Alimera Sciences, Inc. (NASDAQ: ALIM) (Alimera), a leader in the

commercialization and development of prescription ophthalmology

treatments for the management of retinal diseases, announces

financial results for the quarter ended September 30, 2019. Alimera

will host a conference call on Wednesday, October 30, 2019 at 9:00

AM ET to review these financial results and provide an update on

corporate developments.

“We are pleased to report consolidated revenue of $12.9 million

for the third quarter of 2019, a 16% gain over the third quarter of

last year and significant growth over the recently reported second

quarter of 2019,” said Rick Eiswirth, President and CEO of

Alimera. “Our international business contributed greatly to

our growth, delivering a 62% increase in revenue on a combined

basis, and our U.S. sales team, which was fully staffed, delivered

increases in end user demand month-to-month during the

quarter.”

Third Quarter 2019 Financial Results Net

RevenueConsolidated net revenue for the third quarter of 2019 grew

16% to $12.9 million, compared to $11.1 million for the third

quarter of 2018. U.S. net revenue was $8.7 million during the third

quarter of 2019, up 2% from $8.5 million during the same period in

2018, and up 19% over the second quarter of 2019. End user demand,

which represents units purchased by physicians and pharmacies from

Alimera’s U.S. distributors, decreased slightly for the third

quarter of 2019, to 973 units compared to 978 units from the third

quarter of 2018, but increased sequentially from 917 units in the

second quarter of 2019 after the sales force was fully staffed.

The discrepancy between GAAP revenue and end user demand in the

U.S. is due to the timing of distributor purchases from quarter to

quarter. In the third quarter of 2018, Alimera’s distributors

purchased approximately 5% more units than they sold to end users,

increasing their stock on hand during that quarter. In the third

quarter of 2019, Alimera’s distributors purchased approximately 9%

more units than they sold to end users, increasing their stock on

hand during the quarter.

International net revenue increased 62% to approximately $4.2

million during the third quarter of 2019, compared to approximately

$2.6 million for the same period during 2018, driven by increased

unit sales across all markets. We expect revenue in the

international segment to fluctuate from quarter to quarter

depending primarily on the timing and size of our international

distributor ordering patterns.

Operating Expenses Total operating expenses for the third

quarter of 2019 increased by $600,000 or 5% to $13.0 million,

compared to $12.4 million during the same period of 2018. The

increase was primarily attributable to an approximately $900,000

increase in sales and marketing expenses, partially offset by a

$300,000 decrease in general and administrative expenses. The

increase in sales and marketing expenses was due to increases in

personnel costs and marketing costs, including those related to our

direct-to-patient campaign.

Net Loss and Non-GAAP Adjusted EBITDAFor the third quarter of

2019, Alimera reported a net loss of approximately

$3.1 million, compared to a net loss of $3.5 million for the

same period in 2018. “Adjusted EBITDA,” a non-GAAP financial

measure defined below, was a loss of approximately $500,000 for the

third quarter of 2019, compared to a similar Adjusted EBITDA loss

for the third quarter of 2018.

Net (Loss) Income per ShareBasic and diluted net loss per share

for the third quarter of 2019 was $0.04 on approximately 71.0

million weighted average shares outstanding. This compares to basic

net income per share for the third quarter of 2018 of $0.40 on

approximately 88.0 million weighted average shares outstanding,

which includes approximately 17.9 million participating securities.

Diluted net income per share for the third quarter of 2018 was

$0.39 on approximately 88.5 million weighted average shares

outstanding, which includes approximately 18.5 million dilutive and

participating securities. Net income available to stockholders for

the third quarter of 2018 was primarily attributable to the gain on

the extinguishment of Alimera’s Series B Convertible Preferred

Stock resulting from its exchange in September 2018 for new Series

C Convertible Preferred Stock.

Cash and Cash EquivalentsAs of September 30, 2019, Alimera had

cash and cash equivalents of approximately $7.9 million,

compared to $13.0 million in cash and cash equivalents as of

December 31, 2018.

On October 25, 2019, Alimera announced a $20.0 million equity

purchase agreement with Lincoln Park Capital Fund, LLC. Under that

agreement, Lincoln Park has purchased $1.0 million of

Alimera’s registered common stock. This agreement will provide a

flexible and efficient option to invest in Alimera’s current

business to pursue strategies to leverage its global sales

infrastructure and build a leading company focused on the treatment

of retinal diseases.

Definition of Non-GAAP Financial MeasureFor

purposes of this press release, “Adjusted EBITDA” is defined as

earnings before interest, taxes, depreciation, amortization,

stock-based compensation expenses, net unrealized gains and losses

from foreign currency exchange transactions, losses on

extinguishment of debt and severance expenses. Please refer to the

sections of this press release entitled “Non-GAAP Financial

Measure” and “Reconciliation of GAAP Net Loss to Non-GAAP Adjusted

EBITDA.”

Conference Call to Be Held October 30, 2019A

live conference call will be hosted on October 30, 2019 at 9:00am

eastern time by Rick Eiswirth, president and chief executive

officer, and Phil Jones, chief financial officer, to discuss

Alimera’s financial results. Please refer to the information below

for conference call dial-in information and webcast

registration.

Conference date: Wednesday, October 30, 2019, 9:00 AM ET

Conference dial-in: 866-777-2509International dial-in:

412-317-5413Conference Call Name: Alimera Sciences (Nasdaq: ALIM)

Third Quarter 2019 Financial Results and Corporate Update

Conference Call Conference Call Pre-registration: Participants

can register for the conference by navigating to

http://dpregister.com/10136395Please note that registered

participants will receive their dial in number upon registration

and will dial directly into the call without delay.Live Webcast

URL:

https://services.choruscall.com/links/alimera191030.html

A replay will be available on Alimera’s

website, www.alimerasciences.com, under

“Investor Relations” one hour following the live call.Conference

Call replay: US Toll Free: 1-877-344-7529International Toll:

1-412-317-0088Canada Toll Free: 855-669-9658Replay Access Code:

10136395End Date: November 13, 2019

About Alimera Sciences, Inc.

www.alimerasciences.com

Alimera, founded in June 2003, is a pharmaceutical company that

specializes in the commercialization and development of

prescription ophthalmic pharmaceuticals. Alimera is presently

focused on diseases affecting the back of the eye, or retina,

because these diseases are not well treated with current therapies

and affect millions of people in our aging populations. For

more information, please visit www.alimerasciences.com.

Non-GAAP Financial Measure

This press release contains a discussion of a non-GAAP financial

measure, as defined in Regulation G promulgated under the

Securities Exchange Act of 1934, as amended. Alimera reports its

financial results in compliance with GAAP but believes that the

non-GAAP measure of Adjusted EBITDA provides useful information to

investors regarding Alimera’s operating performance. Alimera

uses Adjusted EBITDA in the management of its business.

Accordingly, Adjusted EBITDA for the three and nine months ended

September 30, 2019 and 2018 has been presented in certain instances

excluding items identified in the reconciliations provided in the

table entitled “Reconciliation of GAAP Net Loss to non-GAAP

Adjusted EBITDA.” GAAP net loss is the most directly comparable

GAAP financial measure to Adjusted EBITDA.

Adjusted EBITDA, as presented, may not be comparable to

similarly titled measures reported by other companies because not

all companies may calculate Adjusted EBITDA in an identical manner.

Therefore, Adjusted EBITDA is not necessarily an accurate measure

of comparison between companies.

The presentation of Adjusted EBITDA is not intended to be

considered in isolation or as a substitute for guidance prepared in

accordance with GAAP. The principal limitation of this non-GAAP

financial measure is that it excludes significant elements required

by GAAP to be recorded in Alimera’s financial statements. In

addition, Adjusted EBITDA is subject to inherent limitations as it

reflects the exercise of judgments by management in determining

this non-GAAP financial measure.

Forward Looking Statements

This press release contains “forward-looking statements,” within

the meaning of the Private Securities Litigation Reform Act of

1995, regarding, among other things, Alimera’s expectation

regarding its use of the Lincoln Park purchase agreement to obtain

capital and Alimera’s expectation that revenue in its international

segment will fluctuate from quarter to quarter depending primarily

on the timing and size of its international distributor ordering

patterns. Such forward-looking statements are based on current

expectations and involve inherent risks and uncertainties,

including factors that could delay, divert or change them, and

could cause actual results to differ materially from those

projected in the forward-looking statements. Meaningful factors

that could cause actual results to differ include, but are not

limited to, (a) Alimera’s ability to satisfy the conditions in the

purchase agreement to direct Lincoln Park to make purchases of

common stock, (b) the possible negative effects on the market

liquidity of Alimera’s common stock of the reverse stock split that

Alimera expects to implement if its stockholders approve it at the

upcoming special stockholders meeting on November 4, 2019,

(c) changes in Alimera’s international sales due to a

reduction in end user demand, unanticipated competition, regulatory

issues, including delays in obtaining reimbursement approval in

various countries in the EU for the treatment of non-infectious

posterior uveitis, or other unexpected circumstances, and

(d) other factors discussed in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of Alimera’s Annual Report on Form

10-K for the year ended December 31, 2018, and Alimera’s Quarterly

Reports on Form 10-Q for the first and second quarters of 2019,

which are on file with the Securities and Exchange Commission (SEC)

and available on the SEC’s website at http://www.sec.gov.

Additional factors will also be described in those sections of

Alimera’s Quarterly Report on Form 10-Q for the third quarter of

2019, to be filed with the SEC soon.

The forward-looking statements in this press release speak only

as of the date of this press release (unless another date is

indicated). Alimera undertakes no obligation, and specifically

declines any obligation, to publicly update or revise any such

forward-looking statements, whether as a result of new information,

future events or otherwise.

|

|

|

|

For investor inquiries: Scott Gordon for

Alimera Sciences scottg@coreir.com |

For media inquiries:Jules Abrahamfor Alimera

Sciencesjulesa@coreir.com |

|

|

|

ALIMERA SCIENCES,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands)

| |

September 30,2019 |

|

December 31,2018 |

| |

(unaudited) |

|

|

| CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

7,903 |

|

|

$ |

13,043 |

|

| Restricted cash |

31 |

|

|

32 |

|

| Accounts receivable, net |

16,377 |

|

|

17,259 |

|

| Prepaid expenses and other

current assets |

2,155 |

|

|

2,109 |

|

| Inventory |

1,642 |

|

|

2,405 |

|

| Total current assets |

28,108 |

|

|

34,848 |

|

| NON-CURRENT ASSETS: |

|

|

|

| Property and equipment,

net |

1,060 |

|

|

1,355 |

|

| Right of use assets, net |

1,162 |

|

|

— |

|

| Intangible asset, net |

15,272 |

|

|

16,723 |

|

| Deferred tax asset |

1,127 |

|

|

1,182 |

|

| TOTAL ASSETS |

$ |

46,729 |

|

|

$ |

54,108 |

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable |

$ |

6,728 |

|

|

$ |

6,355 |

|

| Accrued expenses |

3,916 |

|

|

3,643 |

|

| Note payable |

3,333 |

|

|

— |

|

| Finance lease obligations |

258 |

|

|

236 |

|

| Total current liabilities |

14,235 |

|

|

10,234 |

|

| NON-CURRENT LIABILITIES: |

|

|

|

| Note payable |

35,166 |

|

|

37,873 |

|

| Finance lease obligations —

less current portion |

132 |

|

|

305 |

|

| Other non-current

liabilities |

3,672 |

|

|

2,974 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

| STOCKHOLDERS’ (DEFICIT)

EQUITY: |

|

|

|

| Preferred stock: |

|

|

|

| Series A Convertible Preferred

Stock |

19,227 |

|

|

19,227 |

|

| Series C Convertible Preferred

Stock |

11,117 |

|

|

11,117 |

|

| Common stock |

710 |

|

|

701 |

|

| Additional paid-in

capital |

348,035 |

|

|

346,108 |

|

| Common stock warrants |

3,707 |

|

|

3,707 |

|

| Accumulated deficit |

(388,068 |

) |

|

(377,127 |

) |

| Accumulated other

comprehensive loss |

(1,204 |

) |

|

(1,011 |

) |

| TOTAL STOCKHOLDERS’ (DEFICIT)

EQUITY |

(6,476 |

) |

|

2,722 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ (DEFICIT) EQUITY |

$ |

46,729 |

|

|

$ |

54,108 |

|

| |

|

|

|

|

|

|

|

ALIMERA SCIENCES,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONSFOR THE THREE AND NINE MONTHS ENDED

SEPTEMBER 30, 2019 AND 2018(in thousands,

except share and per share data)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

| |

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET REVENUE |

$ |

12,850 |

|

|

$ |

11,137 |

|

|

$ |

36,595 |

|

|

$ |

31,484 |

|

| COST OF GOODS SOLD, EXCLUDING

DEPRECIATION AND AMORTIZATION |

(1,579 |

) |

|

(965 |

) |

|

(4,353 |

) |

|

(2,982 |

) |

| GROSS PROFIT |

11,271 |

|

|

10,172 |

|

|

32,242 |

|

|

28,502 |

|

| |

|

|

|

|

|

|

|

| RESEARCH, DEVELOPMENT AND

MEDICAL AFFAIRS EXPENSES |

2,761 |

|

|

2,799 |

|

|

8,322 |

|

|

8,398 |

|

| GENERAL AND ADMINISTRATIVE

EXPENSES |

3,121 |

|

|

3,446 |

|

|

10,189 |

|

|

10,530 |

|

| SALES AND MARKETING

EXPENSES |

6,437 |

|

|

5,480 |

|

|

18,458 |

|

|

17,375 |

|

| DEPRECIATION AND

AMORTIZATION |

668 |

|

|

642 |

|

|

1,974 |

|

|

1,941 |

|

| OPERATING EXPENSES |

12,987 |

|

|

12,367 |

|

|

38,943 |

|

|

38,244 |

|

| NET LOSS FROM OPERATIONS |

(1,716 |

) |

|

(2,195 |

) |

|

(6,701 |

) |

|

(9,742 |

) |

| |

|

|

|

|

|

|

|

| INTEREST EXPENSE AND

OTHER |

(1,232 |

) |

|

(1,211 |

) |

|

(3,696 |

) |

|

(3,540 |

) |

| UNREALIZED FOREIGN CURRENCY

(LOSS) GAIN, NET |

(115 |

|

|

(16 |

|

|

(135 |

|

|

18 |

|

| LOSS ON EARLY EXTINGUISHMENT

OF DEBT |

— |

|

|

— |

|

|

— |

|

|

(1,766 |

) |

| NET LOSS BEFORE TAXES |

(3,063 |

) |

|

(3,422 |

) |

|

(10,532 |

) |

|

(15,030 |

) |

| PROVISION FOR TAXES |

(77 |

) |

|

(28 |

) |

|

(409 |

) |

|

(104 |

) |

| NET LOSS |

|

(3,140 |

) |

|

|

(3,450 |

) |

|

|

(10,941 |

) |

|

|

(15,134 |

) |

| GAIN ON EXTINGUISHMENT OF

PREFERRED STOCK |

|

— |

|

|

|

38,330 |

|

|

|

— |

|

|

|

38,330 |

|

| NET (LOSS) INCOME AVAILABLE TO

STOCKHOLDERS |

$ |

(3,140 |

|

|

$ |

34,880 |

|

|

$ |

(10,941 |

|

|

$ |

23,196 |

|

| NET (LOSS) INCOME PER SHARE —

Basic |

$ |

(0.04 |

) |

|

$ |

0.40 |

|

|

$ |

(0.15 |

) |

|

$ |

0.26 |

|

| WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING — Basic |

|

71,002,307 |

|

|

|

70,038,411 |

|

|

|

70,912,124 |

|

|

|

69,981,744 |

|

| WEIGHTED AVERAGE PARTICIPATING

SHARES – Basic |

|

— |

|

|

|

17,934,164 |

|

|

|

— |

|

|

|

17,604,533 |

|

| TOTAL WEIGHTED AVERAGE SHARES

OUTSTANDING — Basic |

71,002,307 |

|

|

87,972,575 |

|

|

70,912,124 |

|

|

87,586,277 |

|

| NET (LOSS) INCOME PER SHARE —

Diluted |

$ |

(0.04 |

) |

|

$ |

0.39 |

|

|

$ |

(0.15 |

) |

|

$ |

0.26 |

|

| WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING — Diluted |

|

71,002,307 |

|

|

|

70,038,411 |

|

|

|

70,912,124 |

|

|

|

69,981,744 |

|

| WEIGHTED AVERAGE PARTICIPATING

AND DILUTIVE SHARES – Diluted |

|

— |

|

|

|

18,445,093 |

|

|

|

— |

|

|

|

18,126,536 |

|

| TOTAL WEIGHTED AVERAGE SHARES

OUTSTANDING — Diluted |

71,002,307 |

|

|

88,483,504 |

|

|

70,912,124 |

|

|

88,108,280 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

ALIMERA SCIENCES,

INC.CONSOLIDATING STATEMENTS OF

OPERATIONSFOR THE THREE AND NINE MONTHS ENDED

SEPTEMBER 30, 2019 AND 2018(in

thousands)

| |

Three Months EndedSeptember 30,

2019 |

|

Three Months EndedSeptember 30,

2018 |

| |

U.S. |

|

International |

|

Other |

|

Consolidated |

|

U.S. |

|

International |

|

Other |

|

Consolidated |

| |

|

| |

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET REVENUE |

$ |

8,692 |

|

|

$ |

4,158 |

|

|

$ |

— |

|

|

$ |

12,850 |

|

|

$ |

8,492 |

|

|

$ |

2,645 |

|

|

$ |

— |

|

|

$ |

11,137 |

|

| COST OF GOODS SOLD, EXCLUDING

DEPRECIATION AND AMORTIZATION |

(1,001 |

) |

|

(578 |

) |

|

— |

|

|

(1,579 |

) |

|

(715 |

) |

|

|

(250 |

) |

|

— |

|

|

(965 |

) |

| GROSS PROFIT |

7,691 |

|

|

3,580 |

|

|

— |

|

|

11,271 |

|

|

7,777 |

|

|

|

2,395 |

|

|

— |

|

|

10,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RESEARCH, DEVELOPMENT AND

MEDICAL AFFAIRS EXPENSES |

1,573 |

|

|

1,100 |

|

|

88 |

|

|

2,761 |

|

|

1,684 |

|

|

|

904 |

|

|

211 |

|

|

2,799 |

|

| GENERAL AND ADMINISTRATIVE

EXPENSES |

2,032 |

|

|

768 |

|

|

321 |

|

|

3,121 |

|

|

2,050 |

|

|

|

786 |

|

|

610 |

|

|

3,446 |

|

| SALES AND MARKETING

EXPENSES |

4,502 |

|

|

1,840 |

|

|

95 |

|

|

6,437 |

|

|

3,913 |

|

|

|

1,356 |

|

|

211 |

|

|

5,480 |

|

| DEPRECIATION AND

AMORTIZATION |

— |

|

|

— |

|

|

668 |

|

|

668 |

|

|

— |

|

|

|

— |

|

|

642 |

|

|

642 |

|

| OPERATING EXPENSES |

8,107 |

|

|

3,708 |

|

|

1,172 |

|

|

12,987 |

|

|

7,647 |

|

|

|

3,046 |

|

|

1,674 |

|

|

12,367 |

|

| SEGMENT (LOSS) INCOME FROM

OPERATIONS |

(416 |

) |

|

(128 |

) |

|

(1,172 |

) |

|

(1,716 |

) |

|

130 |

|

|

|

(651 |

) |

|

(1,674 |

) |

|

(2,195 |

) |

| OTHER INCOME AND EXPENSES,

NET |

— |

|

|

— |

|

|

(1,347 |

) |

|

(1,347 |

) |

|

— |

|

|

|

— |

|

|

(1,227 |

) |

|

(1,227 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS BEFORE TAXES |

|

|

|

|

|

|

$ |

(3,063 |

) |

|

|

|

|

|

|

|

|

$ |

(3,422 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months EndedSeptember 30,

2019 |

|

Nine Months EndedSeptember 30,

2018 |

| |

U.S. |

|

International |

|

Other |

|

Consolidated |

|

U.S. |

|

International |

|

Other |

|

Consolidated |

| |

|

| |

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET REVENUE |

$ |

22,778 |

|

|

$ |

13,817 |

|

|

$ |

— |

|

|

$ |

36.595 |

|

|

$ |

23,096 |

|

|

$ |

8,388 |

|

|

$ |

— |

|

|

$ |

31,484 |

|

| COST OF GOODS SOLD, EXCLUDING

DEPRECIATION AND AMORTIZATION |

(2,494 |

) |

|

(1,859 |

) |

|

— |

|

|

(4,353 |

) |

|

(2,084 |

) |

|

(898 |

) |

|

— |

|

|

(2,982 |

) |

| GROSS PROFIT |

20,284 |

|

|

11,958 |

|

|

— |

|

|

32,242 |

|

|

21,012 |

|

|

7,490 |

|

|

— |

|

|

28,502 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RESEARCH, DEVELOPMENT AND

MEDICAL AFFAIRS EXPENSES |

4,629 |

|

|

3,361 |

|

|

332 |

|

|

8,322 |

|

|

4,926 |

|

|

2,808 |

|

|

664 |

|

|

8,398 |

|

| GENERAL AND ADMINISTRATIVE

EXPENSES |

6,116 |

|

|

2,876 |

|

|

1,197 |

|

|

10,189 |

|

|

6,209 |

|

|

2,416 |

|

|

1,905 |

|

|

10,530 |

|

| SALES AND MARKETING

EXPENSES |

12,760 |

|

|

5,324 |

|

|

374 |

|

|

18,458 |

|

|

12,427 |

|

|

4,127 |

|

|

821 |

|

|

17,375 |

|

| DEPRECIATION AND

AMORTIZATION |

— |

|

|

— |

|

|

1,974 |

|

|

1,974 |

|

|

— |

|

|

— |

|

|

1,941 |

|

|

1,941 |

|

| OPERATING EXPENSES |

23,505 |

|

|

11,561 |

|

|

3,877 |

|

|

38,943 |

|

|

23,562 |

|

|

9,351 |

|

|

5,331 |

|

|

38,244 |

|

| SEGMENT (LOSS) INCOME FROM

OPERATIONS |

(3,221 |

) |

|

397 |

|

|

(3,877 |

) |

|

(6,701 |

) |

|

(2,550 |

) |

|

(1,861 |

) |

|

(5,331 |

) |

|

(9,742 |

) |

| OTHER INCOME AND EXPENSES,

NET |

— |

|

|

— |

|

|

(3,831 |

) |

|

(3,831 |

) |

|

— |

|

|

— |

|

|

(5,288 |

) |

|

(5,288 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS BEFORE TAXES |

|

|

|

|

|

|

$ |

(10,532 |

) |

|

|

|

|

|

|

|

$ |

(15,030 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF GAAP MEASURES TO

NON-GAAP ADJUSTED MEASURESGAAP NET LOSS TO

NON-GAAP ADJUSTED EBITDA(in

thousands)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

| |

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP NET LOSS |

$ |

(3,140 |

) |

|

$ |

(3,450 |

) |

|

$ |

(10,941 |

) |

|

$ |

(15,134 |

) |

| Adjustments to net loss: |

|

|

|

|

|

|

|

| Interest expense and

other |

1,232 |

|

|

1,211 |

|

|

3,696 |

|

|

3,540 |

|

| Provision for taxes |

77 |

|

|

28 |

|

|

409 |

|

|

104 |

|

| Depreciation and

amortization |

668 |

|

|

642 |

|

|

1,974 |

|

|

1,941 |

|

| Stock-based compensation

expenses |

504 |

|

|

1,032 |

|

|

1,903 |

|

|

3,390 |

|

| Unrealized foreign currency

exchange losses (gains) |

115 |

|

|

16 |

|

|

135 |

|

|

(18 |

) |

| Loss on early extinguishment

of debt |

— |

|

|

— |

|

|

— |

|

|

1,766 |

|

| Severance expenses |

23 |

|

|

— |

|

|

198 |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-GAAP ADJUSTED EBITDA |

$ |

(521 |

) |

|

$ |

(521 |

) |

|

$ |

(2,626 |

) |

|

$ |

(4,411 |

) |

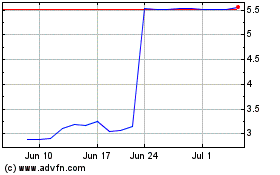

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

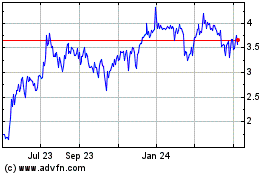

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Apr 2023 to Apr 2024