Starboard Nominates Bristol Board Members -- WSJ

February 21 2019 - 3:02AM

Dow Jones News

By Cara Lombardo and Micah Maidenberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 21, 2019).

Activist investor Starboard Value LP is unhappy with

Bristol-Myers Squibb Co.'s deal to buy rival Celgene Corp., and it

has moved to install its own set of directors at Bristol-Myers.

The hedge fund has nominated five potential directors, including

its chief executive, Jeffrey Smith, and has been meeting with the

drugmaker's executives, Bristol-Myers said in a filing

Wednesday.

The activist proposal comes as Bristol-Myers has a deal in place

to buy Celgene that was valued at $74 billion when it was announced

earlier this year. It isn't clear why Starboard nominated the

slate, though the hedge fund is unhappy with the deal, according to

people familiar with the matter.

Activists don't always nominate board members when opposing a

deal. The fact that Starboard did could indicate it has ideas for

alternatives it would hope to implement, one of the people said.

But analysts have said it is unlikely an activist could compel

another company to make a bid for Bristol-Myers itself, partly

because there aren't many potential suitors.

Bristol-Myers told Starboard it would review Starboard's

proposal for the board, and the company and activist have met on

multiple occasions, according to the filing.

Starboard in those meetings has asked the company to help it

understand the rationale of the deal and hasn't expressed an

opinion on it, another person familiar with the matter said. It has

also indicated to the company that it isn't sure of its plans, this

person said.

Successfully challenging the deal could be a long shot for

Starboard by itself. The hedge fund has acquired about one million

shares in the company, Bristol-Myers said, a sliver of its roughly

1.6 billion shares outstanding. Bristol-Myers indicated in the

filing that Starboard, which bought the bulk of its stake Jan. 31,

could also be planning to buy more stock.

Bristol-Myers shareholders are set to vote on the deal with

Celgene on April 12, and a majority of the shares voted need to

approve the deal for it to pass.

Should Starboard be looking to challenge the deal, it would need

to garner significant support from other shareholders given its

relatively small position. A handful of other shareholders are

unhappy with the deal, including the fifth-largest shareholder,

Dodge & Cox, according to the people familiar with the matter.

But that doesn't necessarily mean they will vote against it.

Shareholders who own Bristol-Myers shares as of March 1 will be

permitted to vote, meaning there is still a window for investors

opposed to the deal to buy shares to vote against it.

Bristol-Myers and Celgene announced their proposed combination

on Jan. 3, touting the benefits of combining two major sellers of

cancer drugs. The deal is expected to be completed in the third

quarter this year. Bristol-Myers shareholders were cool on the deal

when it was announced, driving the company's stock down 14%, though

it has been climbing in recent weeks.

Starboard has agitated for change at a range of companies,

including Dollar Tree Inc., semiconductor company Mellanox

Technologies and Cars.com, though it is rare for Starboard to

target a company as large as Bristol-Myers, which has a roughly $84

billion market value.

Shares of Bristol-Myers closed down 0.12% at $51.30 Wednesday,

while Celgene shares fell 0.32% to $90.40.

Write to Cara Lombardo at cara.lombardo@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

February 21, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

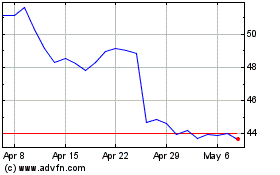

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Aug 2024 to Sep 2024

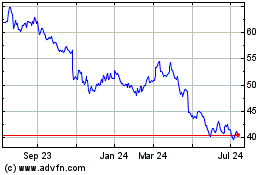

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Sep 2023 to Sep 2024