TIDMRNO

RNS Number : 1533K

Renold PLC

27 August 2019

Renold plc

Completion of investigation

27 August 2019

Renold plc ("Renold" or "the Group"), a leading international

supplier of industrial chains and related power transmission

products, today issues the following statement.

Summary

On 9 July 2019, the Group announced the postponement of the

Annual General Meeting ("AGM") to permit the preparation of revised

audited financial statements for the year ended 31 March 2019,

following the identification of historical accounting issues in the

Gears business unit, which is part of the Torque Transmission

division.

In order to prepare accurate revised financial statements, an

independent internal audit investigation, supported by PwC, has

been undertaken to assess the extent and impact of the historical

misstatement of results. This independent investigation has now

been concluded and the Board can confirm that these issues, the

nature of which were as set out in the announcement of 9 July 2019,

were confined to the Gears business unit.

With the independent investigation complete, revised financial

statements have been prepared and audited. The over-statements of

profit for the years ended 31 March 2018 and 2019 are broadly

consistent with the guidance provided on 9 July 2019 and the final

outcome of the investigation does not affect the outlook commentary

provided at that time. A summary of the adjustments made to the

historic accounts as a result of this investigation is provided

below.

Investigation and findings

A review of the Gears business unit was initially undertaken

following comments made by the Auditor to the Audit Committee

regarding application of accounting controls in the business unit.

The initial management investigation identified intentional

misstatement of results at a local level, and as a result the Board

immediately initiated an independent internal audit investigation,

supported by PwC, reporting directly to the Audit Committee.

In the announcement on 9 July 2019, the Company reported that

the initial investigation had identified a total overstatement of

the balance sheet at 31 March 2019 of GBP1.8m. The more extensive

independent investigation largely corroborated the initial

findings, in addition to identifying further errors which

principally impact profit in the year to 31 March 2017. The

cumulative effect of these misstatements resulted in net assets at

31 March 2019 being overstated by GBP2.5m in total, and adjusted

operating profit in the year to 31 March 2019 being overstated by

GBP1.0m.

This independent investigation concluded that the misstatement

was a result of intentional mis-reporting of financial information

at a local level. The misstatement comprised many adjustments

across a number of balance sheet categories. The impact on cash and

net debt of GBP0.3m is unchanged from the announcement on 9 July

2019.

Robert Purcell, Chief Executive of Renold, said:

"These events are frustrating and deeply disappointing but the

Board, in conjunction with the Audit Committee, have acted swiftly

to fully investigate all matters. We are working closely with

Deloitte, the Group's Auditor, to ensure that recommended

improvements to the internal control environment are quickly and

effectively implemented.

"With the investigation and audit of the revised accounts

completed, we can refocus our efforts on operational improvement

and generating value for shareholders."

Impact of findings on historical financial results

A summary of the impact of the adjustments is set out below.

More detail is included in notes 27 and 28 of the revised 2019

annual report and accounts which can be found on the Group's

website at www.renold.com.

Consolidated statement of comprehensive income (extract):

2017 2018 2019

------------------------------------- ------------------------------------- --------------------------------

As As As

previously 2017 previously 2018 previously 2019

reported Restate-ment restated reported Restate-ment restated reported Revision revised

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

Revenue 183.4 - 183.4 191.6 - 191.6 202.4 - 202.4

Operating

costs

before

adjusting

items (168.9) (1.0) (169.9) (177.4) (0.5) (177.9) (186.0) (1.0) (187.0)

--------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

Adjusted

operating

profit 14.5 (1.0) 13.5 14.2 (0.5) 13.7 16.4 (1.0) 15.4

Adjusting

items (3.5) - (3.5) (8.6) - (8.6) (0.2) - (0.2)

--------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

Operating

profit 11.0 (1.0) 10.0 5.6 (0.5) 5.1 16.2 (1.0) 15.2

Net financing

costs (4.3) - (4.3) (4.2) - (4.2) (5.0) - (5.0)

--------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

Profit before

tax 6.7 (1.0) 5.7 1.4 (0.5) 0.9 11.2 (1.0) 10.2

Taxation (1.9) - (1.9) (3.6) - (3.6) (3.5) - (3.5)

--------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

Profit/(loss) 4.8 (1.0) 3.8 (2.2) (0.5) (2.7) 7.7 (1.0) 6.7

Consolidated balance sheet (extract):

2017 2018 2019

------------------------------------- ------------------------------------- --------------------------------

As As As

previously 2017 previously 2018 previously 2019

reported Restate-ment restated reported Restate-ment restated reported Revision revised

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

ASSETS

Non-current

assets 104.2 (0.4) 103.8 98.2 (0.4) 97.8 107.0 (0.3) 106.7

Current

assets

Inventories 40.4 (0.2) 40.2 41.0 (0.2) 40.8 44.8 (0.5) 44.3

Trade and

other

receivables 36.8 (0.1) 36.7 36.4 (0.3) 36.1 37.8 (0.3) 37.5

Cash and

cash

equivalents 16.4 - 16.4 14.3 - 14.3 17.9 (0.3) 17.6

------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

Current

assets 93.6 (0.3) 93.3 91.7 (0.5) 91.2 100.5 (1.1) 99.4

Non-current

assets 0.3 - 0.3 - - - - - -

------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

TOTAL ASSETS 198.1 (0.7) 197.4 189.9 (0.9) 189.0 207.5 (1.4) 206.1

LIABILITIES

Current

liabilities

Trade and

other

payables (41.9) (0.3) (42.2) (39.6) (0.6) (40.2) (41.0) (1.1) (42.1)

Other

current

liabilities (8.7) - (8.7) (7.1) - (7.1) (1.6) - (1.6)

------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

Current

liabilities (50.6) (0.3) (50.9) (46.7) (0.6) (47.3) (42.6) (1.1) (43.7)

Non-current

liabilities (139.7) - (139.7) (142.1) - (142.1) (163.3) - (163.3)

------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

NET ASSETS 7.8 (1.0) 6.8 1.1 (1.5) (0.4) 1.6 (2.5) (0.9)

------------- ----------- ------------- --------- ----------- ------------- --------- ----------- --------- --------

ENQUIRIES:

Renold plc 0161 498 4500

Robert Purcell, Chief Executive

Ian Scapens, Group Finance Director

Peel Hunt LLP 020 7418 8900

Mike Bell

Ross Allister

Ed Allsopp

Instinctif Partners 020 7457 2020

Mark Garraway

Rosie Driscoll

Cautionary statement regarding forward-looking statements

Some of the information in this document may contain projections

or other forward-looking statements regarding future events or the

future financial performance of Renold Plc and its subsidiaries

(the Group). You can identify forward-looking statements by terms

such as "expect", "believe", "anticipate", "estimate", "intend",

"will", "could", "may" or "might", the negative of such terms or

other similar expressions. Renold Plc (the Company) wishes to

caution you that these statements are only predictions and that

actual events or results may differ materially. The Company does

not intend to update these statements to reflect events and

circumstances occurring after the date hereof or to reflect the

occurrence of unanticipated events. Many factors could cause the

actual results to differ materially from those contained in

projections or forward-looking statements of the Group, including

among others, general economic conditions, the competitive

environment as well as many other risks specifically related to the

Group and its operations. Past performance of the Group cannot be

relied on as a guide to future performance.

NOTES FOR EDITORS

Renold is a global leader in the manufacture of industrial

chains and also manufactures a range of torque transmission

products which are sold throughout the world to a broad range of

original equipment manufacturers and distributors. The Company has

a well-deserved reputation for quality that is recognised

worldwide. Its products are used in a wide variety of industries

including manufacturing, transportation, energy, steel and

mining.

Further information about Renold can be found on the website at:

www.renold.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDMGZRLVDGLZM

(END) Dow Jones Newswires

August 27, 2019 02:02 ET (06:02 GMT)

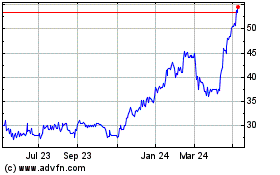

Renold (LSE:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

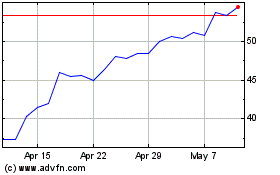

Renold (LSE:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024