In July 2018, the FASB issued ASU 2018-09,

“Codification Improvements”

, which facilitates amendments to a variety of topics to clarify, correct errors in, or make minor improvements to the accounting standards codification. The effective date of the standard is dependent on the facts and circumstances of each amendment. Some amendments do not require transition guidance and were effective upon the issuance of this standard. A majority of the amendments in ASU 2018-09 were effective for fiscal years beginning after December 15, 2018. The Company adopted ASU 2018-09 during the first quarter of 2019 and the adoption of this guidance did not have a material impact on the Company’s

financial statements.

Recent Accounting Pronouncements

In August 2018, the FASB issued ASU 2018‑13, “

Fair Value Measurement - Disclosure Framework (Topic 820)

”. The updated guidance modified the disclosure requirements on fair value measurements. The updated guidance is effective for fiscal years beginning after December 15, 2019, including interim reporting periods within those fiscal years. Early adoption is permitted for any removed or modified disclosures, however the Company has not yet adopted this ASU. When adopted, the Company does not expect the adoption of this ASU to have a significant impact on its financial statements.

This Quarterly Report on Form 10-Q does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its financial condition, results of operations, cash flows or disclosures.

Note 2 - Going Concern

As of and for the six months ended June 30, 2019, the Company had cash and cash equivalents of $12.8 million and a net loss of $5.4 million. The net loss is primarily attributable to operating expenses of $6.3 million, which were offset by the non-cash derivative gain of $822,000 that was recognized during the six months ended June 30, 2019. The Company used net cash in operations of $5.9 million for the six months ended June 30, 2019. As of June 30, 2019, the Company had an accumulated deficit of $176.4 million and stockholders’ equity of $11.1 million. In addition, as a clinical stage biopharmaceutical company, the Company has not generated any revenues or profits to date. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

During the six months ended June 30, 2019, the Company conducted a public offering of its securities through which it raised gross proceeds of $12.0 million (see

Note 7

). In addition, the Company received a total of $350,000 from the exercise of investor warrants (see

Note 6

). The Company has prepared an updated projection covering the period from July 1, 2019 through September 30, 2020 based on the requirements of ASU 2014-15, “

Going Concern

”, which reflects cash requirements for fixed, on-going expenses such as payroll, legal and accounting, patents and overhead at an average cash burn rate of approximately $0.6 million per month. The Company’s projection also reflects an appropriation of additional funds for regulatory approvals, clinical trials, outsourced research and development and commercialization consulting of approximately $0.7 million per month. Based on the current projections, the Company expects that current cash resources and operating cash flows will be sufficient to sustain operations into the second quarter of 2020. The ability of the Company to continue its operations is dependent on its ability to satisfy the Company’s future cash needs through private or public sales of securities, debt financings or partnering/licensing transactions. However, there is no assurance that the Company will be successful in satisfying its future cash needs such that the Company will be able to continue operations.

The accompanying unaudited interim financial statements were prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

of the patient recruiting services contract to increase proportionately as a result of an increased number of patients required for the current trial; however, an amended contract has not yet been finalized.

Biologics License Application (“BLA”) Consulting Services

In March 2018, the Company entered into a BLA consulting services agreement for $1.2 million, which had an outstanding commitment of approximately $1.1 million as of June 30, 2019. The Company had incurred cumulative costs totaling $79,000 against this contract as of June 30, 2019. This contract does not have an expiration date as the Company incurs costs as sections of the BLA are drafted for the submission of the complete BLA to the U.S. Food and Drug Administration (“FDA”).

Statistical Analysis and Programming Consulting Services

In May 2019, Ampio entered into a statistical analysis and programming consulting services agreement for $579,000, which had an outstanding commitment of $522,000 as of June 30, 2019. The Company had incurred cumulative costs totaling $57,000 against the contract as of June 30, 2019.

Employment Agreements

The Company entered into an employment agreement with Mr. Michael Macaluso, Chief Executive Officer, effective January 9, 2012. This agreement provided for an annual salary of $195,000, with an initial term ending January 9, 2015. On October 1, 2013, the Company increased Mr. Macaluso’s annual salary from $195,000 to $300,000. On December 20, 2014, the Company extended the employment agreement of Mr. Macaluso for three additional years, expiring January 9, 2017. On March 9, 2017, the Company extended his employment agreement for another three years until January 9, 2020.

The Company entered into an employment agreement with Ms. Holli Cherevka, Chief Operating Officer, on September 19, 2017, which provided for an annual salary of $200,000 and a term ending September 19, 2019.

The Company entered into an employment agreement with Mr. Daniel Stokely, Chief Financial Officer, on July 9, 2019, which provided for an annual salary of $285,000 and a term ending July 31, 2022.

Insurance Premium Financing Agreement

In June 2019, Ampio entered into an insurance premium financing agreement for a term of six months with an interest rate of 7.75% for $470,000. The outstanding commitment as of June 30, 2019 was $470,000.

Facility Lease

In December 2013, the Company entered into a 125-month non-cancellable operating lease for office space and a manufacturing facility. The effective date of the lease was May 1, 2014. The initial base rent of the lease was $23,000 per month. The total base rent over the term of the lease is approximately $3.3 million, which includes rent abatements and leasehold incentives. As discussed within

Note 1

, the Company adopted the

FASB issued ASU 2016-02,

“Leases (Topic 842)”

as of January 1, 2019. With the adoption of ASU 2016-02, the Company recorded an operating right-of-use asset and an operating lease liability on its balance sheet. The right-of-use asset represents the Company’s right to use the underlying asset for the lease term and the lease obligation represents the Company’s commitment to make the lease payments arising from the lease. Right-of-use lease assets and obligations are recognized at the commencement date based on the present value of remaining lease payments over the lease term. As the Company’s lease does not provide an implicit rate, the Company used an estimated incremental borrowing rate based on the information available at the commencement date in determining the present value of the lease payments. Rent expense is recognized on a straight-line basis over the lease term, subject to any changes in the lease or expectations regarding the terms. The

lease liability is classified as current or long-term on the balance sheet.

The total value for the warrant liability as of June 30, 2019 is $6.1 million, which includes investor warrant issuances from prior periods. See

Note 4

for additional information regarding the warrant derivative liability.

During the six months ended June 30, 2019, the Company issued 875,000 shares of common stock as a result of the exercise of investor warrants with an exercise price of $0.40. The Company received $350,000 as of June 30, 2019 related to these investor warrant exercises.

The following table summarizes Ampio’s warrant activity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

|

|

Weighted Average

|

|

|

|

Number of

|

|

Average

|

|

Remaining

|

|

|

|

Warrants

|

|

Exercise Price

|

|

Contractual Life

|

|

|

|

|

|

|

|

|

|

|

Outstanding at December 31, 2018

|

|

22,283,191

|

|

$

|

0.51

|

|

4.25

|

|

Warrants issued in connection with the public offering

|

|

2,100,000

|

|

$

|

0.50

|

|

4.97

|

|

Warrants exercised

|

|

(875,000)

|

|

$

|

0.40

|

|

|

|

Outstanding at June 30, 2019

|

|

23,508,191

|

|

$

|

0.51

|

|

3.85

|

Note 7 - Common Stock

Shelf Registration

In March 2017, the Company filed a shelf registration statement on Form S‑3 (the “Shelf Registration Statement”) with the SEC to register Ampio common stock and warrants in an aggregate amount of up to $100.0 million for offerings from time to time, as well as 5.0 million shares of common stock available for sale by selling shareholders. The Shelf Registration Statement was declared effective in April 2017 by the SEC and expires in March 2020. As a result of equity raises, approximately $66.7 million remained available under the Shelf Registration Statement as of June 30, 2019.

Public Offering

In June 2019, the Company completed a public offering whereby it issued 30.0 million shares of its common stock at a stock price of $0.40, generating gross proceeds of $12.0 million. In connection with this offering, the placement agent received a 7% commission of $840,000, and $230,000 as compensation for other costs related to the offering. The placement agent also received 2.1 million warrants with an exercise price of $0.50 and an expiration date of June 17, 2024 (“Placement Agent Warrants”). At issuance, these warrants had a value of $777,000 and were accounted for as equity-based warrants. Such Placement Agent Warrants provide for cashless exercise, which the placement agent may elect if Ampio does not have an effective registration statement registering, or the prospectus contained therein is not available for the issuance of, the shares underlying the warrants. The Company also incurred expenses related to legal, accounting and other registration costs of $173,000.

The shares were offered and sold pursuant to the Company’s Shelf Registration Statement.

Controlled Equity Offering

In February 2016, Ampio entered into a Controlled Equity Offering

SM

Sales Agreement (the “Controlled Equity Offering Agreement”) with a placement agent to implement an “at-the-market” equity program under which Ampio, from time to time could offer and sell shares of its common stock having an aggregate offering price of up to $25.0 million through the placement agent. The Company had no obligation to sell any of the shares and could at any time suspend sales under the Controlled Equity Offering Agreement or terminate the Controlled Equity Offering Agreement in accordance with its terms. The Company provided the placement agent with customary indemnification rights. The placement agent was entitled to a fixed commission of 3.0% of the gross proceeds from shares sold. In April 2019, the Company terminated this Controlled Equity Offering Agreement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

Net Income (loss)

|

|

$

|

420,766

|

|

$

|

4,620,201

|

|

$

|

(5,390,868)

|

|

$

|

26,659,673

|

|

Less: decrease in fair value of investor warrants

|

|

|

(3,981,169)

|

|

|

(7,751,838)

|

|

|

(821,637)

|

|

|

(33,366,143)

|

|

Income (loss) available to common stockholders

|

|

$

|

(3,560,403)

|

|

$

|

(3,131,637)

|

|

$

|

(6,212,505)

|

|

$

|

(6,706,470)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted-average common shares outstanding

|

|

|

115,031,289

|

|

|

86,300,054

|

|

|

113,078,639

|

|

|

84,630,970

|

|

Add: dilutive effect of equity instruments

|

|

|

3,738,807

|

|

|

6,699,756

|

|

|

4,270,877

|

|

|

6,903,707

|

|

Diluted weighted-average shares outstanding

|

|

|

118,770,096

|

|

|

92,999,810

|

|

|

117,349,516

|

|

|

91,534,677

|

|

Earnings per share - basic

|

|

$

|

0.00

|

|

$

|

0.05

|

|

$

|

(0.05)

|

|

$

|

0.32

|

|

Earnings per share - diluted

|

|

$

|

(0.03)

|

|

$

|

(0.03)

|

|

$

|

(0.05)

|

|

$

|

(0.07)

|

Note 10 – Litigation

On August 25, 2018, a purported shareholder of the Company commenced a putative class action lawsuit in the United States District Court for the Central District of California, captioned

Shi v. Ampio Pharmaceuticals, Inc., et al.

, Case No. 18-cv-07476 (the “Securities Class Action”). A second, similar class action was filed on August 31, 2018, but has since been voluntarily dismissed. Plaintiff in the Securities Class Action alleges that the Company and certain of its current and former officers violated the federal securities laws by misrepresenting and/or omitting material information regarding the AP-003 Phase III clinical trial of Ampion. The plaintiff asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Securities and Exchange Commission Rule 10b-5, on behalf of a putative class of purchasers of the Company’s common stock from December 14, 2017 through August 7, 2018. Plaintiff in the Securities Class Action seeks unspecified damages, pre-judgment and post-judgment interest, and attorneys’ fees and costs.

On September 10, 2018, a purported stockholder of the Company brought a derivative action in the United States District Court for the Central District of California, captioned

Cetrone v. Macaluso, et al.

, Case No. 18-cv-07855 (the “Cetrone Action”), alleging primarily that the directors and officers of Ampio breached their fiduciary duties in connection with alleged misstatements and omissions regarding the AP-003 Phase III clinical trial of Ampion.

On October 5, 2018, a purported stockholder of the Company brought a derivative action in the United States District Court for the District of Colorado,

Theise v. Macaluso, et al.

, Case No. 18-cv-02558 (the “Theise Action”), which closely parallels the allegations in the Cetrone Action. A second derivative action was filed in the United States District Court for the District of Colorado and was consolidated with the Theise Action under the caption

In re: Ampio Pharmaceuticals Inc. Stockholder Derivative Actions

, Case No. 18-cv-02558.

In April 2019 we and certain of our directors and executive officers received subpoenas from the SEC requesting documents and information in an investigation relating to the trading of our securities around two significant corporate announcements that resulted in material declines in the market price of our stock. The Company and the directors and executive officers are cooperating with the inquiry. The Company is, at this time, unable to predict what action, if any, might be taken in the future by the SEC as a result of the matters that are the subject of the subpoena.

The Company believes that all claims asserted are without merit and intends to defend these lawsuits vigorously and that the matters under investigation by the SEC are unlikely to result in liability for the Company. However, it is possible that additional actions will be filed in the future or additional investigations could be ongoing or may be initiated. The Company currently believes the likelihood of a loss contingency related to these matters is remote and, therefore, no provision for a loss contingency is required.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This discussion should be read in conjunction with our historical financial statements. The following discussion and analysis contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those projected in the forward-looking statements. For additional information regarding these risks and uncertainties, please see Part II, Item 1A of this Quarterly Report on Form 10‑Q, “Risk Factors,” and the risk factors included in our 2018 Annual Report.

EXECUTIVE SUMMARY

We are a development stage biopharmaceutical company focused on the development of Ampion, our product candidate, to treat prevalent inflammatory conditions for which there are limited treatment options.

The pharmaceutical market is a competitive industry with strict regulations that are time intensive and costly. However, we are committed to offer a compelling therapeutic option for the patients most in need of new treatment options for osteoarthritis.

Since we are in the research and development phase, we have not generated revenue to date. Our operations have been funded solely through equity raises, which have occurred from time to time.

Moving forward, we plan to maintain a lean and efficient operating model by streamlining our operations and continuing to allocate all our resources towards achieving regulatory approval for the commercialization of Ampion.

Overview

We maintain an Internet website at www.ampiopharma.com. Information on or linked to our website is not incorporated by reference into this Quarterly Report on Form 10‑Q. Filings with the SEC can also be obtained at the SEC’s website, www.sec.gov.

Ampion has advanced through late-stage clinical trials in the United States. The FDA provided guidance that we should complete a trial of Kellgren Lawrence Grade 4 (“KL 4”) severe osteoarthritis of the knee (“OAK”) patients with concurrent controls that would be carried out under a Special Protocol Assessment (“SPA”), or otherwise with FDA feedback.

An SPA is a process in which sponsors may ask to meet with the FDA to reach agreement with the FDA on the design and size of certain clinical trials to determine if they adequately address scientific and regulatory requirements for a study that could support regulatory submission. An SPA agreement indicates concurrence by the FDA with the adequacy and acceptability of specific critical elements of overall protocol design (e.g. entry criteria, dose selection, endpoints and planned analyses) for a study intended to support a future marketing application. These elements are critical to ensuring that the trial conducted under the protocol can be considered an adequate and well-controlled study that can support marketing approval. Feedback on these issues provides the greatest benefit to sponsors in planning late-phase development strategy. The existence of an SPA agreement does not guarantee that the FDA will accept a biologics license application (“BLA”), or that the trial results will be adequate to support approval. Those issues are addressed during the review of a submitted application and are determined based on the adequacy of the overall submission. In June 2019, we received an SPA agreement from the FDA for our Phase III clinical trial titled,

"A Randomized, Controlled, Double-Blind Study to Evaluate the Efficacy and Safety of an Intra-Articular Injection of Ampion in Adults with Pain Due to Severe Osteoarthritis of the Knee."

AMPION

Ampion for Osteoarthritis and Other Inflammatory Conditions

Ampion is the < 5 kDa ultrafiltrate of 5% Human Serum Albumin (“HSA"), an FDA approved biologic product. Ampion is a non-steroidal, low molecular weight, anti-inflammatory biologic, which has the potential to be used in a wide variety of acute and chronic inflammatory conditions, as well as immune-mediated diseases. Ampion and its known components have demonstrated anti-inflammatory activity which supports the mechanism of action.

We are currently developing Ampion as an intra-articular injection to treat the signs and symptoms of severe OAK, which is a growing epidemic in the United States. OAK is a progressive disease characterized by gradual degradation and loss of cartilage due to inflammation of the soft tissue and bony structures of the knee joint. Progression of the most severe form of OAK leaves patients with little to no treatment options other than a total knee arthroplasty. The FDA has stated that severe OAK is an ‘unmet medical need’ with no licensed therapies for this indication. While we believe that Ampion could treat this ‘unmet medical need’, our ability to market this product is subject to FDA approval.

Ampion Development

Since our inception, we have conducted multiple clinical trials and have advanced through late-stage clinical trials in the United States, initially under the guidance of the FDA’s Office of Blood Research and Review (“OBRR”), and most recently under the guidance of the FDA’s Office of Tissues and Advanced Therapies, or (“OTAT”).

Study AP-003-A was a U.S. multicenter, randomized, double-blind trial of 329 patients who were randomized 1:1 to receive Ampion or saline control via intra-articular injection. The study showed a statistically significant reduction in pain compared to the control, with an average of greater than 40% reduction in pain from baseline at 12 weeks. Patients who received Ampion also showed a significant improvement in function and quality of life compared to patients who received the saline control at 12 weeks. Quality of life was assessed using Patient Global Assessment (“PGA”). Furthermore, the trial included severely diseased patients (defined as KL 4). From this patient population, those patients who received Ampion had a significantly greater reduction in pain than those who received the saline control. Ampion was well tolerated with minimal adverse events reported across the Ampion and saline groups in the study. There were no drug-related serious adverse events.

In 2018, the FDA reiterated and confirmed that our successful pivotal phase III clinical trial, AP-003-A, was adequate and well-controlled, provided evidence of the effectiveness of Ampion and can contribute to the substantial evidence of effectiveness necessary for the approval of a BLA. The FDA provided guidance that we should complete an additional trial of KL 4 severe OAK patients with concurrent controls that would be carried out under an SPA to obtain FDA concurrence on the trial design.

In June 2019, we received an SPA agreement from the FDA for a clinical protocol titled “A Randomized, Controlled, Double-Blind Study to Evaluate the Efficacy and Safety of an Intra-Articular Injection of Ampion in Adults with Pain Due to Severe Osteoarthritis of the Knee” (the “AP-013 study”).

This pivotal trial, was initially proposed to enroll 724 patients, with an interim analysis, to allow sample size adjustments if required. The FDA issued SPA for protocol AP-013 finalized patient enrollment at 1,034 patients. In the SPA agreement, the FDA agreed that the design and planned analysis of the AP-013 study adequately address the objectives necessary to support a regulatory submission. According to the FDA's guidance for industry regarding SPAs (published in April 2018), an SPA documents the FDA's agreement that the design and planned analysis of a study can address objectives in support of a regulatory submission, however final determinations for marketing application approval are made after a complete review of the marketing application and are based on the entire data in the application. Following the receipt of the SPA agreement, we initiated the AP-013 study, identified and engaged clinical sites for the trial, and initiated dosing of patients at those sites.

Recent Financing Activities

Information regarding our Recent Financing Activities is contained in

Note 7

to the Financial Statements.

Known Trends or Future Events; Outlook

We are a clinical stage company that has not generated revenues and therefore, we have incurred significant net losses totaling $176.5 million since our inception in December 2008. We expect to generate continued operating losses for the foreseeable future as we continue to develop and seek regulatory approval for Ampion. However, we intend to try to limit the extent of these losses by entering into co-development or collaboration agreements with one or more strategic partners. As of June 30, 2019, we had $12.8 million of cash and cash equivalents which we expect can fund our operation into the second quarter of 2020 (see

Note 2

to the Financial Statements).

Although we have raised net proceeds of over $180 million since our inception through the sale of common stock and warrants, we cannot be certain that we will be able to secure additional financing or that funding, if secured, will be adequate to execute our business strategy. Even if we are able to obtain additional financing, such additional financing may be costly and may require us to agree to covenants or other provisions that favor new investors over existing shareholders.

Our primary focus for fiscal year 2019 and into fiscal year 2020 is advancing the clinical development and preparation of a BLA for Ampion to treat the signs and symptoms of severe OAK.

ACCOUNTING POLICIES

Significant Accounting Policies and Estimates

Our financial statements were prepared in accordance with GAAP. The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to recoverability of long-lived assets, valuation allowance(s), useful lives of assets and remaining useful lives, accrued compensation, stock compensation, warrant derivative liability, right-of-use asset, lease liability and the ability for the Company to continue as a going concern. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable and appropriate under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The methods, estimates, and judgments used by us in applying these most critical accounting policies have a significant impact on the results we report in our financial statements. Our significant accounting policies and estimates are included in our 2018 Annual Report.

Newly Issued Accounting Pronouncements

Information regarding the recently issued accounting standards (adopted and not adopted as of June 30, 2019) is contained in

Note 1

to the Financial Statements.

RESULTS OF OPERATIONS –

Results of Operations – June 30, 2019 Compared to June 30, 2018

We recognized net income for the three months ended June 30, 2019 (“2019 quarter”) of $420,800 compared to net income recognized of $4.6 million for the three months ended June 30, 2018 (“2018 quarter”). The net income during the 2019 quarter was attributable to the recognition of a non-cash derivative gain of $4.0 million, which was partially offset by operating expenses of $3.6 million. The decrease in our stock price from $0.56 as of March 31, 2019 to $0.39 as of June 30, 2019 caused the valuation of the warrant liability to decrease resulting in a derivative gain during the 2019 quarter. The net income during the 2018 quarter was attributable to the recognition of a non-cash derivative gain of $7.7 million, which was partially offset by operating expenses of $3.1 million. The decrease in our stock price from $3.40 as of March 31, 2018 to $2.20 as of June 30, 2018 caused the valuation of the warrant liability to decrease resulting in a derivative gain during the 2018 quarter. The operating expenses increased $450,000 from the 2018 quarter to the 2019

quarter primarily due to a $22,000 increase in research and development costs and a $428,000 increase in general and administrative costs, which is further explained below.

We recognized a net loss for the six months ended June 30, 2019 (“2019 period”) of $5.4 million compared to net income recognized of $26.7 million for the six months ended June 30, 2018 (“2018 period”). The net loss during the 2019 period was attributable to operating expenses of $6.3 million, which were partially offset by the recognition of a non-cash derivative gain of $822,000. Our stock price was consistent at $0.39 as of December 31, 2018 and as of June 30, 2019, however the outstanding amount of investor warrants outstanding decreased causing the valuation of the warrant liability to decrease, which resulted in a derivative gain during the 2019 period. The net income during the 2018 period was primarily attributable to the non-cash derivative gain of $33.4 million, which was partially offset by operating expenses of $6.7 million. The decrease in our stock price from $4.07 as of December 31, 2017 to $2.20 as of June 30, 2018 caused the valuation of the warrant liability to decrease resulting in a derivative gain during the 2018 period of $33.4 million. The operating expenses increased $449,000 from the 2018 period to the 2019 period primarily due to a $458,000 decrease in research and development costs and a $9,000 increase in general and administrative costs, which is further explained below.

Operating Expenses

Research and Development

Research and development costs consist of clinical trials and sponsored research, labor, consultants and stock-based compensation. These costs relate solely to direct research and development without an allocation of general and administrative expenses and are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

Clinical trials and sponsored research

|

|

$

|

859,497

|

|

$

|

810,761

|

|

$

|

1,326,833

|

|

$

|

1,806,196

|

|

|

Labor

|

|

|

746,032

|

|

|

608,780

|

|

|

1,387,901

|

|

|

1,171,493

|

|

|

Consultants and other

|

|

|

500,833

|

|

|

665,572

|

|

|

955,313

|

|

|

1,128,598

|

|

|

Stock-based compensation

|

|

|

30,472

|

|

|

29,670

|

|

|

30,965

|

|

|

52,972

|

|

|

|

|

$

|

2,136,834

|

|

$

|

2,114,783

|

|

$

|

3,701,012

|

|

$

|

4,159,259

|

|

Research and development costs increased $22,000, or 1.0%, for the 2019 quarter compared to the 2018 quarter. This increase is primarily attributable to labor, offset by consulting and other costs. Labor costs increased for the 2019 quarter compared to the 2018 quarter primarily due to the addition of three new positions to assist with managing the AP-013 study and the BLA filing. Consultants and other related costs decreased for the 2019 quarter compared to the 2018 quarter as we finalized a quality control project related to the manufacturing of Ampion. Clinical trials and sponsored research costs were consistent for the 2019 quarter compared to the 2018 quarter, however it should be noted that during the 2019 quarter we incurred start-up costs for the AP-013 study and during the 2018 quarter we incurred costs related to the extension study, AP-003-C-OLE. Stock-based compensation is consistent for the 2019 quarter compared to the 2018 quarter.

Research and development costs decreased $458,000, or 11.0%, for the 2019 period compared to the 2018 period. This decrease is primarily attributable to clinical trials, sponsored research, consulting and other costs, which is offset by an increase in labor costs. Clinical trials and sponsored research expense decreased for the 2019 period compared to the 2018 period, as we received an SPA agreement from the FDA toward the end of the 2019 period compared to the 2018 period when we were conducting the AP-003-C-OLE study. As noted above, labor costs increased for the 2019 period as compared to the 2018 period, which was primarily due to the addition of three new positions. Consulting and other costs decreased for the 2019 period compared to the 2018 period as we finalized a quality control project related to the manufacturing of Ampion. The decrease in stock-based compensation in the 2019 period as compared to the 2018 period is a result of fewer options being granted at lower stock prices and previously awarded high priced options becoming fully vested during the 2018 period.

General and Administrative

General and administrative expenses consist of labor, director fees, stock-based compensation, patent costs, professional fees (for example: legal, auditing and accounting) and occupancy, travel and other (for example: rent, insurance, investor/public relations and professional subscriptions). These costs are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

Occupancy, travel and other

|

|

$

|

406,451

|

|

$

|

313,897

|

|

$

|

829,497

|

|

$

|

1,072,184

|

|

|

Professional fees

|

|

|

451,373

|

|

|

246,850

|

|

|

676,426

|

|

|

401,568

|

|

|

Labor

|

|

|

390,457

|

|

|

235,455

|

|

|

621,491

|

|

|

453,053

|

|

|

Patent costs

|

|

|

70,547

|

|

|

120,209

|

|

|

149,539

|

|

|

313,643

|

|

|

Directors fees

|

|

|

83,500

|

|

|

57,500

|

|

|

150,000

|

|

|

107,500

|

|

|

Stock-based compensation

|

|

|

42,326

|

|

|

42,943

|

|

|

129,390

|

|

|

199,263

|

|

|

|

|

$

|

1,444,654

|

|

$

|

1,016,854

|

|

$

|

2,556,343

|

|

$

|

2,547,211

|

|

General and administrative costs increased $428,000, or 42.1%, for the 2019 quarter compared to the 2018 quarter. The increase is primarily attributable to an increase in costs related to professional fees and occupancy, travel and other related expenses and labor. Professional fees increased due to ongoing current litigation and investigation matters. Occupancy, travel and other related expenses increased primarily due to an increase in our insurance premiums covering our new policy period. Labor costs for the 2019 quarter increased compared to the 2018 quarter due to a separation agreement executed during the 2019 quarter. Patent costs for the 2019 quarter decreased compared to the 2018 quarter as we continued to allow non-essential patents to lapse and discontinue prosecution of patent applications that are non-essential to our future commercialization of Ampion. Directors fees increased as more board meetings were held during the 2019 quarter as compared to the 2018 quarter. The decrease in stock-based compensation is a result of fewer options being granted at lower stock prices and previously awarded high priced options becoming fully vested during 2018.

General and administrative costs increased $9,000, or 0.4%, for the 2019 period compared to the 2018 period. The increase is primarily attributable to professional fees and labor costs, offset by a decrease in occupancy, travel and other related expenses, patent costs and stock-based compensation. Professional fees increased due to ongoing current litigation and investigation matters. Labor costs for the 2019 period increased compared to the 2018 period due to a separation agreement executed during the 2019 period. Occupancy, travel and other expenses decreased as we incurred one-time costs related to a strategic assessment of the osteoarthritis environment report during the 2018 period. As noted above, patent costs for the 2019 period decreased compared to the 2018 period as we continued to allow non-essential patents to lapse and discontinue prosecution of patent applications that are non-essential to our planned future commercialization of Ampion. The decrease in stock-based compensation is a result of fewer options being granted at lower stock prices and previously awarded high priced options becoming fully vested during 2018. Directors fees increased as more board meetings were held during the 2019 period as compared to the 2018 quarter.

Net Cash Used in Operating Activities

During the 2019 period, our operating activities used approximately $5.9 million in cash, which was more than our net loss of $5.5 million primarily as a result of the non-cash gain from the warrant derivative, offset by changes in operating assets and liabilities.

During the 2018 period, our operating activities used approximately $6.6 million in cash, which was less than our net income of $26.7 million during that period, which was primarily as a result of the non-cash gain in the warrant derivative, offset by changes in operating assets and liabilities.

Net Cash Used in Investing Activities

During the 2019 period, cash was used to acquire $13,600 of manufacturing machinery and equipment.

During the 2018 period, cash was used to acquire $442,000 of manufacturing machinery and equipment.

Net Cash from Financing Activities

During the 2019 period, we received gross proceeds from the sale of common stock in a public offering of $12.0 million, which was offset by offering costs of $1.2 million. We also received $350,000 from warrant exercises.

During the 2018 period, we received $3.5 million from option and warrant exercises.

Liquidity and Capital Resources

We have not generated operating revenue or profits. Our primary activities since inception have been focused on research and development activities for advancement of Ampion towards BLA submission, which has required raising capital. As of June 30, 2019, we had $12.8 million of cash and cash equivalents which we expect will fund our operations into the second quarter of 2020. This projection is based on many assumptions that may prove to be wrong, and we could exhaust our available cash and cash equivalents earlier than presently anticipated. In addition, we anticipate that we will seek additional capital investments in both the near and long-term to enable us to expand our clinical and commercial development activities for Ampion and continue our business operations. We intend to evaluate the capital markets from time to time to determine whether to raise additional capital in the form of equity, convertible debt or otherwise, depending on market conditions relative to our need for funds at such time.

We have prepared a projection through September 30, 2020 that reflects cash requirements for fixed, on-going expenses such as payroll, legal and accounting, patents and overhead at an average cash burn rate of approximately $0.6 million per month.

The Company’s projection also reflects an appropriation of additional funds for regulatory approvals, clinical trials, outsourced research and development and commercialization consulting of approximately $0.7 million per month.

Accordingly, we believe that it will be necessary to raise additional capital and/or enter into licensing or collaboration agreements to fund the further development and regulatory activities that we plan to conduct. At this time, we expect to satisfy our future cash needs through private or public sales of our securities, debt financings and/or partnering/licensing transaction. However, we cannot be certain that any of such transactions will be available to us on acceptable terms, or at all. Volatility in the financial markets has adversely affected the market capitalizations of many bio-pharmaceutical companies, particularly small capitalization companies such as us, and generally made equity and debt financing more difficult to obtain. This volatility, coupled with other factors, may limit our access to additional financing.

If we cannot obtain funding through capital raises and/or partnering/licensing transactions in the future when we require it, we will be required to delay, reduce the scope of, or eliminate our development, manufacturing and/or regulatory programs for Ampion or our future commercialization efforts and/or suspend operations for a period until we are able to obtain additional funding. If we are not successful in raising sufficient funds to pay for further development and licensing of Ampion, we may choose to license or otherwise relinquish greater, or all rights to Ampion, at an earlier stage of development or on less favorable terms than we would otherwise choose. This would lead to impairment or other charges, which could materially affect our balance sheet and operating results.

Off Balance Sheet Arrangements

We do not have off-balance sheet arrangements, financings or other relationships with unconsolidated entities or other persons, also known as “variable interest entities”.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

We are not currently exposed to material market risk arising from financial instruments, changes in interest rates or commodity prices or fluctuations in foreign currencies. We have no need to hedge against any of the foregoing risks and therefore currently engage in no hedging activities.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

We maintain “disclosure controls and procedures,” as such terms are defined in Rules 13a‑15(e) and 15d‑15(e) of the Exchange Act, that are designed to ensure that information required to be disclosed by us in reports that we file or submit under the Exchange Act are recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

In May 2019, the Company identified a material weakness relating to identification of information for appropriate disclosure. The material weakness related to a deficiency in the procedures in place to ensure disclosure of certain information to our Disclosure Committee. The Disclosure Committee has revised the Disclosure Committee charter and is committed to implementing the proper procedures and controls to remediate the material weakness identified.

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of senior management, including the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Exchange Act Rules 13a‑15(b) and 15d‑15(b). Based upon this evaluation, the Chief Executive Officer and the Chief Financial Officer concluded that the Company’s disclosure controls and procedures were not effective as of June 30, 2019, due to the material weakness described on the Form 10-Q report for the period ended March 31, 2019.

Notwithstanding the material weakness, management has concluded that the Financial Statements included in this Quarterly Report on Form 10-Q present fairly, in all material respects, the Company’s financial position, results of operations and cash flows for the periods presented in conformity with accounting principles generally accepted in the United States.

Changes in Internal Control over Financial Reporting

There were material changes in our internal controls over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. The Company has implemented remedial procedures to address the material weakness in our disclosure controls and procedures identified above. These remedial procedures will continue throughout the remainder of fiscal 2019.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings.

Information regarding our Legal Proceedings is contained in

Note 9

to the Financial Statements.

Item 1A. Risk Factors.

We operate in a rapidly changing environment that involves a number of risks that could materially affect our business, financial condition or future results, some of which are beyond our control. In addition to the other information set forth in this Quarterly Report on Form 10‑Q and the risk factors included below, you should carefully consider the factors in Part I, “Item 1A. Risk Factors” in our 2018 Annual Report as may be further updated by our Quarterly Reports on Form 10-Q filed with the SEC, which could materially affect our business, financial condition or future results.

We received an SPA agreement from the FDA relating to our product candidate. This SPA agreement does not guarantee approval of Ampion or any other particular outcome from regulatory review.

We requested agreement from the FDA under a SPA for our AP-013 study of Ampion, which we received in June 2019. The FDA’s SPA process is designed to facilitate the FDA’s review and approval of biologics by allowing the FDA to evaluate the proposed design and size of certain clinical trials that are intended to form the primary basis for determining a biologic’s efficacy. Upon specific request by a clinical trial sponsor, the FDA will evaluate the protocol and respond to a sponsor’s questions regarding, among other things, primary efficacy endpoints, trial conduct and data analysis. The FDA ultimately assesses whether the protocol design and planned analysis of the trial are acceptable to support regulatory approval of the product candidate with respect to the effectiveness of the indication studied. Based on their review, the FDA will issue an SPA Agreement letter, or an SPA No Agreement letter.

According to the FDA’s guidance for industry regarding SPAs (published in April 2018), an SPA agreement does not guarantee approval of a product candidate, even if the trial is conducted in accordance with the protocol. Moreover, the FDA may revoke or alter our SPA agreement in certain circumstances. In particular, a SPA agreement is not binding on the FDA if public health concerns emerge that were unrecognized at the time of the SPA agreement, other new scientific concerns regarding product safety or efficacy arise, we fail to comply with the agreed upon trial protocols, or the relevant data, assumptions or information provided by us in our request for the SPA change or are found to be false or omit relevant facts. In addition, even after an SPA agreement is finalized, the SPA agreement may be modified, and such modification will be deemed binding on the FDA review division, except under the circumstances described above, if the FDA and the sponsor agree in writing to modify the protocol and such modification is intended to improve the study. The FDA retains significant latitude and discretion in interpreting the terms of the SPA agreement and the data and results from any study that is the subject of the SPA agreement.

Even though we obtained an agreement on our SPA, we cannot assure you that our planned Phase III clinical trial will succeed or will result in any FDA approval for Ampion. Moreover, if the FDA revokes or alters its agreement under our SPA, or interprets the data collected from the clinical trial differently than we do, the FDA may not deem the data sufficient to support an application for regulatory approval, or th

e FDA may require additional clinical trials to support a BLA for Ampion, both of

which could materially impact our business, financial condition and results of operations.

We had a material weakness in our internal control over disclosure reporting during the reporting period, which could result in the failure to identify information for appropriate disclosure.

The Company identified a material weakness relating to identification of information for appropriate disclosure in May 2019. As a result, our management determined that our control over the identification of information for appropriate disclosure was not effective at that time. Specifically, there was a deficiency in the procedures in place to ensure disclosure of certain information to our Disclosure Committee. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in our reports that we file or submit under the Exchange Act is accumulated and communicated to management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding our required disclosures. The Disclosure Committee has reviewed this matter and implemented appropriate controls to address the material weakness identified. However, the fact that we experienced a material weakness could adversely affect our ability to raise funds in the future.

We may be limited in our ability to access sufficient funding through a public or private equity offering or convertible debt offering.

NYSE rules impose restrictions on our ability to raise

funds through a private offering of our common stock, convertible debt or similar instruments without obtaining stockholder approval. Under NYSE rules, an offering of more than 20% of our total shares outstanding at a price per share less than (i) the closing price of our common stock on the NYSE immediately preceding the signing of the binding agreement, or (ii) the average closing price of our common stock on the NYSE for the five trading days immediately preceding the signing of the binding agreement requires stockholder approval unless the offering qualifies as a “public offering” for purposes of the NYSE rules. As of June 30, 2019, we had 142,207,862 shares of common stock outstanding, 20% of which is approximately 28.4 million shares. In June 2019, we sold 30.0 million shares of our common stock in a public offering, which was more than 20% of our total

shares outstanding at that time, and if we had not been able to sell through a public offering at that time, such offering would have required stockholder approval. Under current SEC regulations, if at the time the Company files its Form 10-K in 2020, the Company’s public float is less than $75 million, and for so long as its non-affiliated public float is less than $75 million, the amount the Company will be able to raise through primary public offerings of securities in the twelve-month period using its Shelf Registration Statement or a newly filed shelf registration statement on Form S-3 will be limited to an aggregate of one-third of the Company’s non-affiliated public float, which is referred to as the baby shelf rules.

As of June 30, 2019, the Company’s non-affiliated public float was approximately $54.2 million, based on 139,858,643 shares of outstanding common stock held by non-affiliates at a price of $0.39 per share, which was the last reported sale price of the Company’s common stock on the NYSE American Market on June 28, 2019. While the Company was not subject to the baby shelf rules due to its public float being above $75 million on June 14, 2019, it is possible that it will be subject to the baby shelf rules in the future. In such event, the amount of financing the Company could raise may be limited.

If we receive FDA licensure for Ampion, we will be subject to FDA post approval requirements, which could limit our financial resources available for other development activities.

If we receive FDA licensure for Ampion, we will be subject to continuing regulation by the FDA, including, among other things, record-keeping requirements, reporting of adverse experiences with the product, providing the FDA with updated safety and efficacy information, product sampling and distribution requirements, and complying with FDA promotion and advertising requirements, which include, among others, standards for direct-to-consumer advertising, restrictions on promoting products for uses or in patient populations that are not described in the product’s approved uses (known as “off-label use”), limitations on industry-sponsored scientific and educational activities, and requirements for promotional activities involving the internet. In addition, our quality control and manufacturing procedures will continue to be required to conform to applicable manufacturing requirements after approval to ensure the long-term stability of the product. cGMP regulations require among other things, quality control and quality assurance as well as the corresponding maintenance of records and documentation and the obligation to investigate and correct any deviations from cGMP. Additionally, as the manufacturer of Ampion, we, or other entities that we may outsource manufacturing to or that may otherwise be involved in the manufacture and distribution of Ampion, will be required to register ours or their establishments with the FDA and certain state agencies, and will be subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMP and other laws. Accordingly, we will continue to expend time, money and effort in the area of production and quality control to maintain cGMP compliance. In addition, changes to the manufacturing process are strictly regulated, and depending on the significance of the change, may require prior FDA approval before being implemented. If licensed, the FDA also may require post-marketing testing, known as Phase IV testing, and surveillance to monitor the effects of our approved product. Discovery of previously unknown problems with a product or the failure to comply with applicable FDA requirements can have negative consequences, including adverse publicity, judicial or administrative enforcement, warning letters from the FDA, mandated corrective advertising or communications with doctors and civil or criminal penalties, among others. Newly discovered or developed safety or effectiveness data may require changes to a product’s approved labeling, including the addition of new warnings and contraindications, and also may require the implementation of other risk management measures. Also, new government requirements, including those resulting from new legislation, may be established, or the FDA’s policies may change, which could delay or prevent regulatory approval of Ampion.

We may have difficulties obtaining and maintaining sufficient insurance coverage

As a result of a number of factors, such as ongoing litigation and the SEC subpoenas received, certain of the insurance products that we buy have become less available and their cost has increased significantly (

See Note 9

). Although we maintain directors and officers insurance as well as general liability and product liability insurance, these insurance coverages only cover potential liabilities after our retention has been met and only to the extent of the insurance coverage, therefore, our insurance coverages may not fully cover potential liabilities. In addition, our inability to obtain or maintain sufficient insurance coverage at an acceptable cost or to otherwise protect against potential product or other legal or administrative liability claims could prevent or inhibit the manufacture and sale of Ampion if it receives regulatory approval, which could adversely affect our business.

Item 2. Unregistered Sales of Securities and Use of Proceeds.

None.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

None.

Item 5. Other Information.

None.

Item 6. Exhibits.

The exhibits listed on the “Exhibit Index” set forth below are filed or furnished with this Quarterly Report on Form 10-Q or incorporated by reference as set forth therein.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Equity Distribution Agreement, dated as of April 12, 2019, by and between Canaccord Genuity LLC and Ampio Pharmaceuticals, Inc. (1)

|

|

10.2

|

|

Separation Agreement, dated as of June 13, 2019, between Ampio Pharmaceuticals, Inc. and Thomas E. Chilcott, III. (2)

|

|

10.3

|

|

Placement Agency Agreement, dated June 17, 2019, by and among Ampio Pharmaceuticals, Inc. and ThinkEquity, a division of Fordham Financial Management, Inc.(3)

|

|

10.4

|

|

Securities Purchase Agreement, dated June 17, 2019, by and among Ampio Pharmaceuticals, Inc. and certain investors listed therein (3)

|

|

10.5

|

|

Form of Lock-Up Agreement (3)

|

|

10.6

|

|

Employment Agreement, dated July 9, 2019, by and among Ampio Pharmaceuticals, Inc. and Daniel Stokely (4)

|

|

31.1

|

|

Certificate of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002*.

|

|

31.2

|

|

Certificate of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002*.

|

|

32.1

|

|

Certificate of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002*.

|

|

|

|

|

|

101

|

|

XBRL (eXtensible Business Reporting Language). The following materials from Ampio Pharmaceuticals, Inc.’s Quarterly Report on Form 10‑Q for the quarter ended June 30, 2019 formatted in XBRL: (i) the Balance Sheets, (ii) the Statements of Operations, (iii) the Statements of Stockholders’ Equity (Deficit), (iv) the Statements of Cash Flows, and (v) the Notes to Financial Statements.

|

* Filed herewith.

|

|

(1)

|

|

Incorporated by reference from the Registrant’s Form 8-K filed on April 15, 2019.

|

|

|

(2)

|

|

Incorporated by reference from the Registrant’s Form 8-K filed on June 13, 2019.

|

|

|

(3)

|

|

Incorporated by reference from the Registrant’s Form 8-K filed on June 17, 2019

|

|

|

(4)

|

|

Incorporated by reference from the Registrant’s Form 8-K filed on July 10, 2019.

|

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

AMPIO PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Michael Macaluso

|

|

|

|

Michael Macaluso

|

|

|

|

Chairman and Chief Executive Officer

|

|

|

|

Date: August 9, 2019

|

|

|

|

|

|

|

By:

|

/s/ Daniel G. Stokely

|

|

|

|

Daniel G. Stokely

|

|

|

|

Chief Financial Officer, Treasurer and Secretary

|

|

|

|

Date: August 9, 2019

|

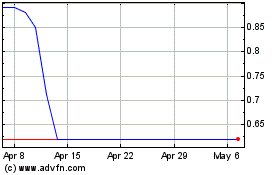

Ampio Pharmaceuticals (AMEX:AMPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampio Pharmaceuticals (AMEX:AMPE)

Historical Stock Chart

From Apr 2023 to Apr 2024