Current Report Filing (8-k)

September 15 2020 - 7:22AM

Edgar (US Regulatory)

false00008150970001125259FLGB 0000815097 2020-09-15 2020-09-15 0000815097 ccl:CarnivalPLCMember 2020-09-15 2020-09-15 0000815097 us-gaap:CommonStockMember 2020-09-15 2020-09-15 0000815097 ccl:OrdinarySharesEachRepresentedByAmericanDepositarySharesMember ccl:CarnivalPLCMember 2020-09-15 2020-09-15 0000815097 ccl:A1625SeniorNotesDue2021Member 2020-09-15 2020-09-15 0000815097 ccl:A1875SeniorNotesDue2022Member ccl:CarnivalPLCMember 2020-09-15 2020-09-15 0000815097 ccl:A1000SeniorNotesDue2029Member ccl:CarnivalPLCMember 2020-09-15 2020-09-15

SECURITIES AND EXCHANGE COMMISSION

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported) September 15, 2020

|

|

|

|

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(I.R.S. Employer Identification No.)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

Miami, Florida 33178-2428

|

|

Carnival House, 100 Harbour Parade,

Southampton SO15 1ST, United Kingdom

|

(Address of principal executive offices)

|

|

(Address of principal executive offices)

|

|

|

|

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock ($0.01 par value)

|

|

|

|

New York Stock Exchange, Inc.

|

Ordinary Shares each represented by American Depositary Shares ($1.66 par value), Special Voting Share, GBP 1.00 par value and Trust Shares of beneficial interest in the P&O Princess Special Voting Trust

|

|

|

|

New York Stock Exchange, Inc.

|

1.625% Senior Notes due 2021

|

|

|

|

New York Stock Exchange LLC

|

1.875% Senior Notes due 2022

|

|

|

|

New York Stock Exchange LLC

|

1.000% Senior Notes due 2029

|

|

|

|

New York Stock Exchange LLC

|

Indicate by check mark whether the registrants are emerging growth companies as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2)

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On September 15, 2020, Carnival Corporation and Carnival plc announced that Carnival Corporation has filed a prospectus supplement with the Securities and Exchange Commission (the “Commission”), under which it may offer and sell shares of its common stock, through any of its Sales Agents (the “Shares”), having an aggregate offering price of up to $1 billion from time to time through an

equity offering program (the “ATM Offering”). Carnival Corporation expects to use the net proceeds from sales of Shares under the ATM Offering for general corporate purposes. The timing of any sales will depend on a variety of factors. Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, BofA Securities, Inc. and 12 other financial institutions are acting as sales agents (the “Sales Agents”) under the ATM Offering. PJT Partners is serving as independent financial advisor to Carnival Corporation.

The ATM Offering was registered under the Securities Act of 1933, as amended, pursuant to a registration statement on Form

S-3

(File Nos.

333-322555

and

(the “Registration Statement”) filed by Carnival Corporation and Carnival plc with the Commission on March 9, 2018. The terms of the ATM Offering are described in the prospectus dated March 9, 2018, as supplemented by the prospectus supplement dated September 15, 2020.

In connection with the ATM Offering, on September 15, 2020, Carnival Corporation and Carnival plc entered into an equity distribution agreement (the “Equity Distribution Agreement”) with the Sales Agents. The Equity Distribution Agreement contains customary representations, covenants and indemnification provisions. A copy of the Equity Distribution Agreement is attached hereto as Exhibit 1.1 to this Current Report on Form

8-K,

and the descriptions of the material terms of the Equity Distribution Agreement in this Item 8.01 are qualified in their entirety by reference to such Exhibit, which is incorporated by reference into this Current Report on Form

8-K

and the Registration Statement.

The legality opinions of Tapia, Linares y Alfaro, Maples and Calder and Freshfields Bruckhaus Deringer LLP, issued in connection with the ATM Offering, are attached hereto as Exhibits 5.1, 5.2 and 5.3, respectively, and are incorporated by reference into the Registration Statement.

This Current Report on Form

8-K

shall not constitute an offer to sell or the solicitation of an offer to buy any Shares under the Equity Distribution Agreement nor shall there be any sale of such Shares in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Cautionary Note Concerning Factors That May Affect Future Results

Carnival Corporation and Carnival plc and their respective subsidiaries are referred to collectively in this Current Report on Form

8-K,

including the Exhibits hereto (collectively, this “document”), as “Carnival Corporation & plc,” “our,” “us” and “we.” Some of the statements, estimates or projections contained in this document are “forward-looking statements” that involve risks, uncertainties and assumptions with respect to us, including some statements concerning the financing transactions described herein, future results, operations, outlooks, plans, goals, reputation, cash flows, liquidity and other events which have not yet occurred. These statements are intended to qualify for the safe harbors from liability provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical facts are statements that could be deemed forward-looking. These statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and the beliefs and assumptions of our management. We have tried, whenever possible, to identify these statements by using words like “will,” “may,” “could,” “should,” “would,” “believe,” “depends,” “expect,” “goal,” “anticipate,” “forecast,” “project,” “future,” “intend,” “plan,” “estimate,” “target,” “indicate,” “outlook,” and similar expressions of future intent or the negative of such terms.

Forward-looking statements include those statements that relate to our outlook and financial position including, but not limited to, statements regarding:

|

|

|

|

|

|

|

|

|

|

|

• Net cruise costs, excluding fuel per available lower berth day

|

|

|

|

|

|

|

|

|

|

• Estimates of ship depreciable lives and residual values

|

|

|

|

|

|

|

|

|

|

• Goodwill, ship and trademark fair values

|

|

|

|

|

• Interest, tax and fuel expenses

|

|

|

|

|

|

|

|

|

• Currency exchange rates

|

|

|

|

• Adjusted earnings per share

|

|

|

|

|

|

|

|

|

|

• Impact of the

COVID-19

coronavirus global pandemic on our financial condition and results of operations

|

Because forward-looking statements involve risks and uncertainties, there are many factors that could cause our actual results, performance or achievements to differ materially from those expressed or implied by our forward-looking statements. This note contains important cautionary statements of the known factors that we consider could materially affect the accuracy of our forward-looking statements and adversely affect our business, results of operations and financial position. Additionally, many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the

COVID-19

outbreak. It is not possible to predict or identify all such risks. There may be additional risks that we consider immaterial or which are unknown.

|

|

•

|

|

COVID-19

has had, and is expected to continue to have, a significant impact on our financial condition and operations, which impacts our ability to obtain acceptable financing to fund resulting reductions in cash from operations. The current, and uncertain future, impact of the

COVID-19

outbreak, including its effect on the ability or desire of people to travel (including on cruises), is expected to continue to impact our results, operations, outlooks, plans, goals, growth, reputation, litigation, cash flows, liquidity, and stock price;

|

|

|

•

|

|

as a result of the

COVID-19

outbreak, we may be out of compliance with a maintenance covenant in certain of our debt facilities, for which we have waivers for the period through March 31, 2021 with the next testing date of May 31, 2021;

|

|

|

•

|

|

world events impacting the ability or desire of people to travel may lead to a decline in demand for cruises;

|

|

|

•

|

|

incidents concerning our ships, guests or the cruise vacation industry as well as adverse weather conditions and other natural disasters may impact the satisfaction of our guests and crew and lead to reputational damage;

|

|

|

•

|

|

changes in and

non-compliance

with laws and regulations under which we operate, such as those relating to health, environment, safety and security, data privacy and protection, anti-corruption, economic sanctions, trade protection and tax may lead to litigation, enforcement actions, fines, penalties and reputational damage;

|

|

|

•

|

|

breaches in data security and lapses in data privacy as well as disruptions and other damages to our principal offices, information technology operations and system networks, including the recent ransomware incident, and failure to keep pace with developments in technology may adversely impact our business operations, the satisfaction of our guests and crew and lead to reputational damage;

|

|

|

•

|

|

ability to recruit, develop and retain qualified shipboard personnel who live away from home for extended periods of time may adversely impact our business operations, guest services and satisfaction;

|

|

|

•

|

|

increases in fuel prices, changes in the types of fuel consumed and availability of fuel supply may adversely impact our scheduled itineraries and costs;

|

|

|

•

|

|

fluctuations in foreign currency exchange rates may adversely impact our financial results;

|

|

|

•

|

|

overcapacity and competition in the cruise and land-based vacation industry may lead to a decline in our cruise sales, pricing and destination options;

|

|

|

•

|

|

geographic regions in which we try to expand our business may be slow to develop or ultimately not develop how we expect; and

|

|

|

•

|

|

inability to implement our shipbuilding programs and ship repairs, maintenance and refurbishments may adversely impact our business operations and the satisfaction of our guests.

|

The ordering of the risk factors set forth above is not intended to reflect our indication of priority or likelihood.

Forward-looking statements should not be relied upon as a prediction of actual results. Subject to any continuing obligations under applicable law or any relevant stock exchange rules, we expressly disclaim any obligation to disseminate, after the date of this document, any updates or revisions to any such forward-looking statements to reflect any change in expectations or events, conditions or circumstances on which any such statements are based.

|

|

Financial Statements and Exhibits.

|

Pursuant to the requirements of the Securities Exchange Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

By:

|

|

|

|

Name:

|

|

David Bernstein

|

|

Name:

|

|

David Bernstein

|

|

Title:

|

|

Chief Financial Officer and Chief Accounting Officer

|

|

Title:

|

|

Chief Financial Officer and Chief Accounting Officer

|

|

|

|

|

|

|

Date:

|

|

September 15, 2020

|

|

Date:

|

|

September 15, 2020

|

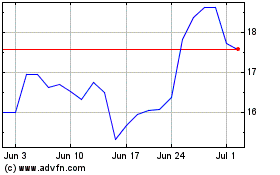

Carnival (NYSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

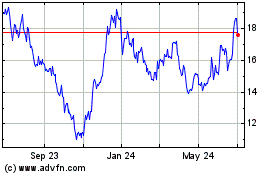

Carnival (NYSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024