Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-231964

Prospectus Supplement

(To Prospectus dated June 5, 2019)

Up to $50,000,000 of Common Shares

We have entered into an equity distribution agreement with BMO Capital Markets Corp., as sales agent (the "Agent") relating to our common shares offered

by this prospectus supplement and the accompanying prospectus. In accordance with the equity distribution agreement we may offer and sell common shares having an aggregate offering price of up to

$50,000,000 from time to time through the Agent.

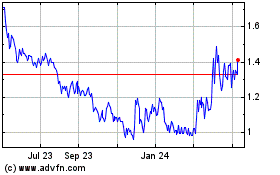

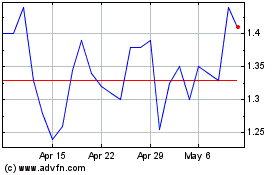

Our

outstanding common shares are listed for trading on the NYSE American under the symbol "PLG" and on the Toronto Stock Exchange ("TSX") under the symbol "PTM". On February 4, 2021, the

closing sales price of our common shares on the NYSE American and the TSX were $4.45 and C$5.70 per share, respectively. We have applied to list the common shares sold in this offering on the NYSE

American and TSX.

Sales

of our common shares, if any, under this prospectus supplement and the accompanying prospectus may be made by the Agent by any method permitted by law deemed to be an "at the market" offering as

defined in Rule 415 promulgated under the Securities Act of 1933, as amended (the "Securities Act"), including sales made directly on or through the NYSE American, the existing trading

market for our common shares, or on any other existing trading market for the common shares, and, if expressly authorized by us, in negotiated transactions. The Agent will not be permitted to purchase

common shares for its own account as principal unless expressly authorized by us to do so in a placement notice. If we and the Agent agree on any method of distribution other than sales of shares of

our common shares over the NYSE American or another existing trading market in the United States at market prices, we will file a further prospectus supplement providing all information

about such offering as required by Rule 424(b) under the Securities Act. None of our common shares will be offered or sold in Canada under this prospectus supplement and the accompanying

prospectus and no sales of common shares under this prospectus supplement and the accompanying prospectus will be made to anyone known by the Agent to be a resident of Canada or over or through the

facilities of the TSX or any other exchange or market in Canada. The Agent will act as sales agent on a commercially reasonable efforts basis consistent with its normal trading and sales practices.

There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The

Agent will be entitled to a placement fee of up to 3.0% of the gross sales price per share sold. In connection with the sale of our common shares on our behalf, the Agent will be deemed to be an

"underwriter" within the meaning of the Securities Act and the compensation of the Agent will be deemed to be underwriting commissions or discounts.

Investing in our securities involves significant risks. Please carefully consider the risks discussed in "Risk Factors" beginning on page S-16 of this prospectus

supplement and in our filings with the Securities and Exchange Commission (the "SEC") that are incorporated by reference in this prospectus supplement before making a decision to invest in our

common shares.

Neither the SEC nor any state or Canadian securities regulator has approved or disapproved of the securities offered hereby, passed upon the accuracy or adequacy of this

prospectus supplement or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

BMO Capital Markets Corp.

The date of this prospectus supplement is February 5, 2021

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ii

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of

common shares and updates the information contained in the accompanying prospectus and the documents incorporated by reference herein and therein. The second part is the accompanying prospectus, which

provides more general information, some of which does not apply to this offering. To the extent the information contained in this prospectus supplement differs or varies from the information contained

in the accompanying prospectus or documents previously filed with the SEC that are incorporated by reference herein, the information in this prospectus supplement will supersede such information. For

a more detailed understanding of an investment in our common shares, you should read both this prospectus supplement and the accompanying prospectus, together with additional information described

under the heading "Additional Information."

This

prospectus supplement is part of a "shelf" registration statement on Form F-3 that we filed with the SEC on June 5, 2019. Under the shelf registration process, we may

from time to time offer and sell the securities described in the accompanying prospectus in one or more offerings.

Neither we nor the Agent have authorized anyone to provide you with information that is different or in addition to that contained or incorporated by reference in

this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by us or on our behalf. Neither we nor the Agent take

any responsibility for, or can provide any assurance as to the reliability of, any information that others may give. Neither we nor the Agent are making an offer to sell or soliciting an offer to buy

our common shares under any circumstance in any jurisdiction where the offer or solicitation is not permitted. We are not offering to sell, or seeking offers to buy, common shares in Canada, to anyone

known by the Agent to be a resident of Canada or over or through the facilities of the TSX or any other exchange or market in Canada. You should not assume that the information in this prospectus

supplement, the accompanying prospectus and any free writing prospectus is accurate as of any date other than the respective date of each of those documents, or that any information in documents that

we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any sale

of common shares hereunder. Our business, financial condition, results of operations and prospects may have changed since those dates.

All

references in this prospectus supplement to "the Company", "Platinum Group Metals", "Platinum Group", "we", "us", or "our" refer to Platinum Group Metals Ltd. and the

subsidiaries through which it conducts its business unless otherwise indicated.

Unless

otherwise specified, all financial information has been prepared in accordance with International Financial Reporting Standards

("IFRS") as issued by the International Accounting Standards Board ("IASB").

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or the context otherwise requires, all references to dollar amounts in this prospectus supplement and the

prospectus are references to United States dollars. All references to "C$" are to Canadian dollars, references to "$" are to United States dollars and references to "R" or "Rand" are to

South African Rand.

The

following table sets forth the rate of exchange for the United States dollar expressed in Canadian dollars in effect at the end of each of the periods indicated, the average

of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the

S-1

periods

indicated in each case based on the daily exchange rate, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars.

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended

August 31,

|

|

|

|

2020

|

|

2019

|

|

|

Average rate for period

|

|

C$

|

1.3458

|

|

C$

|

1.3255

|

|

|

Rate at end of period

|

|

C$

|

1.3042

|

|

C$

|

1.3295

|

|

|

High for period

|

|

C$

|

1.4496

|

|

C$

|

1.3642

|

|

|

Low for period

|

|

C$

|

1.2970

|

|

C$

|

1.2803

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

November 30,

|

|

|

|

2020

|

|

2019

|

|

|

Average rate for period

|

|

C$

|

1.3172

|

|

C$

|

1.3222

|

|

|

Rate at end of period

|

|

C$

|

1.2965

|

|

C$

|

1.3289

|

|

|

High for period

|

|

C$

|

1.3396

|

|

C$

|

1.3343

|

|

|

Low for period

|

|

C$

|

1.2965

|

|

C$

|

1.3056

|

|

The

daily rate of exchange on February 4, 2021, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was $1.00 equals

C$1.2828.

The

following table sets forth the rate of exchange for the United States dollar expressed in South African Rand in effect at the end of each of the periods indicated, the average

of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated in each case, based on the

daily noon buying rate, as reported by the Federal Reserve Bank of New York for the conversion of United States dollars into South African Rand.

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended August 31,

|

|

|

|

2020

|

|

2019

|

|

|

Average rate for period

|

|

|

R16.0676

|

|

|

R14.3372

|

|

|

Rate at end of period

|

|

|

R16.8916

|

|

|

R15.1925

|

|

|

High for period

|

|

|

R19.2637

|

|

|

R15.4725

|

|

|

Low for period

|

|

|

R14.0020

|

|

|

R13.2850

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended November 30,

|

|

|

|

2020

|

|

2019

|

|

|

Average rate for period

|

|

|

R16.2735

|

|

|

R14.8430

|

|

|

Rate at end of period

|

|

|

R15.4325

|

|

|

R14.6360

|

|

|

High for period

|

|

|

R17.1875

|

|

|

R15.3525

|

|

|

Low for period

|

|

|

R15.2175

|

|

|

R14.5300

|

|

The

daily noon buying rate on January 29, 2021, as reported by the Federal Reserve Bank of New York for the conversion of United States dollars into South African

Rand was $1.00 equals R15.1375.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein contain "forward-looking

statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical fact, that address activities, events or developments that we believe, expect or anticipate will, may, could or might occur in the

future are forward-looking statements. The words "expect", "anticipate", "estimate", "may", "could", "might", "will", "would",

S-2

"should",

"intend", "believe", "target", "budget", "plan", "strategy", "goals", "objectives", "projection" or the negative of any of these words and similar expressions are intended to identify

forward-looking statements, although these words may not be present in all forward-looking statements. Forward-looking statements included or incorporated by reference in this prospectus supplement

and the documents

incorporated by reference herein include, without limitation, statements with respect to:

-

•

-

the repayment and compliance with the terms and conditions of our indebtedness, including our 67/8%

convertible senior subordinated notes due 2022 (the "Notes") and our secured loan facility entered into with Sprott Private Resource Lending II

(Collector), LP and several lenders who may become party to such facility (the "Sprott Lenders") on August 15, 2019

(as amended, the "2019 Sprott Facility");

-

•

-

the completion of appropriate contractual smelting and/or refining arrangements with Impala Platinum Holdings Ltd.

("Implats") or another third-party smelter/refiner;

-

•

-

the projections set forth or incorporated into, or derived from, the "Independent Technical Report, Waterberg Project

Definitive Feasibility Study and Mineral Resource Update, Bushveld Complex, South Africa" dated effective September 4, 2019 (the "Waterberg

DFS"), including, without limitation, estimates of mineral resources and mineral reserves, and projections relating to future prices of metals, commodities and supplies,

currency rates, capital and operating expenses, production rate, grade, recovery and return, and other technical, operational and financial forecasts with respect to the Waterberg Project;

-

•

-

the approval of required permits for, and other developments related to, the Waterberg Project;

-

•

-

the impacts of COVID-19 on our operations;

-

•

-

the timely completion of additional required financings and the potential terms thereof;

-

•

-

the adequacy of capital, financing needs and the availability and terms of and potential for obtaining further capital;

-

•

-

revenue, cash flow and cost estimates and assumptions;

-

•

-

future events or future performance;

-

•

-

development of next generation battery technology by our battery technology joint venture (described below);

-

•

-

governmental and securities exchange laws, rules, regulations, orders, consents, decrees, provisions, charters,

frameworks, schemes and regimes, including interpretations of and compliance with the same;

-

•

-

developments in South African politics and laws relating to the mining industry;

-

•

-

anticipated exploration, development, construction, production, permitting and other activities on our properties;

-

•

-

project economics;

-

•

-

future metal prices and exchange rates;

-

•

-

the identification of several large-scale water basins that could provide mine process and potable water for the Waterberg

Project and local communities;

-

•

-

any expectations with respect to the outcomes of litigation;

-

•

-

mineral reserve and mineral resource estimates; and

-

•

-

potential changes in the ownership structures of our projects.

Forward-looking

statements reflect our current expectations or beliefs based on information currently available to us. Forward-looking statements in respect of capital costs, operating

costs, production rate, grade per tonne and concentrator and smelter recovery are based upon the estimates in the technical report referred to in this prospectus supplement and in the documents

incorporated by reference herein and ongoing cost estimation work, and the forward-looking statements in respect of metal prices and exchange rates are based

S-3

upon

the three year trailing average prices and the assumptions contained in such technical report and ongoing estimates.

Forward-looking

statements are subject to a number of risks and uncertainties that may cause the actual events or results to differ materially from those discussed in the forward-looking

statements, and even if events or results discussed in the forward-looking statements are realized or substantially realized, there can be no assurance that they will have the expected consequences

to, or effects on, us. Factors that could cause actual results or events to differ materially from current expectations include, among other things:

-

•

-

our inability to generate sufficient additional cash flow to make payments on the $15.235 million aggregate

principal amount of indebtedness under the 2019 Sprott Facility, and the outstanding $19.99 million aggregate principal amount of the Notes, and to comply with the terms of such indebtedness,

and the restrictions imposed by such indebtedness;

-

•

-

our additional financing requirements;

-

•

-

the 2019 Sprott Facility is, and any other future indebtedness may be, secured and we have pledged our shares of Platinum

Group Metals (RSA) Proprietary Limited, our wholly-owned subsidiary located in South Africa ("PTM RSA"), and PTM RSA has pledged its shares of Waterberg

JV Resources Proprietary Limited "Waterberg JV Co.") and Mnombo Wethu Consultants (Pty) Ltd., a South African Broad-Based Black Economic

Empowerment company ("Mnombo"), to the Sprott Lenders under the 2019 Sprott Facility, which, in the event of a default under the 2019 Sprott Facility or

under any new secured indebtedness could result in the loss of our interest in PTM RSA and the Waterberg Project;

-

•

-

our history of losses and expectation that we will continue to incur losses;

-

•

-

our negative cash flow;

-

•

-

our ability to continue as a going concern;

-

•

-

uncertainty of estimated production, development plans and cost estimates for the Waterberg Project;

-

•

-

our ability to bring properties into a state of commercial production;

-

•

-

the inherently imprecise estimates of mineral reserves and mineral resources based on interpretation

and assumption;

-

•

-

actual capital costs, operating costs, production and economic returns differing from those anticipated and the

uncertainty of future development activities;

-

•

-

the potential impact of COVID-19 on us;

-

•

-

fluctuations in the relative values of the U.S. Dollar, the Rand and the Canadian Dollar;

-

•

-

volatility in metals prices;

-

•

-

the possibility that we may become subject to the Investment Company Act of 1940, as amended;

-

•

-

Implats or another third party may not enter into appropriate contractual smelting and/or refining arrangements with

Waterberg JV Co.;

-

•

-

the failure of us or the other shareholders of Waterberg JV Co. to fund our or their pro rata share of

funding obligations for the Waterberg Project;

-

•

-

any disputes or disagreements with the other shareholders of Waterberg JV Co. or Mnombo, or former shareholders of

Maseve Investments 11 (Pty) Ltd. ("Maseve");

-

•

-

we are subject to assessment by various taxation authorities, who may interpret tax legislation in a manner different from

us, which may negatively affect the final amount or the timing of the payment or refund of taxes;

-

•

-

our ability to retain our key management employees;

-

•

-

our ability to procure the services of skilled and experienced personnel;

S-4

-

•

-

contractor performance and delivery of services, changes in contractors or their scope of work or any disputes with

contractors;

-

•

-

conflicts of interest;

-

•

-

litigation or other legal or administrative proceedings brought against us;

-

•

-

actual or alleged breaches of governance processes or instances of fraud, bribery or corruption;

-

•

-

exploration, development and mining risks and the inherently dangerous nature of the mining industry, including

environmental hazards, industrial accidents, unusual or unexpected formations, safety stoppages (whether voluntary or regulatory), pressures, mine collapses, cave ins or flooding and the risk of

inadequate insurance or inability to obtain insurance to cover these risks and other risks and uncertainties;

-

•

-

property and mineral title risks including defective title to mineral claims or property;

-

•

-

changes in national and local government legislation, taxation, controls, regulations and political or economic

developments in Canada, South Africa or other countries in which we do or may carry out business in the future;

-

•

-

equipment shortages and our ability to acquire the necessary access rights and infrastructure for our mineral properties;

-

•

-

environmental regulations and the ability to obtain and maintain necessary permits, including environmental authorizations

and water use licenses;

-

•

-

extreme competition in the mineral exploration industry;

-

•

-

delays in obtaining, or a failure to obtain, permits necessary for current or future operations or failures to comply with

the terms of such permits;

-

•

-

an adverse decision under the Mineral and Petroleum Resources Development Act, 2002;

-

•

-

the failure to maintain or increase equity participation by historically disadvantaged South Africans in our prospecting

and mining operations and to otherwise comply with the Broad-Based Socio-Economic Empowerment Charter for the South African Mining Industry, 2018;

-

•

-

socio-economic instability in South Africa or regionally, including risks of resource nationalism;

-

•

-

labour disruptions and increased labour costs;

-

•

-

changes in South African state royalties;

-

•

-

interruptions, shortages or cuts in the supply of electricity or water;

-

•

-

characteristics of and changes in the tax systems in South Africa;

-

•

-

a change in community relations;

-

•

-

South African foreign exchange controls impacting repatriation of profits;

-

•

-

land restitution claims or land expropriation;

-

•

-

restriction on dividend payments;

-

•

-

volatility of share price;

-

•

-

any inability to maintain compliance with NYSE American and TSX continued listing standards or the listing of our common

shares thereon;

-

•

-

the exercise of stock options or settlement of restricted share units resulting in dilution to the holders of

common shares;

-

•

-

future sales, conversion of senior subordinated notes or issuances of equity securities decreasing the value of the common

shares, diluting investors' voting power, and reducing our earnings per share;

S-5

-

•

-

enforcing judgements based on the civil liability provisions of United States federal securities laws;

-

•

-

certain potential adverse Canadian tax consequences for foreign-controlled Canadian companies that acquire our

common shares;

-

•

-

any designation of our company as a "passive foreign investment company" and potential adverse U.S. federal income

tax consequences for U.S. shareholders;

-

•

-

"non-accelerated filer" status and the reduced disclosure requirements may make securities less attractive

to investors;

-

•

-

global financial conditions; and

-

•

-

the other risks disclosed under the heading "Risk Factors" in this prospectus supplement and in our most recent

Form 20-F annual report, as well as in the documents incorporated by reference herein and therein.

These

factors should be considered carefully, and investors should not place undue reliance on the forward-looking statements. In addition, although we have attempted to identify

important factors that could cause actual actions or results to differ materially from those described in the forward-looking statements, there may be other factors that cause actions or results not

to be as anticipated, estimated or intended.

The

mineral resource and mineral reserve figures referred to in this prospectus supplement and the documents incorporated herein by reference are estimates and no assurances can be given

that the indicated levels of platinum, palladium, rhodium and gold will be produced. Such estimates are expressions of

judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes

available. By their nature, mineral resource and mineral reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences that may ultimately prove unreliable. Any

inaccuracy or future reduction in such estimates could have a material adverse impact on us.

Any

forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, we disclaim any intent or obligation to update

any forward-looking statement, whether as a result of new information, future events or results or otherwise.

CAUTIONARY NOTE REGARDING MINERAL RESERVE AND MINERAL RESOURCE DISCLOSURE

Estimates of mineralization and other technical information included or incorporated by reference herein have been prepared in

accordance with Canada's National Instrument 43-101 — Standards of Disclosure for Mineral Projects

("NI 43-101"). The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7 of

the SEC. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash

flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. As a result, the reserves we reported in accordance with

NI 43-101 may not qualify as "reserves" under current SEC standards. In addition, the terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral

resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and have not normally been permitted to be used in

reports and registration statements filed with the SEC. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Investors are cautioned not to assume that any part

or all of the mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as

to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates

of inferred mineral resources may not form the basis of feasibility or prefeasibility studies, except in rare cases. Additionally, disclosure of "contained ounces" in a resource is permitted

disclosure under Canadian securities laws; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC Industry Guide 7 standards as in

place tonnage and grade without reference to unit measurements. Accordingly, information contained in this prospectus supplement and the documents

S-6

incorporated

by reference herein containing descriptions of our mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and

disclosure requirements of SEC Industry Guide 7. We have not disclosed or determined any mineral reserves under SEC Industry Guide 7 standards in respect of any of

our properties.

On

October 31, 2018, the SEC adopted a final rule ("New Final Rule") that is replacing SEC Industry Guide 7 with new

disclosure requirements that are more closely aligned with current industry and global regulatory practices and standards, including NI 43-101. This prospectus supplement is not required to,

nor does it, comply with the New Final Rule.

Due

to the uncertainty that may be attached to inferred mineral resource estimates, it cannot be assumed that all or any part of an inferred mineral resource estimate will be upgraded to

an indicated or measured mineral resource estimate as a result of continued exploration. Confidence in an inferred mineral resource estimate is insufficient to allow meaningful application of the

technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances set out NI 43-101. Inferred mineral

resource estimates are excluded from estimates forming the basis of a feasibility study.

NI 43-101

requires mining companies to disclose reserves and resources using the subcategories of proven reserves, probable reserves, measured resources, indicated resources and

inferred resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

A

"mineral reserve" is the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include

adequate information on mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social, governmental and other relevant factors that demonstrate, at the time of

reporting, that extraction could reasonably be justified. A mineral reserve includes diluting materials and allowances for losses, which may occur when the material is mined or extracted. A "proven

mineral reserve" is the economically mineable part of a measured mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with confidence

sufficient to allow the appropriate application of technical and economic parameters to support detailed mine planning and final evaluation of the economic viability of the deposit. A "probable

mineral reserve" is the economically mineable part of an indicated, and in some circumstances, a measured mineral resource for which quantity, grade or quality, densities, shape and physical

characteristics are estimated with sufficient confidence to allow the appropriate application of technical and economic parameters in sufficient detail to support mine planning and evaluation of the

economic viability of the deposit.

A

"mineral resource" is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are

reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or

interpreted from specific geological evidence and knowledge, including sampling. A "measured mineral resource" is that part of a mineral resource for which quantity, grade or quality, densities,

shape, and physical characteristics are estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support detailed mine planning and final

evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or

quality continuity between points of observation. An "indicated mineral resource" is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics

are estimated with sufficient confidence to allow the application of technical and economic parameters in sufficient detail to support mine planning and evaluation of the economic viability of the

deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of

observation. An "inferred mineral resource" is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological

evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource is based on limited information and sampling

gathered through appropriate sampling techniques from locations such as outcrops, trenches, pits, workings and drill holes.

S-7

A

"feasibility study" is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of

applicable mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social, governmental and other relevant operational factors and detailed financial analysis

that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may serve as the basis for a final decision by a

proponent or financial institution to proceed with, or finance, the development of the project. A "preliminary feasibility study" or "pre-feasibility study" is a comprehensive study of a range of

options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the

case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the applicable mining, processing,

metallurgical, infrastructure, economic, marketing, legal, environmental, social, governmental and other relevant operational factors and the evaluation of any other relevant factors which are

sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve at the time of reporting. "Cut-off grade" means

(a) in respect of mineral resources, the lowest grade below which the mineralized rock currently cannot reasonably be expected to be economically extracted, and (b) in respect of mineral

reserves, the lowest grade below which the mineralized rock currently cannot be economically extracted as demonstrated by either a preliminary feasibility study or a feasibility study. Cut-off grades

vary between deposits depending upon the amenability of ore to mineral extraction and upon costs of production and metal prices.

DOCUMENTS INCORPORATED BY REFERENCE

Copies of the documents incorporated by reference in this prospectus supplement and not delivered with this

prospectus supplement may be obtained on written or oral request without charge from Frank Hallam at Suite 838, 1100 Melville Street, Vancouver, British Columbia, Canada, V6E 4A6,

telephone (604) 899-5450 and are also available electronically at www.sedar.com and www.sec.gov.

The

following documents, filed or furnished by us with or to the SEC, are specifically incorporated by reference into, and form an integral part of, this prospectus supplement:

|

|

|

|

|

|

|

(a)

|

|

Exhibit 99.1 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on January 14,

2021, containing our unaudited condensed consolidated interim financial statements for the three months ended November 30, 2020, together with the notes thereto (the "November Financials");

|

|

(b)

|

|

Exhibit 99.2 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on January 14,

2021, containing our management's discussion and analysis for the three months ended November 30, 2020 (the "November

MD&A");

|

|

(c)

|

|

Exhibit 99.1 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on January 12,

2021, containing our management information circular dated January 11, 2021 prepared for purposes of our annual general meeting held on February 18, 2021;

|

|

(d)

|

|

Exhibit 99.2 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on December 9,

2020, containing our material change report announcing the closing of a non-brokered private placement of 1,121,076 common shares at a price of $2.23 each;

|

|

(e)

|

|

Exhibit 99.2 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on December 1,

2020, containing our material change report announcing completion of an at-the-market offering first announced on September 4, 2020 for aggregate sales proceeds of up to $12 million (the "September 2020 ATM")

;

|

|

(f)

|

|

our Form 20-F annual report for the financial year ended August 31, 2020, filed with the SEC on November 25,

2020, including without limitation, the consolidated financial statements included therein, as amended by Amendment No. 1 thereto, filed with the SEC on

February 2, 2021;

|

|

(g)

|

|

Exhibit 99.1 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on

November 25, 2020, containing our management's discussion and analysis for the year ended August 31, 2020;

|

S-8

|

|

|

|

|

|

|

(h)

|

|

Exhibit 99.1 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on October 27,

2020, containing our material change report announcing the closing of a non-brokered private placement of 1,146,790 common shares at a price of $2.18 each;

|

|

(i)

|

|

Exhibit 99.2 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on

September 4, 2020, containing our material change report announcing the execution of the Equity Distribution Agreement with BMO Capital Markets Corp. and commencement of the September 2020 ATM;

|

|

(j)

|

|

Exhibit 99.1 to our Report of Foreign Private Issuer on Form 6-K, furnished to the SEC on October 8,

2019, containing the Waterberg DFS; and

|

|

(k)

|

|

the description of our common shares set forth in our annual report on Form 20-F/A filed with the SEC on

May 22, 2007, and as further set forth in the Amendment No. 1 to our registration statement on Form 8-A (File No. 001-33562) filed with the SEC on February 3, 2016 (Two Filings) and Amendment

No. 2 to our registration statement on Form 8-A (File No. 001-33562) filed with the SEC on December 13, 2018 (Two Filings).

|

In

addition, all subsequent annual reports filed by us on Form 20-F, Form 40-F or Form 10-K, and all subsequent filings on Forms 10-Q and 8-K filed by

us pursuant to the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), prior to the termination of the

offering, shall be deemed to be incorporated by reference into this prospectus supplement. Also, we may incorporate by reference future reports on Form 6-K that we furnish subsequent to the

date of this prospectus supplement by stating in those Form 6-Ks that they are being incorporated by reference into this prospectus supplement.

Any statement contained in this prospectus supplement or a document incorporated or deemed to be incorporated by reference herein or therein shall be deemed to be

modified or superseded for the purposes of this prospectus supplement to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be

incorporated by reference herein modifies or supersedes that prior statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any

other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or

superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to

make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be considered in its unmodified or superseded form to constitute a

part of this prospectus supplement, except as so modified or superseded.

S-9

SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement, the accompanying

prospectus and the documents incorporated by reference herein and therein. It does not contain all of the information you should consider before making an investment decision. Before you decide to

invest in our securities, you should read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein carefully, including the

cautionary note regarding forward-looking statements, the risk factors and the financial statements and related notes incorporated by reference herein and therein.

Company Overview

We are a platinum and palladium focused exploration and development company conducting work primarily on mineral properties we have

staked or acquired by way of option agreements or applications in the Republic of South Africa. Our material mineral property is the Waterberg Project. The Waterberg Project is comprised of two

adjacent project areas formerly known as the Waterberg joint venture project and the Waterberg extension project. The Waterberg Project is held by Waterberg JV Co., in which we are the largest

owner, with a 50.02% beneficial interest. Our wholly owned direct subsidiary, PTM RSA, directly holds 37.05% of this interest, and 12.974% is held indirectly through PTM RSA's 49.9% interest in

Mnombo, a Black Economic Empowerment company that holds 26.0% of Waterberg JV Co. PTM RSA is a participant in the Waterberg Project, together with Implats, Mnombo, Japan Oil, Gas and Metals

National Corporation ("JOGMEC") and Hanwa Co., Ltd. PTM RSA is the operator of the Waterberg Project.

In

April 2018, we completed the sale of all our rights and interests, indirectly held through PTM RSA, in Maseve, including the Maseve platinum and palladium mine and Project 3 of

what was formerly the Western Bushveld Joint Venture, both located on the Western Limb of the Bushveld Complex. Currently, we consider the Waterberg Project to be our sole material mineral property.

In

2019, we founded Lion Battery Technologies Inc. in partnership with Anglo American Platinum Limited to support the use of palladium and platinum in lithium battery

applications.

Our

principal executive office is located at Suite 838, 1100 Melville Street, Vancouver, BC, Canada V6E 4A6 and our telephone number is (604) 899-5450.

On

January 28, 2016, our common shares were consolidated on the basis of one new share for ten old shares (1:10). On December 13, 2018, our common shares were further

consolidated on the basis of one new share

for ten old shares (1:10). Unless otherwise indicated, the information in this prospectus supplement has been adjusted to give effect to these share consolidations.

Recent Updates

On January 22, 2021, Liberty Metals & Mining Holdings, LLC filed an amendment to its beneficial ownership report

on Schedule 13D, reporting that it owned 7,733,275 of our common shares as at January 21, 2021.

On

December 29, 2020 we paid $687,156 cash in settlement of bi-annual interest on the Notes due on January 1, 2021. We have now paid cash of $1.37 million and issued

2,591,647 common shares in settlement of $4.85 million of interest on the Notes. We have also issued 1,319 common shares upon the conversion of $10,000 of Notes in July, 2017. Due

to a limitation on conversion contained in the indenture governing the Notes, dated June 30, 2017 between the Company and The Bank of New York Mellon, no more than

2,954,278 common shares, being 19.9% of the number of common shares outstanding on June 30, 2017, may be issued in settlement of interest payments or conversions pursuant to the Notes.

As of the date of this prospectus supplement a total of 361,312 common shares remain as potentially issuable in settlement of future interest payments or conversions pursuant to

the Notes.

On

December 29, 2020, Hosken Consolidated Investments Limited ("HCI"), an existing major shareholder of the Company, filed an

advance "Notice of Intention to Distribute Securities under Section 2.8 of National Instrument 45-102 Resale of Securities" stating that HCI shall dispose of up to 2.6 million

common shares over a

S-10

three

month period, subject to market price and liquidity considerations, in order to rebalance its portfolio due to the recent price increase of the Company's common shares.

On

December 8, 2020, we closed a non-brokered private placement of 1,121,076 common shares at a price of $2.23 for gross proceeds of $2.5 million. HCI subscribed for

all 1,121,076 common shares through Deepkloof Limited ("Deepkloof"), a subsidiary of HCI.

On

November 30, 2020, we completed the September 2020 ATM, in which we sold 5,440,186 common shares at an average price of $2.21 for gross proceeds of

$12.0 million.

On

October 15, 2020, we closed a non-brokered private placement of 1,146,790 common shares at a price of US$2.18 for gross proceeds of $2.5 million. HCI subscribed

for all 1,146,790 common shares through Deepkloof.

As

at November 30, 2020, we had completed payment of all deferred fees owed to BMO Nesbitt Burns Inc. and Macquarie Capital Markets Canada Ltd. As at

November 30, 2020, we had made $3.515 million in prepayments of principal on the 2019 Sprott Facility, and subsequent to November 30, 2020 the Company made a further prepayment of

$1.25 million, reducing the aggregate principal amount thereunder from the original balance of $20 million to $15.235 million.

As

at November 30, 2020, we held cash of $4.78 million and had working capital of $6.44 million, including $1.695 million of net proceeds due pursuant to the

September 2020 ATM and exclusive of the 2019 Sprott Facility and the Notes. We currently have limited financial resources and no sources of operating revenues. As a result, we will require

additional financing and you should expect that common shares will be sold by us under this prospectus supplement in order to assist us in meeting our financing requirements. From September 1,

2015 to August 31, 2020, the share price of the Company has decreased by approximately 92% compared to an increase in the S&P/TSX Composite Index of approximately 44% and an increase in the

S&P/TSX Global Mining Index of approximately 136% during the corresponding period. For a discussion of our additional financing needs, see "Risk Factors" in this prospectus supplement and in our

Form 20-F annual report and our November MD&A, which are incorporated herein by reference, and "Use of Proceeds" in this prospectus supplement.

On September 24, 2019, we published the positive results of the Waterberg DFS. The Waterberg DFS was formally delivered to the

shareholders of Waterberg JV Co. on October 4, 2019 and was then approved by all shareholders on December 5, 2019. The Waterberg DFS reported a reserve estimate and an updated

independent 4E resource estimate effective September 4, 2019. Proven and probable mineral reserves were estimated at 187 million tonnes at 3.24 g/t 4E for 19.5 million 4E

ounces. Mineral resources estimated in the combined measured and indicated categories aggregate 242.4 million tonnes at 3.38 g/t 4E for 26.4 million 4E ounces. Inferred

mineral resources were estimated at 66.7 million tonnes at 3.27 g/t 4E for 7.0 million 4E ounces. The aggregate T Zone and F Zone measured and indicated

resource is comprised of approximately 63% palladium, 29% platinum, 6% gold and 1% rhodium. All of the preceding was estimated at a 2.5 g/t 4E cut-off grade. Refer to the Waterberg DFS

for additional information.

On

February 26, 2020, we announced that the shareholders of Waterberg JV Co. had agreed to amend the terms of Implats' call option

(the "Purchase and Development Option") to increase its stake in Waterberg JV Co. from 15.0% to 50.01% through additional share purchases,

which was originally due to be exercised by April 17, 2020 following the Waterberg JV Co. approval of the Waterberg DFS on December 5, 2019. The termination date of the Purchase

and Development Option was amended from the original date of April 17, 2020 to 90 calendar days following receipt of an executed mining right for the Waterberg Project. All other terms

of the Purchase and Development Option remained unchanged. In consideration for the amendment, Implats agreed to fund 100% of a Rand 55 million implementation budget and work program effective

February 1, 2020. The program, aimed at increasing confidence in specific areas of the Waterberg DFS, was approved by Waterberg JV Co. and completed on September 15, 2020 at a

final cost of Rand 24.7 million. Planned geo-technical drilling of boxcuts/portals and along planned decline pathways, budgeted at approximately R 27 million, was not completed

before September 15, 2020 as such work first required the grant of a mining right.

S-11

On

June 15, 2020, Implats delivered a formal notice that it did not intend to exercise the Purchase and Development Option to acquire and earn into a 50.01% interest in the

Waterberg Project. Implats stated that notwithstanding the positive progress achieved on the implementation budget and work program to date, and the strategic alignment between the Waterberg asset and

Implats stated portfolio objectives, the

unprecedented events brought about by the COVID-19 pandemic has necessitated Implats management and Board to re-evaluate the impact of the increased economic uncertainty on Implats' strategy

and risk appetite across the Group in the short, medium and long term. On August 11, 2020, Waterberg JV Co. and JOGMEC notified Implats of the termination of the Purchase and Development

Option. As a result of their election not to execute the Purchase and Development Option, the costs of the implementation budget incurred prior to September 14, 2020 shall be for Implats'

own account.

Implats

has indicated they intend to continue discussions in good faith on potential smelter off-take arrangements for the Waterberg Project. Implats is a 15% shareholder in Waterberg

JV Co. Implats reiterated their support of both the Waterberg Project and the joint venture partners and plans to remain an active participant, including funding of their share of costs,

subject to future considerations.

On

August 12, 2020 the South African Department of Mineral Resources and Energy (the "DMR") issued an Integrated

Environmental Authorization for the Waterberg Project, subject to a public notice period and finalization of issues raised by affected parties, which process was completed with the issue of a final

Amended Integrated Environmental Authorization on November 10, 2020.

On

February 2, 2021 the DMR notified the Company that the Waterberg Mining Right had been granted on January 28, 2021 pursuant to section 23(1) of the Mineral and

Petroleum Resources Development Act (2002). After notarial execution, the Waterberg Mining Right will be registered at the Mining and Petroleum Titles Registration Office in

South Africa. Under South African Law, mining rights are issued for an initial period of up to 30 years and may be renewed for further periods, each of which may not exceed

30 years at a time. Mining will be subject to the Environmental Authorization granted on November 10, 2020, Water Use Licenses and compliance with other legislation on an ongoing basis.

In common with other worldwide jurisdictions, South Africa has been severely impacted by the respiratory illness caused by the new

coronavirus, termed "2019-nCoV" ("COVID-19"), and the measures that have been put in place nationally to combat the spread of this pandemic. On

March 15, 2020 South Africa declared a national state of disaster under the Disaster Management Act, No. 72 of 2002 ("Disaster Act"),

followed by regulations promulgated under the Disaster Act which imposed a lockdown from midnight on March 26, 2020 until April 21, 2020. Under the lockdown, all persons were required to

stay at home except for those rendering a limited number of essential services, including health care, banking, gas stations, supermarkets and coal mines providing coal to ESKOM (defined below) as

well as mine care and maintenance services on all other mines.

On

March 26, 2020, the DMR issued a document called the "Guiding Principles on the Prevention and Management of COVID-19 in SAMI" (an abbreviation for the South

African Mining Industry) in a bid to provide guidance to the SAMI members on how to prevent and manage the spread of COVID-19 pandemic. The Guiding Principles were developed through the Mine

Health and Safety Council ("MHSC") in consultation with mining companies, the Minerals Council South Africa and organized labour.

The

lockdown was thereafter extended to April 30, 2020.

On

April 29, 2020, the Minister issued directions in terms of regulation 10(8) of the regulations issued in terms of section 27(2) of the Disaster Act to further

regulate measures to prevent and manage the spread of COVID-19 in mining.

Also,

on April 29, 2020, new Disaster Act regulations were issued permitting mining companies to continue with reduced operations at a level of no more than 50%. With respect to

the Company, these regulations provide that mining operations being conducted at a reduced capacity of not more than 50%, may thereafter increase capacity as determined by direction issued by

the Minister.

S-12

The

following conditions apply to the starting and increasing of capacity:

-

1.

-

appropriate

measures to protect the health and safety of workers must be implemented by mining companies in accordance with the directions issued from time

to time by the Minister, in consultation with the Cabinet member responsible for health;

-

2.

-

a

rigorous screening and testing programme must be implemented as employees return to work;

-

3.

-

the

mining industry must provide quarantine facilities for employees who have tested positive for the COVID -19;

-

4.

-

data

collected during the screening and testing programme must be submitted to the authority referred to in regulation 8; and

-

5.

-

mining

companies must make arrangements to transport their South African employees from their homes to their respective areas of operations.

Following

an order handed down in the Labour Court of South Africa on May 1, 2020, the Chief Inspector of Mines in consultation with MHSC developed a guideline in accordance with

Section 9 of the Mine Health and Safety Act No. 29 of 1996 ("MHSA"). The guideline requires employers to prepare and implement a code of

practice for the prevention, mitigation and management of the COVID-19 outbreak amongst employees in the South African Mining Industry and any other person(s) at or on mines and any other

person(s) they may contact in the community. Failure by employers to prepare and implement a mine's code of practice in line with these guidelines, the "Guiding Principles on

the Prevention and Management of COVID-19 in SAMI", directions issued by the Minister in terms of regulation 10(8) of the regulations issued in terms of

section 27(2) of the Disaster Act and guidelines developed by the World Health Organisation, constitutes a criminal offence and a contravention of the MHSA.

The

following key elements must be addressed in the code of practice:

-

1.

-

risk

assessment and review;

-

2.

-

start-up

and on-going procedure for mines;

-

3.

-

COVID-19 Management

Programme;

-

4.

-

monitoring

and reporting; and

-

5.

-

compensation

for occupationally acquired COVID-19.

Currently,

South Africa is under a phased risk-alert lockdown process, with Level 5 being the drastic lockdown that was imposed during April 2020 and Level 1 being a

return to normalcy, but retaining the use of masks, sanitisers and social distancing. After three months at Level 1, a surge in infections necessitated the implementation of Level 3

restrictions on December 28, 2020, with further Level 3 adjustments made on January 11, 2021. All mining companies may continue normal operations under strict measures to prevent

the spread of COVID-19 infections.

With

regard to the Company, the COVID-19 pandemic and the measures implemented for the prevention, mitigation and management thereof may result in delays in the grant of required

authorizations and permits for the Waterberg Project by reason of regulatory officials not being available, the restriction on the movement of persons to conduct inspections and site visits and the

inability to meet with community consultative forums.

On July 12, 2019, the Company, together with an affiliate of Anglo American Platinum Limited

("Amplats"), launched a new venture through a jointly owned company, Lion Battery Technologies Inc.

("Lion") to accelerate the development of next generation battery technology using platinum and palladium. The Company received 400,000 common

shares of Lion, valued at a price of $0.01 per share, as the original founder of Lion. Both the Company and Amplats are to equally invest up to an aggregate of $4.0 million into Lion, of which

approximately $1.0 million would be for general and administrative expenses and the commercialization of the technology developed, subject to certain conditions. All investment funding into

Lion

S-13

by

the Company or Amplats is to be in exchange for preferred shares of Lion at a price of $0.50 per share over an approximate three to four year period.

On

July 12, 2019 the Company and Amplats each invested $0.55 million as a first tranche of funding into Lion in exchange for 1,100,000 Lion preferred shares each at

a price of $0.50 per share. In June 2020 the Company and Amplats each invested $0.350 million as a second tranche of funding in exchange for 700,000 Lion preferred shares at a

price of $0.50 per share. On January 22, 2021, Amplats and the Company have approved and equally invested in a third tranche of funding into Lion in an aggregate amount of $0.70 million

in exchange for 700,000 Lion preferred shares each at a price of $0.50 per share, of which $0.667 million is to be provided by Lion to FIU (defined below) for continued research. The

Company owns a 53.7% interest in Lion as of the completion of the this third tranche of funding. If the Company should fail to contribute its share of a required subscription to Lion, it would

be in breach of its agreements with Lion and its interest in Lion may be subject to dilution.

Effective

from May 1, 2019, Lion entered into an agreement (the "Sponsored Research Agreement") with Florida International

University ("FIU") to fund a $3.0 million research program over a three year period utilizing platinum and palladium to unlock the potential of

Lithium Air and Lithium Sulphur battery chemistries to increase their discharge capacities and cyclability. Under the Sponsored Research Agreement, Lion will have exclusive rights to all intellectual

property developed and will lead all commercialization efforts. Lion is to advance funding to FIU in four tranches. The first tranche to FIU, totaling $1.0 million plus a one-time fee of

$50,000, was funded by Lion in mid July 2019, with a second tranche of $666,667 funded in June 2020. A third tranche of funding by Lion to FIU of $666,667 is in process as of the date of

this prospectus supplement.

On

August 4, 2020 the U.S. Patent and Trademark Office issued Patent No. 10,734,636 B2 entitled "Battery Cathodes for Improved Stability" to FIU. The patent

includes the use of platinum group metals and carbon nanotubes and other innovations in a lithium battery. A second patent related to this work, No. US 10862,103 B2, was issued on

December 8, 2020. Further patents are currently applied for. Under the Sponsored Research Agreement, Lion has exclusive rights to all intellectual property being developed by FIU including

patents granted. Lion is also reviewing several additional and complementary opportunities focused on developing next-generation battery technology using platinum and palladium.

S-14

THE OFFERING

|

|

|

|

|

Issuer

|

|

Platinum Group Metals Ltd.

|

|

Common shares offered by us

|

|

Common shares having an aggregate offering price of up to $50,000,000.

|

|

Common shares to be outstanding immediately after this offering

|

|

Up to 83,514,131 common shares, based on 72,278,176 common shares outstanding as of February 4, 2021 and assuming sales of

11,235,955 of our common shares in this offering at an assumed offering price of $4.45 per common share, which is the last reported sale price of our common shares on the NYSE American on February 4, 2021. The actual number of common shares

issued will vary depending on the sale price under this offering.

|

|

Use of proceeds

|

|

We intend to use the net proceeds from the sale of our common shares pursuant to this offering, if any, together with our

existing cash and cash equivalents, for general corporate purposes, including pre-construction engineering, site work and preparation for the Waterberg Project, and to repay a portion or all of the 2019 Sprott Facility. We may also elect to use a

portion of the proceeds to repay a portion or all of the Notes. See "Use of Proceeds" on page S-17.

|

|

Risk factors

|

|

Investing in our common shares involves significant risks. See "Risk Factors"

beginning on page S-16 of this prospectus supplement as well as those risk factors that are incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors to consider carefully before deciding

to invest in our common shares.

|

|

Exchange Listings

|

|

Our common shares are listed on the NYSE American under the symbol "PLG" and on the TSX under the symbol "PTM".

|

None of our common shares will be offered or sold in Canada under this prospectus supplement and the accompanying prospectus, and no sales of common shares under

this prospectus supplement and the accompanying prospectus will be made to anyone known by the Agent to be a resident of Canada or over or through the facilities of the TSX or any other exchange or

market in Canada.

HCI

has waived any participation right with respect to this offering.

Outstanding Shares

The number of common shares to be outstanding immediately after this offering is based on 72,278,176 common shares outstanding as of

February 4, 2021, based on an assumed offering price of $4.45 per common share, which is the last reported sale price of our common shares on the NYSE American on February 4, 2021, and

excludes as of that date:

-

•

-

common shares issuable pursuant to the Notes;

-

•

-

4,297,834 common shares issuable upon the exercise of options with a weighted average exercise price of C$3.75;

-

•

-

575,763 common shares issuable upon the settlement of restricted share

units ("RSUs");

-

•

-

common shares issuable upon the extension of the 2019 Sprott Facility; and

-

•

-

remaining common shares reserved for issuance under our share compensation plan.

Except

as otherwise indicated, all information in the prospectus supplement, including the number of common shares outstanding immediately after this offering, excludes the shares

referenced in the bullets above.

S-15

RISK FACTORS

Investing in our common shares involves a high degree of risk. In addition to the other information contained

in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, you should carefully consider the risks described below and under the "Risk

Factors" section of our annual report on Form 20-F and November MD&A before purchasing our common shares. See "Documents Incorporated by Reference". For a summary of key risk factors

applicable to our company, also see "Cautionary Note Regarding Forward-Looking Statements" in this prospectus supplement. Resource exploration and development is a speculative business, characterized

by a number of significant risks. These risks include, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits,

which, though present, are insufficient in quantity or quality to return a profit from production. If any such risks actually occur, our business, financial condition, results of operations and

prospects could materially suffer. As a result, the trading price of our securities could decline, and you might lose all or part of your investment. The risks set out in this prospectus supplement,

the accompanying prospectus and the documents incorporated by reference herein and therein, including our annual report on Form 20-F and November MD&A, are not the only risks that we

face; risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, results of operations and

prospects, cause actual events to differ materially from those described in "Cautionary Statement Regarding Forward-Looking Statements" above and could result in a loss of your investment. You should

also refer to the other information set forth or incorporated by reference in this prospectus supplement and the accompanying prospectus, including the financial statements and

related notes.

Risks Relating to the Offering

Our management team will have broad discretion to use the net proceeds from this offering and its investment of these proceeds may not yield a favorable return. They may

invest the proceeds of this offering in ways with which investors disagree.

Our management team will have broad discretion in the application of the remaining net proceeds from this offering and could spend or

invest the proceeds in ways with which our shareholders disagree. Accordingly, investors will need to rely on our management team's judgment with respect to the use of these proceeds. However, the

failure by management to apply these funds effectively could negatively affect our ability to operate and grow our business.

We

cannot specify with certainty all of the particular uses for the net proceeds to be received from this offering. Accordingly, we will have broad discretion in using these proceeds.

Until the net proceeds are used, they may be placed in investments that do not produce significant income or that may lose value.

We cannot assure you that we will sell common shares having an aggregate offering price of $50,000,000 in this offering. If we sell less than the maximum offering amount,

the time at which we require additional financing may be accelerated and the amount of required additional funding will increase.

This offering is not subject to any minimum offering amount. We may sell less than the maximum offering amount. If we sell less than

the maximum offering amount, this may accelerate the time at which we require additional financing and will increase the amount of additional funding we require. We cannot assure you that additional

financing will be available on favorable terms, or at all. See "Risk Factors" in our annual report on Form 20-F, which is incorporated herein by reference.

S-16

USE OF PROCEEDS

The amount of proceeds from this offering will depend upon the number of our common shares sold and the market price at which they are

sold. There can be no assurance that we will be able to sell any shares under or fully utilize the equity distribution agreement with the Agent as a source of financing.

Assuming

the closing of the offering in full, we intend to use the net proceeds of the offering as follows:

|

|

|

|

|

|

|

Repayment of 2019 Sprott Facility

|

|

$

|

15,235,000

|

|

|

General corporate purposes, including Waterberg Project pre-construction site work, engineering and preparation

|

|

$

|

32,965,000

|

|

|

|

|

|

|

|

Estimated net proceeds of the offering

|

|

$

|

48,200,000

|

|

|

|

|

|

|

The

2019 Sprott Facility provides that 50% of the proceeds of offerings of equity or debt securities are required to be paid to Sprott in partial repayment of the 2019 Sprott Facility.

The 2019 Sprott Facility is a credit agreement with Sprott and the Sprott Lenders pursuant to which the Sprott Lenders provided a $20.0 million principal amount senior secured credit facility

advance to us. The maturity date of the 2019 Sprott Facility is August 14, 2021. We have an option, exercisable by notice to Sprott no sooner than four months before the maturity date and no

later than two months before the maturity date, to extend the maturity date by one year in exchange for a payment in common shares or cash of three percent of the outstanding principal amount of the

2019 Sprott Facility two business days prior to the original maturity date. Amounts outstanding under the 2019 Sprott Facility bear interest at a rate of 11.00% per annum, compounded monthly. After

partial repayments in November 2020 and in December 2020, as of the date of this prospectus supplement, the principal amount outstanding under the 2019 Sprott Facility is

$15.235 million.

We

may elect to use a portion of the net proceeds of the offering that are allocated to general corporate purposes to repay a portion or all of the Notes, which have an outstanding

principal amount as of the date of this prospectus supplement of $19.99 million, bear interest at 67/8% and mature on July 1, 2022.

We

have limited financial resources and do not generate any cash flow from current operations. As at November 30, 2020 we held cash of $4.78 million and had working capital

of $6.44 million, including $1.695 million of net proceeds due pursuant to the September 2020 ATM and exclusive of the 2019 Sprott Facility and the Notes. Assuming the successful

closing of this offering in full, based on our planned Waterberg Project expenditures, debt service expenditures and historical average monthly cash burn rate for general and administrative costs over

the three month period ended November 30, 2020 of approximately $0.40 million (unaudited), we expect to have sufficient capital to maintain general operations, including interest

payments on the Notes, and interest payments on and repayment in full of the 2019 Sprott Facility, but not the construction capital required for the Waterberg Project, until either June 2022 or

December 2022, assuming we elect to use a portion of the net proceeds of the offering to repay the Notes. After such time, we will require additional capital to satisfy our obligations,

including under our indebtedness. The Company will also require additional financing to fund its share of expected Waterberg project construction, development and ramp up costs, likely within twelve

months of the grant of the Waterberg Mining Right, which ocurred on January 28, 2021. If we do not raise the maximum amount under the offering, the date on which we require additional financing

would be accelerated. If additional financing is raised by the issuance of shares from treasury of the Company or other securities convertible into common shares, control of the Company may change,

security holders will suffer additional dilution and the price of our common shares may decrease. Failure to obtain such additional financing could result in the delay or indefinite postponement of

further development of our properties, or even a loss of property interests.

The

expected use of net proceeds of this offering represents our current intentions based upon our present plans and business conditions, which could change in the future as our plans

and business conditions evolve. The amounts and timing of our actual expenditures in these areas may vary significantly from our current intentions and will depend upon a number of factors, including

our ability to advance the Waterberg Project into production, actual expenses to operate our business, and other unforeseen events, including those listed

under the "Risk Factors" section of this prospectus supplement, our annual report on Form 20-F and November

S-17

MD&A

and the prospectus. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to be received upon the closing of this

offering. Accordingly, our management will have broad discretion in the application of the net proceeds, and investors will be relying on the judgment of our management regarding the application of

the net proceeds of this offering.

Pending

use of proceeds from this offering, we intend to invest the proceeds in a variety of capital preservation investments, including long-term and short-term, investment-grade or

FDIC insured, interest-bearing instruments.

S-18

CAPITALIZATION

The following table sets forth our cash and investments and our capitalization as of November 30,

2020 on:

-

•

-

an actual basis;

-

•

-

an as adjusted basis giving effect to (i) closing of the offering in full, at an assumed offering price of $4.45

per common share, which is the last reported sale price of our common shares on the NYSE American on February 4, 2021, and (ii) repayment of $15.235 million of the 2019 Sprott

Facility.

The

information in this table is illustrative only and our capitalization following the completion of this offering will be adjusted based on the public offering price and other terms of

this offering determined at pricing. You should read this table in conjunction with consolidated financial statements and the notes thereto included in the documents.

|

|

|

|

|

|

|

|

|

|

|

As of November 30, 2020

|

|

|