Ault Alliance, Inc. (NYSE American: AULT), a diversified holding

company (“Ault Alliance,” or the “Company”), reported

its financial results for the first quarter ended March 31, 2024,

which were disclosed on a quarterly report on Form 10-Q filed

yesterday with the Securities and Exchange Commission.

First quarter 2024 highlights include:

- Total revenue increased 55% to $44.9 million, compared to $28.9

million in the prior year’s first fiscal quarter;

- Revenue of approximately $3 million from Ault Global Real

Estate Equities, Inc. (“AGREE”), was not included in the

total revenue of $44.9 million as the assets of AGREE were

classified as discontinued operations as they were previously held

for sale;

- Revenue from digital assets mining increased 56% to $11.4

million, compared to $7.3 million in the prior year’s first fiscal

quarter;

- Revenue from lending and trading activities increased to $9.1

million, compared to negative $4.9 million in the prior year’s

first fiscal quarter;

- Gross margins improved to 43%, compared to 9% in the prior

year’s first fiscal quarter;

- Operating expenses declined 41% to $19.1 million, compared to

$32.3 million in the prior year’s first fiscal quarter;

- Income from operations improved to $0.4 million, compared to a

loss from operations of $29.9 million in the prior year’s first

fiscal quarter;

- Total assets of $299.8 million as of March 31, 2024; and

- Net income available to common stockholders of $2.5 million,

compared to a net loss available to common stockholders of $48.9

million in the prior year first fiscal quarter.

Milton “Todd” Ault III, the Founder and Executive Chairman of

Ault Alliance, expressed optimism about the Company’s trajectory,

noting, “We are beginning to see the results of our commitment to

focusing on and strengthening our key assets, as three of our main

reporting segments, Sentinum, Inc. (“Sentinum”), Technology

and Finance (“Fintech”) and Energy and Infrastructure

(“Energy”), all reported positive income from operations for

the fiscal quarter ended March 31, 2024. Only the Energy segment

reported positive income from operations during the comparable

period for the prior quarter. However, we recognize that the next

few quarters may present fluctuations in our results, due to

variables such as Bitcoin volatility and difficulty as well as the

dynamic, evolving artificial intelligence (“AI”) industry,

which we anticipate will significantly impact our future

operations.”

Further emphasizing its commitment to technological advancement,

Sentinum has made substantial investments in its Michigan data

center (the “MI Facility”), aiming to extract the maximum

possible value from the growing AI industry. This state-of-the-art

facility spans 34.5 acres with 617,000 square feet, including 14

acres under roof, and boasts a current capacity of approximately 30

megawatts (“MWs”) of power. However, the MI Facility has the

opportunity to expand to 300 MW, subject to the Company’s receipt

of necessary approvals and adequate funding, which it may or may

not obtain. The Company expects the MI Facility to dramatically

enhance sales and profitability. Sentinum is seeking to enter into

long-term leases with AI tenants for the MI Facility, which will be

expected to range between seven and ten years, positioning this

center to be a long-term major growth engine for the Company.

Ault Alliance is strategically positioning itself to capitalize

on technological advancements in AI, with its Sentinum business

segment expected to be a key growth driver. “The AI revolution is

underway, and our investments in the MI Facility are positioning us

to be a significant player in this burgeoning industry,” added Mr.

Ault.

Ault Alliance is committed to minimizing equity issuance and

currently plans to finance the significant expansion of the MI

Facility primarily through debt. This strategy aligns with the

Company’s fiscal goals and supports the expanding AI industry,

ensuring capital efficiency and sustainable growth.

The Company also notes that its Fintech segment continues to

experience, and is expected to continue to experience, wide

fluctuations in its profitability as its positions are marked to

the market.

Reflecting on the strategic plan launched in 2017 to acquire

assets and grow the Company’s topline across multiple sectors, Mr.

Ault highlighted the long-term vision, “It has been a bumpy road,

but we remain steadfast in our mission to build on our core

businesses and capitalize on emerging opportunities. By the end of

2027, assuming that we leased the Michigan data center and the

power generated there were upgraded to 300 MW, we would expect

revenues to exceed $500 million with gross margins in excess of

50%. The Company expects the large majority of this growth to be

driven by Sentinum and its data center operations.”

For more information on Ault Alliance and its subsidiaries, Ault

Alliance recommends that stockholders, investors, and any other

interested parties read Ault Alliance’s public filings and press

releases available under the Investor Relations section at

www.Ault.com or available at www.sec.gov.

About Ault Alliance, Inc.

Ault Alliance, Inc. is a diversified holding company pursuing

growth by acquiring undervalued businesses and disruptive

technologies with a global impact. Through its wholly and

majority-owned subsidiaries and strategic investments, Ault

Alliance owns and operates a data center at which it mines Bitcoin

and offers colocation and hosting services for the emerging

artificial intelligence ecosystems and other industries, and

provides mission-critical products that support a diverse range of

industries, including metaverse platform, oil exploration, crane

services, defense/aerospace, industrial, automotive,

medical/biopharma, hotel operations and textiles. In addition, Ault

Alliance extends credit to select entrepreneurial businesses

through a licensed lending subsidiary. Ault Alliance’s headquarters

are located at 11411 Southern Highlands Parkway, Suite 240, Las

Vegas, NV 89141; www.Ault.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements generally include

statements that are predictive in nature and depend upon or refer

to future events or conditions, and include words such as

“believes,” “plans,” “anticipates,” “projects,” “estimates,”

“expects,” “intends,” “strategy,” “future,” “opportunity,” “may,”

“will,” “should,” “could,” “potential,” or similar expressions.

Statements that are not historical facts are forward-looking

statements. Forward-looking statements are based on current beliefs

and assumptions that are subject to risks and uncertainties.

Forward-looking statements speak only as of the date they are

made, and the Company undertakes no obligation to update any of

them publicly in light of new information or future events. Actual

results could differ materially from those contained in any

forward-looking statement as a result of various factors. More

information, including potential risk factors, that could affect

the Company’s business and financial results are included in the

Company’s filings with the U.S. Securities and Exchange Commission,

including, but not limited to, the Company’s Forms 10-K, 10-Q and

8- K. All filings are available at www.sec.gov and on the Company’s

website at www.Ault.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240521220491/en/

Ault Alliance Investor Contact: IR@Ault.com or

1-888-753-2235

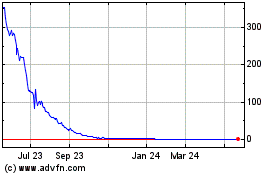

Ault Alliance (AMEX:AULT)

Historical Stock Chart

From Oct 2024 to Nov 2024

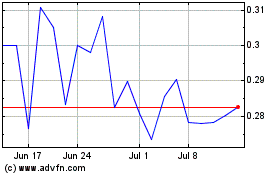

Ault Alliance (AMEX:AULT)

Historical Stock Chart

From Nov 2023 to Nov 2024