Additional Proxy Soliciting Materials (definitive) (defa14a)

March 17 2020 - 4:17PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act

of 1934

Filed by the Registrant

☑

Filed by a Party

other than the Registrant ☐

Check the

appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, For Use of the Commission Only (As Permitted by Rule

14a-6(e)(2))

☐

Definitive Proxy Statement

☑

Definitive Additional Materials

☐

Soliciting Material under Rule 14a-12

|

CEL-SCI CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

|

Payment of Filing

Fee (Check the appropriate box):

☑ No

fee required

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

(1) Title

of each class of securities to which transaction

applies:

(2) Aggregate

number of securities to which transaction applies:

(3) Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it

was determined):

(4) Proposed

maximum aggregate value of transaction:

(5) Total

fee paid:

☐ Fee

paid previously with preliminary materials.

☐ Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the form or schedule and the date

of its filing.

(1) Amount

Previously Paid:

(2) Form,

Schedule or Registration Statement No.:

(3) Filing

Party:

(4) Date

Filed:

At the

annual shareholders meeting scheduled for April 17, 2020

shareholders are being asked to approve the adoption of the

Company’s 2020 Non-Qualified Stock Option Plan. More

information about the plan follows:

Section

5 of the Plan provides that all Company employees, directors,

officers, and consultants and advisors are eligible to participate

in the Plan. However, the Company’s Compensation Committee,

which administers the Plan, determines which persons will be

granted options pursuant to the Plan and Section 5 of the Plan

restricts the type of services that can be provided in order for

consultants or advisors to be eligible to receive options pursuant

to the Plan. As of March 16, 2020 the Company had approximately 40

employees and three directors who are not employees of the Company.

The number of the Company’s consultants and advisors varies

from time to time.

The

Company’s Compensation Committee also determines, for each

option granted, the shares issuable upon the exercise of the

option, the option exercise price, the expiration date of the

option, any vesting requirements applicable to the option, and all

other terms of the option. The Company does not receive any cash or

property from the Optionee when an option is granted.

No

income is recognized by the Optionee at the time the option is

granted. The difference between the option price and the market

value of the shares on the date the option is exercised is taxable

as ordinary income to an Optionee at the time of exercise, and to

the extent such difference does not constitute unreasonable

compensation, is deductible by the Company at that time. Gain or

loss on any subsequent sale of shares received through the exercise

of an option is treated by the Optionee as a capital gain or

loss.

As of

March 16, 2020 the closing price of the Company’s common

stock was $9.15.

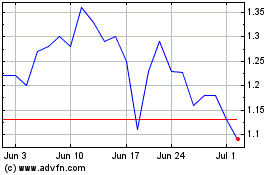

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

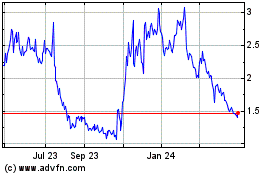

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Apr 2023 to Apr 2024