Nike's Blowout Underscores How Perception of Safety and Quality Can Affect Reputation

February 21 2019 - 8:16PM

Dow Jones News

By Mengqi Sun

The blowout of a college basketball star's shoe Wednesday

underscored how consumer perception of safety and quality can weigh

heavily on a company's reputation.

Duke University forward Zion Williamson's Nike basketball shoe

appeared to rip apart in the first minute of a rivalry game against

the University of North Carolina.

Mr. Williamson tried to change direction to shake a Tar Heel

defender, but his left foot broke through the side of the shoe. Mr.

Williamson, considered one of best collegiate players, fell to the

ground holding his right knee before limping off the court. He

didn't return to the game.

The prime-time spectacle, which played out on national

television, highlighted a delicate dance between customer

expectations and quality assurance, risk consultants said. Shoes

take a beating, and few customers would expect a pair to last

forever. But shoes tend to degrade over time, not in an

instant.

"Stakeholders are not expecting the shoes to have a failure;

they would be surprised and disappointed," said Nir Kossovsky,

chief executive of corporate reputation insurance company Steel

City Re.

Nike uses sports icons as a means to convey the quality of the

products, he said. The implied message: If it's good enough for the

athletes, it's good enough for average consumers. But the failure

of the shoe under Mr. Williamson -- a high-profile player who has

been projected by some as a likely future star on the professional

level -- challenged that premise. "It didn't hold up," Mr.

Kossovsky said.

How a company responds in moments after an event like this can

help determine the extent of the damage to its reputation. That

often includes some form of acknowledging the issue and reassuring

customers that it is an anomaly, and that the company has controls

in place to ensure that this isn't a failure in its governance or

the company's mission.

Nike attempted that in a statement Thursday. "We are obviously

concerned and want to wish Zion a speedy recovery," the company

said. "The quality and performance of our products are of utmost

importance. While this is an isolated occurrence, we are working to

identify the issue."

The lasting effect on Nike will be determined by consumers and

investors. Some of the indicators for the scale of the impact could

be the extent of movement in equity value, credit default swap

prices and bond prices over time, Mr. Kossovsky said. Nike shares

fell 1% to $83.95 on Thursday.

"The bond guys, they are the most sensitive to risks," he said.

"Their risk assessment is the most accurate." Bonds are a measure

that could suggest material cash flow damage, he said.

"Cash flow risk is the end of state of reputation risk," Mr.

Kossovsky said.

Write to Mengqi Sun at mengqi.sun@wsj.com

(END) Dow Jones Newswires

February 21, 2019 20:01 ET (01:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

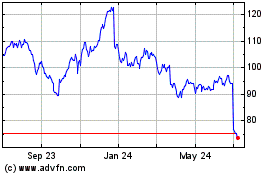

Nike (NYSE:NKE)

Historical Stock Chart

From Aug 2024 to Sep 2024

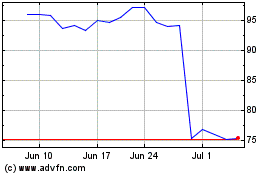

Nike (NYSE:NKE)

Historical Stock Chart

From Sep 2023 to Sep 2024