UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-KSB

(Mark One)

|

|

|

|

|

þ

|

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended June 30, 2008

OR

|

|

|

|

|

o

|

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

to

Commission file number 000-50929

Ignis Petroleum Group, Inc.

(Name of small business issuer in its charter)

|

|

|

|

|

Nevada

|

|

16-1728419

|

|

|

|

|

(State or other jurisdiction of incorporation

or

organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

One Legacy Town Center, 7160 Dallas Parkway, Suite 380

|

|

|

|

Plano, TX

|

|

75024

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

972-526-5250

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the

Exchange Act. Yes

o

No

þ

.

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the

Exchange Act during the past 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

þ

No

o

.

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B

contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge,

in definitive proxy or information statements incorporated by reference in Part III of this Form

10-KSB or any amendment to this Form 10-KSB

o

.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act). Yes

o

No

þ

.

The

issuer’s revenues for its most recent fiscal year were $2,096,319.

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the

registrant computed by reference to average bid and asked price of such common equity as of June

30, 2008 was $260,288. (For purposes of determination of the aggregate market value, only

directors, executive officers and 10% or greater stockholders have been deemed affiliates).

As of September 23, 2008, the registrant had issued and outstanding 123,562,294 shares of common

stock.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Transitional Small Business Disclosure Format (check one): Yes

o

No

þ

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements, as defined in Section 27A of the

Securities Act of 1933, or the Securities Act, and Section 21E of the Securities Exchange Act of

1934, or the Exchange Act. These forward-looking statements relate to, among other things, the

following:

We have based these forward-looking statements on our current assumptions, expectations and

projections about future events.

We use the words “may,” “expect,” “anticipate,” “estimate,” “believe,” “continue,” “intend,”

“plan,” “budget” and other similar words to identify forward-looking statements. You should read

statements that contain these words carefully

2

because they discuss future expectations, contain

projections of results of operations or of our financial condition and/or state other

“forward-looking” information. We do not undertake any obligation to update or revise publicly any

forward-looking

statements, except as required by law. These statements also involve risks and

uncertainties that could cause our actual results or financial condition to materially differ from

our expectations in this annual report, including, but not limited to the risk factors identified

in Item 1 below.

We believe that it is important to communicate our expectations of future performance to our

investors. However, events may occur in the future that we are unable to accurately predict, or

over which we have no control. You are cautioned not to place undue reliance on a forward-looking

statement. When considering our forward-looking statements, you should keep in mind the risk

factors and other cautionary statements in this annual report. The risk factors noted in this

annual report and other factors noted throughout this annual report provide examples of risks,

uncertainties and events that may cause our actual results to differ materially from those

contained in any forward-looking statement.

Our revenues, operating results, financial condition and ability to borrow funds or obtain

additional capital depend substantially on prevailing prices for oil and natural gas. Declines in

oil or natural gas prices may materially adversely affect our financial condition, liquidity,

ability to obtain financing and operating results. Lower oil or natural gas prices may also reduce

the amount of oil or natural gas that we can produce economically. A decline in oil and/or natural

gas prices could have a material adverse effect on the estimated value and estimated quantities of

our oil and natural gas reserves, our ability to fund our operations and our financial condition,

cash flow, results of operations and access to capital. Historically, oil and natural gas prices

and markets have been volatile, with prices fluctuating widely, and they are likely to continue to

be volatile.

PART I

ITEMS 1 and 2

. DESCRIPTION OF BUSINESS AND PROPERTY

Our History

Ignis Petroleum Corporation was incorporated in the State of Nevada on December 9, 2004.

On May 11, 2005, the stockholders of Ignis Petroleum Corporation entered into a stock exchange

agreement with Sheer Ventures, Inc. pursuant to which Sheer Ventures, Inc. issued 9,600,000 shares

of common stock in exchange for all of the issued and outstanding shares of common stock of Ignis

Petroleum Corporation. As a result of this stock exchange, Ignis Petroleum Corporation became a

wholly owned subsidiary of Sheer Ventures, Inc. The stock exchange was accounted for as a reverse

acquisition in which Ignis Petroleum Corporation acquired Sheer Ventures, Inc. in accordance with

Statement of Financial Accounting Standards No. 141,

Business Combinations

. Also on May 11, 2005,

and in connection with the stock exchange, D.B. Management Ltd., a corporation owned and controlled

by Doug Berry, who was then the President, Chief Executive Officer, Secretary, Treasurer and sole

director of Sheer Ventures, Inc., agreed to sell an aggregate of 11,640,000 shares of Sheer

Ventures, Inc.’s common stock to six individuals, including Philipp Buschmann, then the President,

Secretary, Treasurer and sole director of Ignis Petroleum Corporation, for $0.0167 per share for a

total purchase price of $194,000. The stock exchange and the stock purchase were both consummated

on May 16, 2005. On July 11, 2005, Sheer Ventures, Inc. changed its name to Ignis Petroleum Group,

Inc.

Our Operations

We are engaged in the exploration, development, and production of crude oil and natural gas

properties in the United States. We plan to explore for and develop crude oil and natural gas

primarily in the onshore areas of the United States Gulf Coast. During the last half of the fiscal

year ended June 30, 2008, we have focused our activities primarily on restructuring our capital

structure and the identification of additional oil and gas prospects. Although we have had

discussions with our major creditors, including, but not limited to, Yorkville Capital Advisors,

LLC (formerly Cornell Capital Partners) and Petrofinanz GMBH, we have not yet been successful in

reaching an agreement on restructuring our debt beyond its current maturity dates. Currently, we

have only a fractional interest in one producing oil and gas well. Unless our creditors agree to a

restructuring of our debt prior to the maturity date of our secured debentures in January 2009, we

will not be able

to pay our debentures when they become due and we may have to seek protection from the

bankruptcy courts or our only producing asset may be lost in foreclosure. Furthermore, in order to

finance any additional oil and gas prospects, our creditors must agree to restructure our debt

before we are able to raise additional capital. We cannot assure you that we will be successful in

ur endeavors to restructure our debt.

3

During the first half of the fiscal year ended June 30, 2008, we were actively engaged in the

day to day management of Ignis Barnett Shale, LLC, our joint venture with Silver Point Capital,

LLC. On December 21, 2007, following the

resignation of our Chief Executive Officer, Michael

Piazza, we were removed as the day to day manager of the joint venture by Silver Point Capital and

our services agreement with the joint venture was automatically terminated. Thereafter, the joint

venture retained Mr. Piazza and other consultants of ours to work directly for the joint venture.

Consequently, we no longer have an active role in the Ignis Barnett Shale LLC.

Our strategy is to build an energy portfolio that benefits from:

|

|

•

|

|

the maturing of new petroleum technologies, such as seismic interpretation;

|

|

|

|

|

•

|

|

the expected increase of oil and gas prices; and

|

|

|

|

|

•

|

|

the availability of short “outsteps” in the same play as previously-discovered

hydrocarbons.

|

We are actively seeking to acquire other oil and gas prospects, although we currently do not

have any contracts or commitments for other prospects at this time. We intend to employ and

leverage industry technology, engineering, and operating talent. We may, from time to time,

participate in high-value or fast-payback plays for short-term strategic reasons. We outsource

lower value activities so that we can focus our efforts on the earliest part of the value chain

while leveraging outstanding talent and strategic partnerships to execute our strategy. We believe

this approach will allow us to grow our business through rapid identification, evaluation and

acquisition of high-value prospects, while enabling it to use specialized industry talent and keep

overhead costs to a minimum. We believe this strategy will result in significant growth in our

reserves, production and financial strength.

Competitors

Oil and gas exploration and acquisition of undeveloped properties is a highly competitive and

speculative business. We compete with a number of other companies, including major oil companies

and other independent operators which are more experienced and which have greater financial

resources. Such companies may be able to pay more for prospective oil and gas properties.

Additionally, such companies may be able to evaluate, bid for and purchase a greater number of

properties and prospects than our financial and human resources permit. We do not hold a

significant competitive position in the oil and gas industry.

Governmental Regulations

Our operations are subject to various types of regulation at the federal, state and local

levels. Such regulation includes requiring permits for the drilling of wells; maintaining bonding

requirements in order to drill or operate wells; implementing spill prevention plans; submitting

notification and receiving permits relating to the presence, use and release of certain materials

incidental to oil and gas operations; and regulating the location of wells, the method of drilling

and casing wells, the use, transportation, storage and disposal of fluids and materials used in

connection with drilling and production activities, surface usage and the restoration of properties

upon which wells have been drilled, the plugging and abandoning of wells and the transporting of

production. Our operations are also subject to various conservation matters, including the

regulation of the size of drilling and spacing units or proration units, the number of wells which

may be drilled in a unit, and the unitization or pooling of oil and gas properties. In this regard,

some states allow the forced pooling or integration of tracts to facilitate exploration while other

states rely on voluntary pooling of lands and leases, which may make it more difficult to develop

oil and gas properties. In addition, state conservation laws establish maximum rates of production

from oil and gas wells, generally limit the venting or flaring of gas, and impose certain

requirements regarding the ratable purchase of production. The effect of these regulations is to

limit the amounts of oil and gas we may be able to produce from our wells and to limit the number

of wells or the locations at which we may be able to drill.

Our business is affected by numerous laws and regulations, including energy, environmental,

conservation, tax and other laws and regulations relating to the oil and gas industry. We plan to

develop internal procedures and policies to ensure that our operations are conducted in full and

substantial environmental regulatory compliance.

Failure to comply with any laws and regulations may result in the assessment of

administrative, civil and criminal

penalties, the imposition of injunctive relief or both. Moreover, changes in any of these laws

and regulations could have a material adverse effect on business. In view of the many uncertainties

with respect to current and future laws and regulations, including their applicability to us, we

cannot predict the overall effect of such laws and regulations on our future operations.

We believe that our operations comply in all material respects with applicable laws and

regulations and that the

4

existence and enforcement of such laws and regulations have no more

restrictive an effect on our operations than on other similar companies in the energy industry. We

do not anticipate any material capital expenditures to comply with federal and

state environmental

requirements.

Environmental

Operations on properties in which we have an interest are subject to extensive federal, state

and local environmental laws that regulate the discharge or disposal of materials or substances

into the environment and otherwise are intended to protect the environment. Numerous governmental

agencies issue rules and regulations to implement and enforce such laws, which are often difficult

and costly to comply with and which carry substantial administrative, civil and criminal penalties

and in some cases injunctive relief for failure to comply.

Some laws, rules and regulations relating to the protection of the environment may, in certain

circumstances, impose “strict liability” for environmental contamination. These laws render a

person or company liable for environmental and natural resource damages, cleanup costs and, in the

case of oil spills in certain states, consequential damages without regard to negligence or fault.

Other laws, rules and regulations may require the rate of oil and gas production to be below the

economically optimal rate or may even prohibit exploration or production activities in

environmentally sensitive areas. In addition, state laws often require some form of remedial

action, such as closure of inactive pits and plugging of abandoned wells, to prevent pollution from

former or suspended operations.

Legislation has been proposed in the past and continues to be evaluated in Congress from time

to time that would reclassify certain oil and gas exploration and production wastes as “hazardous

wastes.” This reclassification would make these wastes subject to much more stringent storage,

treatment, disposal and clean-up requirements, which could have a significant adverse impact on

operating costs. Initiatives to further regulate the disposal of oil and gas wastes are also

proposed in certain states from time to time and may include initiatives at the county and

municipal government levels. These various initiatives could have a similar adverse impact on

operating costs.

The regulatory burden of environmental laws and regulations increases our cost and risk of

doing business and consequently affects our profitability. The federal Comprehensive Environmental

Response, Compensation and Liability Act, or CERCLA, also known as the “Superfund” law, imposes

liability, without regard to fault, on certain classes of persons with respect to the release of a

“hazardous substance” into the environment. These persons include the current or prior owner or

operator of the disposal site or sites where the release occurred and companies that transported,

disposed or arranged for the transport or disposal of the hazardous substances found at the site.

Persons who are or were responsible for releases of hazardous substances under CERCLA may be

subject to joint and several liability for the costs of cleaning up the hazardous substances that

have been released into the environment and for damages to natural resources, and it is not

uncommon for the federal or state government to pursue such claims.

It is also not uncommon for neighboring landowners and other third parties to file claims for

personal injury or property or natural resource damages allegedly caused by the hazardous

substances released into the environment. Under CERCLA, certain oil and gas materials and products

are, by definition, excluded from the term “hazardous substances.” At least two federal courts have

held that certain wastes associated with the production of crude oil may be classified as hazardous

substances under CERCLA. Similarly, under the federal Resource, Conservation and Recovery Act, or

RCRA, which governs the generation, treatment, storage and disposal of “solid wastes” and

“hazardous wastes,” certain oil and gas materials and wastes are exempt from the definition of

“hazardous wastes.” This exemption continues to be subject to judicial interpretation and

increasingly stringent state interpretation. During the normal course of operations on properties

in which we have an interest, exempt and non-exempt wastes, including hazardous wastes, that are

subject to RCRA and comparable state statutes and implementing regulations are generated or have

been generated in the past. The federal Environmental Protection Agency and various state agencies

continue to promulgate regulations that limit the disposal and permitting options for certain

hazardous and non-hazardous wastes.

We believe that the operators of the properties in which we have an interest are in

substantial compliance with applicable laws, rules and regulations relating to the control of air

emissions at all facilities on those properties. Although we

maintain insurance against some, but not all, of the risks described above, including insuring

the costs of clean-up operations, public liability and physical damage, our insurance may not be

adequate to cover all such costs, that the insurance will continue to be available in the future or

that the insurance will be available at premium levels that justify our purchase. The occurrence of

a significant event not fully insured or indemnified against could have a material adverse effect

on our financial condition and operations. Compliance with environmental requirements, including

financial assurance requirements and the costs associated with the cleanup of any spill, could have

a material adverse effect on our capital expenditures, earnings or competitive position. We do

believe, however, that our operators are in substantial compliance with current applicable

5

environmental laws and regulations. Nevertheless, changes in environmental laws have the potential

to adversely affect operations. At this time, we have no plans to make any material capital

expenditures for environmental control facilities.

Employees

As of June 30, 2008, we only have 2 employees, our interim President, Chief Executive Officer

and Treasurer and our Chief Financial Officer. Many of the daily operational tasks of the Company

are performed by consultants.

Our Properties

As of June 30, 2008 and 2007, we had an interest in the following oil and gas prospects in the

United States onshore Gulf Coast region, primarily located in Texas and Louisiana.

Acom A-6 Prospect

We have 25% of the working interest, which is equal to an 18.75% net revenue interest, in the

Acom A-6 Prospect, which is located in Chambers County, Texas. Kerr-McGee Oil & Gas Onshore LP,

d/b/a KMOG Onshore LP is the operator of the prospect and holds the remainder of the working

interest. Drilling of this prospect commenced production in August 2005 and was completed in

October 2005. The Acom A-6 currently holds proved reserves of 6,210 bbls of oil and 20,990 mcf of

gas and is producing oil and gas.

Crimson Bayou Prospect

For the fiscal year ended June 30, 2007 we had the right to earn 25% of the working interest,

which was equal to a 17.88% net revenue interest, in the test well before payout and 20% of the

working interest, which was equal to a 14.3% net revenue interest, after payout in the Crimson

Bayou Prospect, which is located in Iberville Parish, Louisiana. Range Production L, L.P. was the

operator of the prospect and would have held the remainder of the working interest. Drilling of the

first test well on the prospect was expected to commence in 2007. We have decided not to pursue

this prospect and we were refunded our investment of $115,724.

Barnett Shale Property

During the fiscal year ended June 30, 2007 we held a 12.5% of the working interest, which was

equal to a 9.38% net revenue interest before payout and 10% of the working interest, which was

equal to a 7.5% net revenue interest after payout, in three wells located in the Barnett Shale

trend in Greater Fort Worth Basin, Texas. Rife Energy Operating, Inc. is the operator of the

prospect and holds a majority of the remaining working interest. All three wells have been drilled.

One well has been completed and is producing oil and gas. The other two wells were drilled and were

non-commercial. The leases expired and we recorded abandonment expense of $348,200 during the

fiscal year ending June 30, 2007. We also recorded a write down of the underlying value of the

producing well to zero as the reserve value was substantially lower than the asset net book value

of $201,332. No other costs were incurred for this property for the year ended June 30, 2008.

Sherburne Prospect

On May 5, 2006 we entered into a participation agreement to drill the Sherburne Field

Development prospect, located in Pointe Coupee Parish, Louisiana. Under the terms of the agreement,

we will pay 15% of the drilling, testing and completion costs. Upon completion, we will earn a 15%

working interest in the well before payout and an 11.25% working interest in the well after payout.

Drilling operations commenced in August 2006 and were finished in September 2006. Multiple gas

zones were detected. The commercial viability of the gas zones were tested in October 2006. The

Sherburne Prospect is currently unproved. We do not believe the operator will develop this prospect

due to the lack of commercial viability of the gas zones and we recorded a write down of the asset

to zero totaling $172,740 for the year ended June 30,

2007. We did not incur further costs associated with this project in 2008.

Ignis Barnett Shale Joint Venture

On November 15, 2006, we entered into a joint venture with affiliates of Silver Point Capital,

L.P. through a limited liability company named Ignis Barnett Shale, LLC. The joint venture acquired

45% of the interests in the acreage, oil and natural gas producing properties and natural gas

gathering and treating system located in the St. Jo Ridge Field in the North

6

Texas Fort Worth Basin

then held by W.B. Osborn Oil & Gas Operations, Ltd. and St. Jo Pipeline, Limited. The purchase

price for the acquisition was $17,600,000, subject to certain adjustments, plus $850,000 payable by

Ignis Barnett Shale in

thirty-six monthly installments of $23,611, beginning one month after

closing. In addition, Ignis Barnett Shale agreed to fund additional lease acquisitions up to a

total of $5,000,000 for a period of two years.

Under the terms of Ignis Barnett Shale’s operating agreement, we agreed to manage the

day-to-day operations of Ignis Barnett Shale, subject to Silver Point’s power to remove us as a

manager in their sole and absolute discretion, and the Silver Point affiliates agreed to fund 100%

of the purchase price of the transaction and 100% of future acreage acquisitions and development

costs of Ignis Barnett Shale to the extent approved by Silver Point. Ignis Barnett Shale’s budget,

its operating plan, financial and hedging arrangements, if any, and generally all other material

decisions affecting Ignis Barnett Shale are subject to the approval of Silver Point. We assigned

our intellectual property directly related to the Ignis Barnet Shale all of our intellectual

property related to the joint venture and its activities. On December 21, 2007, Silver Point

exercised its right to remove us as a manager of Ignis Barnett Shale and since that date we have

not been actively engaged in the day to day management of Ignis Barnett Shale. Distributions from

Ignis Barnett Shale will be made when and if declared by Silver Point as follows:

|

|

(i)

|

|

To the Silver Point affiliates pro rata until the Silver Point affiliates have received

an amount equal to their aggregate capital contributions; then

|

|

|

|

|

(ii)

|

|

100% to the Silver Point affiliates pro rata until they have received an amount

representing a rate of return equal to 12%, compounded annually, on their aggregate capital

contributions; then

|

|

|

|

|

(iii)

|

|

100% to us until the amount distributed to us under this clause (iii) equals 12.5% of

all amounts distributed pursuant to clauses (ii) and (iii); then

|

|

|

|

|

(iv)

|

|

87.5% to the Silver Point affiliates pro rata and 12.5% to us until the amount

distributed to the Silver Point affiliates represents a return equal to 20%, compounded

annually, on their aggregate capital contributions; then

|

|

|

|

|

(v)

|

|

100% to us until the amount distributed to us under clauses (iii), (iv), and (v) equals

20% of all amounts distributed pursuant to clauses (ii), (iii), (iv), and (v); then

|

|

|

|

|

(vi)

|

|

80% to the Silver Point affiliates pro rata and 20% to us until the amount distributed

to the Silver Point affiliates represents a return equal to 30%, compounded annually, on

their aggregate capital contributions; then

|

|

|

|

|

(vii)

|

|

100% to us until the amount distributed to us under clauses (iii), (iv), (v), (vi),

and (vii) equals 25% of all amounts distributed pursuant to clauses (ii), (iii), (iv), (v),

(vi), and (vii); then

|

|

|

|

|

(viii)

|

|

75% to the Silver Point affiliates pro rata and 25% to us until the amount distributed to

the Silver Point affiliates represents a return equal to 60%, compounded annually, on their

aggregate capital contributions; then

|

|

|

|

|

(ix)

|

|

50% to the Silver Point affiliates pro rata and 50% to us.

|

We also agreed not to make any additional investments in parts of three North Texas counties,

the area of mutual interest that Ignis Barnett Shale established with W.B. Osborn Oil & Gas

Operations, until the joint venture has satisfied its obligation to W.B. Osborn Oil & Gas

Operations to purchase an additional $5 million of acreage. Thereafter, the joint venture will have

a right of first offer on any future investment opportunity we desire to make in the area of mutual

interest. If the joint venture does not exercise its right of first offer, we can pursue the

opportunity, subject to some limitations during the first 18 months after the joint venture

completes the $5 million additional investment with W.B. Osborn Oil & Gas Operations. If the joint

venture exercises its right to pursue an opportunity, we will have the opportunity to co-invest up

to 50% of such investment up to $10 million.

For the year ended June 30, 2008, we have not earned our share of equity and therefore we have

not recorded any financial transactions relating to this venture. During the first six months of

the fiscal year ended June 30, 2008, we charged a management fee to the partnership to handle

day-to-day operations. During the years ended June 30, 2008 and 2007, management fees were paid to

us in the amount of $90,000 and $142,500, respectively.

On December 21, 2007, our Services Agreement, dated November 15, 2006, with Ignis Barnett

Shale, LLC (“IBS”) was automatically terminated pursuant to its term upon our removal as the B

Manager of the Amended and Restated

7

Limited Liability Company Agreement of IBS, dated November 15,

2006 (the “LLC Agreement”), by Silver Point Capital L.P. (“Silver Point”). The Services Agreement

was entered into on November 15, 2006 for the purpose of providing

management and administrative

services to IBS in exchange for payment of $50,750 per month during the initial 12 months and

$43,250 per month thereafter. The LLC Agreement remains in effect and unchanged.

Liberty Hills Prospect

On September 6, 2007, Ignis Louisiana Salt Basin, LLC (“ILSB”), our wholly owned subsidiary,

entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with Anadarko Petroleum

Corporation (“Anadarko”) providing for the sale by Anadarko to ILSB of Anadarko’s interests in the

acreage and oil and natural gas producing properties in the Liberty Hills prospect, located in

Bienville Parish, Louisiana (the “Properties”). The purchase price of the acquisition was to be

$3,000,000 in cash, subject to customary adjustments more fully described in the Purchase

Agreement.

The Purchase Agreement required the parties to close on the acquisition no later than

September 28, 2007. Due to our inability to finalize terms of funding necessary to acquire the

Properties by this deadline, the Purchase Agreement terminated by its own terms on September 28,

2007. Termination of the Purchase Agreement terminated all obligations and liabilities of the

parties to one another and to any third party under the Purchase Agreement. We incurred no material

penalties under the Purchase Agreement as a result of its termination.

Production

The table below sets forth oil and natural gas production from our net interest in producing

properties for each of its last two years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil (bbl)

|

|

Gas (mcf)

|

|

Oil (bbl)

|

|

Gas (mcf)

|

|

Production by State

|

|

2008

|

|

2008

|

|

2007

|

|

2007

|

|

Texas

|

|

|

15,225

|

|

|

|

50,269

|

|

|

|

14,846

|

|

|

|

44,248

|

|

Our oil and natural gas production is sold on the spot market and we do not have any production

that is subject to firm commitment contracts. For the years ended June 30, 2008 and 2007, purchases

by Denbury Onshore, LLC represented 99.8% and 97.0% of our revenues, respectively. We believe that

we would be able to locate an alternate customer in the event of the loss of this customer.

Productive Wells

The table below sets forth certain information regarding our ownership, as of June 30, 2008 and

June 30, 2007, of productive wells in the area indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive Wells

|

|

Oil

|

|

Gas

|

|

State

|

|

Gross

|

|

Net

|

|

Gross

|

|

Net

|

|

Texas

|

|

|

1

|

|

|

|

.25

|

|

|

|

1

|

|

|

|

.13

|

|

Drilling Activity

We did not commence drilling activities during the fiscal years ended June 30, 2008 or 2007.

Reserves

Please refer to unaudited Note 11 in the accompanying audited financial statements for a

summary of our reserves at June 30, 2008 and 2007.

Acreage

8

The following table sets forth the gross and net acres of developed and undeveloped oil and

natural gas leases in

which we had a working interest as of June 30, 2008 and 2007.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Developed

|

|

Undeveloped

|

|

State

|

|

Gross

|

|

Net

|

|

Gross

|

|

Net

|

|

|

|

|

|

|

|

Texas

|

|

|

500

|

|

|

|

120

|

|

|

|

—

|

|

|

|

—

|

|

|

Louisiana

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

Total

|

|

|

500

|

|

|

|

120

|

|

|

|

—

|

|

|

|

—

|

|

9

Office Lease

We maintain our principal executive office at 7160 Dallas Parkway, Suite 380, Plano, Texas

75024. Our telephone number at that office is (972) 526-5250 and our facsimile number is (972)

526-5251. We entered into a 60 month lease effective May 1, 2007. Our current office space consists

of approximately 5,200 square feet. Our lease payment is $10,404 per month for the first 25 months,

$10,729.13 per month for months 26 through 49, and $10,054 per month for the remaining months.

Utilities are expected to be $1,070 per month unless there is a rate adjustment. We paid a security

deposit of $8,500 which is refundable upon expiration of the lease.

Given our current staffing levels, we believe the current office space is greater than our

needs required and, therefore, we are investigating subleasing our current office space to reduce

costs. We do not anticipate any difficulty securing alternative space more in line with our current

needs and staffing levels.

Risk Factors

Risks Relating to Our Current Financing Arrangement

:

Unless We Are Successful in Restructuring Our Secured Debt, We May Be Forced to Seek Protection

From the Bankruptcy Court and Lose Our Only Producing Oil and Gas Well to Foreclosure.

In January 2006, we entered into a securities purchase agreement, as amended and restated, for

the sale of $5,000,000 principal amount of secured convertible debentures and accruing annual

interest of 7%. The secured convertible debentures are due and payable in January 2009, unless

sooner converted into shares of our common stock. Unless we are successful in negotiating a restructuring of our secured debentures, we will not

be able to pay our secured debentures when they become due in January 2009, and we may be forced to

seek bankruptcy protection and lose our only producing oil and gas well to foreclosure. Although we

have had numerous discussions with our creditors about recapitalizing the Company, we have not yet

been successful in doing so and we cannot assure you that we will reach an agreement with our

creditors to recapitalize the Company.

The Continuously Adjustable Conversion Price Feature of Our Secured Convertible Debentures

Could Require Us to Issue a Substantially Greater Number of Shares, Which Will Cause Dilution to

Our Existing Stockholders.

Our obligation to issue shares upon conversion of our secured convertible debentures is

essentially limitless. The number of shares of common stock issuable upon conversion of our

secured convertible debentures will increase if the market price of our stock declines, which will

cause dilution to our existing stockholders.

The Continuously Adjustable Conversion Price Feature of Our Secured Convertible Debentures May

Encourage Investors to Make Short Sales in Our Common Stock, Which Could Have a Depressive Effect

on the Price of Our Common Stock.

The secured convertible debentures are convertible into shares of our common stock at a 6%

discount to the trading price of the common stock prior to the conversion. The downward pressure on

the price of the common stock as the selling stockholder converts and sells material amounts of

common stock could encourage short sales by investors. Short sales by investors could place further

downward pressure on the price of the common stock. The selling stockholder could sell common stock

into the market in anticipation of covering the short sale by converting their securities, which

could cause the further downward pressure on the stock price. In addition, not only the sale of

shares issued upon conversion of secured convertible debentures, but also the mere perception that

these sales could occur, may adversely affect the market price of the common stock.

The Issuance of Shares Upon Conversion of the Secured Convertible Debentures and Exercise of

Outstanding Warrants May Cause Immediate and Substantial Dilution to Our Existing Stockholders.

There

are a large number of shares underlying our secured convertible

debentures. The continued issuance of shares upon conversion of the secured convertible debentures and exercise of

warrants may result in substantial dilution to the interests of other stockholders since the

selling stockholder may ultimately convert and sell the full amount issuable on conversion.

Although the holder of our secured convertible debentures and related

warrants, YA Global (formerly Cornell Capital Partners), may not

fully convert their secured convertible debentures if such conversion would cause

them to own more than 4.99% of our outstanding common stock, this restriction does not prevent

it from converting and/or exercising some of their holdings and then

later converting the rest of their holdings. There is no other upper limit on the number of

shares that may be issued upon conversion of the secured convertible

debentures and such conversions have the

effect of further diluting the proportionate equity interest and

voting power of other holders of our

common stock.

Our Outstanding Secured Convertible Debentures are Due in January 2009, and Our Failure to Repay

the Convertible Debentures, Could Result in Legal Action Against us, Which Could Require the Sale

or Foreclosure of Substantial Assets Including our Only Producing Oil and Gas Well.

Any

event of default in connection with our secured convertible

debentures such as our failure to repay

the principal or interest when due, our failure to issue shares of common stock upon conversion by

the holder, our failure to timely file a registration statement or have such registration statement

declared effective, breach of any covenant, representation or warranty in the securities purchase

agreement, as amended and restated, or related secured convertible debentures, the assignment or

appointment of a receiver to control a substantial part of our property or business, the filing of

a money judgment, writ or similar process against us in excess of $50,000, the commencement of a

bankruptcy, insolvency, reorganization or liquidation proceeding against us and the delisting of

our common stock could require the early repayment of the secured convertible debentures, including

default interest rate on the outstanding principal balance of the secured convertible debentures if

the default is not cured with the specified grace period. If we were required to repay the secured

convertible debentures, we would be required to use our limited working capital and raise

a significant amount of additional funds. If we were unable to repay the secured convertible debentures when required, the

debenture holders could commence legal action against us and

foreclose on all of our assets to recover the amounts due. Any such action would likely

require us to cease operations.

10

If an Event of Default Occurs under the Second Amended and Restated Securities Purchase Agreement,

Secured Convertible Debentures or Security Agreements, the Investor Could Take Possession of all

Our Goods, Inventory, Contractual Rights and General Intangibles, Receivables, Documents,

Instruments, Chattel Paper, and Intellectual Property.

In

connection with the secured convertible debentures and the securities purchase agreement, as amended and restated, we executed a

security agreement in favor of the investor granting it a first priority security interest in all

of our goods, inventory, contractual rights and general intangibles, receivables, documents,

instruments, chattel paper, and intellectual property. The security agreement states that if an

event of default occurs under the securities purchase agreement, as amended and restated, secured

convertible debentures or security agreement, the investor has the right to take possession of the

collateral, to operate our business using the collateral, and has the right to assign, sell, lease

or otherwise dispose of and deliver all or any part of the collateral, at public or private sale or

otherwise to satisfy our obligations under these agreements.

Risks Relating to Our Business

:

We Have a History Of Losses Which May Continue, Which May Negatively Impact Our Ability to Achieve

Our Business Objectives.

We

incurred a net loss of $1,301,705 and net income of $344,151 for our fiscal years ending

June 30, 2008, and June 30, 2007, respectively. We may not be able to achieve or sustain

profitability on a quarterly or annual basis in the future. Our operations are subject to the risks

and competition inherent in the establishment of a business enterprise. Our future operations may

not be profitable. Revenues and profits, if any, will depend upon various factors, including

whether we will be able to continue expansion of our revenue. We may not achieve our business

objectives and the failure to achieve such goals would have an adverse impact on us.

Our Independent Auditors Have Expressed Substantial Doubt About Our Ability to Continue As a Going

Concern, Which May Hinder Our Ability to Obtain Future Financing.

In their report dated October 13, 2008, our independent auditors expressed substantial doubt

about our ability to continue as a going concern. Our ability to continue as a going concern is an

issue raised as a result of recurring losses from operations, lack of sufficient working capital

and our dependence on outside financing. We continue to experience net operating losses. Our

ability to continue as a going concern is subject to our ability to generate a profit and/or obtain

necessary funding from outside sources, including obtaining additional funding from the sale of our

securities, increasing sales or obtaining loans and grants from various financial institutions

where possible. Our continued net operating losses increase the difficulty in meeting such goals

and such methods may not prove successful.

We Have a Limited Operating History and if We are not Successful in Continuing to Grow Our

Business, Then We may have to Scale Back or Even Cease Our Ongoing Business Operations.

We have a limited history of revenues from operations and have limited tangible assets. We

have yet to generate any profits and we may never operate profitably. We have a limited operating

history and just recently emerged from the exploration stage and began producing oil and/or gas.

Our success is significantly dependent on a successful acquisition, drilling, completion and

production program. Our operations will be subject to all the risks inherent in the establishment

of a new enterprise and the uncertainties arising from the absence of a significant operating

history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are

not an established company and potential investors should be aware of the difficulties normally

encountered by enterprises in the early stages of their development. If our business plan is not

successful, and we are not able to operate profitably, investors may lose some or all of their

investment in our company.

Because We Are Small and Do Not Have Much Capital, We May Have to Limit our Exploration and

Development Activity Which May Result in a Loss of Your Investment.

Because we are small and do not have much capital, we must limit our exploration and

development activity. As such we may not be able to complete an exploration and development program

that is as thorough as we would like. In that event, existing reserves may go undiscovered. Without

finding reserves, we cannot generate revenues and you will lose your investment.

If We Are Unable to Successfully Recruit Qualified Managerial and Field Personnel Having Experience

in Oil and

11

Gas Exploration, We May Not Be Able to Continue Our Operations.

In order to successfully implement and manage our business plan, we will be dependent upon,

among other things, successfully recruiting qualified managerial and field personnel having

experience in the oil and gas exploration business. Our current management team does not have a lot

of technical experience in the oil and gas field. Competition for qualified individuals is intense.

We may not be able to find, attract and retain existing employees and we may not be able to find,

attract and retain qualified personnel on acceptable terms. If we are unable to find, attract and

retain qualified personnel with technical expertise, our business operations could be harmed.

We Are Currently Dependent on Other Oil and Gas Operators for Operations on Our Prospects.

All of our current operations are prospects in which we own a minority interest. As a result,

the drilling and operations are conducted by other operators, upon which we are reliant for

successful drilling and revenues. In addition, as a result of our dependence on others for

operations on our properties, we do not have any control over the timing, cost or rate of

development on such properties. As a result, drilling operations may not occur in a timely manner

or take more time than we anticipate as well as resulting in higher expenses. The inability of

these operators to adequately staff or conduct operations on these prospects could have a material

adverse effect on our revenues and operating results.

The Potential Profitability of Oil and Gas Ventures Depends Upon Factors Beyond Our Control.

The potential profitability of oil and gas properties is dependent upon many factors beyond

our control. For instance, world prices and markets for oil and gas are unpredictable, highly

volatile, potentially subject to governmental fixing, pegging, controls, or any combination of

these and other factors, and respond to changes in domestic, international, political, social, and

economic environments. Additionally, due to worldwide economic uncertainty, the availability and

cost of funds for production and other expenses have become increasingly difficult, if not

impossible, to project. These changes and events may materially affect our financial performance.

Adverse weather conditions can also hinder drilling operations. A productive well may become

uneconomic in the event water or other deleterious substances are encountered which impair or

prevent the production of oil and/or gas from the well. In addition, production from any well may

be unmarketable if it is impregnated with water or other deleterious substances. The marketability

of oil and gas which may be acquired or discovered will be affected by numerous factors beyond our

control. These factors include the proximity and capacity of oil and gas pipelines and processing

equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and

environmental protection. These factors cannot be accurately predicted and the combination of these

factors may result in us not receiving an adequate return on invested capital.

The Oil And Gas Industry Is Highly Competitive And There Is No Assurance That We Will Be Successful

In Acquiring Leases.

The oil and gas industry is intensely competitive. We compete with numerous individuals and

companies, including many major oil and gas companies, which have substantially greater technical,

financial and operational resources and staffs. Accordingly, there is a high degree of competition

for desirable oil and gas leases, suitable properties for drilling operations and necessary

drilling equipment, as well as for access to funds. We cannot predict if the necessary funds can be

raised or that any projected work will be completed.

The Marketability of Natural Resources Will be Affected by Numerous Factors Beyond Our Control

Which May Result in Us not Receiving an Adequate Return on Invested Capital to be Profitable or

Viable.

The marketability of natural resources which may be acquired or discovered by us will be

affected by numerous factors beyond our control. These factors include market fluctuations in oil

and gas pricing and demand, the proximity and capacity of natural resource markets and processing

equipment, governmental regulations, land tenure, land use, regulations concerning the importing

and exporting of oil and gas and environmental protection regulations. The exact effect of these

factors cannot be accurately predicted, but the combination of these factors may result in us not

receiving an adequate return on invested capital to be profitable or viable.

Oil and Gas Operations are Subject to Comprehensive Regulation Which May Cause Substantial Delays

or Require Capital Outlays in Excess of Those Anticipated Causing an Adverse Effect on Our Company.

12

Oil and gas operations are subject to federal, state, and local laws relating to the

protection of the environment, including laws regulating removal of natural resources from the

ground and the discharge of materials into the environment. Oil and gas operations are also subject

to federal, state, and local laws and regulations which seek to maintain health and safety

standards by regulating the design and use of drilling methods and equipment. Various permits from

government bodies are required for drilling operations to be conducted; no assurance can be given

that such permits will be received. Environmental standards imposed by federal or local authorities

may be changed and any such changes may have material adverse effects on our activities. Moreover,

compliance with such laws may cause substantial delays or require capital outlays in excess of

those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to

liability for pollution or other environmental damages which we may elect not to insure against due

to prohibitive premium costs and other reasons. To date we have not been required to spend any

material amount on compliance with environmental regulations. However, we may be required to do so

in future and this may affect our ability to expand or maintain our operations.

Exploration and Production Activities are Subject to Environmental Regulations Which May Prevent or

Delay the Commencement or Continuance of Our Operations.

In general, our exploration and production activities are subject to federal, state and local

laws and regulations relating to environmental quality and pollution control. Such laws and

regulations increase the costs of these activities and may prevent or delay the commencement or

continuance of a given operation. Compliance with these laws and regulations has not had a material

effect on our operations or financial condition to date. Specifically, we are subject to

legislation regarding emissions into the environment, water discharges and storage and disposition

of hazardous wastes. In addition, legislation has been enacted which requires well and facility

sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws

and regulations are frequently changed and we are unable to predict the ultimate cost of

compliance. Generally, environmental requirements do not appear to affect us any differently or to

any greater or lesser extent than other companies in the industry. We believe that our operations

comply, in all material respects, with all applicable environmental regulations. Our operating

partners maintain insurance coverage customary to the industry; however, we are not fully insured

against all possible environmental risks.

Exploratory Drilling Involves Many Risks and We May Become Liable for Pollution or Other

Liabilities Which May Have an Adverse Effect on Our Financial Position.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or

unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage,

fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are

involved. We may become subject to liability for pollution or hazards against which we cannot

adequately insure or which we may elect not to insure. Incurring any such liability may have a

material adverse effect on our financial position and operations.

Any Change to Government Regulation/Administrative Practices May Have a Negative Impact on Our

Ability to Operate and Our Profitability.

The laws, regulations, policies or current administrative practices of any government body,

organization or regulatory agency in the United States or any other jurisdiction, may be changed,

applied or interpreted in a manner which will fundamentally alter our ability to carry on our

business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory

agency, or other special interest groups, may have a detrimental effect on us. Any or all of these

situations may have a negative impact on our ability to operate and/or our profitably.

Risk relating to our financial statements for material weakness in controls

Our Chief Executive Officer and Chief Financial Officer evaluated the effectiveness of our

disclosure controls and procedures pursuant to Rule 13a-15 under the Exchange Act as of the end of

the period covered by this report. Based on that evaluation, our Chief Executive Officer and Chief

Financial Officer have concluded that our disclosure controls and procedures (as defined in Rule

13a-15(e) under the Exchange Act) were not effective as of June 30, 2008.

Our management has identified material weaknesses in our internal control over financial reporting,

as defined in the standards by the Public Company Accounting Oversight Board. The Company’s

material weaknesses in internal control are (a) insufficient entity level controls caused by a lack

of senior management oversight and absence of corporate governance structure and (b) lack of

segregation of duties and the lack of sufficient accounting expertise in the financial reporting

process

13

to support sufficient review and approval procedures and timely filing of financial

statements. However, the Company believes the costs of remediation outweigh the benefits given the

limited operations of the Company. Inability to correct the material weakness may have a material

adverse effect on our compliance with financial reporting.

Risks Relating to Our Common Stock

:

There Are a Large Number of Shares Underlying Our Outstanding Convertible Securities and Warrants

That May be Available for Future Sale and the Sale of These Shares May Depress the Market Price of

Our Common Stock.

As of June 30, 2008, we had 57,841,982 shares of common stock, net of 18,250,000 shares held

in escrow related to our loan agreement with YA Global (formerly

Cornell Capital Partners, LP), issued and

outstanding, secured convertible debentures issued and outstanding that may be converted into

1,131,678,487 shares of common stock based on the market price of our common stock on June 30,

2008, and outstanding warrants to purchase 12,000,000 shares of common stock. The

sale of these shares may adversely affect the market price of our common stock.

If We Fail to Remain Current in Our Reporting Requirements, We Could be Removed From the OTC

Bulletin Board Which Would Limit the Ability of Broker-Dealers to Sell Our Securities and the

Ability of Stockholders to Sell Their Securities in the Secondary Market.

Companies trading on the OTC Bulletin Board, such as us, must be reporting issuers under

Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports

under Section 13 or 15(d), in order to maintain price quotation privileges on the OTC Bulletin

Board. If we fail to remain current on our reporting requirements, we could be removed from the OTC

Bulletin Board. As a result, the market liquidity for our securities could be severely adversely

affected by limiting the ability of broker-dealers to sell our securities and the ability of

stockholders to sell their securities in the secondary market.

Our Common Stock is Subject to the “Penny Stock” Rules of the SEC and the Trading Market in Our

Securities is Limited, Which Makes Transactions in Our Stock Cumbersome and May Reduce the Value of

an Investment in Our Stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition

of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price

of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to

certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

|

•

|

|

that a broker or dealer approve a person’s account for transactions in penny

stocks; and

|

|

|

|

|

•

|

|

the broker or dealer receive from the investor a written agreement to the

transaction, setting forth the identity and quantity of the penny stock to be

purchased.

|

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

|

•

|

|

obtain financial information and investment experience objectives of the

person; and

|

|

|

|

|

•

|

|

make a reasonable determination that the transactions in penny stocks are

suitable for that person and the person has sufficient knowledge and experience in

financial matters to be capable of evaluating the risks of transactions in penny

stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a

disclosure schedule prescribed by the Commission relating to the penny stock market, which, in

highlight form:

|

|

•

|

|

sets forth the basis on which the broker or dealer made the suitability

determination; and

|

|

|

|

|

•

|

|

that the broker or dealer received a signed, written agreement from the

investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the

“penny stock” rules. This may make it more difficult for investors to dispose of our common stock

and cause a decline in the market value of our stock.

14

Glossary Of Selected Oil and Natural Gas Terms

“3D” or “3D SEISMIC.” An exploration method of sending energy waves or sound waves into the

earth and recording the wave reflections to indicate the type, size, shape, and depth of subsurface

rock formations. 3D seismic provides three-dimensional pictures.

“Bbl.” One stock tank barrel, or 42 U.S. gallons liquid volume, used herein in reference to

crude oil or other liquid hydrocarbons.

“BOE.” Barrels of oil equivalent. BTU equivalent of six thousand cubic feet (Mcf) of natural

gas which is equal to the BTU equivalent of one barrel of oil.

“BTU.” British Thermal Unit.

“DEVELOPMENT WELL” A well drilled within the proved boundaries of an oil or natural gas

reservoir with the intention of completing the stratigraphic horizon known to be productive.

“DISCOUNTED PRESENT VALUE.” The present value of proved reserves is an estimate of the

discounted future net cash flows from each property at the specified date, or as otherwise

indicated. Net cash flow is defined as net revenues, after deducting production and ad valorem

taxes, less future capital costs and operating expenses, but before deducting federal income taxes.

The future net cash flows have been discounted at an annual rate of 10% to determine their “present

value.” The present value is shown to indicate the effect of time on the value of the revenue

stream and should not be construed as being the fair market value of the properties. In accordance

with Securities and Exchange Commission rules, estimates have been made using constant oil and

natural gas prices and operating costs at the specified date, or as otherwise indicated.

“DRY HOLE.” A development or exploratory well found to be incapable of producing either oil or

natural gas in sufficient quantities to justify completion as an oil or natural gas well.

“EXPLORATORY WELL” A well drilled to find and produce oil or natural gas in an unproved area,

to find a new reservoir in a field previously found to be productive of oil or natural gas in

another reservoir, or to extend a known reservoir.

“GROSS ACRES” or “GROSS WELLS.” The total number of acres or wells, as the case may be, in

which a working or any type of royalty interest is owned.

“Mcf.” One thousand cubic feet of natural gas.

“NET ACRES.” or “NET WELLS.” The sum of the fractional working or any type of royalty

interests owned in gross acres or gross wells, as applicable.

“PRODUCING WELL” or “PRODUCTIVE WELL.“A well that is capable of producing oil or natural gas

in economic quantities.

“PROVED DEVELOPED RESERVES.” The oil and natural gas reserves that can be expected to be

recovered through existing wells with existing equipment and operating methods. Additional oil and

natural gas expected to be obtained through the application of fluid injection or other improved

recovery techniques for supplementing the natural forces and mechanisms of primary recovery should

be included as “proved developed reserves” only after testing by a pilot project or after the

operation of an installed program has confirmed through production response that increased recovery

will be achieved.

“PROVED RESERVES.” The estimated quantities of crude oil, natural gas and natural gas liquids

that geological and engineering data demonstrate with reasonable certainty to be recoverable in

future years from known reservoirs under existing economic and operating conditions.

“PROVED UNDEVELOPED RESERVES.” The oil and natural gas reserves that are expected to be

recovered from new wells on undrilled acreage or from existing wells where a relatively major

expenditure is required for recompletion. Reserves on undrilled acreage are limited to those

drilling units offsetting productive units that are reasonably certain of

15

production when drilled. Proved reserves for other undrilled units can be claimed only where

it can be demonstrated with certainty that there is continuity of production from the existing

productive formation. Under no circumstances should estimates for proved undeveloped reserves be

attributable to any acreage for which an application of fluid injection or other improved recovery

techniques is contemplated, unless such techniques have been proved effective by actual tests in

the area and in the same reservoir.

“STANDARDIZED MEASURE.” Under the Standardized Measure, future cash flows are estimated by

applying year-end prices, adjusted for fixed and determinable changes, to the estimated future

production of year-end proved reserves. Future cash inflows are reduced by estimated future

production and development costs based on period-end costs to determine pretax cash inflows. Future

income taxes are computed by applying the statutory tax rate to the excess inflows over a company’s

tax basis in the associated properties.

Tax credits, net operating loss carryforwards and permanent differences also are considered in

the future tax calculation. Future net cash inflows after income taxes are discounted using a 10%

annual discount rate to arrive at the Standardized Measure.

“WORKING INTEREST.” The operating interest (not necessarily as operator) that gives the owner

the right to drill, produce and conduct operating activities on the property and a share of

production, subject to all royalties, overriding royalties and other burdens, and to all

exploration, development and operational costs including all risks in connection therewith.

|

|

|

|

|

ITEM 3

.

|

|

LEGAL PROCEEDINGS

|

We are not aware of any pending or threatened litigation or legal proceedings.

|

|

|

|

|

ITEM 4

.

|

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

There were no matters submitted to a vote of our security holders during the fourth quarter of

our fiscal year ended June 30, 2008.

PART II

|

|

|

|

|

ITEM 5

.

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND SMALL BUSINESS ISSUER

PURCHASES OF EQUITY SECURITIES

|

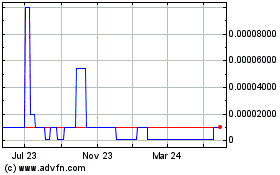

MARKET INFORMATION

Our common stock trades on the National Association of Securities Dealers’ Over-The-Counter

Bulletin Board under the symbol “IGPG”. The following table sets forth the quarterly high and low

bid information for our common stock as reported by the National Association of Securities Dealers’

Over-The-Counter Bulletin Board for the periods indicated below. The over-the-counter quotations

reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent

actual transactions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year 2008

|

|

Fiscal Year 2007

|

|

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

First Quarter

|

|

$

|

0.11

|

|

|

$

|

0.025

|

|

|

$

|

0.34

|

|

|

$

|

0.23

|

|

|

Second Quarter

|

|

$

|

0.07

|

|

|

$

|

0.015

|

|

|

$

|

0.15

|

|

|

$

|

0.12

|

|

|

Third Quarter

|

|

$

|

0.02

|

|

|

$

|

0.003

|

|

|

$

|

0.18

|

|

|

$

|

0.17

|

|

|

Fourth Quarter

|

|

$

|

0.023

|

|

|

$

|

0.0025

|

|

|

$

|

0.10

|

|

|

$

|

0.09

|

|

HOLDERS

As of September 29, 2008, we had approximately 52 holders of our common stock. The number of

record holders was determined from the records of our transfer agent and does not include

beneficial owners of common stock whose shares are held in the names of various security brokers,

dealers, and registered clearing agencies. The transfer agent of our common

16

stock is Empire Stock Transfer, Inc., 2470 St. Rose Parkway, Suite 304, Henderson, Nevada

89074.

DIVIDENDS

We have not paid cash dividends on our stock and we do not anticipate paying any cash

dividends thereon in the foreseeable future.

By the terms of our agreements with Cornell Capital Partners, LP, we are required to obtain

the prior written consent of Cornell Capital Partners, LP prior to paying dividends or redeeming

shares of our stock while the secured convertible debentures owed to Cornell Capital Partners, LP

are outstanding. Any future determination to pay cash dividends will be at the discretion of our

Board of Directors and will be dependent upon our financial condition, results of operations,

capital requirements, and such other factors as our Board of Directors deems relevant.

RECENT SALES OF UNREGISTERED SECURITIES

During our fiscal year ending June 30, 2008, we issued the following equity securities in

transactions exempt from the registration requirements under the Securities Act of 1933, as

amended, that were not disclosed previously in Current Reports on Form 8-K or Quarterly Reports on

Form 10-QSB.

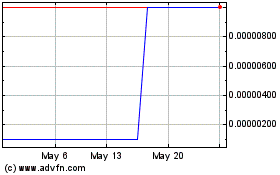

During the period January 1, 2008 through June 30, 2008, we issued 39,652,412 shares of common

stock to YA Global Investments, L.P. (formerly known as Cornell Capital Partners, L.P. and referred

to herein as “YA Global”) upon conversion of a portion of their Convertible Debenture Agreement.

The shares were issued in reliance upon the exemptions contained in Rule 506 and/or Section 4(2) of

the Securities Act. The shares issued were valued at $156,100 or average price of $0.004 per

share, the fair market value of the common stock at the date of conversion.

|

|

|

|

|

ITEM 6

.

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

The following discussion should be read in conjunction with our Financial Statements, and

respective notes thereto, included elsewhere herein. The information below should not be construed

to imply that the results discussed herein will necessarily continue into the future or that any

conclusion reached herein will necessarily be indicative of actual operating results in the

future. You should read the following discussion and analysis of our financial condition and

results of operations together with our financial statements and related notes appearing elsewhere

in this annual report. This discussion and analysis contains forward-looking statements that

involve risks, uncertainties and assumptions. Our actual results may differ materially from those

anticipated in these forward-looking statements as a result of many factors. The information below

should not be construed to imply that the results discussed in this report will necessarily

continue into the future or that any conclusion reached in this report will necessarily be

indicative of actual operating results in the future. Such discussion represents only the best

present assessment of our management.

|

|

•

|

|

Management of portfolio risk; and

|

|

|

|

|

•

|

|

Direction of critical reservoir management and production operations activities.

|

RESULTS OF OPERATIONS

Total revenue for the periods ended June 30, 2008 and 2007 were $2,096,319 and $1,410,448,

respectively, an increase of $685,871 or about 49%. Revenues from the sale of oil and gas increased

$738,371 year-over-year, from $1,267,948 for the period ended June 30, 2007 to $2,006,319 for the

period ended June 30, 2008. In addition we recorded management fees through June 30, 2008 and 2007

of $90,000 and $142,500 under the Ignis Barnett Shale, LLC services agreement, respectively.

The increase in oil and natural gas sales was primarily attributable to higher product

prices. For the year ended June 30, 2008, production was essentially flat compared to the same

period ended June 30, 2007. Overall production increased to 23.6 BOE from 22.2 BOE or an increase

of 1.4 BOE, or about 6%. The production for the year ended June 30, 2008 was primarily from the

Acom A-6 well. Effective September 30, 2007 we sold the Inglish Sisters #3 well located in Montague

County, Texas. During our ownership period in 2008, we had production of .04 BOE from this

well. Oil prices increased from an average of $63.08 to $98.34 or 56% and gas prices increased

$2.52, or 34% from $7.49 to $10.01.

17

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended

|

|

|

|

6/30/2008

|

|

6/30/2007

|

|

Oil and Natural Gas Sales

|

|

$

|

2,006,319

|

|

|

$

|

1,267,948

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

|

|

|

|

|

|

|

Condensate (Mbbls)

|

|

|

15.2

|

|

|

|

14.8

|

|

|

Natural Gas (MMcf)

|

|

|

50.3

|

|

|

|

44.2

|

|

|

Total (MBOE)

|

|

|

23.6

|

|

|

|

22.2

|

|

|

|

|

|

|

|

|

|

|

|

|

Average price

|

|

|

|

|

|

|

|

|

|

Condensate ($/Bbl)

|