August Data Could Prove Ominous for Lagging Industrial Stocks

August 22 2019 - 8:29AM

Dow Jones News

By Akane Otani

One of the hardest-hit areas of the stock market in recent

months faces a fresh test Thursday when a series of reports on the

manufacturing industry are released.

Industrial stocks, ranging from heavy-machinery manufacturers

like Caterpillar Inc. to engine maker Cummins Inc., have lagged

behind the S&P 500, as investors have grown increasingly

worried about the health of the sector.

Economists surveyed by The Wall Street Journal expect one key

gauge of manufacturing activity, IHS Markit's flash manufacturing

purchasing managers index, to clock in at 50.3 for August. That

would mean manufacturing activity barely escaped falling into

contraction territory, defined as a reading below 50. Investors

will also get a look at the Federal Reserve Bank of Kansas City's

manufacturing survey later Thursday.

Both reports could give investors further reason to shy away

from the industrial sector.

The group has fallen 3.9% in August, more than the broader

S&P 500's 1.9% decline. Caterpillar has lost 11%, while farm

machinery maker Deere & Co. has fallen 6.5%, and power and hand

tool maker Stanley Black & Decker Inc. has dropped 6.2%.

Shares of transportation companies that help move raw goods and

materials around the country have also taken a hit. The Dow Jones

Transportation Average, which tracks truckers, railroads and

airlines, is down 5.6% for the month, on track for its biggest

monthly decline since May.

The slide in industrial stocks matters to investors because many

have been trying to gauge whether increasingly disappointing

manufacturing data are foreshadowing a broader pattern of economic

decline or just showing isolated weakness for now.

Activity in the services sector has remained strong for the most

part. That is a reassuring sign for investors who note that

manufacturing activity, while important, accounts for a relatively

small portion of overall economic growth.

The bad news: Downturns in the manufacturing sector have

typically preceded weakening in the services sector over the past

25 years, according to Simon MacAdam, global economist at Capital

Economics.

The caveat? "The extent of the slowdown has varied a lot and has

depended on broader economic conditions than simply the health of

the manufacturing sector," Mr. MacAdam said in a research note.

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

August 22, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

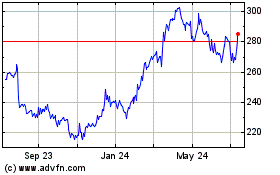

Cummins (NYSE:CMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

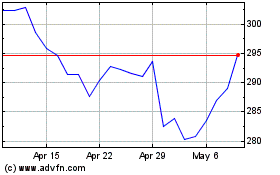

Cummins (NYSE:CMI)

Historical Stock Chart

From Apr 2023 to Apr 2024