Comcast Pushes Revenue Higher -- WSJ

January 24 2019 - 3:02AM

Dow Jones News

NBCUniversal unit, broadband arm drive the quarterly growth;

dividend to climb 10%

By Benjamin Mullin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 24, 2019).

Comcast Corp. said its NBCUniversal media unit and high-speed

internet business fueled growth in the fourth quarter.

The company also is raising its annual dividend 10% to 84 cents

a share.

Overall, Comcast's revenue increased 5.2% from a year earlier to

$28.3 billion, when the effect of its acquisition of pay-television

operator Sky PLC is factored in.

Earnings at the Philadelphia-based company shrank to $2.51

billion, or 55 cents a share, from $15 billion, or $3.17 cents a

share in the year-earlier quarter, when results were boosted by a

one-time tax benefit. Excluding that year-earlier tax benefit,

Comcast earnings rose 36% to 64 cents a share.

The results exceeded estimates from analysts surveyed by

FactSet, which projected revenue of $27.55 billion and adjusted

earnings of 62 cents a share.

Comcast continues to lose traditional pay-TV subscribers, though

at a slower rate than some peers. The company narrowed its

subscriber loss to 29,000, compared with 33,000 a year earlier.

The broadband business added 351,000 customers in the period and

increased revenue 10%.

Revenue at the NBCUniversal division, which houses several TV

networks and the Universal film and TV studio, jumped 7.1%.

Adjusted operating earnings more than doubled at the broadcast-TV

unit, driven by growth in retransmission fees and advertising

revenue.

Comcast's NBCUniversal unit said earlier this month that it

plans to launch an ad-supported streaming service, entering a field

that has grown increasingly crowded.

On an earnings call Wednesday, Chief Executive Brian Roberts

said the streaming service would distinguish itself through a

"light" advertising load and original programming.

"We believe that we can generate significant value with this

service over time, by enhancing our content monetization,

strengthening the value of pay-TV, becoming a leader in targeted,

digital streaming advertising, and expanding our reach through

direct customer relationships," Mr. Roberts said.

Comcast's nascent wireless business, Xfinity Mobile, continues

to grow, though it remains unprofitable on a stand-alone basis.

Xfinity Mobile added 227,000 net subscribers in the fourth quarter

of 2018, bringing its total to 1.2 million subscribers, with losses

of $191 million for the period.

Comcast said it would begin reporting Xfinity Mobile as part of

its cable segment.

"We're very pleased with this performance in mobile so far and

the value it adds to the bundle and are on track to achieve our

primary objectives, including positive stand-alone economics," Mr.

Roberts said.

Comcast also disclosed financial results for its Sky unit for

the first time since it acquired the European pay-TV company in

October of last year. Revenue at Sky rose 5.6% year-over-year to

$5.02 billion in the fourth quarter, with $3.98 billion from

direct-to-consumer services, such as broadband and pay-TV

subscriptions.

Corrections & Amplifications Comcast is raising its annual

dividend 10% to 84 cents per share. An earlier version of this

article incorrectly said that was the quarterly dividend. ( Jan.

23, 2019)

Write to Benjamin Mullin at Benjamin.Mullin@wsj.com

(END) Dow Jones Newswires

January 24, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

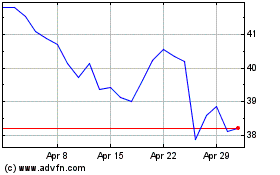

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Sep 2023 to Sep 2024