ProLogis Reports $1.26 Billion of Gross Proceeds From Fourth Quarter Contributions

December 23 2008 - 5:35PM

PR Newswire (US)

- Fourth Quarter Contributions Exceed Expectations - DENVER, Dec.

23 /PRNewswire-FirstCall/ -- ProLogis (NYSE:PLD), a leading global

provider of distribution facilities, today announced that it made

contributions of properties in North America, Europe and Japan

during the fourth quarter for total proceeds of $1.26 billion. The

contributions included a total of 59 properties in 12 countries,

representing 15.2 million square feet of space. "As we outlined in

November, we are de-risking our development business and preserving

capital," said Walter C. Rakowich, chief executive officer. "The

ongoing contribution of development properties into funds and sales

to third parties is a critical element of our plan. We

simultaneously decrease the size of our pipeline and generate

proceeds that can be used to pay down debt, thereby helping us to

accomplish our de-leveraging objectives." Property contributions to

ProLogis North American Industrial Fund (NAIF), ProLogis Mexico

Industrial Fund, European Properties Fund II, ProLogis Korea Fund

and ProLogis Japan Properties Fund II have now been completed for

the fourth quarter 2008. Additionally, incremental equity was

called from NAIF investors to substantially reduce the outstanding

balance of the NAIF warehouse line of credit. North American

Industrial Fund (NAIF) Nine assets representing 3.8 million square

feet of space were contributed to NAIF for total proceeds of $209

million. ProLogis Mexico Industrial Fund (MEX) Eight assets

representing 1.1 million square feet of space were contributed to

MEX for total proceeds of $64 million. ProLogis European Properties

Fund II (PEPF II) Thirty-seven assets representing 8.8 million

square feet of space were contributed to PEPF II for total proceeds

of 539 euro($734) million. ProLogis Korea Fund (PKF) One asset

representing 0.2 million square feet of space was contributed to

PKF for total proceeds of $11 million. ProLogis Japan Properties

Fund II (PJPF II) Three assets representing 1.1 million square feet

of space were contributed to PJPF II for total proceeds of 19,180

billion yen ($193 million). In addition, the company closed on a

2.4 billion yen ($26.8 million) TMK bond financing for ProLogis

Park Kiyama before year end, representing a loan-to-value of

approximately 50 percent. Proceeds from this financing will be used

to pay down ProLogis global lines of credit. In addition, the

company announced that it has contributed the Seton Office Building

in Austin, Texas, to a newly formed joint venture with an affiliate

of Dividend Capital Total Realty Trust (TRT). The value assigned to

the property in connection with the transfer was $44 million, and

ProLogis retained a 10 percent interest in the property and will

receive fees for the ongoing management of the building. TRT is a

non-traded, real estate investment trust that invests in a diverse

portfolio of real estate assets. Located at Catellus' Mueller

mixed-use development, the 156,000 square-foot, four-story building

is Seton's headquarters and houses approximately 650 of their

associates. ProLogis Action Plan On November 13, 2008, the company

outlined an action plan to de-leverage its balance sheet by at

least $2 billion. The plan includes re-financing and/or

renegotiating debt maturities on ProLogis' balance sheet and in its

property funds, targeting regional portfolio sales, shrinking its

development pipeline through fund contributions and a halt in new

development starts and retaining capital through G&A cuts and a

reduction of the dividend. The company has fully implemented a

number of these initiatives and intends to continue to implement on

others to quickly accomplish its objectives. About ProLogis

ProLogis is the world's largest owner, manager and developer of

distribution facilities, with operations in 136 markets across

North America, Europe and Asia. The company had $40.8 billion of

assets owned, managed and under development, comprising 548 million

square feet (51 million square meters) in 2,898 properties as of

September 30, 2008. ProLogis' customers include manufacturers,

retailers, transportation companies, third-party logistics

providers and other enterprises with large-scale distribution

needs. DATASOURCE: ProLogis CONTACT: Investor Relations, Melissa

Marsden, +1-303-567-5622, , or Media, Krista Shepard,

+1-303-567-5907, both of ProLogis; or Financial Media, Suzanne

Dawson of Linden Alschuler & Kaplan, Inc, +1-212-329-1420, Web

Site: http://www.prologis.com/

Copyright

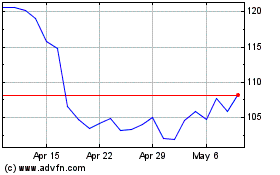

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

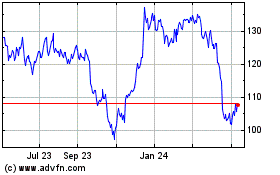

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024