Delaware Investments National Municipal Income Fund Successfully Prices Private Offering of Preferred Securities & Appoints G...

March 15 2012 - 4:58PM

Business Wire

Delaware Investments National Municipal Income Fund (AMEX: VFL)

(the “Fund”) today announced that it has successfully priced a

private offering, as defined pursuant to Rule 144A under the

Securities Act of 1933, of approximately $30 million of Series 2017

Variable Rate MuniFund Term Preferred Shares (“VMTP”). The net

proceeds from the offering will be invested in accordance with the

Fund’s investment objective.

VMTP is a floating-rate form of preferred stock with a mandatory

term redemption. The mandatory term redemption date for the

offering is April 1, 2017. VMTP dividends will be set weekly at a

fixed spread to the Securities Industry and Financial Markets

Association Municipal Swap Index (SIFMA). VMTP shares represent the

preferred stock of the Fund and are senior, with priority in all

respects, to the Fund’s common shares as to payments of

dividends.

In addition, Delaware Investments announced today that Gregory

A. Gizzi has been appointed as a co-manager for the Fund. Mr. Gizzi

joins Joseph R. Baxter, Stephen J. Czepiel, and Denise A.

Franchetti in making day-to-day investment decisions for the

Fund.

Gregory A. Gizzi, Vice President, Portfolio Manager,

Head of Convertible Bond and Municipal Bond Trading, is a

member of the firm’s municipal fixed income portfolio management

team and municipal trading team, and head of the

municipal bond trading staff. Additionally, Gizzi serves

as portfolio manager and head of the convertible bond trading

staff. Before joining Delaware Investments in January 2008 as

head of municipal bond trading, he spent six years as a vice

president at Lehman Brothers for the firm’s tax-exempt

institutional sales effort. Prior to that, he spent two

years trading corporate bonds for UBS before joining Lehman

Brothers in a sales capacity. Gizzi has more than 20 years of

trading experience in the municipal securities industry, beginning

at Kidder Peabody in 1984, where he started as a municipal bond

trader and worked his way up to institutional block trading desk

manager. He later served in the same capacity at Dillon Read.

Gizzi earned his bachelor’s degree in economics

from Harvard University.

The Fund is a closed-end fund managed by Delaware Management

Company, a series of Delaware Management Business Trust.

The investment objective of the Fund is to provide current

income exempt from regular federal income tax consistent with the

preservation of capital. As of Feb. 29, 2012, the Fund had total

managed assets of $63.9 million. At that time, the Fund did not

have any outstanding preferred shares. In the event the Fund had

outstanding preferred shares in the amount of the Series 2017 VMTP

shares, then the pro forma managed assets would have been $93.9

million, including the $30 million attributable to the Series 2017

VMTP shares.

This document is not an offer to sell any security and is not

soliciting an offer to buy any security.

About Delaware Investments

Delaware Investments, a member of Macquarie Group, is a global

asset management firm that offers a wide variety of equity and

fixed income solutions for individual and institutional investors.

Through teams of disciplined and talented investment professionals,

the firm is committed to delivering long-term, consistent

performance. In an ever-changing global marketplace, Delaware

Investments, with more than US $165 billion in assets under

management as of Dec. 31, 2011, has helped its clients move

steadily forward for more than 80 years. Delaware Investments is

supported by the resources of Macquarie Group (ASX: MQG; ADR:

MQBKY), a global provider of asset management, investment, banking,

financial and advisory services with approximately US $317 billion

in assets under management as of Sept. 30, 2011.

Delaware Investments is the marketing name for Delaware

Management Holdings, Inc. and its subsidiaries. Advisory services

provided by Delaware Management Business Trust, a registered

investment advisor. Macquarie Group refers to Macquarie Group

Limited and its subsidiaries and affiliates worldwide. For more

information about Delaware Investments, visit

www.delawareinvestments.com or call 800 523-1918.

Investments in the Fund are not and will not be deposits with or

liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its

holding companies, including their subsidiaries or related

companies (the "Macquarie Group"), and are subject to investment

risk, including possible delays in repayment and loss of income and

capital invested. No Macquarie Group company guarantees or will

guarantee the performance of the Fund, the repayment of capital

from the Fund, or any particular rate of return.

© 2012 Delaware Management Holdings, Inc.

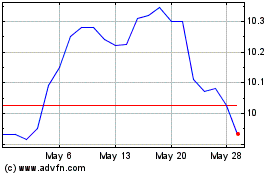

abrdn National Municipal... (AMEX:VFL)

Historical Stock Chart

From May 2024 to Jun 2024

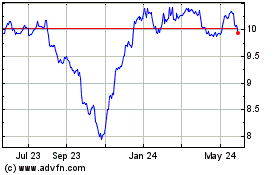

abrdn National Municipal... (AMEX:VFL)

Historical Stock Chart

From Jun 2023 to Jun 2024