0000842717false00008427172023-07-312023-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 31, 2023 |

BLUE RIDGE BANKSHARES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-39165 |

54-1838100 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1807 Seminole Trail |

|

Charlottesville, Virginia |

|

22901 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (540) 743-6521 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, no par value |

|

BRBS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 31, 2023 Blue Ridge Bankshares, Inc. issued a press release announcing its financial results for the second quarter ended June 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this report and is incorporated by reference into this Item 2.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being furnished pursuant to Item 2.02 above.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

BLUE RIDGE BANKSHARES, INC. |

|

|

|

|

Date: |

July 31, 2023 |

By: |

/s/ Judy C. Gavant |

|

|

|

Judy C. Gavant

Executive Vice President and

Chief Financial Officer |

Exhibit 99.1

Blue Ridge Bankshares, Inc. Announces Second Quarter 2023 Results

CHARLOTTESVILLE, VA, July 31, 2023 /PRNewswire/ -- Blue Ridge Bankshares, Inc. (the “Company”) (NYSE American: BRBS), the holding company of Blue Ridge Bank, National Association (“Blue Ridge Bank” or the “Bank”) and BRB Financial Group, Inc. (“BRB Financial Group”), announced today financial results for the quarter ended June 30, 2023.

For the second quarter of 2023, the Company reported net loss from continuing operations of $19.5 million, or $1.03 per diluted common share, compared to net income from continuing operations of $1.6 million, or $0.09 per diluted common share, for the first quarter of 2023, and net income from continuing operations of $1.1 million, or $0.06 per diluted common share, for the second quarter of 2022.

A Message From Blue Ridge Bankshares, Inc. President and CEO, G. William “Billy” Beale:

“The net loss for the quarter was driven primarily by higher provision expense and the associated reversal of interest income related to loans that were placed on nonaccrual during the quarter. This group of loans, totaling $58.1 million at quarter-end, were sourced by a former lender, and is best described as specialty finance that we deemed to be not in keeping with our desired risk profile. I don’t believe this asset quality matter is pervasive within our loan portfolio, and excluding these loans, measures of asset quality were generally stable as compared to the prior quarter.

Having recently joined the organization in May 2023, I am pleased to have found Blue Ridge to be a quality bank providing exceptional service to its customers. My foremost priority, and that of our team, is to remain focused on our regulatory remediation efforts, as we continue to work diligently to bring the Bank’s fintech policies, procedures, and operations into conformity with regulatory directives. At the same time, we want to re-energize the core banking franchise by attracting new customers from within our footprint, while supporting our fintech partners that continue to gain momentum.”

Q2 2023 Highlights

(Comparisons for Second Quarter 2023 are relative to First Quarter 2023 unless otherwise noted)

Formal Written Agreement:

•As previously disclosed, Blue Ridge Bank entered into a formal written agreement (the “Agreement”) with the Office of the Comptroller of the Currency (“OCC”) on August 29, 2022. The Agreement principally concerns the Bank’s fintech line of business and requires the Bank to continue enhancing its controls for assessing and managing the third-party, BSA/AML, and IT risks stemming from its fintech partnerships. A complete copy of the Agreement was filed as an exhibit to the Company’s Form 8-K filed with the Securities and Exchange Commission (“SEC”) on September 1, 2022 and can be accessed on the SEC’s website (www.sec.gov) and the Company’s website (www.mybrb.com). The Company continues to actively work to bring the Bank’s fintech policies, procedures, and operations into conformity with OCC directives. The Company reports that, although work is progressing, many aspects of the Agreement require considerable time for completion, implementation, validation, and sustainability.

Remediation costs related to regulatory matters were $2.4 million in the second quarter of 2023 compared to $1.1 million in the prior quarter.

Asset Quality:

•Nonperforming loans totaled $86.1 million, or 2.68% of total assets, compared to $30.7 million, or 0.92% of total assets, at the prior quarter-end. The increase reflects the migration of a group of specialty finance loans to nonaccrual status during the quarter. These loans had a 1.79% impact on the nonperforming loans to total assets ratio for the second quarter.

•The Company recorded a provision for credit losses of $20.5 million, compared to $3.7 million last quarter. Net loan charge-offs were $8.0 million in the quarter, representing an annualized net charge-off rate of 1.29% of average loans, compared to $1.1 million, representing an annualized net charge-off rate of 0.17% of average loans, for the prior quarter. Net loan charge-offs in the quarter were primarily attributable to one loan.

•The allowance for credit losses (“ACL”) as a percentage of total loans held for investment was 1.76% at quarter-end, compared to 1.22% at the prior quarter-end. Specific reserves associated with the aforementioned specialty finance loans totaled $14.1 million at June 30, 2023.

Capital:

•As previously announced, on July 12, 2023, the Board of Directors determined to forego the declaration and payment of a cash dividend on the Company’s common stock in the third quarter of 2023. The decision was based on the desire to preserve capital and available cash.

•The ratio of tangible stockholders’ equity to tangible total assets was 6.3%1, compared to 6.8%1 at the prior quarter-end. Tangible book value per common share was $10.551, compared to $11.931 at the prior quarter-end.

•For the quarter ended June 30, 2023, the Bank’s tier 1 leverage ratio, tier 1 risk-based capital ratio, common equity tier 1 capital ratio, and total risk-based capital ratio were 7.86%, 9.27%, 9.27%, and 10.77%, respectively, compared to 8.50%, 10.06%, 10.06%, and 11.12%, respectively, at the prior quarter-end. Capital ratios at quarter-end were within regulatory guidelines to categorize the Bank as well capitalized.

Net Interest Income / Net Interest Margin:

•Net interest income was $20.4 million, a decline of $7.0 million from the prior quarter, primarily reflecting the reversal of $4.7 million in interest income, related to the aforementioned group of specialty finance loans, and higher funding costs. These impacts were partially offset by increasing loan yields in the quarter, which increased 5 basis points excluding the effect of the interest income reversal.

•Net interest margin was 2.67% compared to 3.58% for the prior quarter. The reversal of interest income noted above had an approximate negative 60 basis points impact on second quarter net interest margin.

•Cost of deposits and total cost of funds were 2.21% and 2.49%, respectively, compared to 1.74% and 2.11%, respectively, for the prior quarter. Federal Home Loan Bank of Atlanta (“FHLB”) and Federal Reserve Bank of Richmond (“FRB”) advances were $284.1 million at June 30, 2023, compared to $239.1 million at the prior quarter-end. Deposit costs and overall funding costs increased during the second quarter of 2023 due primarily to the impact of higher average balances of wholesale funding secured in late first quarter in response to then market events, as well as interest rates on deposits that adjust with changes in federal funds rates.

Balance Sheet:

•Total deposit balances declined $148.0 million, or 5.4%, from the prior quarter-end, due primarily to a decrease of $93.8 million in wholesale funding, primarily time deposits and interest-bearing demand balances. Excluding wholesale funding, total deposits during the second quarter of 2023 declined by 2.1% from the prior quarter-end.

•Deposits related to fintech relationships were $708 million at June 30, 2023, compared to $716 million at the prior quarter-end. These deposits represented 27.1% of total deposits at June 30, 2023, compared to 25.9% of total deposits at the prior quarter-end. Excluding wholesale funding, deposits related to fintech relationships represented 30.1% and 29.8% of total deposits at June 30, 2023 and March 31, 2023, respectively.

•Loans held for investment, excluding Paycheck Protection Program (“PPP”) loans, were $2.45 billion, essentially level with the prior quarter-end.

•The held for investment loan to deposit ratio measured 94.1% at quarter-end, compared to 89.0% at the prior quarter-end. The increase was primarily due to the reduction in wholesale deposits.

Noninterest Income / Noninterest Expense:

•Noninterest income was $9.7 million, compared to $7.3 million for the prior quarter, due primarily to fair value adjustments to mortgage servicing rights (“MSRs”), reported in residential mortgage banking income, which were a positive $0.8 million, compared to a negative $2.1 million in the prior quarter.

•Noninterest expense was $34.1 million, compared to $28.8 million for the prior quarter. Increased expenses primarily reflected higher other contractual services, legal, regulatory

remediation, and FDIC insurance costs, partially offset by lower salaries and employee benefits costs. Higher other contractual services expense was primarily due to outsourced BSA/AML compliance services as the Bank continues to augment its compliance staff, while higher legal expense was primarily attributable to corporate, employee benefit plans, and other employment matters. Higher FDIC insurance cost relative to the prior quarter was primarily due to balance sheet growth, while lower salaries and employee benefits cost was primarily due to continued headcount reduction in the mortgage division. During the quarter, the Company sold its wholesale mortgage business operating as LenderSelect Mortgage Group.

Income Statement:

Net Interest Income

Net interest income was $20.4 million for the second quarter of 2023, compared to $27.4 million for the first quarter of 2023, and $24.1 million for the second quarter of 2022. Relative to both the prior quarter and year-ago periods, net interest income declined due to a lower net interest margin resulting primarily from the aforementioned reversal of interest income related to the specialty finance loans moved to nonaccrual status during the second quarter of 2023, the impact of higher interest rates on the Company’s deposits and overall funding costs, and actions taken to add balance sheet liquidity following the market events of March 2023. Relative to the prior year period, these developments were partially offset by an increase in average interest-earning asset balances, and relative to both prior periods, higher loan yields.

Total interest income was $39.0 million for the second quarter of 2023, compared to $43.1 million for the first quarter of 2023, and $26.2 million for the second quarter of 2022. The decline relative to the prior quarter reflects the aforementioned reversal of interest income related to loans placed on nonaccrual status during the second quarter of 2023. The increase relative to the prior year reflects higher average balances of and yields on interest-earning asset balances, partially offset by the reversal of interest income on loans moved to nonaccrual status during the second quarter of 2023, and lower income from purchase accounting adjustments. The yield on average loans held for investment, excluding PPP loans, was 5.54% for the second quarter of 2023, compared to 6.24% for the first quarter of 2023, and 4.97% for the second quarter of 2022. The reversal of interest income noted above had an approximate negative 75 basis points impact on the yield on average loans held for investment, excluding PPP loans, for the second quarter of 2023.

Total interest expense was $18.6 million for the second quarter of 2023, compared to $15.7 million for the first quarter of 2023, and $2.2 million for the second quarter of 2022. The increase relative to the prior quarter and the year-ago period reflects higher deposit costs and overall funding costs due to higher market interest rates and a shift in the mix of average interest-bearing liabilities, primarily to higher cost wholesale funding sources.

Average balances of interest-earning assets increased $3.6 million, or 0.1%, to $3.06 billion, in the second quarter of 2023, relative to the prior quarter, and increased by $582.0 million, or 23.5%, from the year-ago period. Relative to the prior quarter, average interest-earning asset balances were relatively flat, reflecting a slight decline in average total securities and loans held for investment balances, offset by higher average balances of loans held for sale and interest-earning deposits in other banks. Relative to the prior year-ago period, average interest-earning asset balances increased due

primarily to higher balances of loans held for investment and interest-earning deposits at other banks, partially offset by lower average securities balances.

Average balances of interest-bearing liabilities increased $177.1 million, or 8.2%, to $2.35 billion, in the second quarter of 2023, relative to the prior quarter, and increased $719.3 million, or 44.2%, relative to the year-ago period. Relative to the prior quarter, the increase reflected higher average interest-bearing deposits, primarily higher average wholesale time deposits, partially offset by lower average FHLB borrowings. Relative to the prior year, the increase reflected higher average interest-bearing deposits and higher average FHLB borrowings.

Cost of funds was 2.49% for the second quarter of 2023, compared to 2.11% for the first quarter of 2023, and 0.36% for the second quarter of 2022, while cost of deposits was 2.21%, 1.74%, and 0.26%, for the same respective periods. Higher deposit costs and overall funding costs reflect the impact of higher market interest rates, higher average balances and related interest costs of FHLB borrowings, and a shift in the mix of funding, including an increase in higher cost time deposits, which includes an increase in wholesale funding average balances and a decline in average noninterest-bearing deposits.

Net interest margin was 2.67% for the second quarter of 2023, compared to 3.58% for the first quarter of 2023, and 3.89% for the second quarter of 2022. The decline in net interest margin relative to both prior periods primarily reflects the aforementioned reversal of interest income related to loans placed on nonaccrual status during the second quarter of 2023, the impact of higher interest rates on funding costs, and less benefit from purchase accounting adjustments. These declines were partially offset by higher yields on loans, excluding the reversal of interest income.

Provision for Credit Losses

The Company recorded a provision for credit losses of $20.5 million for the second quarter of 2023, compared to $3.7 million for the first quarter of 2023, and $7.5 million for the second quarter of 2022. Relative to both prior periods, the increase in provision is primarily attributable to specific reserves and charge-offs on the aforementioned group of specialty finance loans.

Noninterest Income

Noninterest income was $9.7 million for the second quarter of 2023, compared to $7.3 million for the first quarter of 2023, and $10.2 million for the second quarter of 2022. Relative to the prior quarter, the increase reflected higher residential mortgage banking income, primarily due to the aforementioned fair value adjustments to MSRs, and, to a lesser extent, higher bank and purchase card income, partially offset by lower other noninterest income and negative fair value adjustments of other equity investments. Relative to the year-ago period, the decline reflected lower residential mortgage banking income, partially offset by higher other noninterest income and higher gain on sale of government guaranteed loans.

Noninterest Expense

Noninterest expense was $34.1 million for the second quarter of 2023, compared to $28.8 million for the first quarter of 2023, and $25.3 million for the second quarter of 2022. Relative to the prior quarter

and year-ago period, the increase primarily reflects higher other contractual services, legal, regulatory remediation, and FDIC insurance costs, partially offset by lower salaries and employee benefits costs.

Balance Sheet:

Loans

Loans held for investment, excluding PPP loans, were $2.45 billion at June 30, 2023, compared to $2.45 billion at March 31, 2023, and $2.05 billion at June 30, 2022. Loan balances were flat with the prior quarter level, while the Company selectively replaced the amortization of balances with higher yielding loans. The increase in loan balances relative to the year ago period reflected the high level of growth, particularly in the second half of 2022.

Deposits

Total deposits were $2.61 billion at June 30, 2023, a decline of $148.0 million, or 5.4%, from the prior quarter-end, and an increase of $277.4 million, or 11.9%, from the year-ago period. Relative to the prior quarter, the decrease reflected a decline in wholesale funding, primarily time deposits, and, to a lesser extent, declines in other deposit types. Relative to the year-ago period, the increase reflected higher wholesale funding balances, interest-bearing demand and money market deposits, partially offset by lower noninterest-bearing demand deposits. Noninterest-bearing deposits declined 3.1% and 26.7% relative to the prior quarter and year-ago periods, respectively, and represented 22.0%, 21.5%, and 33.6% of total deposits at June 30, 2023, March 31, 2023, and June 30, 2022, respectively. The change from the year-ago period was primarily due to certain fintech-related balances shifting to interest-bearing accounts.

The held for investment loan to deposit ratio was 94.1% at June 30, 2023, compared to 89.0% at the prior quarter-end, and 88.4% at the year-ago period-end. The increase on a linked quarter basis was due primarily to lower wholesale funding at second quarter-end 2023, while the increase from the year-ago period end was due to second half 2022 loan growth.

Fintech Business:

Interest and fee income related to fintech partnerships represented approximately $3.4 million, $2.9 million, and $1.8 million of total revenue for the Company for the second quarter of 2023, the first quarter of 2023, and the second quarter of 2022, respectively.

Deposits related to fintech relationships were $708 million at June 30, 2023, compared to $716 million at the prior quarter-end. These deposits represented 27.1% of total deposits at June 30, 2023, compared to 25.9% of total deposits at the prior quarter-end. Included in deposits related to fintech relationships were assets managed by BRB Financial Group’s trust division of $37.2 million as of June 30, 2023.

Other Matters:

On May 15, 2023, the Company sold its wholesale mortgage business operating as LenderSelect Mortgage Group (“LSMG”) to a third-party for $250 thousand in cash. The Company recorded a loss on

the sale of LSMG of $553 thousand, which is reported in other noninterest income in the consolidated statements of operations for the three and six months ended June 30, 2023.

In the first quarter of 2022, the Company sold its majority interest in MoneyWise Payroll Solutions, Inc. (“MoneyWise”) to the holder of the minority interest in MoneyWise. Income statement amounts related to MoneyWise are reported as discontinued operations for all periods presented.

Non-GAAP Financial Measures:

The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles (“GAAP”) and prevailing practices in the banking industry. However, management uses certain non-GAAP measures to supplement the evaluation of the Company’s performance. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP measures are included at the end of this release.

Forward-Looking Statements:

This release of the Company contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements.

The following factors, among others, could cause the Company’s financial performance to differ materially from that expressed in such forward-looking statements: (i) the strength of the United States economy in general and the strength of the local economies in which it conducts operations; (ii) changes in the level of the Company’s nonperforming assets and charge-offs; (iii) management of risks inherent in the Company’s real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of collateral and the ability to sell collateral upon any foreclosure; (iv) the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Federal Reserve, inflation, interest rate, market, and monetary fluctuations; (v) changes in consumer spending and savings habits; (vi) the Company's ability to identify, attract, and retain experienced management, relationship managers, and support personnel, particularly in a competitive labor environment; (vii) technological and social media changes impacting the Company, the Bank, and the financial services industry in general; (viii) changing bank regulatory conditions, laws, regulations,

policies, or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or the Bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, increased regulations, prohibition of certain income producing activities, or changes in the secondary market for loans and other products; (ix) the impact of changes in financial services policies, laws and regulations, including laws, regulations and policies concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; (x) the Company’s involvement, from time to time, in legal proceedings and examination and remedial actions by regulators; (xi) the impact of, and the ability to comply with, the terms of the formal written agreement between the Bank and the OCC; (xii) the impact of changes in laws, regulations, and policies affecting the real estate industry; (xiii) the effect of changes in accounting policies and practices, as may be adopted from time to time by bank regulatory agencies, the SEC, the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, or other accounting standards setting bodies; (xiv) the impact of the COVID-19 pandemic, including the adverse impact on our business and operations and on the Company’s customers which may result, among other things, in increased delinquencies, defaults, foreclosures and losses on loans; (xv) the occurrence of significant natural disasters, including severe weather conditions, floods, health related issues, and other catastrophic events; (xvi) geopolitical conditions, including acts or threats of terrorism and/or military conflicts, or actions taken by the U.S. or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the U.S. and abroad; (xvii) the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; (xviii) the willingness of users to substitute competitors’ products and services for the Company’s products and services; (xix) the Company’s inability to successfully manage growth or implement its growth strategy; (xx) reputational risk and potential adverse reactions of the Company’s customers, suppliers, employees or other business partners; (xxi) the effect of acquisitions the Company may make, including, without limitation, disruption of employee or customer relationships, and the failure to achieve the expected revenue growth and/or expense savings from such acquisitions; (xxii) the Company’s participation in the PPP established by the U.S. government and its administration of the loans and processing fees earned under the program; (xxiii) the Company’s involvement, from time to time, in legal proceedings, and examination and remedial actions by regulators; (xxiv) the Company’s potential exposure to fraud, negligence, computer theft, and cyber-crime; (xxv) the Bank's ability to effectively manage its fintech partnerships, and the abilities of those fintech companies to perform as expected; (xxvi) the Bank’s ability to pay dividends to the Company; and (xxvii) other risks and factors identified in the “Risk Factors” sections and elsewhere in documents the Company files from time to time with the SEC.

1 Non-GAAP financial measure. Further information can be found at the end of this press release.

|

|

|

|

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

|

|

|

Consolidated Statements of Income (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

(Dollars in thousands, except per common share data) |

|

June 30, 2023 |

|

|

March 31, 2023 |

|

|

June 30, 2022 |

|

Interest income: |

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

34,839 |

|

|

$ |

39,294 |

|

|

$ |

23,787 |

|

Interest on taxable securities |

|

|

2,543 |

|

|

|

2,628 |

|

|

|

2,129 |

|

Interest on nontaxable securities |

|

|

94 |

|

|

|

92 |

|

|

|

89 |

|

Interest on deposit accounts and federal funds sold |

|

|

1,497 |

|

|

|

1,039 |

|

|

|

238 |

|

Total interest income |

|

|

38,973 |

|

|

|

43,053 |

|

|

|

26,243 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

|

14,624 |

|

|

|

11,331 |

|

|

|

1,541 |

|

Interest on subordinated notes |

|

|

547 |

|

|

|

553 |

|

|

|

545 |

|

Interest on FHLB and FRB borrowings |

|

|

3,399 |

|

|

|

3,810 |

|

|

|

67 |

|

Total interest expense |

|

|

18,570 |

|

|

|

15,694 |

|

|

|

2,153 |

|

Net interest income |

|

|

20,403 |

|

|

|

27,359 |

|

|

|

24,090 |

|

Provision for credit losses - loans |

|

|

21,100 |

|

|

|

4,100 |

|

|

|

7,494 |

|

Provision for credit losses - unfunded commitments |

|

|

(600 |

) |

|

|

(400 |

) |

|

|

— |

|

Total provision for credit losses |

|

|

20,500 |

|

|

|

3,700 |

|

|

|

7,494 |

|

Net interest income after provision for credit losses |

|

|

(97 |

) |

|

|

23,659 |

|

|

|

16,596 |

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

Fair value adjustments of other equity investments |

|

|

(281 |

) |

|

|

(51 |

) |

|

|

(86 |

) |

Residential mortgage banking income, including MSRs |

|

|

4,295 |

|

|

|

1,303 |

|

|

|

5,960 |

|

Gain on sale of government guaranteed loans |

|

|

2,384 |

|

|

|

2,409 |

|

|

|

1,538 |

|

Wealth and trust management |

|

|

462 |

|

|

|

432 |

|

|

|

414 |

|

Service charges on deposit accounts |

|

|

349 |

|

|

|

343 |

|

|

|

327 |

|

Increase in cash surrender value of BOLI |

|

|

292 |

|

|

|

282 |

|

|

|

276 |

|

Bank and purchase card, net |

|

|

560 |

|

|

|

340 |

|

|

|

599 |

|

Other |

|

|

1,675 |

|

|

|

2,225 |

|

|

|

1,162 |

|

Total noninterest income |

|

|

9,736 |

|

|

|

7,283 |

|

|

|

10,190 |

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

14,518 |

|

|

|

15,289 |

|

|

|

15,873 |

|

Occupancy and equipment |

|

|

1,913 |

|

|

|

1,569 |

|

|

|

1,500 |

|

Data processing |

|

|

1,131 |

|

|

|

1,346 |

|

|

|

874 |

|

Legal |

|

|

2,753 |

|

|

|

1,234 |

|

|

|

618 |

|

Advertising and marketing |

|

|

337 |

|

|

|

286 |

|

|

|

412 |

|

Communications |

|

|

1,171 |

|

|

|

1,131 |

|

|

|

1,030 |

|

Audit and accounting fees |

|

|

503 |

|

|

|

146 |

|

|

|

379 |

|

FDIC insurance |

|

|

1,246 |

|

|

|

729 |

|

|

|

106 |

|

Intangible amortization |

|

|

335 |

|

|

|

355 |

|

|

|

386 |

|

Other contractual services |

|

|

3,218 |

|

|

|

939 |

|

|

|

999 |

|

Other taxes and assessments |

|

|

803 |

|

|

|

802 |

|

|

|

671 |

|

Regulatory remediation |

|

|

2,388 |

|

|

|

1,134 |

|

|

|

— |

|

Other |

|

|

3,736 |

|

|

|

3,887 |

|

|

|

2,478 |

|

Total noninterest expense |

|

|

34,052 |

|

|

|

28,847 |

|

|

|

25,326 |

|

(Loss) income before income tax |

|

|

(24,413 |

) |

|

|

2,095 |

|

|

|

1,460 |

|

Income tax (benefit) expense |

|

|

(4,949 |

) |

|

|

491 |

|

|

|

342 |

|

Net (loss) income |

|

|

(19,464 |

) |

|

|

1,604 |

|

|

|

1,118 |

|

Basic and diluted (loss) earnings per common share |

|

$ |

(1.03 |

) |

|

$ |

0.09 |

|

|

$ |

0.06 |

|

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

Consolidated Statements of Income (unaudited) |

|

|

|

|

|

|

|

|

For the Six Months Ended |

|

(Dollars in thousands except per share data) |

|

June 30, 2023 |

|

|

June 30, 2022 |

|

Interest income: |

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

74,133 |

|

|

$ |

47,686 |

|

Interest on taxable securities |

|

|

5,171 |

|

|

|

3,899 |

|

Interest on nontaxable securities |

|

|

186 |

|

|

|

164 |

|

Interest on deposit accounts and federal funds sold |

|

|

2,536 |

|

|

|

296 |

|

Total interest income |

|

|

82,026 |

|

|

|

52,045 |

|

Interest expense: |

|

|

|

|

|

|

Interest on deposits |

|

|

25,955 |

|

|

|

3,097 |

|

Interest on subordinated notes |

|

|

1,100 |

|

|

|

1,098 |

|

Interest on FHLB and FRB borrowings |

|

|

7,209 |

|

|

|

92 |

|

Total interest expense |

|

|

34,264 |

|

|

|

4,287 |

|

Net interest income |

|

|

47,762 |

|

|

|

47,758 |

|

Provision for credit losses - loans |

|

|

25,200 |

|

|

|

9,994 |

|

Provision for credit losses - unfunded commitments |

|

|

(1,000 |

) |

|

|

— |

|

Total provision for credit losses |

|

|

24,200 |

|

|

|

9,994 |

|

Net interest income after provision for credit losses |

|

|

23,562 |

|

|

|

37,764 |

|

Noninterest income: |

|

|

|

|

|

|

Fair value adjustments of other equity investments |

|

|

(332 |

) |

|

|

9,278 |

|

Residential mortgage banking income, including MSRs |

|

|

5,598 |

|

|

|

15,519 |

|

Gain on sale of government guaranteed loans |

|

|

4,793 |

|

|

|

2,965 |

|

Wealth and trust management |

|

|

894 |

|

|

|

805 |

|

Service charges on deposit accounts |

|

|

692 |

|

|

|

642 |

|

Increase in cash surrender value of BOLI |

|

|

574 |

|

|

|

548 |

|

Bank and purchase card, net |

|

|

900 |

|

|

|

1,021 |

|

Other |

|

|

3,900 |

|

|

|

3,506 |

|

Total noninterest income |

|

|

17,019 |

|

|

|

34,284 |

|

Noninterest expense: |

|

|

|

|

|

|

Salaries and employee benefits |

|

|

29,807 |

|

|

|

29,969 |

|

Occupancy and equipment |

|

|

3,482 |

|

|

|

2,985 |

|

Data processing |

|

|

2,477 |

|

|

|

1,820 |

|

Legal |

|

|

3,987 |

|

|

|

1,000 |

|

Advertising and marketing |

|

|

623 |

|

|

|

840 |

|

Communications |

|

|

2,302 |

|

|

|

1,829 |

|

Audit and accounting fees |

|

|

649 |

|

|

|

520 |

|

FDIC insurance |

|

|

1,975 |

|

|

|

337 |

|

Intangible amortization |

|

|

690 |

|

|

|

783 |

|

Other contractual services |

|

|

4,157 |

|

|

|

1,533 |

|

Other taxes and assessments |

|

|

1,605 |

|

|

|

1,241 |

|

Regulatory remediation |

|

|

3,522 |

|

|

|

— |

|

Merger-related |

|

|

— |

|

|

|

50 |

|

Other |

|

|

7,623 |

|

|

|

5,108 |

|

Total noninterest expense |

|

|

62,899 |

|

|

|

48,015 |

|

(Loss) income from continuing operations before income tax |

|

|

(22,318 |

) |

|

|

24,033 |

|

Income tax (benefit) expense |

|

|

(4,458 |

) |

|

|

5,495 |

|

Net (loss) income from continuing operations |

|

$ |

(17,860 |

) |

|

$ |

18,538 |

|

Discontinued operations: |

|

|

|

|

|

|

Income from discontinued operations before income taxes (including gain on disposal of $471 thousand for the six months ended June 30, 2022) |

|

|

— |

|

|

|

426 |

|

Income tax expense |

|

|

— |

|

|

|

89 |

|

Net income from discontinued operations |

|

$ |

— |

|

|

$ |

337 |

|

Net (loss) income |

|

$ |

(17,860 |

) |

|

$ |

18,875 |

|

Net income from discontinued operations attributable to noncontrolling interest |

|

|

— |

|

|

|

(1 |

) |

Net (loss) income attributable to Blue Ridge Bankshares, Inc. |

|

$ |

(17,860 |

) |

|

$ |

18,874 |

|

Net (loss) income available to common stockholders |

|

$ |

(17,860 |

) |

|

$ |

18,874 |

|

|

|

|

|

|

|

|

|

|

Basic and diluted (loss) earnings per common share from continuing operations |

|

$ |

(0.95 |

) |

|

$ |

0.99 |

|

Basic and diluted (loss) earnings per common share from discontinued operations |

|

$ |

— |

|

|

$ |

0.02 |

|

Basic and diluted (loss) earnings per common share attributable to Blue Ridge Bankshares, Inc. |

|

$ |

(0.95 |

) |

|

$ |

1.01 |

|

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

Consolidated Balance Sheets |

|

|

|

|

|

|

(Dollars in thousands, except share data) |

|

(unaudited)

June 30, 2023 |

|

|

December 31, 2022 (1) |

|

Assets |

|

|

|

|

|

|

Cash and due from banks |

|

$ |

131,843 |

|

|

$ |

77,274 |

|

Federal funds sold |

|

|

2,492 |

|

|

|

1,426 |

|

Securities available for sale, at fair value |

|

|

340,617 |

|

|

|

354,341 |

|

Restricted equity investments |

|

|

17,538 |

|

|

|

21,257 |

|

Other equity investments |

|

|

22,693 |

|

|

|

23,776 |

|

Other investments |

|

|

27,157 |

|

|

|

24,672 |

|

Loans held for sale |

|

|

64,102 |

|

|

|

69,534 |

|

Paycheck Protection Program loans, net of deferred fees and costs |

|

|

7,234 |

|

|

|

11,967 |

|

Loans held for investment, net of deferred fees and costs |

|

|

2,451,697 |

|

|

|

2,399,092 |

|

Less: allowance for credit losses |

|

|

(43,067 |

) |

|

|

(22,939 |

) |

Loans held for investment, net |

|

|

2,408,630 |

|

|

|

2,376,153 |

|

Accrued interest receivable |

|

|

15,474 |

|

|

|

12,393 |

|

Other real estate owned |

|

|

— |

|

|

|

195 |

|

Premises and equipment, net |

|

|

22,849 |

|

|

|

23,152 |

|

Right-of-use asset |

|

|

5,744 |

|

|

|

6,903 |

|

Bank owned life insurance |

|

|

47,828 |

|

|

|

47,245 |

|

Goodwill |

|

|

26,826 |

|

|

|

26,826 |

|

Other intangible assets |

|

|

5,925 |

|

|

|

6,583 |

|

Mortgage servicing rights, net |

|

|

28,246 |

|

|

|

28,991 |

|

Deferred tax asset, net |

|

|

11,051 |

|

|

|

9,182 |

|

Other assets |

|

|

28,175 |

|

|

|

19,175 |

|

Total assets |

|

$ |

3,214,424 |

|

|

$ |

3,141,045 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Noninterest-bearing demand |

|

$ |

575,989 |

|

|

$ |

640,101 |

|

Interest-bearing demand and money market deposits |

|

|

1,293,754 |

|

|

|

1,318,799 |

|

Savings |

|

|

131,332 |

|

|

|

151,646 |

|

Time deposits |

|

|

612,019 |

|

|

|

391,961 |

|

Total deposits |

|

|

2,613,094 |

|

|

|

2,502,507 |

|

FHLB borrowings |

|

|

219,100 |

|

|

|

311,700 |

|

FRB borrowings |

|

|

65,000 |

|

|

|

51 |

|

Subordinated notes, net |

|

|

39,888 |

|

|

|

39,920 |

|

Lease liability |

|

|

6,765 |

|

|

|

7,860 |

|

Other liabilities |

|

|

39,306 |

|

|

|

19,634 |

|

Total liabilities |

|

|

2,983,153 |

|

|

|

2,881,672 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

Common stock, no par value; 50,000,000 shares authorized at June 30, 2023 and December 31, 2022; 18,933,637 and 18,950,329 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively |

|

|

196,990 |

|

|

|

195,960 |

|

Additional paid-in capital |

|

|

252 |

|

|

|

252 |

|

Retained earnings |

|

|

80,287 |

|

|

|

108,262 |

|

Accumulated other comprehensive loss, net of tax |

|

|

(46,258 |

) |

|

|

(45,101 |

) |

Total stockholders’ equity |

|

|

231,271 |

|

|

|

259,373 |

|

Total liabilities and stockholders’ equity |

|

$ |

3,214,424 |

|

|

$ |

3,141,045 |

|

|

|

|

|

|

|

|

(1) Derived from audited December 31, 2022 Consolidated Financial Statements. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Summary of Selected Financial Data (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Three Months Ended |

|

(Dollars and shares in thousands, except per common share data) |

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|

June 30, |

|

Income Statement Data: |

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2022 |

|

Interest income |

|

$ |

38,973 |

|

|

$ |

43,053 |

|

|

$ |

42,285 |

|

|

$ |

33,146 |

|

|

$ |

26,243 |

|

Interest expense |

|

|

18,570 |

|

|

|

15,694 |

|

|

|

8,329 |

|

|

|

4,469 |

|

|

|

2,153 |

|

Net interest income |

|

|

20,403 |

|

|

|

27,359 |

|

|

|

33,956 |

|

|

|

28,677 |

|

|

|

24,090 |

|

Provision for credit losses |

|

|

20,500 |

|

|

|

3,700 |

|

|

|

3,992 |

|

|

|

3,900 |

|

|

|

7,494 |

|

Net interest income after provision for credit losses |

|

|

(97 |

) |

|

|

23,659 |

|

|

|

29,964 |

|

|

|

24,777 |

|

|

|

16,596 |

|

Noninterest income |

|

|

9,736 |

|

|

|

7,283 |

|

|

|

5,840 |

|

|

|

7,968 |

|

|

|

10,190 |

|

Noninterest expenses |

|

|

34,052 |

|

|

|

28,847 |

|

|

|

27,552 |

|

|

|

29,208 |

|

|

|

25,326 |

|

(Loss) income before income taxes |

|

|

(24,413 |

) |

|

|

2,095 |

|

|

|

8,252 |

|

|

|

3,537 |

|

|

|

1,460 |

|

Income tax (benefit) expense |

|

|

(4,949 |

) |

|

|

491 |

|

|

|

1,948 |

|

|

|

801 |

|

|

|

342 |

|

Net (loss) income |

|

$ |

(19,464 |

) |

|

$ |

1,604 |

|

|

$ |

6,304 |

|

|

$ |

2,736 |

|

|

$ |

1,118 |

|

Per Common Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) earnings per common share - basic and diluted |

|

$ |

(1.03 |

) |

|

$ |

0.09 |

|

|

$ |

0.33 |

|

|

$ |

0.15 |

|

|

$ |

0.06 |

|

Dividends declared per common share |

|

|

— |

|

|

|

0.1225 |

|

|

|

0.1225 |

|

|

|

0.1225 |

|

|

|

0.1225 |

|

Book value per common share |

|

|

12.21 |

|

|

|

13.60 |

|

|

|

13.69 |

|

|

|

13.22 |

|

|

|

13.95 |

|

Tangible book value per common share - Non-GAAP |

|

|

10.55 |

|

|

|

11.93 |

|

|

|

12.00 |

|

|

|

11.51 |

|

|

|

12.21 |

|

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

3,214,424 |

|

|

$ |

3,334,911 |

|

|

$ |

3,141,045 |

|

|

$ |

2,881,451 |

|

|

$ |

2,799,643 |

|

Average assets |

|

|

3,277,282 |

|

|

|

3,270,110 |

|

|

|

3,020,371 |

|

|

|

2,903,447 |

|

|

|

2,646,874 |

|

Average interest-earning assets |

|

|

3,064,103 |

|

|

|

3,060,534 |

|

|

|

2,812,898 |

|

|

|

2,686,376 |

|

|

|

2,482,065 |

|

Loans held for investment (including PPP loans) |

|

|

2,458,931 |

|

|

|

2,456,980 |

|

|

|

2,411,059 |

|

|

|

2,171,490 |

|

|

|

2,064,037 |

|

Loans held for investment (excluding PPP loans) |

|

|

2,451,697 |

|

|

|

2,448,992 |

|

|

|

2,399,092 |

|

|

|

2,158,342 |

|

|

|

2,048,383 |

|

Allowance for credit losses |

|

|

43,067 |

|

|

|

29,974 |

|

|

|

22,939 |

|

|

|

20,534 |

|

|

|

17,242 |

|

Purchase accounting adjustments (discounts) on acquired loans |

|

|

6,381 |

|

|

|

6,724 |

|

|

|

7,872 |

|

|

|

10,373 |

|

|

|

12,192 |

|

Loans held for sale |

|

|

64,102 |

|

|

|

76,528 |

|

|

|

69,534 |

|

|

|

25,800 |

|

|

|

32,759 |

|

Securities available for sale, at fair value |

|

|

340,617 |

|

|

|

351,990 |

|

|

|

354,341 |

|

|

|

359,516 |

|

|

|

381,536 |

|

Noninterest-bearing demand deposits |

|

|

575,989 |

|

|

|

594,518 |

|

|

|

640,101 |

|

|

|

787,514 |

|

|

|

785,743 |

|

Total deposits |

|

|

2,613,094 |

|

|

|

2,761,047 |

|

|

|

2,502,507 |

|

|

|

2,409,486 |

|

|

|

2,335,707 |

|

Subordinated notes, net |

|

|

39,888 |

|

|

|

39,904 |

|

|

|

39,920 |

|

|

|

39,937 |

|

|

|

39,953 |

|

FHLB and FRB advances |

|

|

284,100 |

|

|

|

239,100 |

|

|

|

311,751 |

|

|

|

150,155 |

|

|

|

135,060 |

|

Average interest-bearing liabilities |

|

|

2,346,722 |

|

|

|

2,169,643 |

|

|

|

1,777,391 |

|

|

|

1,771,246 |

|

|

|

1,627,423 |

|

Total stockholders' equity |

|

|

231,271 |

|

|

|

257,586 |

|

|

|

259,373 |

|

|

|

250,502 |

|

|

|

261,660 |

|

Average stockholders' equity |

|

|

257,117 |

|

|

|

259,911 |

|

|

|

263,826 |

|

|

|

267,057 |

|

|

|

284,913 |

|

Weighted average common shares outstanding - basic |

|

|

18,851 |

|

|

|

18,856 |

|

|

|

18,857 |

|

|

|

18,849 |

|

|

|

18,767 |

|

Weighted average common shares outstanding - diluted |

|

|

18,851 |

|

|

|

18,860 |

|

|

|

18,863 |

|

|

|

18,860 |

|

|

|

18,778 |

|

Financial Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (1) |

|

|

-2.38 |

% |

|

|

0.20 |

% |

|

|

0.83 |

% |

|

|

0.38 |

% |

|

|

0.17 |

% |

Return on average equity (1) |

|

|

-30.28 |

% |

|

|

2.47 |

% |

|

|

9.56 |

% |

|

|

4.10 |

% |

|

|

1.57 |

% |

Total loan to deposit ratio |

|

|

96.6 |

% |

|

|

91.8 |

% |

|

|

99.1 |

% |

|

|

91.2 |

% |

|

|

89.8 |

% |

Held for investment loan to deposit ratio |

|

|

94.1 |

% |

|

|

89.0 |

% |

|

|

96.3 |

% |

|

|

90.1 |

% |

|

|

88.4 |

% |

Net interest margin (1) |

|

|

2.67 |

% |

|

|

3.58 |

% |

|

|

4.83 |

% |

|

|

4.27 |

% |

|

|

3.89 |

% |

Cost of deposits (1) |

|

|

2.21 |

% |

|

|

1.74 |

% |

|

|

0.85 |

% |

|

|

0.50 |

% |

|

|

0.26 |

% |

Cost of funds (1) |

|

|

2.49 |

% |

|

|

2.11 |

% |

|

|

1.22 |

% |

|

|

0.69 |

% |

|

|

0.36 |

% |

Efficiency ratio |

|

|

113.0 |

% |

|

|

83.3 |

% |

|

|

69.2 |

% |

|

|

79.7 |

% |

|

|

73.9 |

% |

Regulatory remediation expenses |

|

|

2,388 |

|

|

|

1,134 |

|

|

|

2,884 |

|

|

|

4,025 |

|

|

|

510 |

|

Capital and Asset Quality Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average stockholders' equity to average assets |

|

|

7.8 |

% |

|

|

7.9 |

% |

|

|

8.7 |

% |

|

|

9.2 |

% |

|

|

10.8 |

% |

Allowance for credit losses to loans held for investment, excluding PPP loans |

|

|

1.76 |

% |

|

|

1.22 |

% |

|

|

0.96 |

% |

|

|

0.95 |

% |

|

|

0.84 |

% |

Nonperforming loans to total assets |

|

|

2.68 |

% |

|

|

0.92 |

% |

|

|

0.59 |

% |

|

|

0.35 |

% |

|

|

0.44 |

% |

Nonperforming assets to total assets |

|

|

2.68 |

% |

|

|

0.92 |

% |

|

|

0.60 |

% |

|

|

0.36 |

% |

|

|

0.44 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures (unaudited): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible Common Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders' equity |

|

$ |

231,271 |

|

|

$ |

257,586 |

|

|

$ |

259,373 |

|

|

$ |

250,502 |

|

|

$ |

261,660 |

|

Less: Goodwill and other intangibles, net of deferred tax liability (2) |

|

|

(31,427 |

) |

|

|

(31,637 |

) |

|

|

(32,027 |

) |

|

|

(32,369 |

) |

|

|

(32,632 |

) |

Tangible common equity (Non-GAAP) |

|

$ |

199,844 |

|

|

$ |

225,949 |

|

|

$ |

227,346 |

|

|

$ |

218,133 |

|

|

$ |

229,028 |

|

Total shares outstanding |

|

|

18,934 |

|

|

|

18,942 |

|

|

|

18,950 |

|

|

|

18,946 |

|

|

|

18,762 |

|

Book value per common share |

|

$ |

12.21 |

|

|

$ |

13.60 |

|

|

$ |

13.69 |

|

|

$ |

13.22 |

|

|

$ |

13.95 |

|

Tangible book value per common share (Non-GAAP) |

|

|

10.55 |

|

|

|

11.93 |

|

|

|

12.00 |

|

|

|

11.51 |

|

|

|

12.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible stockholders' equity to tangible total assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

3,214,424 |

|

|

$ |

3,334,911 |

|

|

$ |

3,141,045 |

|

|

$ |

2,881,451 |

|

|

$ |

2,799,643 |

|

Less: Goodwill and other intangibles, net of deferred tax liability (2) |

|

|

(31,427 |

) |

|

|

(31,637 |

) |

|

|

(32,027 |

) |

|

|

(32,369 |

) |

|

|

(32,632 |

) |

Tangible total assets (Non-GAAP) |

|

$ |

3,182,997 |

|

|

$ |

3,303,274 |

|

|

$ |

3,109,018 |

|

|

$ |

2,849,082 |

|

|

$ |

2,767,011 |

|

Tangible common equity (Non-GAAP) |

|

$ |

199,844 |

|

|

$ |

225,949 |

|

|

$ |

227,346 |

|

|

$ |

218,133 |

|

|

$ |

229,028 |

|

Tangible stockholders' equity to tangible total assets (Non-GAAP) |

|

|

6.3 |

% |

|

|

6.8 |

% |

|

|

7.3 |

% |

|

|

7.7 |

% |

|

|

8.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Annualized. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Excludes mortgage servicing rights. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

v3.23.2

Document And Entity Information

|

Jul. 31, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 31, 2023

|

| Entity Registrant Name |

BLUE RIDGE BANKSHARES, INC.

|

| Entity Central Index Key |

0000842717

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39165

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Tax Identification Number |

54-1838100

|

| Entity Address, Address Line One |

1807 Seminole Trail

|

| Entity Address, City or Town |

Charlottesville

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22901

|

| City Area Code |

(540)

|

| Local Phone Number |

743-6521

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

BRBS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

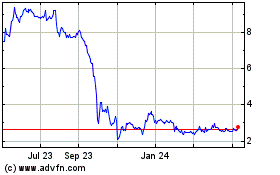

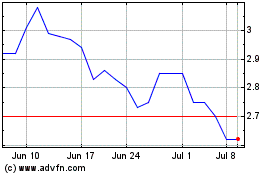

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Apr 2023 to Apr 2024