Cassava Sciences Announces Second Quarter 2019 Financial Results

August 12 2019 - 8:30AM

Cassava Sciences, Inc. (Nasdaq: SAVA), a clinical-stage

biopharmaceutical company developing PTI-125 for Alzheimer’s

disease, today reported financial results for the second quarter

ended June 30, 2019. Net loss for the second quarter 2019 was $1.1

million, or $0.06 per share, as compared to a net loss of $2.5

million for the same period in 2018. Net cash use was $0.6

million during the second quarter of 2019.

Cassava Sciences ended the second quarter 2019

with $18.5 million of cash and cash equivalents, and no

debt.

About PTI-125PTI-125 is an

investigational drug candidate for Alzheimer’s disease. We

developed this small molecule drug to target a process known as

“protein misfolding.” PTI-125 has a novel mechanism of action: it

stabilizes a critical protein that is otherwise altered and

misfolded in the Alzheimer’s brain. PTI-125 has demonstrated both

cognitive improvement and slowing of disease progression in animal

models of disease. We are also developing a blood-based

diagnostic to detect Alzheimer’s disease, called PTI-125Dx.

The goal of PTI-125Dx is to make the detection of Alzheimer’s

disease as simple as getting a blood test.

The underlying science for our scientific

programs is published in prestigious peer-reviewed technical

journals, including Journal of Neuroscience, Neurobiology of Aging,

and Journal of Biological Chemistry. The National Institutes of

Health (NIH) has awarded us several research grants following an

in-depth, confidential review of our science and technology.

In 2019-2020, these NIH grants may represent up to $6.7 million of

non-dilutive financing.

Financial Highlights for Second Quarter

2019

- At June 30, 2019, cash and cash

equivalents were $18.5 million, compared to $19.8 million at

December 31, 2018. Net cash utilized during the second

quarter 2019 was $0.6 million. We have no debt.

- Net loss was $1.1 million compared

to $2.5 million for the same period in the prior year, representing

a 57% decrease. Net loss per share was $0.06 compared to

$0.36 for the same period in the prior year.

- We received research grant funding

reimbursements of $1.4 million from NIH and recorded this as a

reduction in research and development expenses (“R&D”).

This compared to $0.4 million of NIH grant receipts received for

the same period in the prior year.

- Net R&D expenses were $0.3

million. This compared to $1.5 million for the same period in

the prior year, representing a 79% decrease. The decrease was

due primarily to the increase in NIH grant funding in 2019 compared

to the prior year combined with a decrease in non-cash stock-based

compensation expense. R&D expenses included non-cash stock

related compensation costs of $0.1 million compared to $0.3 million

for same period in the prior year.

- General and administrative

(“G&A”) expenses were $0.8 million. This compared to $1.0

million for the same period in 2018, representing a 15%

decrease. G&A expenses included non-cash stock-based

compensation costs of $0.2 million compared to $0.4 million for the

same period in the prior year.

About Alzheimer's

Disease Alzheimer’s disease is a progressive brain

disorder that destroys memory and thinking skills. Eventually, a

person with Alzheimer’s disease may be unable to carry out even

simple tasks. Currently, there are no drug therapies to halt

Alzheimer’s disease, much less reverse its course.

An estimated 5.8 million Americans of all ages are

living with Alzheimer's disease in 2019.

About Cassava Sciences,

Inc.The mission of Cassava Sciences is to detect and treat

neurodegenerative diseases, such as Alzheimer’s disease. Over

the past ten years, we have combined state-of-the-art technology

with new insights in neurobiology to develop novel solutions for

Alzheimer’s disease. We own worldwide development and commercial

rights to our research programs in Alzheimer’s disease, and related

technology, without royalty obligations to any third-party.

For More Information Contact:Eric SchoenChief

Financial Officereschoen@CassavaSciences.com(512) 501-2450

Note Regarding Forward-Looking

Statements: This press release contains forward-looking

statements for purposes of the Private Securities Litigation Reform

Act of 1995 (the "Act"). Cassava Sciences disclaims any

intent or obligation to update these forward-looking statements and

claims the protection of the Safe Harbor for forward-looking

statements contained in the Act. Examples of such statements

include, but are not limited to, statements regarding the timing of

clinical studies and the potential benefits of the Company’s

programs in Alzheimer’s disease, including our ongoing Phase 2

program, and expected cash use in future periods. The Company

cautions that forward-looking statements are inherently uncertain.

Such statements are based on management's current expectations, but

actual results may differ materially due to various factors. Such

statements involve risks and uncertainties, including, but not

limited to, those risks and uncertainties relating to development

and testing of our drug candidates; unexpected adverse side effects

or inadequate therapeutic efficacy of our drug candidates; the

uncertainty of patent protection for our intellectual property or

trade secrets; unanticipated additional research and development,

litigation and other costs; the need to raise additional funding

from time-to-time, and the potential for competing products to be

developed by competitors and potential competitors or others.

Existing and prospective investors are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. Except as required by law, the Company

disclaims any intention or responsibility for updating or revising

any forward-looking statements contained in this press

release. For further information regarding these and other

risks related to our business, investors should consult our filings

with the U.S. Securities and Exchange Commission (SEC), which are

available on the SEC's website at www.sec.gov.

– Financial Tables Follow –

|

CASSAVA SCIENCES, INC. |

|

|

CONDENSED STATEMENTS OF OPERATIONS |

|

|

(unaudited, in thousands, except per share amounts) |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

| |

2019 |

|

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

308 |

|

|

$ |

1,463 |

|

|

$ |

882 |

|

|

$ |

2,532 |

|

|

|

General and administrative |

|

845 |

|

|

|

998 |

|

|

|

1,722 |

|

|

|

2,097 |

|

|

|

Total operating expenses |

|

1,153 |

|

|

|

2,461 |

|

|

|

2,604 |

|

|

|

4,629 |

|

|

| Operating

loss |

|

(1,153 |

) |

|

|

(2,461 |

) |

|

|

(2,604 |

) |

|

|

(4,629 |

) |

|

| Interest

income |

|

94 |

|

|

|

9 |

|

|

|

186 |

|

|

|

16 |

|

|

| Net loss |

$ |

(1,059 |

) |

|

$ |

(2,452 |

) |

|

$ |

(2,418 |

) |

|

$ |

(4,613 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

$ |

(0.06 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.68 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares used

in computing net loss per share, basic and diluted |

|

17,162 |

|

|

|

6,838 |

|

|

|

17,162 |

|

|

|

6,739 |

|

|

|

|

|

|

|

|

|

CONDENSED BALANCE SHEETS |

|

|

(unaudited, in thousands) |

|

| |

|

|

|

|

|

June 30, 2019 |

|

December 31, 2018 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

$ |

18,534 |

|

|

$ |

19,807 |

|

|

|

Other current assets |

|

|

|

|

|

|

49 |

|

|

|

233 |

|

|

|

Total current assets |

|

|

|

|

|

18,583 |

|

|

|

20,040 |

|

|

|

Property and equipment, net |

|

|

|

|

|

75 |

|

|

|

87 |

|

|

|

Operating lease right-of-use assets |

|

|

|

|

|

135 |

|

|

|

— |

|

|

|

Other assets |

|

|

|

|

|

12 |

|

|

|

12 |

|

|

|

Total assets |

|

|

|

|

$ |

18,805 |

|

|

$ |

20,139 |

|

|

|

Liabilities and stockholders'

equity |

|

|

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

|

|

$ |

594 |

|

|

$ |

294 |

|

|

|

Accrued development expense |

|

|

|

|

|

179 |

|

|

|

156 |

|

|

|

Accrued compensation and benefits |

|

|

|

|

|

60 |

|

|

|

61 |

|

|

|

Operating lease liabilities, current |

|

|

|

|

|

90 |

|

|

|

— |

|

|

|

Other accrued liabilities |

|

|

|

|

|

14 |

|

|

|

— |

|

|

|

Total current liabilities |

|

|

|

|

|

937 |

|

|

|

511 |

|

|

|

Operating lease liabilities, non-current |

|

|

|

|

|

45 |

|

|

|

— |

|

|

|

Total liabilities |

|

|

|

|

|

982 |

|

|

|

511 |

|

|

| Stockholders'

equity |

|

|

|

|

|

|

|

|

|

|

|

Common Stock and additional paid-in-capital |

|

|

|

|

|

184,197 |

|

|

|

183,584 |

|

|

|

Accumulated deficit |

|

|

|

|

|

(166,374 |

) |

|

|

(163,956 |

) |

|

|

Total stockholders' equity |

|

|

|

|

|

17,823 |

|

|

|

19,628 |

|

|

|

Total liabilities and stockholders' equity |

|

|

|

|

$ |

18,805 |

|

|

$ |

20,139 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

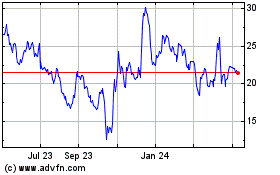

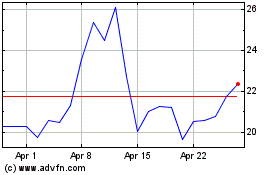

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Sep 2023 to Sep 2024