholders' equity |

$ |

257,586 |

|

$ |

(10,851 |

) |

$ |

246,735 |

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, 2023 |

|

Dollars in thousands, except per share data (unaudited) |

As Reported |

|

Adjustments |

|

As Restated |

|

Net interest income |

$ |

20,403 |

|

$ |

3,487 |

|

$ |

23,890 |

|

Provision (benefit) for credit losses - loans |

|

21,100 |

|

|

(10,487 |

) |

|

10,613 |

|

(Loss) income from continuing operations before income tax expense |

|

(24,413 |

) |

|

13,974 |

|

|

(10,439 |

) |

Income tax (benefit) expense |

|

(4,949 |

) |

|

3,123 |

|

|

(1,826 |

) |

Net (loss) income from continuing operations |

$ |

(19,464 |

) |

$ |

10,851 |

|

$ |

(8,613 |

) |

Basic and diluted (loss) earnings per common share from continuing operations |

$ |

(1.03 |

) |

$ |

0.58 |

|

$ |

(0.45 |

) |

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, 2023 |

|

Dollars in thousands, except per share data (unaudited) |

As Reported |

|

Adjustments |

|

As Restated |

|

Net interest income |

$ |

47,762 |

|

$ |

1,324 |

|

$ |

49,086 |

|

Provision (benefit) for credit losses - loans |

|

25,200 |

|

|

(15,697 |

) |

|

9,503 |

|

(Loss) income from continuing operations before income tax expense |

|

(22,318 |

) |

|

17,021 |

|

|

(5,297 |

) |

Income tax (benefit) expense |

|

(4,458 |

) |

|

3,804 |

|

|

(654 |

) |

Net (loss) income from continuing operations |

$ |

(17,860 |

) |

$ |

13,217 |

|

$ |

(4,643 |

) |

Basic and diluted (loss) earnings per common share from continuing operations |

$ |

(0.95 |

) |

$ |

0.70 |

|

$ |

(0.25 |

) |

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2023 |

|

Dollars in thousands (unaudited) |

As Reported |

|

Adjustments |

|

As Restated |

|

Loans held for investment, net of deferred fees and costs |

$ |

2,451,697 |

|

$ |

(4,500 |

) |

$ |

2,447,197 |

|

Allowance for credit losses |

|

(43,067 |

) |

|

4,500 |

|

|

(38,567 |

) |

Accrued interest receivable |

|

15,474 |

|

|

— |

|

|

15,474 |

|

Deferred tax asset, net |

|

11,051 |

|

|

— |

|

|

11,051 |

|

Other assets |

|

28,175 |

|

|

— |

|

|

28,175 |

|

Total assets |

$ |

3,214,424 |

|

$ |

— |

|

$ |

3,214,424 |

|

Total stockholders' equity |

$ |

231,271 |

|

$ |

— |

|

$ |

231,271 |

|

Review of Internal Control over Financial Reporting

Management has evaluated the effect of the facts leading to the restatement of the financial statements for the periods ended December 31, 2022, March 31, 2023, and June 30, 2023, on its conclusion of the adequacy of internal controls over financial reporting and disclosure controls and procedures. The Company has concluded that a material weakness existed in the timely risk grading, nonaccrual status, and, thus, in the determination of the adequacy of the allowance for credit losses for the specialty finance portfolio of loans, and such material weakness does not exist in the remainder of its loan portfolio.

Management and the Audit Committee have discussed the matters disclosed in this report with Elliott Davis, PLLC, the Company’s current independent registered public accounting firm.

Forward-Looking Statements:

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. For a discussion of the risks, uncertainties and assumptions that could affect the Company’s future events, developments or results, you should carefully review the “Risk Factors,” “Business” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” sections in the Company’s Annual Report on Form 10-K filed March 10, 2023, Form 10-Q for the most recently ended fiscal quarter and other filings the Company makes from time to time with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

BLUE RIDGE BANKSHARES, INC. |

|

|

|

|

Dated: October 31, 2023 |

By: |

|

/s/ Judy C. Gavant |

|

|

|

Judy C. Gavant |

|

|

|

Executive Vice President and Chief Financial Officer |

v3.23.3

Document And Entity Information

|

Oct. 30, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 30, 2023

|

| Entity Registrant Name |

BLUE RIDGE BANKSHARES, INC.

|

| Entity Central Index Key |

0000842717

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39165

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Tax Identification Number |

54-1838100

|

| Entity Address, Address Line One |

1807 Seminole Trail

|

| Entity Address, City or Town |

Charlottesville

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22901

|

| City Area Code |

540

|

| Local Phone Number |

743-6521

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

BRBS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

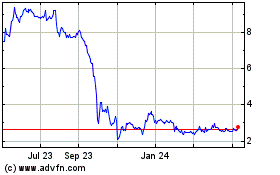

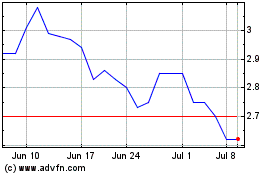

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Apr 2023 to Apr 2024