U.S. Stocks Climb as Tech Sector Rallies

January 22 2020 - 2:30PM

Dow Jones News

By Anna Isaac and Akane Otani

U.S. stocks climbed toward records Wednesday, boosted by a rally

in shares of technology companies.

The Dow Jones Industrial Average advanced 88 points, or 0.3%, to

29281. The S&P 500 added 0.3% and the Nasdaq Composite rose

0.6%, with both indexes on track to close at fresh highs.

Shares of fast-growing technology-driven companies have led the

market higher this year, extending a powerful run that lifted many

stocks to records in 2019.

The trend showed no sign of abating Wednesday. International

Business Machines rose 3.2% after unexpectedly reporting a slight

gain in fourth-quarter revenue, ending a streak of declining

sales.

Tesla shares advanced 7.1% after a Wedbush analyst boosted his

price target for the stock, citing expectations for strong demand

for Tesla products in Europe and China. Shares of the electric-car

maker have risen 40% this year, lifting the firm's market

capitalization above $100 billion.

Apple added 1% following a report that it would take steps to

begin assembling a new low-cost iPhone later this year.

Elsewhere, the Stoxx Europe 600 edged down 0.1% after drifting

around the flatline for much of the session. Yields on Italian

government bonds rose, though, after reports suggested a key member

of the country's ruling coalition might step down.

"Investors don't like uncertainty, but that's very much the

short-term response," said Florian Hense, economist at Berenberg

Bank.

"The issue with Italy is that it's a time bomb. If there's a

global recession in the next two-three years, Italy would be a

prime candidate for a debt crisis."

Shares of Italian banks fell, with Milan-based Banco BPM

dropping 2.8% and UniCredit losing 3.3%.

In Asia, stock indexes chipped away at the prior day's losses

after Chinese authorities said hospitals were taking measures to

contain the outbreak of a potentially deadly virus.

Authorities are recommending that people not go into or out of

Wuhan, the central Chinese city where the virus originated.

Ministries and local governments are also arranging refunds on

plane and train tickets, banning tourist groups from Wuhan and

organizing coverage of medical expenses, analysts at Everbright Sun

Hung Kai said in a note.

Investors have a high degree of confidence in the Chinese

government's ability to contain the virus, said James Athey, senior

investment manager at Aberdeen Standard Investments.

"The global macroeconomic impact of this virus in Asia, based on

what we know now, is likely to be very small," Mr. Athey said. "And

secondly, irrespective of the macro response, the market has been

trained to buy dips and it's done that today."

Hong Kong's Hang Seng Index ended the day 1.3% higher. Japan's

Nikkei Stock Average advanced 0.7%, and the Shanghai Composite rose

0.3%.

Write to Anna Isaac at anna.isaac@wsj.com and Akane Otani at

akane.otani@wsj.com

(END) Dow Jones Newswires

January 22, 2020 14:15 ET (19:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

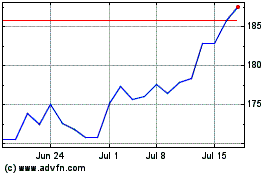

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024