By Mark DeCambre, MarketWatch , Joy Wiltermuth

Mnuchin says U.S. was '90% of the way there' on China trade

deal

Stocks on Wednesday afternoon were losing ground after an

earlier climb, spurred by Micron Technologies's quarterly results,

faded.

The Dow Jones Industrial Average was up 19 points, or less than

0.1%, to 26,567, but had been as high as 26,669, while the S&P

500 was down 2 points, or 0.1%, at 2,915, weighed by a decline in

the real estate and utilities sector, both down by about 2%,

representing the worst performers among the index's 11 sectors. The

Nasdaq Composite Index rose 23 points, or about 0.3%, to 7,908.

Comments from U.S. Treasury Secretary Steven Mnuchin suggesting

that a Sino-American trade resolution had been near

(https://www.cnbc.com/2019/06/26/mnuchin-says-us-china-trade-deal-was-90-percent-complete.html),

provided an early lift to markets. "We were about 90% of the way

there (with a deal) and I think there's a path to complete this,"

he told the financial network in Bahrain.

The U.S. Treasury Secretary said he was "hopeful" that a deal

could be struck as the market awaits a sideline conversation

between President Donald Trump and Chinese President Xi Jinping at

the Group of 20 gathering in Osaka, Japan, which kicks off on

Friday.

But optimism over the prospects for a trade war detente tempered

during the session.

"I am not optimistic of anything of significance to be achieved

for the meetings in Japan this week," said Mariann Montagne, a

portfolio manager at Gradient Investments, in a telephone

interview.

"Mnuchin or members of his team have used that phrase several

times over the past several months," she told MarketWatch. "I think

people are getting too excited."

In April, Mnuchin said U.S.-China trade talks were in the "final

laps

(https://www.nytimes.com/2019/04/28/us/politics/mnuchin-china-us-trade-negotiations.html)."

Separately, President Trump, appearing on Fox Business on

Wednesday said that he was happy to collect China tariffs

(http://www.marketwatch.com/story/trump-today-president-threatens-tariffs-on-china-as-he-jokes-draghi-should-lead-fed-2019-06-26)

if talks broke down.

Concerns about escalating trade tensions between China and the

U.S., the world's largest economies, have fed a sense of rising

uncertainty about the health of the global economy, at least partly

contributing to central banks across the world signaling a

willingness to reinstitute a fresh wave of economic stimulus.

"Certainly, when we came in pre-open, futures were higher on the

Mnuchin comments," said Sahak Manuelian, an equities trader at

Wedbush Securities.

"It seems things are starting to fall off a bit."

On Tuesday

(http://www.marketwatch.com/story/stock-index-futures-point-cautiously-higher-as-investors-await-g-20-meeting-2019-06-24),

equity markets suffered one of the worst declines in about a month,

led by a selloff in trade-sensitive technology shares.

"It's a bit of wavering ahead of the G-20," said Jeff Kleintop,

chief global investment strategist at Charles Schwab, in an

interview. "The markets have priced in a delay to the

implementation of the next round of tariffs, through next month, on

$300 billion of Chinese goods."

But Kleintop also cautioned that stocks, near all-time highs,

may be seeing an overabundance of confidence.

"If it's trade or another factor, the market does feel

vulnerable to a setback," Kleintop said.

Tuesday's slump in stocks came after Federal Reserve Chairman

Jerome Powell, speaking at the Council on Foreign Relations in New

York, signaled that an interest-rate cut in July isn't a done deal,

and St. Louis Fed President James Bullard said isn't advocating for

an aggressive cut of 50 basis point in federal-funds rates when the

Fed meets next month.

Read: Fed's Bullard says he is not in favor of half point rate

cut in July

(http://www.marketwatch.com/story/feds-bullard-says-he-is-not-in-favor-of-half-point-rate-cut-in-july-2019-06-25)

Check out: Powell says the Fed is 'grappling' with whether to

cut interest rates

(http://www.marketwatch.com/story/powell-says-the-fed-is-grappling-with-whether-to-cut-interest-rates-2019-06-25)

U.S. economic data published Wednesday was again weak, with

durable-goods orders for May dropping 1.3%, weighed down by Boeing

Co.'s (BA) woes from its grounded 737 MAX jets.

Check out: Durable-goods orders drop 1.3% in May, but business

investment picks up in reassuring sign

(http://www.marketwatch.com/story/durable-goods-orders-drop-13-in-may-but-business-investment-picks-up-in-reassuring-sign-2019-06-26)

A separate report on international trade in goods also showed

the U.S. trade deficit climbed 5.1% for the same month which was

wider than expected.

Read: U.S. trade deficit in goods widens 5.1% to $74.5 billion

in May

(http://www.marketwatch.com/story/us-trade-deficit-in-goods-jumps-51-to-745-billion-in-may-2019-06-26)

Which stocks are in focus?

Shares of Apple Inc.(AAPL) were in focus after the iPhone maker

and tech giant acquired autonomous-driving startup Drive.ai

(http://www.marketwatch.com/story/apple-buys-autonomous-car-startup-driveai-reports-2019-06-25),

according to multiple reports. Apple confirmed the deal to both

Axios and the San Francisco Chronicle

(https://www.sfchronicle.com/business/article/Drive-ai-a-self-driving-car-startup-once-worth-14047625.php).

Shares of Apple were up 4% on Wednesday.

Micron Technology Inc. shares (MU) rose 13% on Wednesday after

the memory-chip maker's results topped expectations

(http://www.marketwatch.com/story/micron-stock-surges-after-hours-as-earnings-top-lowered-expectations-2019-06-25)

for the quarter, and executives forecast improvement in the fourth

quarter.

That was good news for other semiconductor companies. Shares of

Advanced Mico Devices(AMD) climbed more than 3%; Nvidia Corp.

almost 9% and shares of exchange-traded semiconductor fund iShares

PHLX Semiconductor ETF (SOXX) climbed 1.8%.

Shares of Boeing (BA) were up more than 2% on Wednesday.

Consumer-goods giant General Mills(GIS) shares fell more than

4%, a day after it reported disappointing sales for its fiscal

fourth-quarter

(http://www.marketwatch.com/story/general-mills-stock-falls-after-profit-beats-but-sales-come-up-short-2019-06-26).

Shares of retailer Big Lots(BIG) gained 2.5% after the retailer

said it would appoint former Abercrombie & Fitch veteran

Jonathan Ramsden as chief financial officer in August.

FedEx Corp(FDX) shares bumped up more than 2% a day after it

beat earnings estimates

(http://www.marketwatch.com/story/fedex-shares-tick-down-after-earnings-beat-2019-06-25).

(END) Dow Jones Newswires

June 26, 2019 14:56 ET (18:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

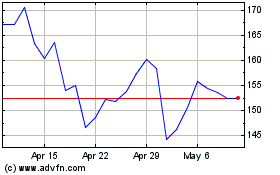

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024