DESCRIPTION OF DEBT SECURITIES

We may issue debt securities, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. While the terms we have summarized below will apply generally to any future debt securities we may offer under this prospectus, the applicable prospectus supplement or free writing prospectus will describe the specific terms of any debt securities offered through that prospectus supplement or free writing prospectus. The terms of any debt securities we offer under a prospectus supplement or free writing prospectus may differ from the terms we describe below. Unless the context requires otherwise, whenever we refer to the “indentures,” we are also referring to any supplemental indentures that specify the terms of a particular series of debt securities.

We will issue any senior debt securities under the senior indenture that we will enter into with the trustee named in the senior indenture. We will issue any subordinated debt securities under the subordinated indenture that we will enter into with the trustee named in the subordinated indenture. We have filed forms of these documents as exhibits to the registration statement, of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the SEC.

The indentures will be qualified under the Trust Indenture Act of 1939, as amended, or the Trust Indenture Act. We use the term “trustee” to refer to either the trustee under the senior indenture or the trustee under the subordinated indenture, as applicable.

The following summaries of material provisions of the senior debt securities, the subordinated debt securities and the indentures are subject to, and qualified in their entirety by reference to, all of the provisions of the indenture applicable to a particular series of debt securities. We urge you to read the applicable prospectus supplement or free writing prospectus and any related free writing prospectuses related to the debt securities that we may offer under this prospectus, as well as the complete applicable indenture that contains the terms of the debt securities. Except as we may otherwise indicate, the terms of the senior indenture and the subordinated indenture are identical.

General

We will describe in the applicable prospectus supplement or free writing prospectus the terms of the series of debt securities being offered, including:

|

|

·

|

|

the principal amount being offered, and if a series, the total amount authorized and the total amount outstanding;

|

|

|

·

|

|

any limit on the amount that may be issued;

|

|

|

·

|

|

whether or not we will issue the series of debt securities in global form, and, if so, the terms and who the depository will be;

|

|

|

·

|

|

whether and under what circumstances, if any, we will pay additional amounts on any debt securities held by a person who is not a United States person for tax purposes, and whether we can redeem the debt securities if we have to pay such additional amounts;

|

|

|

·

|

|

the annual interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the dates interest will be payable and the regular record dates for interest payment dates or the method for determining such dates;

|

|

|

·

|

|

whether or not the debt securities will be secured or unsecured, and the terms of any secured debt;

|

|

|

·

|

|

the terms of the subordination of any series of subordinated debt;

|

|

|

·

|

|

the place where payments will be payable;

|

|

|

·

|

|

restrictions on transfer, sale or other assignment, if any;

|

|

|

·

|

|

our right, if any, to defer payment of interest and the maximum length of any such deferral period;

|

|

|

·

|

|

the date, if any, after which, the conditions upon which, and the price at which, we may, at our option, redeem the series of debt securities pursuant to any optional or provisional redemption provisions and the terms of those redemption provisions;

|

|

|

·

|

|

the date, if any, on which, and the price at which we are obligated, pursuant to any mandatory sinking fund or analogous fund provisions or otherwise, to redeem, or at the holder’s option, to purchase, the series of debt securities and the currency or currency unit in which the debt securities are payable;

|

|

|

·

|

|

whether the indenture will restrict our ability or the ability of our subsidiaries, if any at such time, to:

|

|

|

·

|

|

incur additional indebtedness;

|

|

|

·

|

|

issue additional securities;

|

|

|

·

|

|

pay dividends or make distributions in respect of our capital stock or the capital stock of our subsidiaries;

|

|

|

·

|

|

place restrictions on our subsidiaries’ ability to pay dividends, make distributions or transfer assets;

|

|

|

·

|

|

make investments or other restricted payments;

|

|

|

·

|

|

sell or otherwise dispose of assets;

|

|

|

·

|

|

enter into sale-leaseback transactions;

|

|

|

·

|

|

engage in transactions with stockholders or affiliates;

|

|

|

·

|

|

issue or sell stock of our subsidiaries; or

|

|

|

·

|

|

effect a consolidation or merger;

|

|

|

·

|

|

whether the indenture will require us to maintain any interest coverage, fixed charge, cash flow-based, asset-based or other financial ratios;

|

|

|

·

|

|

a discussion of certain material or special United States federal income tax considerations applicable to the debt securities;

|

|

|

·

|

|

information describing any book-entry features;

|

|

|

·

|

|

provisions for a sinking fund purchase or other analogous fund, if any;

|

|

|

·

|

|

the applicability of the provisions in the indenture on discharge;

|

|

|

·

|

|

whether the debt securities are to be offered at a price such that they will be deemed to be offered at an “original issue discount” as defined in paragraph (a) of Section 1273 of the Internal Revenue Code of 1986, as amended;

|

|

|

·

|

|

the denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple thereof;

|

|

|

·

|

|

the currency of payment of debt securities if other than U.S. dollars and the manner of determining the equivalent amount in U.S. dollars; and

|

|

|

·

|

|

any other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities, including any additional events of default or covenants provided with respect to the debt securities, and any terms that may be required by us or advisable under applicable laws or regulations or advisable in connection with the marketing of the debt securities.

|

Conversion or Exchange Rights

We will set forth in the applicable prospectus supplement or free writing prospectus the terms on which a series of debt securities may be convertible into or exchangeable for our common stock, our preferred stock or other securities (including securities of a third-party). We will include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which the number of shares of our common stock, our preferred stock or other securities (including securities of a third-party) that the holders of the series of debt securities receive would be subject to adjustment.

Consolidation, Merger or Sale

Unless we provide otherwise in the prospectus supplement or free writing prospectus applicable to a particular series of debt securities, the indentures will not contain any covenant that restricts our ability to merge or consolidate, or sell, convey, transfer or otherwise dispose of all or substantially all of our assets. However, any successor to or acquirer of such assets must assume all of our obligations under the indentures or the debt securities, as appropriate. If the debt securities are convertible into or exchangeable for other securities of ours or securities of other entities, the person with whom we consolidate or merge or to whom we sell all of our property must make provisions for the conversion of the debt securities into securities that the holders of the debt securities would have received if they had converted the debt securities before the consolidation, merger or sale.

Events of Default Under the Indenture

Unless we provide otherwise in the prospectus supplement or free writing prospectus applicable to a particular series of debt securities, the following are events of default under the indentures with respect to any series of debt securities that we may issue:

|

|

·

|

|

if we fail to pay interest when due and payable and our failure continues for 90 days and the time for payment has not been extended;

|

|

|

·

|

|

if we fail to pay the principal, premium or sinking fund payment, if any, when due and payable at maturity, upon redemption or repurchase or otherwise, and the time for payment has not been extended;

|

|

|

·

|

|

if we fail to observe or perform any other covenant contained in the debt securities or the indentures, other than a covenant specifically relating to another series of debt securities, and our failure continues for

|

|

90 days after we receive notice from the trustee or holders of at least 25% in aggregate principal amount of the outstanding debt securities of the applicable series; and

|

|

|

·

|

|

if specified events of bankruptcy, insolvency or reorganization occur.

|

We will describe in each applicable prospectus supplement or free writing prospectus any additional events of default relating to the relevant series of debt securities.

If an event of default with respect to debt securities of any series occurs and is continuing, other than an event of default specified in the last bullet point above, the trustee or the holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series, by notice to us in writing, and to the trustee if notice is given by such holders, may declare the unpaid principal, premium, if any, and accrued interest, if any, due and payable immediately. If an event of default specified in the last bullet point above occurs with respect to us, the unpaid principal, premium, if any, and accrued interest, if any, of each issue of debt securities then outstanding shall be due and payable without any notice or other action on the part of the trustee or any holder.

The holders of a majority in principal amount of the outstanding debt securities of an affected series may waive any default or event of default with respect to the series and its consequences, except defaults or events of default regarding payment of principal, premium, if any, or interest, unless we have cured the default or event of default in accordance with the indenture. Any waiver shall cure the default or event of default.

Subject to the terms of the indentures, if an event of default under an indenture shall occur and be continuing, the trustee will be under no obligation to exercise any of its rights or powers under such indenture at the request or direction of any of the holders of the applicable series of debt securities, unless such holders have offered the trustee reasonable indemnity or security satisfactory to it against any loss, liability or expense. The holders of a majority in principal amount of the outstanding debt securities of any series will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or power conferred on the trustee, with respect to the debt securities of that series, provided that:

|

|

·

|

|

the direction so given by the holder is not in conflict with any law or the applicable indenture; and

|

|

|

·

|

|

subject to its duties under the Trust Indenture Act, the trustee need not take any action that might involve it in personal liability or might be unduly prejudicial to the holders not involved in the proceeding.

|

A holder of the debt securities of any series will have the right to institute a proceeding under the indentures or to appoint a receiver or trustee, or to seek other remedies if:

|

|

·

|

|

the holder has given written notice to the trustee of a continuing event of default with respect to that series;

|

|

|

·

|

|

the holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series have made written request, and such holders have offered reasonable indemnity to the trustee or security satisfactory to it against any loss, liability or expense or to be incurred in compliance with instituting the proceeding as trustee; and

|

|

|

·

|

|

the trustee does not institute the proceeding, and does not receive from the holders of a majority in aggregate principal amount of the outstanding debt securities of that series other conflicting directions within 90 days after the notice, request and offer.

|

These limitations do not apply to a suit instituted by a holder of debt securities if we default in the payment of the principal, premium, if any, or interest on, the debt securities, or other defaults that may be specified in the applicable prospectus supplement or free writing prospectus.

We will periodically file statements with the trustee regarding our compliance with specified covenants in the indentures.

Modification of Indenture; Waiver

Subject to the terms of the indenture for any series of debt securities that we may issue, we and the trustee may change an indenture without the consent of any holders with respect to the following specific matters:

|

|

·

|

|

to fix any ambiguity, defect or inconsistency in the indenture;

|

|

|

·

|

|

to comply with the provisions described above under “—Consolidation, Merger or Sale;”

|

|

|

·

|

|

to comply with any requirements of the SEC in connection with the qualification of any indenture under the Trust Indenture Act;

|

|

|

·

|

|

to add to, delete from or revise the conditions, limitations, and restrictions on the authorized amount, terms, or purposes of issue, authentication and delivery of debt securities, as set forth in the indenture;

|

|

|

·

|

|

to provide for the issuance of and establish the form and terms and conditions of the debt securities of any series as provided under “Description of Our Debt Securities—General,” to establish the form of any certifications required to be furnished pursuant to the terms of the indenture or any series of debt securities, or to add to the rights of the holders of any series of debt securities;

|

|

|

·

|

|

to evidence and provide for the acceptance of appointment hereunder by a successor trustee;

|

|

|

·

|

|

to provide for uncertificated debt securities and to make all appropriate changes for such purpose;

|

|

|

·

|

|

to add to our covenants such new covenants, restrictions, conditions or provisions for the benefit of the holders, to make the occurrence, or the occurrence and the continuance, of a default in any such additional covenants, restrictions, conditions or provisions an event of default or to surrender any right or power conferred to us in the indenture; or

|

|

|

·

|

|

to change anything that does not materially adversely affect the interests of any holder of debt securities of any series.

|

In addition, under the indentures, the rights of holders of a series of debt securities may be changed by us and the trustee with the written consent of the holders of at least a majority in aggregate principal amount of the outstanding debt securities of each series that is affected. However, subject to the terms of the indenture for any series of debt securities that we may issue or as otherwise provided in the prospectus supplement or free writing prospectus applicable to a particular series of debt securities, we and the trustee may make the following changes only with the consent of each holder of any outstanding debt securities affected:

|

|

·

|

|

extending the stated maturity of the series of debt securities;

|

|

|

·

|

|

reducing the principal amount, reducing the rate of or extending the time of payment of interest or reducing any premium payable upon the redemption or repurchase of any debt securities; or

|

|

|

·

|

|

reducing the percentage of debt securities, the holders of which are required to consent to any amendment, supplement, modification or waiver.

|

Discharge

Each indenture provides that, subject to the terms of the indenture and any limitation otherwise provided in the prospectus supplement or free writing prospectus applicable to a particular series of debt securities, we can elect to be discharged from our obligations with respect to one or more series of debt securities, except for specified obligations, including obligations to:

|

|

·

|

|

register the transfer or exchange of debt securities of the series;

|

|

|

·

|

|

replace stolen, lost or mutilated debt securities of the series;

|

|

|

·

|

|

maintain paying agencies;

|

|

|

·

|

|

hold monies for payment in trust;

|

|

|

·

|

|

recover excess money held by the trustee;

|

|

|

·

|

|

compensate and indemnify the trustee; and

|

|

|

·

|

|

appoint any successor trustee.

|

In order to exercise our rights to be discharged, we must deposit with the trustee money or government obligations sufficient to pay all the principal of, any premium and interest on, the debt securities of the series on the dates payments are due.

Form, Exchange and Transfer

We will issue the debt securities of each series only in fully registered form without coupons and, unless we otherwise specify in the applicable prospectus supplement or free writing prospectus, in denominations of $1,000 and any integral multiple thereof. The indentures provide that we may issue debt securities of a series in temporary or permanent global form and as book-entry securities that will be deposited with, or on behalf of, The Depository Trust Company or another depository named by us and identified in a prospectus supplement or free writing prospectus with respect to that series.

At the option of the holder, subject to the terms of the indentures and the limitations applicable to global securities described in the applicable prospectus supplement or free writing prospectus, the holder of the debt securities of any series can exchange the debt securities for other debt securities of the same series, in any authorized denomination and of like tenor and aggregate principal amount.

Subject to the terms of the indentures and the limitations applicable to global securities set forth in the applicable prospectus supplement or free writing prospectus, holders of the debt securities may present the debt securities for exchange or for registration of transfer, duly endorsed or with the form of transfer endorsed thereon duly executed if so required by us or the security registrar, at the office of the security registrar or at the office of any transfer agent designated by us for this purpose. Unless otherwise provided in the debt securities that the holder presents for transfer or exchange, we will make no service charge for any registration of transfer or exchange, but we may require payment of any taxes or other governmental charges.

We will name in the applicable prospectus supplement or free writing prospectus the security registrar, and any transfer agent in addition to the security registrar, that we initially designate for any debt securities. We may at any time designate additional transfer agents or rescind the designation of any transfer agent or approve a change in the office through which any transfer agent acts, except that we will be required to maintain a transfer agent in each place of

payment for the debt securities of each series. If we elect to redeem the debt securities of any series, we will not be required to:

|

|

·

|

|

issue, register the transfer of, or exchange any debt securities of that series during a period beginning at the opening of business 15 days before the day of mailing of a notice of redemption of any debt securities that may be selected for redemption and ending at the close of business on the day of the mailing; or

|

|

|

·

|

|

register the transfer of or exchange any debt securities so selected for redemption, in whole or in part, except the unredeemed portion of any debt securities we are redeeming in part.

|

Information Concerning the Trustee

The trustee, other than during the occurrence and continuance of an event of default under an indenture, undertakes to perform only those duties as are specifically set forth in the applicable indenture. Upon an event of default under an indenture, the trustee must use the same degree of care as a prudent person would exercise or use in the conduct of his or her own affairs.

Subject to this provision, the trustee is under no obligation to exercise any of the powers given it by the indentures at the request of any holder of debt securities unless it is offered reasonable security and indemnity against the costs, expenses and liabilities that it might incur.

Payment and Paying Agents

Unless we otherwise indicate in the applicable prospectus supplement or free writing prospectus, we will make payment of the interest on any debt securities on any interest payment date to the person in whose name the debt securities, or one or more predecessor securities, are registered at the close of business on the regular record date for the interest.

We will pay principal of and any premium and interest on the debt securities of a particular series at the office of the paying agents designated by us, except that unless we otherwise indicate in the applicable prospectus supplement or free writing prospectus, we will make interest payments by check that we will mail to the holder or by wire transfer to certain holders. Unless we otherwise indicate in the applicable prospectus supplement or free writing prospectus, we will designate the corporate trust office of the trustee as our sole paying agent for payments with respect to debt securities of each series. We will name in the applicable prospectus supplement or free writing prospectus any other paying agents that we initially designate for the debt securities of a particular series. We will maintain a paying agent in each place of payment for the debt securities of a particular series.

All money we pay to a paying agent or the trustee for the payment of the principal of or any premium or interest on any debt securities that remains unclaimed at the end of two years after such principal, premium or interest has become due and payable will be repaid to us, and the holder of the debt security thereafter may look only to us for payment thereof.

Governing Law

The indentures and the debt securities will be governed by and construed in accordance with the laws of the State of New York, except to the extent that the Trust Indenture Act is applicable.

Ranking of Debt Securities

The subordinated debt securities will be subordinate and junior in priority of payment to certain of our other indebtedness to the extent described in a prospectus supplement or free writing prospectus. The subordinated indenture does not limit the amount of subordinated debt securities that we may issue. It also does not limit us from issuing any other secured or unsecured debt.

The senior debt securities will rank equally in right of payment to all our other senior unsecured debt. The senior indenture does not limit the amount of senior debt securities that we may issue. It also does not limit us from issuing any other secured or unsecured debt.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of common stock in one or more series. We may issue warrants independently or together with common stock, and the warrants may be attached to or separate from these securities. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the particular terms of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may differ from the terms described below.

We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of warrant agreement, including a form of warrant certificate, that describes the terms of the particular series of warrants we are offering before the issuance of the related series of warrants. The following summaries of material provisions of the warrants and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement and warrant certificate applicable to the particular series of warrants that we may offer under this prospectus. We urge you to read the applicable prospectus supplements related to the particular series of warrants that we may offer under this prospectus, as well as any related free writing prospectuses, and the complete warrant agreements and warrant certificates that contain the terms of the warrants.

General

We will describe in the applicable prospectus supplement the terms of the series of warrants being offered, including:

|

|

·

|

|

the offering price and aggregate number of warrants offered;

|

|

|

·

|

|

the currency for which the warrants may be purchased;

|

|

|

·

|

|

if applicable, the designation and terms of the securities with which the warrants are issued, and the number of warrants issued with each such security or each principal amount of such security;

|

|

|

·

|

|

if applicable, the date on and after which the warrants and the related securities will be separately transferable;

|

|

|

·

|

|

the number of shares of common stock purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise;

|

|

|

·

|

|

the effect of any merger, consolidation, sale or other disposition of our business on the warrant agreements and the warrants;

|

|

|

·

|

|

the terms of any rights to redeem or call the warrants;

|

|

|

·

|

|

any provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants;

|

|

|

·

|

|

the dates on which the right to exercise the warrants will commence and expire;

|

|

|

·

|

|

the manner in which the warrant agreements and warrants may be modified;

|

|

|

·

|

|

a discussion of any material or special United States federal income tax consequences of holding or exercising the warrants;

|

|

|

·

|

|

the terms of the securities issuable upon exercise of the warrants; and

|

|

|

·

|

|

any other specific terms, preferences, rights or limitations of or restrictions on the warrants.

|

Before exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise, including the right to receive dividends, if any, or, payments upon our liquidation, dissolution or winding up or to exercise voting rights, if any.

Exercise of Warrants

Each warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement, holders of the warrants may exercise the warrants at any time up to the specified time on the expiration date that we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Holders of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with specified information, and paying the required amount to the warrant agent in immediately available funds, as provided in the applicable prospectus supplement. We will set forth on the reverse side of the warrant certificate and in the applicable prospectus supplement the information that the holder of the warrant will be required to deliver to the warrant agent.

Upon receipt of the required payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement, we will issue and deliver the securities purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised, then we will issue a new warrant certificate for the remaining amount of warrants. If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise price for warrants.

Governing Law

Unless we provide otherwise in the applicable prospectus supplement, the warrants and warrant agreements will be governed by and construed in accordance with the laws of the State of New York.

Enforceability of Rights by Holders of Warrants

Each warrant agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship of agency or trust with any holder of any warrant. A single bank or trust company may act as warrant agent for more than one issue of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant agreement or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate legal action its right to exercise, and receive the securities purchasable upon exercise of, its warrants.

DESCRIPTION OF UNITS

We may issue, in one or more series, units consisting of common stock and/or warrants for the purchase of common stock in any combination. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each included

security. The units may be issued under unit agreements to be entered into between us and a unit agent, as detailed in the prospectus supplement relating to the units being offered. The prospectus supplement will describe:

|

|

·

|

|

the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances the securities comprising the units may be held or transferred separately;

|

|

|

·

|

|

a description of the terms of any unit agreement governing the units;

|

|

|

·

|

|

a description of the provisions for the payment, settlement, transfer or exchange of the units; and

|

|

|

·

|

|

whether the units if issued as a separate security will be issued in fully registered or global form.

|

While the terms summarized above will apply generally to any units that we may offer, we will describe the particular terms of any series of units in more detail in the applicable prospectus supplement. The terms of any units offered under a prospectus supplement may differ from the terms described above. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, any form of unit agreement, including any related agreements or certificates, that describes the terms of the particular series of units we are offering before the issuance of the related series of units. The material provisions of the units and any unit agreements are subject to, and qualified in their entirety by reference to, all the provisions of the unit agreement and related agreements and certificates applicable to the particular series of units that we may offer under this prospectus. We urge you to read the applicable prospectus supplements related to the particular series of units that we may offer under this prospectus, as well as any related free writing prospectuses, and the complete unit agreements and related agreements and certificates that contain the terms of the units.

LEGAL MATTERS

Certain legal matters with respect to the validity of the issuance of the securities offered hereby will be passed upon by our counsel, Squire Patton Boggs (US) LLP.

EXPERTS

The audited financial statements for the fiscal year ended December 31, 2018 incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the report of Plante & Moran PLLC, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

The 2019 financial statements appearing in the Annual Report on Form 10-K of Ampio Pharmaceuticals, Inc. for the year ended December 31, 2019, and the effectiveness of internal control over financial reporting as of December 31, 2019, of Ampio Pharmaceuticals, Inc. have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in its report (which report expresses an unqualified opinion and includes explanatory paragraphs related to going concern uncertainty and the adoption of a new accounting standard), which are incorporated herein by reference. Such consolidated statements have been so incorporated in reliance upon the report of such firm and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet site that contains reports, proxy and information statement, and other information regarding issuers that file electronically with the SEC, which are available at the SEC’s website at http://www.sec.gov.

This prospectus is part of a registration statement on Form S‑3 that we have filed with the SEC under the Securities Act and therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration statement that are excluded from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other document.

You may inspect a copy of the registration statement, including the exhibits and schedules, without charge, at the public reference room or obtain a copy from the SEC upon payment of the fees prescribed by the SEC.

We also maintain a website at www.ampiopharma.com, through which you can access our SEC filings. The information set forth on our website is not part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with the SEC. This permits us to disclose important information to you by referring to these filed documents. Any information referred to in this way is considered part of this prospectus. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits, for further information about us and the securities we may offer pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete, and each statement is qualified in all respects by that reference. We incorporate by reference the following documents that have been filed with the SEC (other than information furnished under Item 2.02 or Item 7.01 of Form 8‑K and all exhibits related to such items):

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this prospectus modifies or replaces such information. We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8‑K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering of the securities made by this prospectus, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

We will provide, upon written or oral request, without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, a copy of any or all of the information incorporated herein by reference (exclusive of exhibits to such documents unless such exhibits are specifically incorporated by reference herein). You may request in writing or orally a copy of these filings, at no cost, by writing or telephoning us at the following address:

Ampio Pharmaceuticals, Inc.

373 Inverness Parkway, Suite 200

Englewood, Colorado 80112

(720) 437‑6500

Attn: Investor Relations

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

|

|

|

|

|

|

|

|

PROSPECTUS (Subject to Completion)

|

|

Dated [___], 2020

|

Up to $50,000,000

Common Stock

Ampio Pharmaceuticals, Inc.

________________________________________________________________

We have entered into a sales agreement (the “Sales Agreement”) with ThinkEquity, a division of Fordham Financial Management, Inc. (“ThinkEquity”) and Roth Capital Partners, LLC (“Roth,” and ThinkEquity collectively the “Sales Agents”) relating to shares of our common stock, $0.0001 par value per share, offered by this prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock from time to time up to an aggregate offering price of $50,000,000 through or to the Sales Agents, acting as sales agents or principals. Prior to the date of this Prospectus, $2.1 million of shares of our common stock were sold pursuant to the Sales Agreement. All of such shares of common stock were included in our prior registration statement on Form S-3 (Registration No. 333-217094).

Upon our delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, each Sales Agent may sell shares of the common stock by methods deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). The Sales Agents will use their commercially reasonable efforts consistent with their normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the New York Stock Exchange American market. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

We will pay the Sales Agents a total commission for their services in acting as agents in the sale of common stock equal to 4.0% of the gross sales price per share of all shares sold through them as agents under the Sales Agreement. See “Plan of Distribution” for information relating to certain expenses of the Sales Agents to be reimbursed by us.

In connection with the sale of common stock on our behalf, the Sales Agents will be deemed to be “underwriters” within the meaning of the Securities Act and the compensation to the Sales Agents will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to the Sales Agents with respect to certain liabilities, including liabilities under the Securities Act.

Our common stock is listed on the New York Stock Exchange American market under the symbol “AMPE.” The last sale price of our common stock on April 13, 2020, as reported by the New York Stock Exchange American market, was $0.50 per share.

We are a smaller reporting company under Rule 405 of the Securities Act and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus, the documents incorporated by reference herein and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus, as well as the information under the caption “Risk Factors” in our Annual Report on Form 10‑K for the year ended December 31, 2019 and in the other documents incorporated by reference into this prospectus for a discussion of the factors you should carefully consider before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

ThinkEquity

|

Roth Capital Partners

|

|

a division of Fordham Financial Management, Inc.

|

|

Prospectus dated , 2020.

ABOUT THIS PROSPECTUS

This prospectus is part of a shelf registration statement on Form S‑3 that we filed with the Securities and Exchange Commission, or SEC. Under the shelf registration process, we may offer shares of our common stock having an aggregate offering price of up to $50,000,000 from time to time under this prospectus at prices and on terms to be determined by market conditions at the time of the offering.

Before buying any shares of our common stock offered hereby, we urge you to carefully read this prospectus, together with the information incorporated herein by reference as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” These documents contain important information that you should consider when making your investment decision.

You should rely only on the information contained or incorporated herein by reference in this prospectus. We have not authorized any other person to provide you with any information that is different. If anyone provides you with different, additional or inconsistent information, you should not rely on it.

If the description of the offering varies between this prospectus and the documents incorporated by reference, you should rely on the information contained in this prospectus. However, if any statement in this prospectus is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference — the statement in the document having the later date modifies or supersedes the earlier statement.

We are offering to sell our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the securities in certain jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the prospectus was made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We obtained statistical data, market data and other industry data, and forecasts used in this prospectus and the documents incorporated by reference into the prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical data, market data and other industry data and forecasts used herein are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of the information.

All references in this prospectus to “Ampio,” “Ampio Pharmaceuticals Inc.,” the “Company,” “we,” “us,” “our” or similar references refer to Ampio Pharmaceuticals, Inc., except where the context otherwise requires or as otherwise indicated.

AMPIO (and design), our logo design and AMPION are our registered trademarks. This prospectus also contains trademarks, registered marks and trade names of other companies. Any other trademarks, registered marks and trade names appearing in this prospectus are the property of their respective holders.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in these documents contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. All statements other than statements of historical facts contained in this

prospectus, including statements regarding our anticipated future clinical and regulatory events, future financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. Forward looking statements are generally written in the future tense and/or are preceded by words such as “may,” “will,” “should,” “forecast,” “could,” “expect,” “suggest,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan” or similar words, or the negatives of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, without limitation, statements regarding the anticipated start dates, durations and completion dates, as well as the potential future results, of our current and future clinical trials, the designs of our current and future clinical trials, anticipated future regulatory submissions and events, regulatory responses or other actions in relation to our submissions, applications and proposals, the potential future commercialization of our product candidate, Ampion, our anticipated future cash position and future events under our current and potential future collaborations. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including without limitation the risks described in the “Risk Factors” section in this prospectus.

These risks are not exhaustive. Other sections of this prospectus include additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. We assume no obligation to update or supplement forward-looking statements.

All written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We caution investors not to rely too heavily on the forward-looking statements we make or that are made on our behalf. We undertake no obligation, and specifically decline any obligation, to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto appearing elsewhere or incorporated by reference in this prospectus. Before you decide to invest in our common stock, you should read the entire prospectus carefully, including the risk factors and the financial statements and related notes incorporated by reference in this prospectus.

About Ampio Pharmaceuticals, Inc.

Overview

We are a pre-revenue development stage biopharmaceutical company focused on the development of Ampion, our lead product candidate, to treat prevalent inflammatory conditions for which there are limited treatment options.

Ampion is in the process of advancing through late-stage clinical trials in the United States. The U.S. Food and Drug Administration (“FDA”) provided guidance that we should complete a trial of severe osteoarthritis of the knee (“OAK”) patients with concurrent controls that would be carried out under an Special Protocol Assessment (“SPA”). An SPA is a process in which sponsors may ask to meet with the FDA to reach agreement with the FDA on the design and size of certain clinical trials to determine if they adequately address scientific and regulatory requirements for a study that could support regulatory submission.

In June 2019, we received an SPA agreement from the FDA and commenced our Phase III clinical trial titled, “A Randomized, Controlled, Double-Blind Study to Evaluate the Efficacy and Safety of an Intra-Articular Injection of Ampion in Adults with Pain Due to Severe Osteoarthritis of the Knee” (the “AP‑013 study”).

In late March 2020, we announced the closing of patient enrollment in our AP-013 study at the recommendation of our SMC and due to extenuating circumstances relating to severe acute respiratory syndrome coronavirus 2 (“COVID-19”), which is further explained below, to minimize the risk to study participants. Recognizing these challenges, we are exploring options to enable us to complete the study, but it is possible that the COVID-19 pandemic may prevent completion of the AP-013 study at this time or completely.

In late March 2020, we also announced that we are concurrently focusing on investigating the potential use of nebulized Ampion for the treatment of a serious complication of COVID-19, the rapid onset of respiratory failure, termed Acute Respiratory Distress Syndrome (“ARDS”). Based on Ampion’s immunomodulatory and anti-inflammatory action, we believe that it may help individuals with widespread inflammation in the lungs and that treatment with Ampion may reduce this serious complication of COVID-19.

AMPION

Ampion for Osteoarthritis

We have developed a novel biologic drug, Ampion, containing a blood-derived cyclized peptide and small molecules that target multiple pathways in the innate immune response and other pathways that are characteristic of OAK disease. Ampion targets the cellular pathways in the innate immune response correlated with pain, inflammation, and joint damage in osteoarthritis. In vitro studies have shown that Ampion represses the transcription of proteins responsible for inflammation, while activating anti-inflammatory proteins. Ampion has also been shown in vitro to regulate the cellular pathways responsible for tissue growth and healing. We believe that this mechanism of action interrupts the disease process responsible for the pain and disability associated with OAK and provides market expansion potential as a disease modifying biologic and may provide a treatment option for other inflammatory and degenerative indications.

We are currently developing Ampion as an intra-articular injection to treat the signs and symptoms of severe OAK, which is a growing epidemic in the United States. OAK is a progressive disease characterized by gradual degradation and loss of cartilage due to inflammation of the soft tissue and bony structures of the knee joint. Progression of the most severe form of OAK leaves patients with little to no treatment options other than a total knee arthroplasty. The FDA has

stated that severe OAK is an “unmet medical need” with no licensed therapies for this indication. While we believe that Ampion could treat this “unmet medical need”, our ability to market this product is subject to FDA approval.

Market Opportunity for Osteoarthritis

Osteoarthritis (“OA”), is the most common form of arthritis, affecting over 30 million people in the United States. It is a progressive and incurable disease of the joints involving degradation of the intra-articular cartilage, joint lining, ligaments, and bone. Certain risk factors in conjunction with natural wear and tear lead to the breakdown of cartilage. Osteoarthritis is caused by inflammation of the soft tissue and bony structures of the joint, which worsens over time and leads to progressive thinning of intra-articular cartilage. Other progressive effects include narrowing of the joint space, synovial membrane thickening, osteophyte formation and increased density of the subchondral bone. The global market size for treatments that currently address moderate to moderately severe OAK was valued at approximately $3.6 billion in 2018 and is expected to grow with a compound annual growth rate of 9.11% through 2026. The global demand for OAK treatment is expected to be fueled by aging demographics and increased awareness of treatment options. Despite the size and growth of the OAK market, only a few treatment options currently exist, with none labeled specifically for the severely diseased patient population.

Ampion Development for Osteoarthritis

Since our inception, we have conducted multiple clinical trials and have advanced through late-stage clinical trials in the United States, initially under the guidance of the FDA’s Office of Blood Research and Review (“OBRR”) and most recently under the guidance of the FDA’s Office of Tissues and Advanced Therapies (“OTAT”).

Study AP‑003‑A was a multicenter, randomized, double-blind trial of 329 patients who were randomized 1:1 to receive Ampion or saline control via intra-articular injection. The study showed a statistically significant reduction in pain compared to the control, with an average of greater than 40% reduction in pain from baseline at 12 weeks with Ampion treatment. Patients who received Ampion also showed a significant improvement in function and quality of life compared to patients who received the saline control at 12 weeks. Quality of life was assessed using Patient Global Assessment. Furthermore, the trial included severely diseased patients, defined radiographically as Kellgren Lawrence Grade 4 (“KL 4”). From this patient population, those patients who received Ampion had a significantly greater reduction in pain than those who received the saline control. Ampion was well tolerated with minimal adverse events reported across the Ampion and saline groups in the study. There were no drug-related serious adverse events.

In 2018, the FDA reiterated and confirmed that our successful pivotal Phase III clinical trial, AP‑003‑A, was adequate and well-controlled, provided evidence of the effectiveness of Ampion and can contribute to the substantial evidence of effectiveness necessary for the approval of a BLA. The FDA provided guidance that we should complete an additional trial of KL 4 severe OAK patients with concurrent controls that would be carried out under a SPA so that we could obtain FDA concurrence on the trial design prior to initiation of the trial.

As noted above, we received a SPA agreement in June 2019 from the FDA for a clinical protocol for the AP‑013 study. The SPA agreement for the AP‑013 study finalized patient enrollment at 1,034 patients, with a sample size assessment at an interim analysis of 724 patients to allow an adjustment up to 1,551 patients if deemed necessary. In the SPA agreement, the FDA agreed that the design and planned analysis of the AP‑013 study adequately addressed the objectives necessary to support a regulatory submission. According to the FDA’s guidance for industry regarding SPAs (published in April 2018), an SPA documents the FDA’s agreement that the design and planned analysis of a study can address objectives in support of a regulatory submission, however final determinations for marketing application approval are made after a complete review of the marketing application and are based on the entire data in the application. Following the receipt of the SPA agreement, we initiated the AP‑013 study, identified and engaged clinical sites for the trial, and initiated dosing of patients at those sites. As of December 31, 2019, we completed the enrollment and dosing of 724 patients required from the interim analysis sample size assessment.

In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. The Centers for Disease Control and Prevention (“CDC”) projects that COVID-19 deaths in the U.S. may eventually number in the hundreds of thousands, and potentially in the millions. The AP-013 study population is comprised of elderly patients with an average

age of 65 years old and a maximum age of 87 years, and the CDC have indicated that older adults, 65 years and older, are at higher risk for severe illness during the current COVID-19 pandemic. This guidance from the CDC indicates the AP-013 study population is the highest risk demographic for developing severe illness during the current COVID-19 pandemic. In March 2020, the FDA acknowledged the impact of COVID-19 on clinical trials in a published guidance, “FDA Guidance on Conduct of Clinical Trials of Medical Products during the COVID-19 Pandemic”, which outlines the Agency’s recommendations for ensuring trial participant safety and adherence to good clinical practice (“GCP”) guidelines and protocol requirements for trials during the outbreak. In concurrence with the FDA guidance, the Safety Monitoring Committee (“SMC”) for the AP-013 study recognized the impact of COVID-19 on the clinical trial. Therefore, in late March 2020, we announced the closing of patient enrollment in our AP-013 study at the recommendation of our SMC and due to extenuating circumstances relating to COVID-19 virus to minimize the risk to study participants. Recognizing these challenges, we are exploring options to enable us to complete the trial, but it is possible that the COVID-19 pandemic may prevent completion of the AP-013 study at this time or at all.

Ampion for Acute Respiratory Distress Syndrome secondary to COVID-19 infection

At the time of this filing, the pandemic has resulted in over 2 million cases and approximately 140,000 deaths worldwide that continues to grow exponentially, demonstrating the urgency of situation. COVID-19 infection is an acute respiratory illness caused by a novel coronavirus (SARS-COV-2). The CDC has estimated that approximately 20% of patients with COVID-19 will progress to severe disease. Complications of severe COVID-19 infection include ARDS, pneumonia, sepsis and septic shock, cardiomyopathy and arrhythmia, acute kidney injury, and prolonged hospitalization for other complications (e.g. secondary bacterial infection). The primary cause of death associated with COVID-19 infection is ARDS, and, as of the date of this filing, there are no approved treatments for ARDS or COVID-19 infection.

An article published in peer-reviewed journal, The Journal of the American Medical Association (“JAMA”), by Bellani et al. in February 2016 titled, ‘Epidemiology, Patterns of Care, and Mortality for Patients With Acute Respiratory Distress Syndrome in Intensive Care Units in 50 Countries’, indicates that under normal circumstances, there is approximately a 40% mortality rate for patients with ARDS. COVID-19 is newly emerging, and there is little published research on mortality in this subset of patients; however, we believe that ARDS secondary to COVID-19 infection may prove to be more lethal than ARDS due to other causes. A study of 191 patients in Wuhan, China reported that 50 of the 54 patients with COVID-19 who died during their hospitalization developed ARDS, while only nine of the 137 survivors developed ARDS. This study, published in The Lancet by Zhou et al. in March 2020 demonstrates an 85% (50/59) case mortality rate of ARDS secondary to COVID-19 infection, which is more than double the mortality rate observed without COVID-19 infection.

During the pandemic, the CDC reports that as many as 20,000 new COVID-19 cases have been reported daily in the US, and the daily reported cases continue to grow exponentially. The CDC has reported that among all patients with a COVID-19 infection, between 3%-17% develop ARDS, but that percentage increases to 67%-85% for patients admitted to an intensive care unit (“ICU”). An article published in The New England Journal of Medicine in March 2020 states that based on the size and scope of COVID-19 pandemic, the disease burden on healthcare facilities and hospitals is expected to be severe, and estimates of material requirements for the treatment of COVID-19 patients indicate the US is likely to experience widespread shortages of critical standard of care items such as ventilators throughout much of 2020. We believe that it is imperative that effective treatments are identified and developed to address the full spectrum of clinical features of ARDS secondary to COVID-19 infection. For instance, it has been reported that treatments that reduce required time on ventilation would free up equipment and staff resources and allow additional COVID-19 infected patients access to critical and potentially life-saving care. As an immunomodulatory agent, we believe that Ampion may be effective in improving the clinical course and outcome of COVID-19 patients experiencing ARDS.

Market Opportunity for ARDS

ARDS secondary to COVID-19 infection is a life-threatening disease for which no FDA-approved treatment exists as of the date of this filing. Current available treatment is limited to supportive interventions designed to improve ventilation and mitigate hypoxemia. Alternative/off-label treatments for COVID-19 include antiviral agents and convalescent plasma infusion. Alternative/off-label treatments often considered for ARDS include corticosteroids and neuromuscular blocking agents. We believe that identifying a treatment for ARDS that could improve the clinical course of ARDS,

including but not limited to, gas exchange ratios, reduction of time on ventilators, and shortening the duration of the condition would greatly benefit this patient population and may help reduce overall mortality due to ARDS secondary to COVID-19.

Ampion Development for ARDS

As reported in The Lancet in February 2020 by Huang et al., patients with coronavirus infection, including COVID-19, present symptoms which are primarily fever, fatigue, and dry cough. In some cases, the disease progresses to severe illness, dyspnea, and hypoxemia within one week after onset of the disease. These patients with severe illness develop ARDS requiring intensive care, oxygen therapy, and ventilation. ARDS is an inflammatory process, and when secondary to COVID-19, the inflammatory response is exaggerated after being triggered by the initial viral infection.

During ARDS, including ARDS secondary to COVID-19, the activation of the innate immune system leads to a dysregulated or ‘hyper-inflammatory’ response, resulting in the excess release of innate pro-inflammatory cytokines by alveolar macrophages and neutrophils as part of a “cytokine storm”. In humans, the severity of ARDS is closely related to increased serum levels of pro-inflammatory cytokines accompanied by a corresponding decrease in anti-inflammatory cytokines. These findings have been published in Cell Host and Microbe in February 2016 by Channappanavar et al. and in The International Journal of Clinical and Experimental Pathology in January 2017 by Yang et al.

Ampion is in development as a novel biologic drug that regulates multiple therapeutic targets in the innate immune system responsible for the inflammation, tissue damage, and pathogenesis associated with dysregulated immune disorders, such as ARDS. Development of Ampion supports a mechanism of action as an immunological agent which decreases the production of physiological mediators (e.g., cytokines and chemokines) responsible for inflammation and tissue damage, while simultaneously promoting the production of those mediators required for resolving inflammation and tissue repair. One of the most common and problematic clinical features of ARDS is pulmonary edema, which causes hypoxemia and may result in death. Cellular models treated with Ampion indicate treatment enhances microvascular barrier function in the lung to protect this facet of ARDS. Ampio is currently working with the FDA to receive authorization to develop Ampion as a potential treatment for ARDS secondary to COVID-19 infection.

Ampion Manufacturing Facility

In May 2014, we commenced a 125‑month lease of a multi-purpose facility containing approximately 19,000 square feet. This facility includes quality control and research laboratories, our corporate offices and approximately 3,000 square feet of modular clean rooms to manufacture Ampion.

Since the manufacturing site has been operational, we have implemented a quality system for both U.S. and E.U. (“European Union”) regulatory compliance, validated the facility for human-use products, produced Ampion and placebo for use in the inception-to-date clinical trials, and produced approximately 200,000 vials of Ampion without a sterility failure.

The manufacturing facility utilizes automated equipment with single use line sets and modular clean rooms designed to maximize flexibility and scalability while meeting international quality standards to fulfill potential future global demand. We believe that the Ampion manufacturing process delivers a competitive cost of goods that is significantly lower than the industry benchmark. Additionally, we estimate that the maximum capacity for this turnkey facility is approximately 8.0 million vials per year. During fiscal 2019, we engaged an independent third-party to conduct a quality audit of the Ampion manufacturing facility, which confirmed that our facility is expected to meet the requirements of an FDA inspection for the CMC section of a BLA filing.

Corporate Information

We are a Delaware corporation. Our principal offices are located at 373 Inverness Parkway, Suite 200, Englewood, Colorado 80112, and our telephone number is (720) 437‑6500. Our website address is www.ampiopharma.com. Our website and the information contained on, or that can be accessed through, our website shall not be deemed to be

incorporated by reference in, and are not considered part of, this prospectus and our reference to the URL for our website is intended to be an inactive textual reference only. You should not rely on any such information in making your decision whether to purchase our common stock.

THE OFFERING

The following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus.

|

|

|

|

|

|

|

|

|

Common stock offered by us

|

|

Shares of our common stock having an aggregate offering price of up to $50,000,000.

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

Up to 96,630,244 shares, assuming sales at a price of $0.50 per share, which was the closing price of our common stock on the New York Stock Exchange American market on April 13, 2020. The actual number of shares issued, if any, will vary depending on the sales price under this offering.

|

|

|

|

|

|

Plan of Distribution

|

|

“At the market offering” that may be made from time to time through or to the Sales Agents, as sales agents or principals. See the section titled “Plan of Distribution.”

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for working capital and other general corporate purposes. See the section titled “Use of Proceeds.”

|

|

|

|

|

|

Risk Factors

|

|

You should read the “Risk Factors” section of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of factors to consider before deciding to purchase shares of our common stock.

|

|

|

|

|

|

The New York Stock Exchange American symbol

|

|

AMPE

|

The number of shares of common stock that will be outstanding immediately after this offering as shown above is based on 162,950,231 shares of common stock outstanding as of April 13, 2020, and excludes, in each case as of April 13, 2020:

|

|

·

|

|

7,116,524 shares of our common stock issuable upon the exercise of outstanding warrants;

|

|

|

·

|

|

6,239,832 shares of our common stock issuable upon the exercise of outstanding options under the 2010 Stock and Incentive Plan (the “2010 Plan”) and the 2019 Stock and Incentive Plan (the “2019 Plan”), collectively; and

|

|

|

·

|

|

9,516,500 shares of our common stock reserved for issuance under the 2019 Plan.

|

Unless otherwise indicated, all information in this prospectus assumes no conversion of preferred stock, exercise of the outstanding options or warrants or settlement of outstanding restricted stock units, described above.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 10‑K, as such risks may be amended, updated or modified periodically in our reports filed with the SEC, and all of the other information contained in this prospectus, and incorporated by reference into this prospectus, including our financial statements and related notes, before investing in our common stock. If any of the possible adverse events described below or in those sections actually occur, our business, business prospects, cash flow, results of operations or financial condition could be harmed, the trading price of our common stock could decline, and you might lose all or part of your investment in our common stock. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our operations and results.

Risks Related to This Offering and Our Common Stock

An active trading market for our common stock may not develop or be sustained and investors may not be able to resell their shares at or above the price at which they purchased them.

An active trading market for our shares may never develop or be sustained. In the absence of an active trading market for our common stock, investors may not be able to sell their common stock at or above the price they paid or at the time that they would like to sell. In addition, an inactive market may impair our ability to raise capital by selling shares and may impair our ability to acquire other companies or technologies by using our shares as consideration, which, in turn, could harm our business.

The trading price of the shares of our common stock has been and is likely to continue to be highly volatile, and purchasers of our common stock could incur substantial losses.

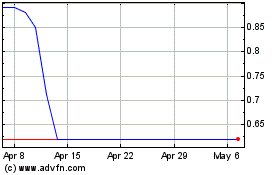

Our stock price has been and will likely continue to be volatile for the foreseeable future. The stock market in general and the market for biotechnology companies in particular have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. In addition, recently the stock market has on an overall basis dropped and the price of our stock has lessened along with it, moving from a high of $0.74 per share on January 23, 2020 to a low of $0.36 per share on March 25, 2020 due to the continued worldwide spread of COVID-19. As a result of this volatility, investors may not be able to sell their common stock at or above the price they paid.

In addition, in the past, stockholders have initiated class action lawsuits against biotechnology and pharmaceutical companies including us following periods of volatility in the market prices of these companies’ and our stock. Such litigation, including the litigation that is currently instituted against us and certain of our officers and directors and any litigation that may be instituted against us, our officers and/or our directors in the future, could cause us to incur substantial costs and divert management’s attention and resources, which could have a material adverse effect on our business, financial condition and results of operations.

Our business, financial condition and results of operations may be materially adversely affected by global health epidemics and pandemics, including the recent COVID-19 pandemic.

Outbreaks of epidemic, pandemic, or contagious diseases such as the novel strain of a virus named SARS-CoV-2 (severe acute respiratory syndrome coronavirus 2), or coronavirus, which causes novel coronavirus disease 2019, or COVID-19, that was reported to have surfaced in Wuhan, China in December 2019 and has reached multiple other regions and countries, including the United States and, more specifically, Englewood, Colorado, where our primary office is located COVID-19, could have an adverse effect on our business, financial condition, and results of operations. The spread of COVID-19 from China to other countries has resulted in the World Health Organization declaring the outbreak of COVID-19 as a global pandemic. Since the COVID-19 outbreak in early January 2020, both domestic and international stock markets have reflected significant volatility as a result of the near and long-term uncertainty associated with the near shut down of the domestic and global economy.