By Angus Loten

Microsoft Corp.'s bet on delivering business software over the

internet is paying off, thanks to the tech giant's ability to

understand the needs of its corporate customers and help them

adjust to a rapidly changing market.

The company's record fourth-quarter revenue, announced last

week, was boosted by its cloud-computing business, where sales were

up 39% from a year earlier. Revenue from its Azure cloud service

alone rose 64%, the company said.

The success rests on its technology, combined with an

understanding of complex enterprises' software needs. The company

over a period of decades has developed the ability to understand

large corporations. This has enabled Microsoft to develop a range

of technologies that allows customers to consolidate their

purchases with a familiar source. At the same time, it has stayed

technologically competitive.

"Microsoft isn't just a cloud company," said Sue Bergamo, chief

information officer at digital commerce and marketing company

Episerver, a Microsoft client. "They are a partner who works with

customers to understand business problems," she said.

One of Microsoft's key advantages in the cloud market is an

appreciation of the unique tech needs of large organizations, said

Tim Crawford, founder and chief information officer of AVOA LLC, a

strategic advisory firm.

"One of the things about the enterprise that very few people

understand is the complexity of enterprise IT," he said, adding

that Microsoft speaks to CIOs and other corporate IT managers "in

language they can understand."

The Redmond, Wash., company's focus on big enterprise customers

is helping it keep pace with the cloud-market leader, Amazon.com

Inc.'s cloud unit Amazon Web Services. Amazon holds roughly a third

of the world-wide cloud market, with Microsoft in second place at

16%, far ahead of the rest of the pack, according to research firm

Canalys.

Despite Azure's rapid growth, its market position relative to

AWS has changed little in recent years, as gains from the cloud

market accrue to the two front-runners.

Steve Stine, senior vice president of business transformation at

AT&T Communications, said Microsoft's grasp of corporate

customers' computing needs was a key reason behind a move announced

last week to shift most of the internal business applications in

AT&T Inc.'s communications unit to Azure, Microsoft's main

cloud platform.

"We'll work with Microsoft because they have experience with

doing this and helping large enterprises," Mr. Stine told CIO

Journal.

Deals with AT&T and other large organizations are propelling

sales in Microsoft's cloud unit and lifting overall revenue.

A Microsoft spokesman credited the company's cloud success with

being able to meet customer needs.

The company's gains are expected to grow as more companies

ratchet up spending on cloud services, which provide on-demand

software, computing power and storage.

Global spending on the public cloud, where companies pay tech

firms for computing and storage, is expected to more than double

over the next five years to roughly $500 billion in 2023 from $229

billion this year, according to International Data Corp. More than

half of total spending will come from businesses with 1,000

employees or more, IDC said.

Amazon's AWS counts Dole Food Co., Hess Corp., McDonald's Corp.

and other large firms as customers. It has also proved popular with

startups, small businesses and companies that model their

technology infrastructure on consumer internet firms, many of which

seek individual software tools to develop unique services, rather

than fully formed platforms, said AVOA's Mr. Crawford.

Amazon declined to comment.

For Microsoft, it helps that the company has long had a foot in

the door with enterprise customers through its suite of business

applications, which many businesses have traditionally run on

in-house servers and data centers -- easing the transition to the

cloud.

Taking its cue from CIOs and other corporate IT managers,

Microsoft has invested heavily in capabilities like artificial

intelligence, at a time when more businesses are experimenting with

advanced digital tools, said Dave Bartoletti, vice president and

principal analyst at Forrester Research.

"Clouds are the best place to experiment," Mr. Bartoletti

said.

Microsoft this week announced plans to invest $1 billion in

artificial-intelligence startup OpenAI LP, a move aimed at

developing supercomputing technologies for Azure, the company

said.

"One of the things Microsoft is really good at is that it can

provide solutions all the way to the edge and to the cloud and

everything in between," said Mr. Crawford of AVOA. "No other

companies really can do that at the software level," he said.

--Steven Rosenbush and Agam Shah contributed to this

article.

Write to Angus Loten at angus.loten@wsj.com

(END) Dow Jones Newswires

July 23, 2019 19:15 ET (23:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

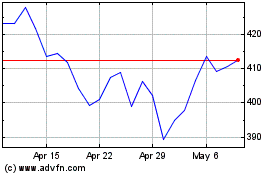

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024