Statement of Changes in Beneficial Ownership (4)

January 12 2021 - 4:51PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Smith Mike C. |

2. Issuer Name and Ticker or Trading Symbol

Stitch Fix, Inc.

[

SFIX

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O STITCH FIX, INC., 1 MONTGOMERY STREET, SUITE 1500 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/8/2021 |

|

(Street)

SAN FRANCISCO, CA 94104

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 1/8/2021 | | D(1) | | 41002 | D | $0 | 46102 | D | |

| Class A Common Stock | 1/8/2021 | | A(2) | | 1254 (3) | A | $0 | 47356 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Employee Stock Option (Right to Buy) | $16.98 | 1/8/2021 | | D (4) | | | 14155 | (5) | 6/29/2027 | Class B Common Stock (6)(7) | 14155.0 | $0 | 42009 | D | |

| Employee Stock Option (Right to Buy) | $16.98 | 1/8/2021 | | D (4) | | | 120822 | (8) | 7/10/2027 | Class B Common Stock (6)(7) | 120822.0 | $0 | 0 | D | |

| Employee Stock Option (Right to Buy) | $22.32 | 1/8/2021 | | D (9) | | | 56401 | (10) | 12/11/2028 | Class A Common Stock | 56401.0 | $0 | 66653 | D | |

| Employee Stock Option (Right to Buy) | $27.55 | 1/8/2021 | | D (9) | | | 37430 | (11) | 12/10/2029 | Class A Common Stock | 37430.0 | $0 | 44234 | D | |

| Non-qualified Stock Option (Right to Buy) | $56.53 | 1/11/2021 | | A (12) | | 2553 | | (13) | 1/10/2031 | Class A Common Stock | 2553.0 | $0 | 2553 | D | |

| Explanation of Responses: |

| (1) | Reflects the cancellation of restricted stock units in connection with the termination of Mr. Smith's employment and the continuation of Mr. Smith's service on our board of directors. |

| (2) | Reflects the grant of restricted stock units in accordance with our Director Compensation Policy. |

| (3) | 100% of the restricted stock units will vest on the earlier of the first anniversary of the date of grant or the next Annual Meeting of Stockholders. All vesting is subject to the Reporting Person's Continuous Service through the applicable vesting date. Outstanding restricted stock units are subject to acceleration upon a Change in Control. |

| (4) | Reflects the cancellation of options to purchase shares of Class B Common Stock in connection with the termination of Mr. Smith's employment and the continuation of Mr. Smith's service on our board of directors. |

| (5) | The stock option vests in equal monthly installments over 24 months beginning on June 30, 2019, subject to the individual's continued service through each vesting date. |

| (6) | Each share of Class B Common Stock is convertible at any time at the option of the Reporting Person into one share of Class A Common Stock and has no expiration date. Class B Common Stock will convert automatically into Class A Common Stock on the earlier of (i) the date on which the number of outstanding shares of Class B Common Stock represents less than 10% of the aggregate combined number of outstanding shares of Class A Common Stock and Class B Common Stock; (ii) ten years following the effective date of the Issuer's initial public offering; or (iii) the date specified by vote of the holders of a majority of the outstanding shares of Class B Common Stock, voting as a single class. |

| (7) | In addition, each share of Class B Common Stock will convert automatically into one share of Class A Common Stock (i) upon any transfer, whether or not for value (subject to certain exceptions), or (ii) in the event of the death or disability (as defined in the amended and restated certificate of incorporation of the Issuer) of the reporting person, shares of Class B Common Stock held by the reporting person or the reporting person's permitted estate planning entities will convert into Class A Common Stock. |

| (8) | The stock option vests in equal monthly installments over 24 months beginning on July 11, 2021, subject to the completion of the Issuer's initial public offering by July 11, 2018 and to the individual's continued service through each vesting date. If the completion of the Issuer's initial public offering does not occur by July 11, 2018, the stock option shall be cancelled. |

| (9) | Reflects the cancellation of options to purchase shares of Class A Common Stock in connection with the termination of Mr. Smith's employment and the continuation of Mr. Smith's service on our board of directors. |

| (10) | 1/4 of the options will vest on 10/16/2019 and 1/48 of the total number of options will vest monthly thereafter. All vesting is subject to the Reporting Person's continuous service through the applicable vesting date. |

| (11) | The option grant will vest in a series of 24 equal monthly installments starting on 12/11/2019. All vesting is subject to the Reporting Person's continuous service through the applicable vesting date. |

| (12) | Reflects the grant of options to purchase shares of Class A common Stock in accordance with our Director Compensation Policy. |

| (13) | 100% of the options will vest on the earlier of the first anniversary of the date of grant or the next Annual Meeting of Stockholders. All vesting is subject to the Reporting Person's Continuous Service through the applicable vesting date. Outstanding options are subject to acceleration upon a Change in Control. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Smith Mike C.

C/O STITCH FIX, INC.

1 MONTGOMERY STREET, SUITE 1500

SAN FRANCISCO, CA 94104 | X |

|

|

|

Signatures

|

| /s/ Scott Darling, Attorney-in-Fact for Mike Smith | | 1/12/2021 |

| **Signature of Reporting Person | Date |

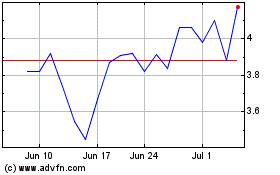

Stitch Fix (NASDAQ:SFIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

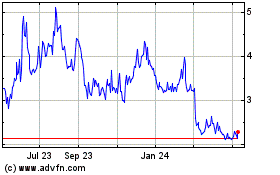

Stitch Fix (NASDAQ:SFIX)

Historical Stock Chart

From Sep 2023 to Sep 2024