By Robert Wall and Daniel Michaels

When Airbus SE launched the A380 superjumbo in 2000, it touted

the two-deck plane as "the Eighth Wonder of the World." Instead,

the world's largest passenger plane exposed dysfunction inside the

European aerospace company and now offers a textbook case of a

company misjudging its market and losing big.

Airbus has sunk at least $17 billion into the project yet sold

fewer than half of the 750 superjumbo jetliners it promised to

deliver by the end of this year. On Thursday Airbus said it would

cease producing the 555-seat plane at the end of 2021.

By then, Airbus expects to have sold 251 A380s -- one more than

its original break-even target, set before production delays added

billions of dollars in costs. At its peak, A380 deliveries never

reached 5% of annual Airbus deliveries -- less than half its

target.

How did some of the world's best engineers get their numbers so

wrong? Airbus misjudged market trends and underestimated emerging

technologies. It compounded the error by justifying its decision

with emotion and European pride, some former Airbus officials have

said. Then its production system, organized for politics more than

efficiency, failed.

Steven Udvar-Hazy, a pioneer of aircraft-leasing who was early

both to order the A380 and terminate his planned purchase, said the

plane was inspired largely by political ambition to out-do Boeing

Co.'s 747 jumbo jet as the world's largest airliner.

"The technological achievement was formidable," he said, but the

A380's "commercial viability was always dubious."

All jetliners are expensive bets on technology, engineering and

market trends. When Boeing's 747 first flew in 1969, it was triple

the size of any other plane in the air and for several years its

success was uncertain. Europeans in the 1960s wagered on the

government-funded supersonic Concorde, an aviation marvel that

flopped because of high operating cost and house-rattling

noise.

Airliners typically fly for a generation, but the first A380s

are already parked after only about a decade and being sold for

scrap. Boeing's jumbo jet could still be in production -- though

barely -- when Airbus mothballs its A380 factories.

"We were probably at least 10 years too late," Airbus Chief

Executive Tom Enders said in announcing the A380 cancellation.

With the A380, Airbus planners bet prevailing market conditions

would persist. They assumed airlines would keep using big,

increasingly congested hub airports to transfer passengers between

connecting flights, and need to fly large, four-engine jetliners on

very long routes. Both changed around the time A380s started

flying.

Not long after Airbus began developing the A380, Boeing in 2003

embarked on its smaller, hyper-efficient twin-engine 787

Dreamliner. It quickly became a best seller. Only in 2006 did

Airbus respond with a big two-engine model, the A350. Together, the

twins rewrote the economics of long-haul flying, hurting the

A380.

The technology change coincided with shifts in airline

boardrooms. Whipsawed by traffic-crushing crises and soaring fuel

prices, airline executives in the 2000s focused increasingly on

costs and investor returns. Profit took precedence over market

share. Big planes that could be tough to fill profitably fell from

favor. No U.S. carrier bought the A380. The biggest European buyer,

Germany's Deutsche Lufthansa AG, took only 14.

Airbus officials offered many reasons for the order dearth,

including production problems and the financial crisis. Yet they

insisted airport congestion would snarl growth that only the A380

could revive. In 2015, after another order drought, Fabrice

Bregier, then-Airbus Commercial Plane president, said the A380 was

simply ahead of its time.

The A380 might have built more momentum if not for production

debacles. Around the time of the first test flight in 2005, Airbus

realized it had underestimated the complexity of wiring the

superjumbo. Managers discovered that French and German designers

had used incompatible software.

The snafu exposed deep cultural rifts inside the planemaker,

which was led by French and German co-CEOs -- a structure designed

to appease government shareholders. In 2006, during the depth of

the A380 crisis, Airbus ousted senior French and German executives.

The next year it abandoned the co-CEO structure altogether.

More setbacks followed. The engine of an A380 blew up during a

passenger flight in 2010. Nobody was hurt, but it drew negative

attention to the plane. Wing cracks discovered on many A380s led to

costly repairs.

Customers, including Richard Branson's Virgin Atlantic Airways

Ltd., Air France-KLM SA and Qantas Airways Ltd., canceled

orders.

Airbus stumbled into its production fiasco because of

overconfidence in its own abilities, company veterans said later.

That hubris was fueled by giddiness from politicians and executives

at the turn of the century about the plane maker itself and the

Europe Union.

Airbus was created in 1969 as a loose consortium of European

aerospace companies. After a slow start, by the late 1990s it had

squeezed McDonnell-Douglas out of the market and was nipping at

Boeing's heels.

The corporate champions fit with the growing stature of the EU,

created in 1993, and its single currency, the euro, which debuted

in 1999. When the Airbus partners announced their merger in October

1999, it was unveiled by French Prime Minister Lionel Jospin and

German Chancellor Gerhard Schroeder.

"Europe has succeeded with the great feat of the euro," said

French Finance Minister Dominique Strauss-Kahn at the ceremony.

Integrating Airbus "is a euro of industry."

Fusing Airbus was deemed a prerequisite for undertaking a

project so ambitious as a superjumbo, which in turn would bond the

partners, said Jean-Luc Lagardere, who was co-chairman of Airbus's

holding company.

"This aircraft will be the cement of the company for years to

come," Mr. Lagardere said when Airbus launched the A380 in June

2000.

Write to Robert Wall at robert.wall@wsj.com and Daniel Michaels

at daniel.michaels@wsj.com

(END) Dow Jones Newswires

February 19, 2019 13:20 ET (18:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

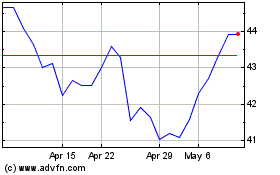

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Aug 2024 to Sep 2024

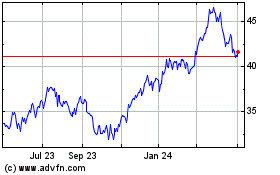

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Sep 2023 to Sep 2024