Kinder Morgan Sees Profits Rise in 2021 After Year of High Impairment Charges

January 20 2021 - 5:14PM

Dow Jones News

By Adriano Marchese

Kinder Morgan Inc. said Wednesday that it expects a significant

increase in profits in 2021 following a year with large impairments

associated with its natural gas pipelines.

The Houston-based company said that it expects net income to be

$2.1 billion in the year, compared with $119 million in 2020, where

it was saddled with $1.95 billion of non-cash impairments. In 2019,

the company's net profits were $2.19 billion.

The company also expects to declare a 3% higher dividend of

$1.08 a share.

Adjusted earnings before interest, taxes, depreciation and

amortization--a metric that excludes exceptional costs--is expected

to be $6.8 billion, compared with $6.96 billion in 2020.

In the year, Kinder Morgan anticipates investing in expansion

projects and contributing to joint ventures for an expected $800

million.

As at Dec. 31, the company said it had $3.9 billion of borrowing

capacity and nearly $1.2 billion in cash.

"We believe this borrowing capacity, current cash on hand, and

our cash from operations are more than adequate to allow us to

manage our cash requirements, including maturing debt, through

2021," the company said.

At 4:31 p.m. EST in after-hours trading, shares were up 39

cents, or 2.5%, at $15.98.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

January 20, 2021 16:59 ET (21:59 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

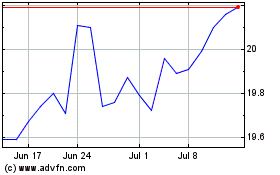

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Aug 2024 to Sep 2024

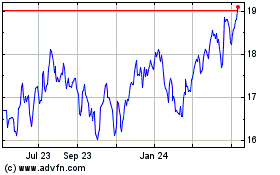

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Sep 2023 to Sep 2024