Diageo Settles for $5 Million With SEC on Profit-Boosting Charges

February 19 2020 - 11:31AM

Dow Jones News

By Dave Sebastian

Diageo PLC has agreed to pay $5 million to settle charges

brought by the Securities and Exchange Commission that it hit

performance goals by pressuring distributors to buy products in

excess of demand.

The pressure on distributors by the company's employees at

Diageo North America, its largest subsidiary, contributed to an

uptick in shipments that allowed it to meet performance targets and

post higher growth in closely watched indicators amid declining

market conditions, the SEC alleges. The London-based

alcoholic-beverage company didn't disclose the risk of the

inventory increase on future growth, the SEC said.

In addition to the settlement, Diageo agreed to cease and desist

from further violations without admitting or denying the SEC's

findings.

"Diageo is pleased to have resolved this legacy matter, which

relates back to fiscal years 2014 and 2015," the company said.

"Diageo regularly reviews and refines its policies and procedures

and is committed to maintaining a robust and transparent disclosure

process."

The SEC also said the metric-boosting method created a

misleading impression that the company was able to achieve growth

through regular demand.

"Investors rely on public companies to make complete and

accurate disclosures upon which they can base their investment

decisions," Melissa Hodgman, an associate director in the SEC's

Division of Enforcement, said in prepared remarks.

American depositary shares of Diageo rose about 0.7% to

$162.94.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

February 19, 2020 11:16 ET (16:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

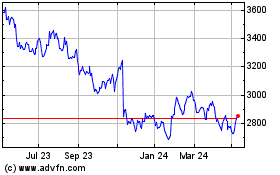

Diageo (LSE:DGE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Diageo (LSE:DGE)

Historical Stock Chart

From Sep 2023 to Sep 2024