London Stock Exchange Group 2019 Pretax Profit Fell

February 28 2020 - 3:05AM

Dow Jones News

By Adria Calatayud

London Stock Exchange Group PLC said Friday that pretax profit

fell on higher costs, and that it remains on track to close its

proposed acquisition of data provider Refinitiv in the second half

of the year.

The U.K. exchange operator, which is in the process of acquiring

data-provider Refinitiv, made a pretax profit of 651 million pounds

($839.7 million) compared with GBP685 million in 2018. Net profit

fell to GBP417 million from GBP480 million a year before.

Excluding nonunderyling items, the owner of the London and Milan

bourses said pretax profit rose to GBP994 million last year from

GBP865 million in 2018.

LSE Group's revenue climbed to GBP2.06 billion in 2019 from

GBP1.91 billion a year before, matching analysts' consensus

expectations. Revenue from the FTSE Russell index business rose 6%

on a constant-currency basis, while LCH over-the-counter clearing

revenue was up 13% on the same basis.

The board declared a final dividend of 49.9 pence a share, up

from 43.2 pence share in 2018.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

February 28, 2020 02:50 ET (07:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

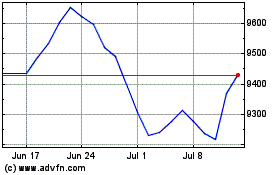

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

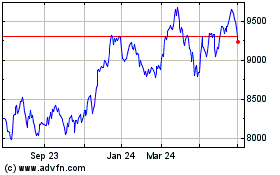

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024